What Are UIIA Requirements

What is the UIIA and why is it important?

The Uniform Intermodal Interchange and Facilities Access Agreement (UIIA) serves as a foundational framework for the intermodal transportation industry. Established to facilitate the interchange of equipment among various transportation providers, the UIIA plays a pivotal role in ensuring that all parties involved in the transportation process adhere to standardized practices.

The importance of the UIIA cannot be overstated. It provides a structured agreement that outlines the responsibilities and liabilities of each participant, including motor carriers, equipment providers, and other stakeholders. This agreement enhances the efficiency of intermodal operations by minimizing disputes and clarifying expectations regarding equipment use and maintenance.

The UIIA also fosters a collaborative environment among participants, enabling smoother transactions and reducing the risk of delays. As intermodal transportation continues to grow, adherence to the UIIA is essential for maintaining operational integrity and ensuring compliance with industry standards.

What are the insurance requirements for UIIA compliance?

Insurance is a critical aspect of UIIA compliance. Participants must meet specific insurance requirements to protect themselves and their assets during the interchange process. These requirements typically include:

**** General Liability Insurance

General liability insurance protects against claims of bodily injury or property damage that may occur during operations. UIIA participants must maintain a minimum coverage limit, which is typically set at $1 million per occurrence.

**** Auto Liability Insurance

Auto liability insurance covers damages resulting from accidents involving vehicles used in the transportation process. UIIA participants are required to carry a minimum coverage limit, often set at $1 million per occurrence, to ensure adequate protection against potential claims.

**** Cargo Insurance

Cargo insurance provides coverage for loss or damage to goods being transported. UIIA participants must have cargo insurance in place, with coverage limits that align with the value of the cargo being transported. This insurance is vital for protecting both the carrier and the shipper’s interests.

**** Trailer Interchange Insurance

Trailer interchange insurance covers damages to trailers while they are in the possession of a motor carrier. This coverage is essential for UIIA participants who frequently interchange trailers with other carriers. The minimum coverage limit typically required is $1 million.

How do auto liability and general liability requirements differ for UIIA participants?

Understanding the differences between auto liability and general liability insurance is essential for UIIA participants.

| Aspect | Auto Liability Insurance | General Liability Insurance |

|---|---|---|

| Coverage Focus | Covers damages from vehicle accidents | Covers bodily injury and property damage claims |

| Required Limits | Typically $1 million per occurrence | Typically $1 million per occurrence |

| Applicability | Applies specifically to vehicles used in transportation | Applies to all operations, including non-vehicle-related incidents |

| Claim Examples | Accidents involving trucks or trailers | Slip and fall incidents at a terminal or facility |

Auto liability insurance is specifically designed to address risks associated with vehicle operations, while general liability insurance covers a broader range of potential claims that may arise during business operations. Both types of insurance are necessary for comprehensive coverage under UIIA compliance.

What specific cargo insurance and trailer interchange coverage do UIIA participants need?

Cargo insurance and trailer interchange coverage are vital components of the UIIA compliance framework.

**** Cargo Insurance Requirements

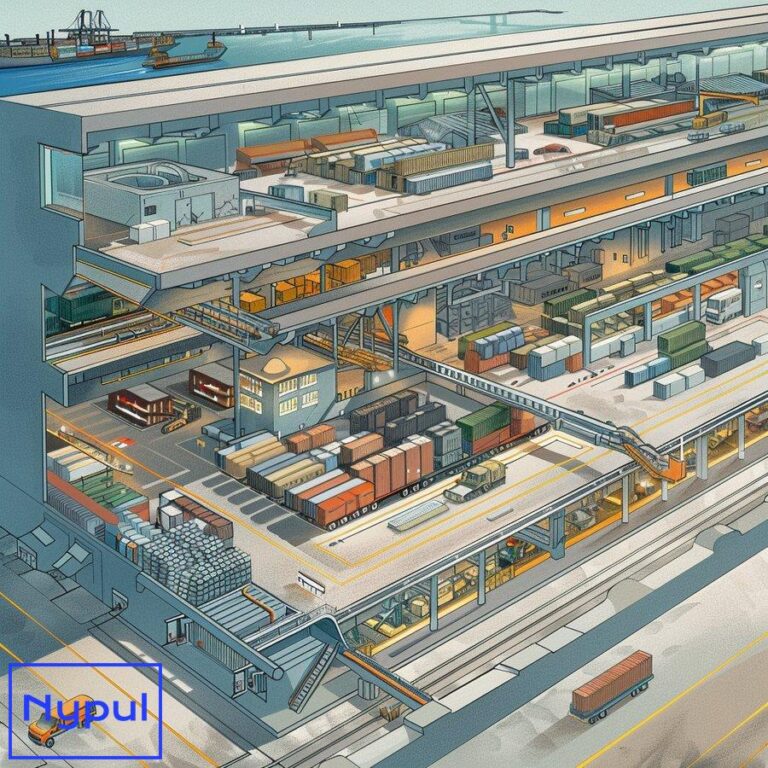

![]()

UIIA participants must maintain cargo insurance that covers the full value of the goods being transported. This insurance protects against loss, theft, or damage during transit. The specific coverage limits can vary based on the type of cargo and the agreements in place between shippers and carriers. It is essential for participants to assess the value of the cargo and ensure that their insurance coverage is adequate to cover potential losses.

**** Trailer Interchange Coverage Requirements

Trailer interchange coverage is necessary for motor carriers that frequently interchange trailers with other carriers. This insurance covers damages to trailers while they are in the possession of the motor carrier. UIIA participants are typically required to have a minimum coverage limit of $1 million for trailer interchange insurance. This coverage is crucial for protecting against potential liabilities arising from damage to trailers that are not owned by the carrier.

How do workers’ compensation requirements factor into UIIA compliance?

Workers’ compensation insurance is another critical element of UIIA compliance. This insurance provides benefits to employees who suffer work-related injuries or illnesses.

**** Importance of Workers’ Compensation Insurance

UIIA participants must comply with state-specific workers’ compensation requirements to ensure that their employees are protected in the event of an accident or injury. This insurance covers medical expenses, rehabilitation costs, and lost wages for employees who are injured while performing their job duties.

**** Compliance Considerations

Each state has its own regulations regarding workers’ compensation, including coverage limits and requirements for employers. UIIA participants must familiarize themselves with these regulations to maintain compliance and protect their workforce. Failure to obtain adequate workers’ compensation coverage can lead to significant legal and financial repercussions for businesses.

What additional participation requirements must be met for UIIA membership?

In addition to insurance requirements, UIIA participants must meet several other criteria to maintain membership.

![]()

![]()

**** Application Process

To become a UIIA participant, companies must complete an application process that includes providing necessary documentation, such as proof of insurance and compliance with safety regulations. This process ensures that all members adhere to the standards set forth by the UIIA.

**** Compliance with Safety Standards

UIIA participants must also comply with safety standards established by the Federal Motor Carrier Safety Administration (FMCSA) and other regulatory bodies. This includes maintaining proper vehicle maintenance records and adhering to safety protocols during operations.

**** Payment of Fees

Membership in the UIIA requires the payment of annual fees. These fees contribute to the administration and management of the UIIA program. Participants must ensure that they remain current on their fees to maintain their membership status.

How can motor carriers ensure and maintain UIIA compliance?

Maintaining UIIA compliance is an ongoing process that requires diligence and attention to detail.

**** Regular Insurance Reviews

Motor carriers should conduct regular reviews of their insurance policies to ensure that they meet UIIA requirements. This includes verifying coverage limits, updating policies as needed, and ensuring that all necessary types of insurance are in place.

**** Training and Education

Providing training and education for employees on UIIA compliance is essential. This includes educating staff on safety protocols, insurance requirements, and the importance of adhering to UIIA standards. Regular training sessions can help reinforce compliance and promote a culture of safety within the organization.

**** Documentation and Record-Keeping

Maintaining accurate documentation and records is crucial for demonstrating compliance with UIIA requirements. Motor carriers should keep detailed records of insurance policies, safety inspections, and training sessions. This documentation can be invaluable in the event of an audit or compliance review.

In conclusion, understanding and adhering to UIIA requirements is essential for all participants in the intermodal transportation industry. By ensuring compliance with insurance and safety standards, motor carriers can protect their businesses, employees, and customers while contributing to the overall efficiency of the intermodal transportation process.