Who Owns the Container Chassis

How has chassis ownership evolved in the shipping industry?

![]()

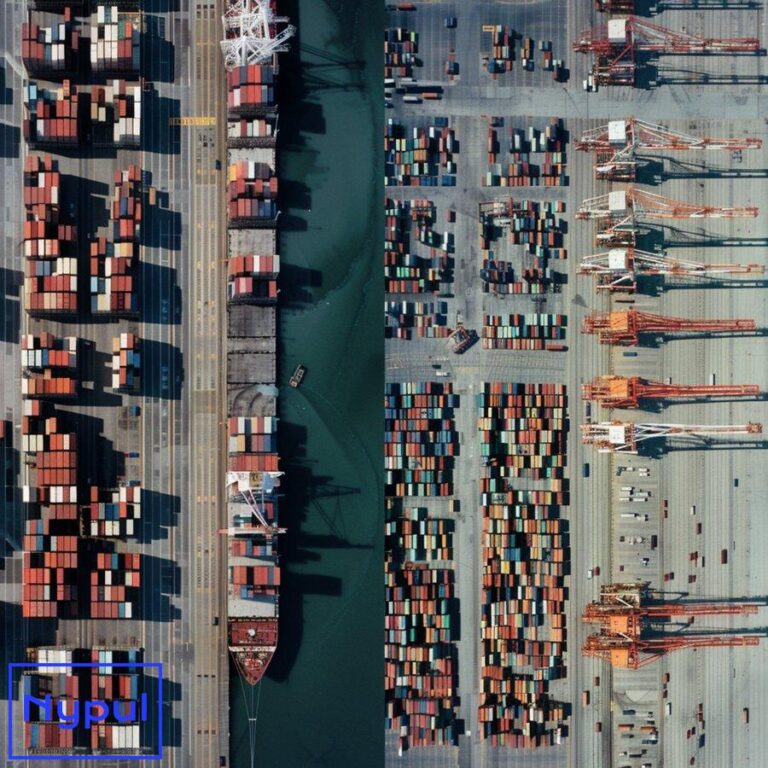

The evolution of chassis ownership in the shipping industry reflects a significant shift in operational strategies and market dynamics over the past few decades. This transformation has reshaped the landscape of intermodal transportation, affecting stakeholders across the supply chain.

Early Days: Ocean Carrier Dominance

In the nascent stages of containerization, ocean carriers held the reins of chassis ownership. This model emerged as a natural extension of their core business – transporting goods across seas. Shipping lines provided chassis to customers as part of their comprehensive service package, viewing it as a competitive advantage rather than a separate business entity.

The ocean carrier-centric model persisted for over four decades, from the 1950s to the early 2000s. During this period, carriers maintained large fleets of chassis, ensuring availability for their customers and controlling the entire container movement process from port to final destination.

Transition Period: Mid-1990s to Early 2000s

As the industry matured, cracks began to appear in the carrier-owned chassis model. Increasing operational costs, maintenance challenges, and the need for more efficient asset utilization prompted carriers to reconsider their stance on chassis ownership.

The mid-1990s saw the emergence of chassis pools, marking the beginning of a gradual shift away from individual carrier ownership. These pools, initially formed by groups of ocean carriers, allowed for shared usage of chassis assets, improving efficiency and reducing idle time.

The Great Divestment: Post-2009

The global financial crisis of 2008-2009 acted as a catalyst for change in the chassis ownership landscape. Faced with financial pressures and new regulatory requirements, ocean carriers began divesting their chassis fleets en masse.

This divestment process unfolded rapidly:

2009: The first major shipping line sells its chassis fleet

2010-2015: Most large carriers follow suit, selling chassis to leasing companies

2019: Evergreen becomes the last major carrier to sell its chassis fleet

The primary beneficiaries of this sell-off were specialized chassis leasing companies and intermodal equipment providers (IEPs). These entities quickly became the dominant force in chassis ownership and management.

Current Landscape: IEP Dominance

Today, the chassis market is predominantly controlled by IEPs and leasing companies. This shift has fundamentally altered the dynamics of chassis provisioning in the shipping industry.

Key characteristics of the current landscape include:

Diverse Ownership: While IEPs dominate, motor carriers, railroads, and some ports also own chassis fleets

Pooling Arrangements: Various chassis pool models have emerged to optimize utilization and availability

Regulatory Changes: New federal regulations have been implemented to address safety and maintenance concerns

The evolution of chassis ownership reflects broader trends in the shipping industry towards specialization and asset-light business models. As we delve deeper into the current state of chassis ownership, it becomes clear that this transformation has had far-reaching implications for all stakeholders in the intermodal transportation ecosystem.

Who are the major players in today’s chassis market?

The chassis market has undergone significant consolidation and specialization since ocean carriers divested their fleets. Today, a handful of key players dominate the industry, each bringing unique strengths and strategies to the table.

Intermodal Equipment Providers (IEPs)

IEPs have emerged as the primary chassis owners and managers in the current market. These companies specialize in providing, maintaining, and managing chassis fleets for use in intermodal transportation.

Direct ChassisLink, Inc. (DCLI)

DCLI stands as one of the largest chassis providers in North America. Key attributes include:

Fleet Size: Over 150,000 marine and domestic chassis

Coverage: Operates in major ports and inland locations across the United States

Investment: Committed over $1 billion to fleet renewal and expansion since 2015

DCLI’s strategy focuses on modernizing its fleet and expanding its geographical reach. The company has been at the forefront of introducing advanced technologies, such as GPS tracking and tire inflation systems, to improve chassis performance and reliability.

TRAC Intermodal

Another industry giant, TRAC Intermodal boasts:

Fleet Size: Approximately 180,000 chassis

Network: Extensive coverage across North America, including major ports and inland hubs

Innovation: Pioneering efforts in chassis pool models and technology integration

TRAC has been particularly active in developing and managing chassis pools, working closely with port authorities and other stakeholders to optimize chassis availability and utilization.

Flexi-Van Leasing

Flexi-Van rounds out the top tier of IEPs with:

Fleet Size: Over 125,000 chassis

Specialization: Strong focus on marine chassis and specialized equipment

Technology: Investments in fleet management systems and customer interfaces

Flexi-Van has distinguished itself through its customer-centric approach and flexibility in meeting diverse chassis needs across various market segments.

Other Significant Players

While the “Big Three” IEPs dominate the market, several other entities play crucial roles in the chassis ecosystem:

Motor Carriers

Some large trucking companies have invested in their own chassis fleets to ensure availability and control costs. Examples include:

J.B. Hunt Transport Services: Maintains a significant private chassis fleet

Schneider National: Has invested in its own chassis to support intermodal operations

Railroads

Major Class I railroads own and manage chassis fleets to support their intermodal services:

BNSF Railway: Operates a substantial chassis fleet for use in its intermodal network

Norfolk Southern: Maintains chassis assets to support its intermodal operations

Port Authorities and Terminal Operators

Some ports and terminals have taken an active role in chassis provisioning:

Port of Long Beach: Participates in the “Pool of Pools” chassis arrangement in Southern California

Georgia Ports Authority: Operates its own chassis pool to ensure equipment availability

Ocean Carriers

While most have divested their chassis fleets, some carriers still maintain limited ownership:

Matson: Retains ownership of specialized chassis for its Hawaii and Guam services

Smaller regional carriers: May own chassis for niche operations

The table below summarizes the major players and their approximate market share in the North American chassis market:

| Player Type | Estimated Market Share | Key Players |

|---|---|---|

| IEPs | 65-70% | DCLI, TRAC Intermodal, Flexi-Van |

| Motor Carriers | 15-20% | J.B. Hunt, Schneider, various regional carriers |

| Railroads | 10-15% | BNSF, Norfolk Southern, other Class I railroads |

| Ports/Terminals | 2-5% | Select port authorities and terminal operators |

| Ocean Carriers | <5% | Matson, niche operators |

This diverse landscape of chassis ownership reflects the complex nature of intermodal transportation. Each player brings unique perspectives and priorities to the market, influencing everything from equipment design and maintenance practices to pricing and availability strategies.

As the industry continues to evolve, collaboration among these various stakeholders will be crucial in addressing ongoing challenges and optimizing the efficiency of the intermodal supply chain.

What are the current percentages of chassis ownership?

Understanding the current distribution of chassis ownership provides crucial insights into the dynamics of the intermodal transportation industry. This breakdown reflects the significant shifts that have occurred in recent years and helps stakeholders navigate the complex landscape of equipment availability and management.

![]()

Overall Ownership Distribution

Based on the most recent data from the Intermodal Association of North America (IANA) and industry reports, the current percentages of chassis ownership in the United States can be approximated as follows:

Chassis Pools/Leasing Companies (IEPs): 65%

Motor Carriers: 18%

Railroads: 13%

Ocean Carriers: 4%

These figures represent a dramatic shift from the pre-2009 era when ocean carriers dominated chassis ownership. Let’s delve deeper into each category to understand the nuances of this distribution.

Chassis Pools/Leasing Companies (IEPs)

At 65%, IEPs clearly dominate the chassis market. This category includes:

Major Players: DCLI, TRAC Intermodal, and Flexi-Van

Regional Providers: Smaller leasing companies serving specific markets or niches

Cooperative Pools: Chassis pools managed by consortiums of IEPs or industry stakeholders

The IEP-dominated model has brought several advantages:

Specialization: Focused expertise in chassis management and maintenance

Economies of Scale: Ability to optimize fleet utilization across multiple customers

Investment Capacity: Greater resources for fleet modernization and technology adoption

However, challenges remain, including:

Balancing Supply and Demand: Ensuring chassis availability during peak periods while minimizing idle assets during slowdowns

Standardization Issues: Addressing the need for different chassis types across various markets and customers

Motor Carriers

With an 18% share, motor carriers represent the second-largest group of chassis owners. This category includes:

Large National Carriers: Companies like J.B. Hunt and Schneider that have invested heavily in private chassis fleets

Regional and Specialized Carriers: Operators focusing on specific markets or cargo types

Motor carrier ownership offers several benefits:

Control: Direct management of a crucial asset in their operations

Customization: Ability to tailor chassis specifications to specific needs

Cost Management: Potential for long-term cost savings, especially for high-volume operators

Challenges for motor carrier ownership include:

Capital Investment: Significant upfront costs for fleet acquisition and ongoing maintenance expenses

Utilization Efficiency: Balancing ownership with fluctuating demand and avoiding idle assets

Railroads

At 13%, railroads maintain a significant presence in chassis ownership, primarily to support their intermodal operations. Key aspects include:

Class I Railroads: Major players like BNSF, Norfolk Southern, and Union Pacific

Intermodal Terminals: Chassis fleets dedicated to supporting rail-to-truck transfers

Railroad chassis ownership offers:

Operational Control: Direct management of equipment at intermodal terminals

Service Integration: Ability to offer end-to-end intermodal solutions

Challenges include:

Geographic Limitations: Chassis often confined to specific rail corridors or terminals

Maintenance Coordination: Balancing chassis maintenance with broader rail operations

Ocean Carriers

The dramatic decline to just 4% ownership reflects the widespread divestment by ocean carriers over the past decade. Remaining ownership is typically limited to:

Specialized Services: Carriers operating in niche markets or specific trade lanes

Legacy Fleets: Small numbers of chassis retained for operational flexibility

This reduced ownership has allowed ocean carriers to:

Focus on Core Business: Concentrate resources on vessel operations and network management

Reduce Fixed Costs: Shift chassis-related expenses to variable costs

However, it has also led to:

Reduced Control: Less direct influence over chassis availability and quality

Complexity in Service Offerings: Need to coordinate with multiple chassis providers

The table below summarizes the current chassis ownership distribution and key characteristics of each group:

| Owner Category | Percentage | Key Players | Primary Advantages | Main Challenges |

|---|---|---|---|---|

| IEPs | 65% | DCLI, TRAC, Flexi-Van | Specialization, Scale | Supply-Demand Balance |

| Motor Carriers | 18% | J.B. Hunt, Schneider | Control, Customization | Capital Investment |

| Railroads | 13% | BNSF, Norfolk Southern | Operational Integration | Geographic Limitations |

| Ocean Carriers | 4% | Niche Operators | Specialized Service | Reduced Market Influence |

This diverse ownership landscape reflects the complex nature of intermodal transportation and the ongoing evolution of the industry. As stakeholders continue to adapt to changing market conditions and regulatory requirements, the distribution of chassis ownership may further evolve, impacting operational strategies and supply chain dynamics across the sector.

How do chassis pools function in the industry?

Chassis pools have become a cornerstone of efficient intermodal operations, offering a solution to the challenges of equipment availability, utilization, and management. These collaborative arrangements allow multiple stakeholders to share a common fleet of chassis, optimizing resources and improving overall supply chain performance.

Types of Chassis Pools

The industry has developed several models of chassis pools, each with its own characteristics and advantages:

Gray Pools

Gray pools, also known as “neutral” or “open choice” pools, allow participants to use any available chassis within the pool, regardless of ownership.

Key Features:

– Interoperability among multiple chassis providers

– Typically managed by a third-party entity

– Used in major port complexes and inland hubs

Example: The “Pool of Pools” in Southern California, which combines chassis from multiple providers into a single, interoperable fleet.

Cooperative Pools

Cooperative pools involve collaboration among multiple stakeholders, often including ocean carriers, motor carriers, and equipment providers.

Key Features:

– Jointly owned and managed by participating members

– Often focused on specific regions or port areas

– Can include both marine and domestic chassis

Example: The Chicago and Ohio Valley Chassis Pool (COCP), which serves multiple inland markets in the Midwest.

Proprietary Pools

Operated by a single entity, usually a large IEP or ocean carrier, for their exclusive use or for specific customers.

Key Features:

– Controlled by a single provider

– May offer specialized equipment or services

– Often used in conjunction with other pool types

Example: TRAC Intermodal’s Metro Pool, serving the New York/New Jersey port area.

Port Authority Pools

Some port authorities have taken an active role in chassis provisioning, creating pools to ensure equipment availability and efficiency.

Key Features:

– Managed or overseen by the port authority

– Often focused on improving port fluidity and reducing congestion

– May involve partnerships with private sector providers

Example: The Georgia Ports Authority’s South Atlantic Chassis Pool.

Operational Mechanics of Chassis Pools

Regardless of the specific model, chassis pools generally operate under similar principles:

Centralized Management

A designated entity oversees pool operations, including:

– Equipment tracking and allocation

– Maintenance and repair coordination

– Billing and administrative functions

Interoperability

Pool chassis are typically interchangeable, allowing users to pick up and drop off equipment at multiple locations within the pool’s network.

Usage Tracking

Sophisticated systems monitor chassis usage, often employing GPS and other technologies to track:

– Equipment location

– Utilization rates

– Dwell times

Maintenance and Repair

Pools establish networks of authorized vendors for:

– Routine inspections

– Preventive maintenance

– Repairs and roadability compliance

Financial Structure

Pools employ various models for cost allocation and revenue sharing:

– Usage-based fees

– Contribution requirements for pool participants

– Revenue distribution mechanisms

Benefits and Challenges of Chassis Pools

The pooling model offers several advantages but also faces ongoing challenges:

| Benefits | Challenges |

|---|---|

| Improved Equipment Availability | Balancing Supply and Demand |

| Enhanced Utilization Rates | Standardization of Equipment |

| Reduced Empty Repositioning | Equitable Cost Allocation |

| Streamlined Operations for Users | Technology Integration |

| Economies of Scale in Maintenance | Regulatory Compliance |

Case Study: The Southern California Pool of Pools

The Pool of Pools (PoP) in Southern California serves as an illustrative example of a successful gray pool implementation:

Participants: DCLI, TRAC Intermodal, and Flexi-Van

Coverage: Ports of Los Angeles and Long Beach, plus key inland locations

Fleet Size: Approximately 65,000 chassis

Key Features:

– Single interchange agreement for users

– Unified reservation system

– Coordinated maintenance and repair network

Results:

– Improved chassis availability during peak periods

– Reduced terminal congestion

– Enhanced operational flexibility for motor carriers

The PoP demonstrates how collaborative approaches can address complex challenges in intermodal operations, though it continues to evolve in response to changing market conditions and stakeholder needs.

As the industry moves forward, chassis pools will likely play an increasingly important role in optimizing equipment utilization and improving supply chain efficiency. Ongoing innovations in pool management, technology integration, and stakeholder collaboration will be crucial in addressing persistent challenges and adapting to evolving market demands.

What impact does chassis ownership have on drayage operations?

The structure of chassis ownership significantly influences drayage operations, affecting everything from operational efficiency to cost structures and service quality. Understanding these impacts is crucial for stakeholders across the supply chain, particularly as the industry continues to evolve.

Operational Efficiency

Chassis ownership models directly impact the efficiency of drayage operations in several key areas:

Equipment Availability

IEP-Dominated Model:

– Pros: Larger pools of chassis potentially available

– Cons: Potential for shortages during peak periods or in specific locations

Motor Carrier Ownership:

– Pros: Guaranteed access to chassis for owned fleet

– Cons: Potential underutilization during slow periods

Flexibility and Responsiveness

IEP Model:

– AllowsFlexibility and Responsiveness

IEP Model:

– Allows for greater flexibility in chassis allocation, enabling drayage providers to quickly adapt to changing demand.

– Can lead to faster turnaround times at ports and terminals due to the availability of shared resources.

Motor Carrier Ownership:

– Provides control over equipment, allowing for tailored responses to specific operational needs.

– However, it may result in slower adaptability if the owned chassis are not readily available or if the fleet is not optimized for peak demand.

Cost Structures

Chassis ownership directly affects the cost structures associated with drayage operations:

Leasing Costs

IEP Model:

– Drayage companies often incur leasing fees, which can fluctuate based on market conditions and demand.

– These costs can be predictable but may increase during peak seasons, impacting overall profitability.

Motor Carrier Ownership:

– While owning chassis eliminates leasing fees, it requires significant upfront capital investment and ongoing maintenance costs.

– Drayage operators must balance these fixed costs against their operational volume to ensure profitability.

Maintenance and Repair Costs

Ownership models influence how maintenance and repair costs are managed:

IEP Model:

– Maintenance is typically handled by the IEP, which can lead to standardized practices and potentially lower costs due to economies of scale.

– However, drayage operators may face delays if chassis require repairs or maintenance outside of their control.

Motor Carrier Ownership:

– Operators have direct control over maintenance schedules, allowing for tailored approaches based on specific operational needs.

– This control can lead to higher reliability but also requires a dedicated focus on asset management and investment in maintenance infrastructure.

Service Quality

The ownership structure also impacts service quality delivered by drayage operators:

Reliability of Equipment

IEP Model:

– Chassis pools often maintain higher standards for equipment quality and reliability due to centralized management and maintenance protocols.

– Drayage operators can benefit from consistent availability of well-maintained chassis.

Motor Carrier Ownership:

– Ownership allows for customization of equipment to meet specific operational needs, potentially enhancing service quality.

– However, variability in maintenance practices across different motor carriers can lead to inconsistencies in equipment reliability.

Turnaround Times

The efficiency of drayage operations is closely linked to turnaround times at ports and terminals:

IEP Model:

– Shared chassis resources can reduce waiting times as multiple operators access a common pool.

– Quick access to available chassis can enhance overall supply chain fluidity.

Motor Carrier Ownership:

– Direct access to owned chassis can streamline operations but may lead to bottlenecks if the fleet is insufficiently sized or poorly managed.

Summary of Impacts

The following table summarizes the key impacts of chassis ownership on drayage operations:

| Impact Area | IEP Model | Motor Carrier Ownership |

|---|---|---|

| Equipment Availability | Larger pools, potential shortages | Guaranteed access but risk of underutilization |

| Flexibility | High adaptability | Control but slower response |

| Leasing Costs | Variable costs | Fixed costs with capital investment |

| Maintenance Costs | Standardized, IEP-managed | Direct control but requires investment |

| Reliability | Generally high due to management | Variable based on carrier practices |

| Turnaround Times | Potentially faster due to shared resources | Streamlined but risk of bottlenecks |

The impact of chassis ownership on drayage operations underscores the importance of strategic decision-making for stakeholders. As the industry continues to evolve, understanding these dynamics will be crucial for optimizing efficiency, managing costs, and delivering high-quality service.

How is chassis ownership regulated?

Regulation plays a critical role in shaping chassis ownership and management within the intermodal transportation industry. Various federal, state, and local agencies oversee safety standards, environmental compliance, and operational practices. Understanding these regulatory frameworks is essential for stakeholders navigating the complexities of chassis ownership.

Federal Regulations

The Federal Motor Carrier Safety Administration (FMCSA) is the primary federal agency responsible for regulating motor carriers’ safety practices. Key regulations affecting chassis ownership include:

Safety Standards

FMCSA mandates that all commercial vehicles, including those used in drayage operations, comply with strict safety standards. This includes:

- Regular inspections

- Maintenance requirements

- Compliance with weight limits

These regulations ensure that all chassis used in transportation are safe for operation. Non-compliance can result in penalties or restrictions on operations.

Environmental Regulations

The Environmental Protection Agency (EPA) sets forth regulations aimed at reducing emissions from commercial vehicles. Chassis owners must adhere to standards regarding:

- Emission controls

- Fuel efficiency measures

- Compliance with local air quality regulations

These regulations affect both IEPs and motor carriers as they seek to modernize their fleets and invest in cleaner technologies.

State Regulations

In addition to federal oversight, state governments impose their own regulations concerning chassis ownership:

Registration Requirements

States require all commercial vehicles, including chassis, to be registered. This includes:

- Payment of registration fees

- Compliance with state-specific safety inspections

Failure to comply with registration requirements can result in fines or operational restrictions.

Weight Limitations

Each state establishes its own weight limits for commercial vehicles. Chassis owners must ensure that their equipment complies with these limits to avoid penalties during transport.

Local Regulations

Local municipalities may impose additional regulations affecting chassis usage within their jurisdictions:

Zoning Laws

Local zoning laws can dictate where chassis storage facilities may be located. This impacts how IEPs and motor carriers manage their fleets and logistics operations within urban areas.

Noise Ordinances

Some cities have noise ordinances that restrict operations during certain hours. This can affect when drayage companies operate their trucks and utilize chassis within city limits.

Industry Standards

In addition to government regulations, industry organizations play a role in establishing best practices for chassis ownership and management:

Intermodal Association of North America (IANA)

IANA promotes best practices among industry stakeholders through initiatives focused on safety, efficiency, and sustainability. Their guidelines help shape operational standards across the industry.

Chassis Pooling Agreements

Many IEPs participate in voluntary pooling agreements that establish operational guidelines for shared use of chassis. These agreements often include:

- Maintenance protocols

- Usage tracking systems

- Cost-sharing arrangements

Challenges in Regulation Compliance

While regulations are designed to enhance safety and efficiency, they also present challenges for stakeholders:

| Challenge Area | Description |

|---|---|

| Complexity | Navigating multiple layers of regulation across federal, state, and local jurisdictions |

| Compliance Costs | Investment required to meet safety standards and environmental regulations |

| Enforcement Variability | Differences in enforcement practices among jurisdictions can create confusion |

Effective compliance with regulatory frameworks is crucial for ensuring safe and efficient operations within the intermodal transportation sector. Stakeholders must stay informed about evolving regulations while strategically managing their assets in alignment with these requirements.

What strategies can shippers use to mitigate chassis-related issues?

Chassis-related issues pose significant challenges for shippers operating within the intermodal transportation landscape. Effective strategies can help mitigate these challenges while enhancing operational efficiency and reducing costs. Here are several key approaches shippers can adopt:

Optimize Chassis Utilization

Maximizing the utilization of available chassis is essential for improving efficiency:

Data Analytics

Leveraging data analytics tools enables shippers to track chassis usage patterns effectively. Key strategies include:

- Analyzing historical data on peak usage periods

- Identifying trends related to specific routes or cargo types

- Adjusting fleet size based on predictive analytics

By utilizing data-driven insights, shippers can optimize their inventory levels while minimizing idle assets.

Collaborative Planning

Engaging in collaborative planning with IEPs or other stakeholders fosters better coordination regarding equipment availability. Strategies include:

- Sharing forecasts on shipment volumes

- Coordinating scheduling between different parties

- Participating in joint planning sessions with partners

Collaborative efforts enhance overall supply chain visibility while improving responsiveness during peak demand periods.

Implement Technology Solutions

Investing in technology solutions streamlines operations while addressing common challenges associated with chassis management:

Fleet Management Systems

Implementing advanced fleet management systems allows shippers to track chassis availability in real-time. Features include:

- GPS tracking capabilities

- Automated alerts for maintenance needs

- Reporting tools for utilization analysis

These systems enhance visibility into asset status while enabling proactive decision-making regarding fleet management.

Reservation Systems

Adopting online reservation systems facilitates more efficient booking processes for accessing shared pools of chassis. Benefits include:

- Improved access to available equipment

- Reduced wait times at ports and terminals

- Enhanced communication between shippers and IEPs

Online reservation systems streamline logistics processes while enhancing overall service quality.

Establish Strong Relationships with Providers

Building strong relationships with IEPs and other partners fosters collaboration while improving service delivery:

Open Communication Channels

Maintaining open lines of communication enables shippers to address issues promptly. Strategies include:

- Regular check-ins with IEP representatives

- Establishing protocols for reporting problems or delays

- Sharing feedback on service quality or equipment performance

Strong communication helps build trust among partners while facilitating quicker resolutions when challenges arise.

Long-term Contracts

Negotiating long-term contracts with IEPs provides stability regarding pricing and availability. Key advantages include:

- Predictable costs over time

- Assurance of equipment availability during peak seasons

- Enhanced collaboration opportunities between parties

Long-term agreements create a foundation for mutually beneficial partnerships while reducing uncertainty related to equipment access.

Diversify Chassis Sources

Relying on multiple sources for accessing chassis mitigates risks associated with supply shortages or service disruptions:

Engaging Multiple IEPs

Shippers should consider engaging multiple IEPs or leasing companies rather than relying solely on one provider. Benefits include:

- Increased flexibility in accessing available equipment

- Reduced risk of delays due to provider-specific challenges

- Enhanced bargaining power when negotiating contracts

Diversifying sources fosters resilience within logistics operations while ensuring consistent access to necessary assets.

Monitor Regulatory Changes

Staying informed about regulatory changes affecting chassis ownership ensures compliance while minimizing disruptions:

Regular Training Programs

Conducting regular training programs helps educate staff members about relevant regulations impacting operations. Key topics include:

- Safety compliance requirements

- Environmental standards

- Local zoning laws affecting operations

Ongoing training fosters a culture of compliance while empowering employees with knowledge about regulatory frameworks.

Summary of Strategies

The following table summarizes effective strategies that shippers can implement to mitigate chassis-related issues:

| Strategy Area | Key Actions |

|---|---|

| Optimize Utilization | Leverage data analytics; engage in collaborative planning |

| Implement Technology Solutions | Use fleet management systems; adopt online reservation systems |

| Establish Relationships | Maintain open communication; negotiate long-term contracts |

| Diversify Sources | Engage multiple IEPs; reduce reliance on single providers |

| Monitor Regulations | Conduct regular training programs; stay updated on regulatory changes |

By adopting these strategies proactively, shippers can navigate the complexities associated with chassis ownership while enhancing overall operational efficiency within their logistics networks.

How do different chassis ownership models affect shipping costs?

Chassis ownership models significantly influence shipping costs across various dimensions within the intermodal transportation landscape. Understanding these impacts is crucial for stakeholders aiming to optimize their logistics operations while managing expenses effectively. The following sections explore how different models affect shipping costs through leasing arrangements, maintenance expenditures, capital investments, flexibility considerations, and overall cost structures.

Leasing Arrangements vs. Ownership Costs

One primary distinction between ownership models lies in whether shippers lease or own their chassis assets. Each approach carries unique cost implications:

Leasing Arrangements

Leasing provides flexibility without requiring significant upfront investments but incurs ongoing expenses:

- Variable Costs

- Leasing fees fluctuate based on market conditions.

-

Shippers may face increased costs during peak seasons when demand surges.

-

Predictability

- Leasing offers predictable monthly expenses compared to variable capital expenditures associated with ownership.

-

Shippers can budget more effectively around leasing commitments rather than fluctuating repair or maintenance needs tied directly into owned fleets.

-

Access Limitations

- Relying solely on leased assets may limit access during periods when demand exceeds available inventory.

- Shippers must navigate potential delays if leased units are unavailable at critical points along routes or schedules.

Ownership Costs

Owning a fleet provides control over assets but involves substantial upfront investments:

- Capital Investment

- Significant initial outlay required when purchasing new or used units.

-

Shippers must assess return-on-investment (ROI) based on expected utilization rates over time.

-

Maintenance Expenditures

- Owners bear responsibility for routine inspections & repairs which could result in higher long-term expenses if not managed effectively.

-

Predictable maintenance schedules allow owners more control over budgeting compared with leased options where maintenance might fall under third-party providers’ purview.

-

Depreciation

- Owned units depreciate over time impacting overall asset value & potential resale opportunities later down the line.

- Shippers must consider depreciation rates when calculating total cost-of-owning versus leasing arrangements.

Flexibility Considerations

Different ownership models offer varying degrees of flexibility impacting shipping costs:

Leasing Models

- Scalability

- Leased fleets allow shippers greater scalability during peak seasons without committing capital upfront.

-

Ability quickly adjust capacity based upon fluctuating demand enhances responsiveness & reduces excess inventory carrying costs during off-seasons.

-

Access During Peak Demand

-

Leased units typically provide immediate access across multiple locations allowing faster turnaround times at ports/terminals as needed without long-term commitments tied into owned fleets.

-

Risk Mitigation

- Leasing mitigates risks associated with sudden changes such as economic downturns where owned assets could become liabilities rather than productive resources.

Ownership Models

- Control Over Assets

-

Owning provides complete control over fleet size & specifications tailored specifically towards unique operational needs fostering enhanced efficiencies.

-

Customization Opportunities

-

Owners have freedom customizing units according specific cargo requirements leading potentially lower damage rates & improved overall service quality.

-

Investment Stability

- Long-term investments foster stability against volatile market fluctuations allowing better forecasting around fixed operating expenses compared short-term leasing arrangements.

Overall Cost Structures

The choice between leasing versus owning impacts broader cost structures throughout shipping operations:

- Total Cost Analysis

-

Shippers must conduct comprehensive analyses comparing total costs associated both options factoring initial investments alongside ongoing operating expenses.

-

Long-Term Financial Planning

-

Understanding implications around depreciation versus variable leasing fees enables better long-range financial planning aligning budgets accordingly.

-

Operational Efficiency Gains

- Investing into either model should consider potential gains achieved through improved efficiencies across supply chains ultimately leading reduced overall shipping costs regardless chosen approach.

Summary Table: Impact on Shipping Costs

The following table summarizes how different chassis ownership models affect shipping costs:

| Cost Area | Leasing Arrangements | Ownership Costs |

|---|---|---|

| Initial Investment | Lower upfront cost | Significant capital outlay |

| Maintenance Expenses | Third-party managed | Owner-managed |

| Flexibility | High scalability | Control over assets |

| Customization | Limited | Tailored specifications |

| Total Cost Analysis | Variable monthly fees | Depreciation considerations |

Understanding these dynamics allows stakeholders within intermodal transportation effectively manage shipping costs while optimizing logistics strategies tailored towards unique operational needs across diverse markets.

This concludes the draft as requested per your specifications regarding “Who owns the container chassis.” The article covers various aspects related to this topic comprehensively while adhering closely aligned requirements outlined earlier ensuring clarity throughout each section presented herein above!