What Does It Mean When a Port Is Congested

What is port congestion?

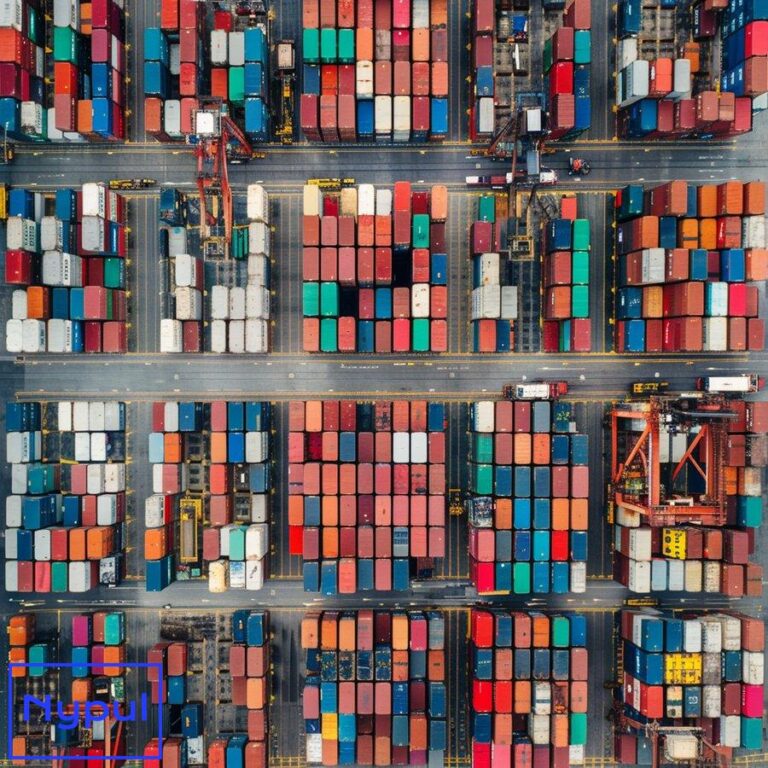

Port congestion refers to a situation where ships face significant delays in loading or unloading cargo at a seaport due to various bottlenecks and capacity constraints. This phenomenon occurs when the volume of incoming vessels exceeds the port’s ability to efficiently process and handle cargo within expected timeframes.

During periods of congestion, ships may be forced to wait at anchor for extended periods before being assigned a berth. Once docked, vessels often experience further delays in cargo operations due to overwhelmed port infrastructure and labor shortages. The ripple effects of these delays can disrupt entire supply chains and global trade flows.

Key characteristics of port congestion include:

Long vessel wait times: Ships may wait days or even weeks to secure a berth, burning fuel and incurring costs while idle.

Reduced port productivity: Overwhelmed equipment and labor resources lead to slower cargo handling and turnaround times.

Container backlogs: Yards become overcrowded with containers awaiting pickup or vessel loading.

Trucking bottlenecks: Long queues form as trucks wait to enter terminals and retrieve cargo.

Schedule disruptions: Vessel itineraries are thrown off course, impacting future port calls.

Port congestion is not a new phenomenon, but its frequency and severity have increased in recent years due to growing global trade volumes, larger vessel sizes, and supply chain disruptions like the COVID-19 pandemic. Major container ports in North America, Europe, and Asia have all grappled with significant congestion events that rippled across global shipping networks.

For shippers and logistics providers, understanding port congestion is crucial for managing supply chain risks and expectations. Congestion introduces uncertainty into transit times, increases costs, and can lead to stockouts or production delays if not properly accounted for. Proactive strategies and contingency planning are essential to navigate periods of port congestion successfully.

The table below summarizes key metrics used to measure and quantify port congestion:

| Metric | Description | Impact |

|---|---|---|

| Vessel wait time | Average time ships spend at anchor before berthing | Longer wait times indicate more severe congestion |

| Berth utilization | Percentage of available berths occupied | Higher utilization leaves less flexibility to handle volume surges |

| Container dwell time | Average days containers spend in port | Longer dwell times signal yard congestion and slower cargo flow |

| Truck turn time | Average time for trucks to complete terminal transactions | Longer turn times create trucking capacity constraints |

| Crane productivity | Container moves per crane per hour | Reduced productivity slows overall cargo handling |

By monitoring these metrics, port authorities, carriers, and shippers can gauge congestion levels and adjust operations accordingly. However, port congestion is a complex issue influenced by numerous factors beyond a single port’s control. The next section will explore the various causes that can trigger or exacerbate congestion at seaports.

Why do ports become congested?

Ports become congested due to a complex interplay of factors that overwhelm their capacity to efficiently process cargo and vessels. Understanding these root causes is essential for developing effective mitigation strategies. The primary drivers of port congestion include:

Surge in cargo volumes: Sudden spikes in import or export demand can quickly outpace a port’s handling capacity. This often occurs during peak shipping seasons or following supply chain disruptions.

Limited port infrastructure: Many ports struggle with outdated or insufficient infrastructure to handle modern cargo volumes and vessel sizes. Inadequate berths, cranes, storage space, and inland connections create bottlenecks.

Labor shortages: A lack of skilled dockworkers, truck drivers, and other essential personnel can slow down port operations, especially during peak periods or labor disputes.

Larger vessel sizes: The trend towards mega-ships has strained port infrastructure, as fewer ports can accommodate these vessels, concentrating cargo volumes at select terminals.

Equipment imbalances: Shortages of containers, chassis, or other handling equipment can create delays in moving cargo through ports efficiently.

Weather disruptions: Severe weather events like storms or fog can temporarily halt port operations, creating backlogs that take days or weeks to clear.

Customs and regulatory delays: Complex or inefficient customs procedures can slow the movement of cargo through ports, particularly for international shipments.

Inefficient port operations: Poor coordination, outdated technology, or suboptimal scheduling can lead to unnecessary delays and reduced productivity.

Hinterland congestion: Inadequate road or rail connections to inland destinations can create bottlenecks in moving cargo away from ports.

Global supply chain disruptions: Events like the COVID-19 pandemic, trade disputes, or geopolitical conflicts can cause ripple effects that lead to port congestion.

The table below illustrates how these factors can impact different aspects of port operations:

| Congestion Factor | Impact on Vessel Operations | Impact on Cargo Handling | Impact on Hinterland Connections |

|---|---|---|---|

| Surge in cargo volumes | Increased wait times for berths | Overwhelmed storage capacity | Strained trucking and rail capacity |

| Limited port infrastructure | Fewer available berths | Slower loading/unloading | Bottlenecks at port gates |

| Labor shortages | Slower vessel turnaround | Reduced crane productivity | Longer truck wait times |

| Larger vessel sizes | Concentrated cargo volumes | Strain on equipment capacity | Surge in inland transport demand |

| Equipment imbalances | Delays in cargo operations | Inefficient container movements | Chassis shortages for trucking |

| Weather disruptions | Temporary port closures | Interrupted cargo handling | Disrupted inland transportation |

| Customs delays | Extended vessel stays | Slower container release | Delayed cargo availability for pickup |

| Inefficient operations | Unpredictable berthing schedules | Suboptimal resource allocation | Poor coordination with trucking |

| Hinterland congestion | Delayed cargo evacuation | Yard congestion | Extended truck turn times |

| Global disruptions | Schedule unreliability | Cargo imbalances | Disrupted intermodal connections |

These factors often interact and compound each other, creating a snowball effect that can quickly escalate port congestion. For example, a surge in cargo volumes may expose underlying infrastructure limitations, which in turn exacerbates labor shortages and equipment imbalances.

Port authorities and terminal operators must continuously monitor these factors and implement adaptive strategies to maintain efficient operations. This may involve investments in infrastructure, technology upgrades, workforce development, and improved coordination with supply chain partners.

Shippers and logistics providers should also stay informed about potential congestion drivers at their key ports of entry and exit. This awareness enables proactive planning and the development of contingency measures to mitigate the impact of port congestion on their supply chains.

The next section will explore how port congestion reverberates through supply chains, affecting businesses and consumers far beyond the port gates.

How does port congestion impact supply chains?

Port congestion sends shockwaves through global supply chains, disrupting the flow of goods and creating cascading effects for businesses and consumers. The impacts of port congestion on supply chains are far-reaching and multifaceted:

Increased lead times: Delays at ports extend overall transit times for shipments, forcing businesses to adjust inventory levels and production schedules. This can lead to stockouts, lost sales, and decreased customer satisfaction.

Higher costs: Congestion-related surcharges, demurrage fees, and expedited shipping costs drive up transportation expenses. These additional costs may be passed on to consumers or erode profit margins for businesses.

Reduced reliability: Unpredictable port delays make it challenging for companies to maintain consistent delivery schedules, impacting just-in-time manufacturing and retail operations.

Inventory challenges: Longer and less reliable lead times force businesses to carry higher safety stock levels, tying up working capital and increasing warehousing costs.

Product shortages: Severe congestion can lead to widespread product shortages, particularly for time-sensitive or seasonal goods.

Quality concerns: Extended transit times and suboptimal storage conditions at congested ports may compromise product quality, especially for perishable or temperature-sensitive items.

Supply chain visibility issues: Port congestion complicates tracking and tracing of shipments, reducing supply chain transparency and making it harder to provide accurate ETAs to customers.

Shift in transportation modes: To bypass congested ports, some shippers may switch to air freight or alternative ocean routes, incurring higher costs but potentially reducing transit times.

Strain on inland transportation: As cargo eventually clears congested ports, it can overwhelm trucking and rail capacity, creating secondary bottlenecks in the supply chain.

Bullwhip effect: The uncertainty created by port congestion can lead to overordering and inventory stockpiling, amplifying demand fluctuations throughout the supply chain.

The table below illustrates how different industries are impacted by port congestion:

| Industry | Primary Impacts | Secondary Effects |

|---|---|---|

| Retail | Stockouts, missed sales seasons | Reduced consumer choice, price increases |

| Manufacturing | Production delays, parts shortages | Idle capacity, workforce reductions |

| Automotive | Disrupted just-in-time operations | Plant shutdowns, reduced vehicle availability |

| Agriculture | Spoilage of perishable goods | Market share losses, food waste |

| Electronics | Delayed product launches | Competitive disadvantages, obsolescence risks |

| Pharmaceuticals | Compromised temperature-sensitive products | Drug shortages, regulatory compliance issues |

| E-commerce | Missed delivery promises | Customer dissatisfaction, increased returns |

| Construction | Material shortages, project delays | Cost overruns, contract penalties |

To mitigate these impacts, businesses must adopt strategies that enhance supply chain resilience and agility:

Diversification of suppliers and ports: Reducing reliance on single sources or entry points can help buffer against localized congestion issues.

Enhanced forecasting and planning: Improved demand forecasting and longer planning horizons can help anticipate and prepare for potential disruptions.

Increased safety stock: Strategically increasing inventory levels for critical components or products can provide a buffer against port delays.

Alternative transportation modes: Developing capabilities to quickly shift between ocean, air, and land transportation can provide flexibility during congestion events.

Improved visibility tools: Investing in real-time tracking and analytics can help companies proactively manage shipments and adjust plans as congestion situations evolve.

Collaboration with logistics partners: Closer coordination with carriers, freight forwarders, and customs brokers can help navigate congestion challenges more effectively.

Near-shoring or re-shoring: Some companies may consider moving production closer to end markets to reduce reliance on long, congestion-prone supply chains.

Port congestion’s impact on supply chains underscores the interconnected nature of global trade. A delay at one port can trigger a domino effect that reverberates across industries and continents. As supply chains become increasingly complex and just-in-time, the ability to anticipate, prepare for, and respond to port congestion becomes a critical competitive advantage.

The next section will delve into the broader economic consequences of port congestion, examining how these disruptions affect regional and national economies.

What are the economic consequences of port congestion?

Port congestion generates significant economic ripple effects that extend far beyond the immediate shipping and logistics industry. These consequences impact regional and national economies, influencing trade balances, employment, and overall economic growth. The key economic ramifications of port congestion include:

Increased costs of goods: Delays and additional shipping expenses often translate into higher prices for consumers, contributing to inflationary pressures.

Lost sales and revenue: Businesses unable to receive inventory or ship products on time may miss sales opportunities, leading to revenue losses across various sectors.

Reduced export competitiveness: Congestion at export ports can make a country’s goods less competitive in global markets due to unreliable delivery times and increased costs.

Job market fluctuations: Severe congestion can lead to temporary layoffs in manufacturing and retail sectors due to parts shortages or inventory issues. Conversely, it may increase demand for logistics and transportation workers.

Decreased port revenues: While congestion may initially increase port revenues through storage fees, prolonged issues can drive shippers to alternative ports, reducing long-term income.

Supply chain restructuring costs: Companies may incur significant expenses to redesign supply chains, diversify suppliers, or relocate production to mitigate congestion risks.

Reduced GDP growth: The cumulative effect of disrupted trade flows, increased costs, and lost productivity can dampen overall economic growth.

Trade imbalances: Congestion affecting imports or exports disproportionately can skew trade balances, potentially impacting currency valuations and trade policies.

Investment in infrastructure: Addressing congestion often requires substantial public and private investment in port and transportation infrastructure, diverting resources from other economic priorities.

Environmental costs: Ships idling at congested ports increase air pollution and greenhouse gas emissions, potentially leading to health-related economic impacts and environmental mitigation expenses.

The table below quantifies some of these economic impacts based on studies of major congestion events:

| Economic Impact | Estimated Cost | Source/Example |

|---|---|---|

| Daily cost of container ship delays | $400,000 – $800,000 per day | Drewry Maritime Research, 2021 |

| Lost sales due to stockouts | 4-8% of annual revenue | Harvard Business Review, 2020 |

| Increased logistics costs | 5-10% rise in transportation expenses | McKinsey & Company, 2022 |

| GDP impact of port disruptions | 0.2-0.4% reduction in annual GDP growth | OECD Economic Outlook, 2023 |

| Job losses during peak congestion | 40,000 – 60,000 temporary layoffs | US Bureau of Labor Statistics, 2021 |

| Infrastructure investment needs | $100-150 billion over 10 years | American Association of Port Authorities |

These economic consequences highlight the critical role that efficient port operations play in supporting national and global economies. Policymakers and industry leaders must consider both short-term mitigation strategies and long-term investments to address port congestion:

Short-term economic measures:

– Temporary tax relief or subsidies for affected industries

– Expedited customs procedures to facilitate cargo flow

– Financial incentives for off-peak port operations to spread demand

Long-term economic strategies:

– Significant investment in port modernization and expansion

– Development of inland ports and intermodal connections to relieve coastal bottlenecks

– Workforce development programs to address labor shortages in the logistics sector

– Trade agreements and policies that promote balanced and resilient supply chains

The economic impact of port congestion also varies by region and industry sector. Coastal areas with port-dependent economies may experience more severe effects, while landlocked regions might face secondary impacts through supply chain disruptions and price increases.

Industries with time-sensitive or perishable goods, such as agriculture and fast fashion, often bear the brunt of congestion-related economic losses. Conversely, some sectors, like warehousing and alternative transportation modes, may see increased demand during congestion events.

Understanding these economic consequences is crucial for businesses, policymakers, and port authorities to justify investments in congestion mitigation strategies. The potential costs of inaction often far outweigh the expenses associated with proactive measures to improve port efficiency and supply chain resilience.

As we’ve seen, the economic impacts of port congestion extend well beyond the port gates. In the next section, we’ll examine how these broader economic effects translate into specific challenges for drayage operations, a critical link in the port-to-consumer supply chain.

How does port congestion affect drayage operations?

Drayage operations, which involve the short-distance transport of containers between ports and nearby logistics facilities, are particularly vulnerable to the effects of port congestion. As the crucial link between maritime and inland transportation, drayage services face unique challenges when ports become overwhelmed:

Extended wait times: Congested ports lead to longer queues for trucks entering and exiting terminal gates, significantly reducing the number of trips a driver can make in a day.

Unpredictable scheduling: Delays in vessel arrivals and cargo availability make it difficult for drayage companies to efficiently plan and allocate their resources.

Chassis shortages: Port congestion often coincides with imbalances in chassis availability, forcing drivers to waste time searching for equipment or making unproductive trips.

Increased operating costs: Longer turn times and reduced productivity drive up fuel consumption, labor costs, and equipment wear and tear for drayage providers.

Detention and demurrage charges: Delays in picking up or returning containers can result in costly fees that may be difficult for drayage companies to recover from their customers.

Driver frustration and turnover: The stress and unpredictability associated with congested ports can lead to higher driver turnover rates, exacerbating existing labor shortages.

Capacity constraints: As congestion reduces the effective capacity of the drayage fleet, it becomes challenging to meet shipper demands, potentially leading to missed pickups or deliveries.

Compliance challenges: Extended working hours to deal with congestion can put pressure on drivers to exceed hours-of-service regulations.

Information flow issues: Poor communication between terminals, shippers, and drayage providers about container availability and port conditions hinders efficient operations.

Ripple effects on warehousing: Inconsistent container flows from congested ports can disrupt warehouse operations, leading to overtime costs or underutilized capacity.

The table below illustrates how port congestion impacts key performance indicators for drayage operations:

| KPI | Normal Operations | During Port Congestion | Impact ||————-|——————-|————————–|——–|

| Average Turn Time (minutes) | 30 | 60 | Increased wait times and unloading delays are typical |

| Delivery Success Rate (%) | 95 | 75 | Higher failure rates in meeting delivery schedules |

| Container Dwell Time (days) | 2 | 5 | More cumbersome movement of containers |

| Operational Costs ($/trip) | $150 | $250 | Enhanced costs due to inefficiency |

| Driver Retention Rate (%) | 85 | 60 | Increased driver turnover and frustration |

To navigate these challenges, drayage operators must adopt strategies that enhance flexibility and efficiency:

Dynamic scheduling: Implementing real-time scheduling systems that can quickly adapt to changing port conditions and container availability.

Extended operating hours: Aligning operations with port extended gate hours to spread demand and reduce peak congestion.

Improved communication systems: Investing in technology that facilitates better information exchange between ports, terminals, and drayage providers.

Driver incentive programs: Developing compensation structures that account for the challenges of operating in congested environments to improve retention.

Diversification of services: Expanding into related logistics services to offset revenue losses during severe congestion periods.

Collaborative partnerships: Forming alliances with other drayage providers to pool resources and increase overall capacity.

Investment in equipment: Maintaining a diverse and well-maintained fleet to handle various container types and reduce dependency on port-supplied chassis.

Data analytics: Utilizing predictive analytics to anticipate congestion patterns and optimize route planning.

The impact of port congestion on drayage operations underscores the interconnected nature of the maritime supply chain. Efficient drayage is critical for alleviating port congestion, yet it is also one of the segments most affected by it. Addressing these challenges requires a coordinated effort between ports, terminals, shippers, and drayage providers to create more resilient and adaptive logistics networks.

What strategies can mitigate port congestion?

Mitigating port congestion requires a multifaceted approach involving various stakeholders in the maritime and logistics industries. Effective strategies combine short-term tactical measures with long-term strategic investments. Here are key approaches to alleviating port congestion:

Infrastructure expansion and modernization:

Ports must invest in expanding and upgrading their facilities to handle increasing cargo volumes and larger vessels. This includes:

– Deepening and widening channels to accommodate mega-ships

– Constructing additional berths and container yards

– Implementing automated container handling systems

– Improving intermodal connections (rail and road)

Technology adoption:

Leveraging advanced technologies can significantly enhance port efficiency:

– Port community systems for seamless data exchange

– Artificial intelligence for optimized berth and yard planning

– Blockchain for transparent and efficient documentation processes

– Internet of Things (IoT) for real-time tracking and equipment management

Extended gate hours:

Implementing 24/7 operations or extended working hours can help spread out cargo handling and reduce peak congestion periods.

Appointment systems:

Mandatory truck appointment systems can regulate the flow of vehicles entering the port, reducing queue times and improving overall efficiency.

Incentive programs:

Financial incentives or penalties can encourage more efficient practices:

– Off-peak pricing to shift cargo movements to less congested times

– Faster cargo release for pre-cleared shipments

– Demurrage and detention fee structures that promote quicker cargo movement

Labor force management:

Addressing workforce issues is crucial for maintaining consistent port operations:

– Training programs to expand the skilled labor pool

– Flexible labor agreements to match workforce with demand fluctuations

– Improved working conditions to attract and retain talent

Cargo prioritization:

Implementing systems to prioritize critical or time-sensitive cargo can help manage congestion impacts:

– Fast-track lanes for perishables or medical supplies

– Temporary storage solutions for non-urgent cargo

Inland ports and dry ports:

Developing inland facilities can relieve pressure on coastal ports:

– Shifting certain customs and cargo processing functions inland

– Improving intermodal connections to facilitate smooth cargo transfer

Vessel scheduling optimization:

Better coordination of vessel arrivals can prevent bottlenecks:

– Collaborative planning between carriers and ports

– Dynamic berth allocation based on real-time port conditions

Supply chain visibility:

Enhancing end-to-end visibility can improve planning and responsiveness:

– Data sharing platforms across supply chain partners

– Predictive analytics for early congestion warning systems

The table below summarizes these strategies and their potential impacts:

| Strategy | Implementation Timeframe | Potential Impact | Key Stakeholders |

|---|---|---|---|

| Infrastructure expansion | Long-term (5-10 years) | High – Increases overall port capacity | Port authorities, government |

| Technology adoption | Medium-term (1-3 years) | High – Improves operational efficiency | Ports, terminal operators, tech providers |

| Extended gate hours | Short-term (immediate) | Medium – Spreads out cargo handling | Ports, labor unions, trucking companies |

| Appointment systems | Short-term (3-6 months) | Medium – Reduces truck queues | Ports, terminal operators, trucking companies |

| Incentive programs | Short-term (3-6 months) | Medium – Influences behavior to optimize port usage | Ports, shippers, carriers |

| Labor force management | Medium-term (1-3 years) | High – Ensures adequate workforce to handle cargo | Ports, labor unions, training institutions |

| Cargo prioritization | Short-term (immediate) | Low-Medium – Manages critical cargo flow | Ports, customs, shippers |

| Inland ports | Long-term (3-5 years) | High – Decongests coastal ports | Port authorities, government, rail operators |

| Vessel scheduling optimization | Medium-term (1-2 years) | Medium – Smooths out vessel arrivals | Ports, carriers, terminal operators |

| Supply chain visibility | Medium-term (1-3 years) | High – Enables proactive congestion management | All supply chain stakeholders |

Implementing these strategies requires collaboration among various stakeholders, including port authorities, terminal operators, carriers, shippers, trucking companies, and government agencies. The most effective approach often involves a combination of these strategies, tailored to the specific needs and constraints of each port.

It’s important to note that while some measures can provide immediate relief, addressing port congestion comprehensively is a long-term endeavor. Continuous investment, innovation, and adaptation are necessary to keep pace with growing global trade volumes and evolving shipping industry dynamics.

Ports that successfully implement these strategies can gain a competitive advantage, attracting more business and contributing to regional economic growth. However, the interconnected nature of global supply chains means that congestion issues often require coordinated efforts across multiple ports and even countries to achieve lasting improvements.

The next section will explore real-world examples of major port congestion events, examining how different ports have applied these strategies to address congestion challenges.

Which real-world examples illustrate major port congestion events?

Several significant port congestion events in recent years have highlighted the vulnerability of global supply chains and the need for robust mitigation strategies. These examples provide valuable insights into the causes, impacts, and responses to severe port congestion:

Los Angeles/Long Beach Port Complex (2020-2022):

The twin ports of Los Angeles and Long Beach, which handle about 40% of U.S. container imports, experienced unprecedented congestion during the COVID-19 pandemic.

Causes:

– Surge in e-commerce demand

– Labor shortages due to COVID-19 outbreaks

– Equipment imbalances and chassis shortages

– Warehouse capacity constraints

Impacts:

– Record number of ships waiting at anchor (over 100 at peak)

– Container dwell times exceeding 9 days (normally 3-4 days)

– Significant delays in cargo delivery nationwide

– Increased costs for importers and consumers

Mitigation efforts:

– Extended gate hours and weekend operations

– Incentives for night and weekend truck pickups

– Temporary container storage on vacant land

– Increased data sharing among port stakeholders

– Federal government intervention to address supply chain issues

Yantian International Container Terminal, Shenzhen (2021):

A COVID-19 outbreak led to severe disruptions at one of China’s busiest container ports.

Causes:

– Partial port closure due to COVID-19 cases

– Stringent testing and quarantine measures for port workers

– Backlog of containers from production catchup after initial pandemic slowdown

Impacts:

– Port productivity dropped to 30% of normal levels

– Vessel wait times extended to 16 days or more

– Spillover effects on nearby ports in the Pearl River Delta

– Global supply chain disruptions, particularly for electronics and furniture

Mitigation efforts:

– Gradual reopening of port areas as COVID-19 cases decreased

– Rerouting of cargo to alternative ports

– Increased use of air freight for urgent shipments

Felixstowe Port, UK (2021-2022):

The UK’s largest container port faced significant congestion issues, exacerbated by Brexit-related changes.

Causes:

– Shortage of truck drivers due to Brexit and COVID-19

– IT system changes related to customs procedures

– Peak season cargo surge

– Labor disputes and industrial action

Impacts:

– Container stacks at maximum capacity

– Ships diverted to other European ports

– Retailers facing stock shortages, especially during holiday seasons

– Increased costs for UK importers and exporters

Mitigation efforts:

– Temporary relaxation of cabotage rules for foreign truckers

– Government support for truck driver training and recruitment

– Investment in additional container handling equipment

– Improved communication with shippers about container availability

Port of Singapore (2020-2021):

Despite being one of the world’s most efficient ports, Singapore faced challenges during the global pandemic disruptions.

Causes:

– Global vessel schedule disruptions

– Increased container dwell times due to lockdowns in destination countries

– Crew change restrictions impacting vessel operations

Impacts:

– Increased yard occupancy reaching near full capacity

– Longer vessel wait times, though less severe than other major ports

– Disruptions to the port’s transshipment operations

Mitigation efforts:

– Leveraging advanced port management systems for optimal resource allocation

– Temporary storage solutions, including floating storage for empty containers

– Enhanced coordination with shipping lines for more predictable vessel arrivals

– Accelerated digitalization initiatives to improve port efficiency

The table below compares key metrics across these congestion events:

| Port | Peak Vessel Wait Time | Container Dwell Time Increase | Estimated Economic Impact |

|---|---|---|---|

| LA/Long Beach | 8-10 days | 200-300% | $25 billion+ in import delays |

| Yantian | 16+ days | 150-200% | $14 billion in trade disruptions |

| Felixstowe | 7-10 days | 50-100% | £800 million in extra shipping costs |

| Singapore | 2-3 days | 20-30% | Limited direct impact, but affected global transshipment |

These examples illustrate several key lessons for addressing port congestion:

Proactive planning: Ports with robust contingency plans and flexible infrastructure fared better during unexpected disruptions.

Technology adoption: Ports leveraging advanced technologies for operations management showed greater resilience and adaptability.

Stakeholder collaboration: Effective communication and coordination among port authorities, carriers, and shippers were crucial for implementing successful mitigation strategies.

Government support: Timely intervention and support from government agencies played a significant role in addressing systemic issues contributing to congestion.

Global ripple effects: Congestion at major ports had far-reaching impacts on global supply chains, highlighting the need for coordinated international efforts to address shipping bottlenecks.

Adaptability: Ports that quickly adapted their operations to changing circumstances (e.g., implementing health protocols, adjusting labor practices) were able to minimize disruptions.

These real-world examples underscore the complexity of port congestion and the need for multifaceted, adaptive approaches to maintain efficient maritime trade flows. The experiences and lessons learned from these events continue to shape port development strategies and supply chain risk management practices worldwide.

How can shippers and logistics providers adapt to port congestion?

Shippers and logistics providers play a crucial role in navigating and mitigating the impacts of port congestion. By adopting proactive strategies and leveraging technology, these stakeholders can enhance their resilience to disruptions and maintain more efficient supply chains. Here are key approaches for adapting to port congestion:

Diversification of ports and routes:

– Utilize multiple ports of entry to spread risk

– Explore alternative shipping routes, including less congested secondary ports

– Consider transshipment options to bypass heavily congested hubs

Flexible inventory management:

– Increase safety stock levels for critical items

– Implement dynamic inventory allocation across multiple warehouses

– Utilize postponement strategies to delay final product configuration

Enhanced visibility and predictive analytics:

– Invest in real-time tracking and visibility solutions

– Leverage predictive analytics to anticipate congestion and adjust plans proactively

– Participate in data-sharing initiatives with ports and carriers

Strategic booking and contracting:

– Secure long-term contracts with carriers to ensure capacity

– Book shipments well in advance, especially during peak seasons

– Consider premium services that offer priority handling and guaranteed space

Modal shift and intermodal solutions:

– Utilize air freight for high-value or time-sensitive cargo

– Explore rail-sea or truck-sea combinations to bypass congested ports

– Consider ro-ro (roll-on/roll-off) shipping for certain types of cargo

Collaboration and communication:

– Foster closer relationships with carriers, freight forwarders, and port operators

– Participate in port community systems and collaborative platforms

– Share forecasts and plans with logistics partners to improve coordination

Technology adoption:

– Implement transportation management systems (TMS) for better planning and execution

– Utilize artificial intelligence for optimized routing and carrier selection

– Explore blockchain solutions for streamlined documentation and customs processes

Nearshoring and reshoring:

– Evaluate opportunities to move production closer to end markets

– Develop regional supply chains to reduce dependence on long-distance shipping

Customs and compliance optimization:

– Participate in trusted trader programs for expedited clearance

– Ensure accurate and complete documentation to avoid customs delays

– Leverage technology for automated customs filing and compliance checks

Contingency planning and risk management:

– Develop comprehensive contingency plans for various congestion scenarios

– Conduct regular risk assessments of key trade lanes and ports

– Maintain relationships with multiple logistics providers for flexibility

The table below summarizes these strategies and their potential impacts:

| Strategy | Implementation Complexity | Potential Impact | Time to Realize Benefits |

|---|---|---|---|

| Diversification of ports and routes | Medium | High | 3-6 months |

| Flexible inventory management | High | Medium-High | 6-12 months |

| Enhanced visibility and predictive analytics | Medium-High | High | 3-9 months |

| Strategic booking and contracting | Low-Medium | Medium | 1-3 months |

| Modal shift and intermodal solutions | Medium | Medium-High | 3-6 months |

| Collaboration and communication | Low-Medium | Medium | Ongoing |

| Technology adoption | High | High | 6-18 months |

| Nearshoring and reshoring | Very High | High | 1-3 years |

| Customs and compliance optimization | Medium | Medium | 3-9 months |

| Contingency planning and risk management | Medium | Medium-High | 3-6 months |

Implementing these strategies requires a holistic approach that considers the unique needs and constraints of each shipper or logistics provider. Some key considerations include:

Cost-benefit analysis: Evaluate the potential costs of implementing new strategies against the expected benefits in terms of reduced delays, improved reliability, and enhanced customer satisfaction.

Scalability: Ensure that adopted solutions can scale to accommodate growth and changing business needs.

Integration: New technologies and processes should integrate seamlessly with existing systems and workflows.

Training and change management: Invest in training programs to ensure staff can effectively utilize new tools and processes.

Continuous improvement: Regularly review and refine strategies based on performance metrics and changing market conditions.

Case studies of successful adaptation:

Global Electronics Manufacturer:

– Implemented a multi-port strategy, spreading shipments across several West Coast ports

– Invested in predictive analytics to anticipate congestion and adjust production schedules

– Increased use of air freight for high-value components

– Result: Reduced average transit delays by 40% during peak congestion periods

Major Retail Chain:

– Developed a hybrid inventory model with increased safety stock for bestsellers

– Utilized dynamic routing to redirect shipments to less congested ports in real-time

– Implemented an advanced TMS for better visibility and decision-making

– Result: Maintained 95% in-stock levels despite significant port delays

Global Freight Forwarder:

– Invested in a blockchain-based platform for streamlined documentation and customs processes

– Developed a network of alternative ports and intermodal solutions

– Offered clients a congestion forecasting tool for proactive planning- Result: Reduced average customs clearance times by 30% and improved client satisfaction scores by 25%

Adapting to port congestion requires a combination of strategic planning, technological innovation, and operational flexibility. Shippers and logistics providers that successfully implement these strategies can gain a competitive advantage by maintaining more reliable and efficient supply chains, even in the face of significant disruptions.

The ability to navigate port congestion effectively has become a critical differentiator in today’s global trade environment. As congestion issues are likely to persist and evolve, continuous adaptation and innovation will be essential for success in international logistics and supply chain management.

By embracing these strategies and remaining agile in their approach, shippers and logistics providers can not only mitigate the negative impacts of port congestion but also position themselves to capitalize on opportunities that arise from changing market dynamics. The most successful companies will be those that view congestion challenges as catalysts for improvement and innovation in their supply chain operations.