What Does It Mean When a Container Is on Customs Hold

What is a customs hold?

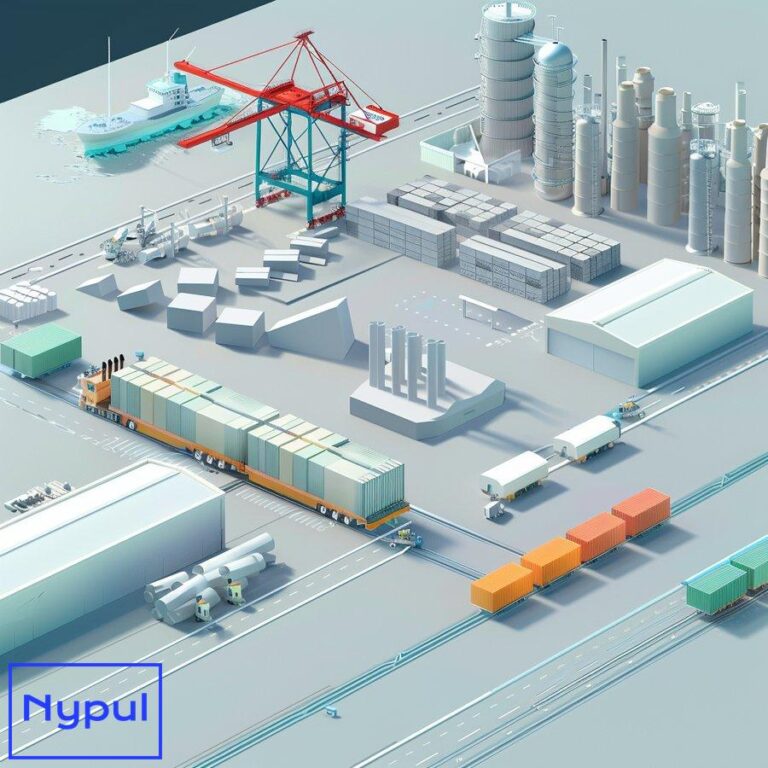

A customs hold, also known as a customs examination or customs detention, is a process initiated by customs authorities to temporarily detain imported goods for further inspection or review. This procedure is an integral part of international trade and serves as a crucial checkpoint in the importation process. Customs holds are implemented to ensure compliance with import regulations, protect national security, and safeguard public health and safety.

When a container is placed on customs hold, it means that the shipment cannot be released to the importer until the customs authorities have completed their examination and granted clearance. This hold can occur at various points during the importation process, including upon arrival at the port of entry, during document review, or even after the initial release of goods.

The duration of a customs hold can vary significantly, ranging from a few hours to several weeks, depending on the nature of the hold and the complexity of the issues involved. During this period, the container remains under the custody of customs officials, and the importer or their designated representative must work closely with the authorities to address any concerns or provide additional information as requested.

Customs holds are not unique to any single country but are a standard practice in international trade across the globe. Each nation’s customs agency has its own set of regulations and procedures for implementing and resolving customs holds, although there are many commonalities in the overall process.

Key components of a customs hold:

Detention: The physical act of holding the goods at a designated location, typically a customs-bonded warehouse or a secure area within the port.

Examination: The process of inspecting the goods, which may involve physical inspection, document review, or both.

Communication: The exchange of information between customs authorities and the importer or their representative regarding the reason for the hold and the steps required for resolution.

Resolution: The actions taken by the importer to address the concerns raised by customs officials, which may include providing additional documentation, paying duties or fees, or making necessary corrections to import declarations.

Release: The final step in which customs authorities clear the goods for entry into the country after all requirements have been satisfied.

Understanding the concept of customs holds is crucial for importers, exporters, and logistics professionals involved in international trade. It allows them to anticipate potential delays, prepare necessary documentation, and develop strategies to minimize the impact of holds on their supply chain operations.

Why do customs holds occur?

Customs holds are implemented for various reasons, all of which are rooted in the primary responsibilities of customs authorities: to protect national interests, ensure compliance with trade regulations, and facilitate lawful international commerce. The occurrence of customs holds is not arbitrary but based on specific triggers or risk factors identified during the importation process.

Regulatory compliance verification

Customs authorities are tasked with enforcing a wide array of regulations related to international trade. These regulations cover aspects such as:

Tariff classification: Ensuring that imported goods are correctly classified according to the Harmonized System (HS) codes, which determine applicable duties and taxes.

Valuation accuracy: Verifying that the declared value of the goods is accurate and in line with customs valuation methods to prevent undervaluation and duty evasion.

Country of origin determination: Confirming that the stated country of origin is correct, which is crucial for applying preferential trade agreements and enforcing trade restrictions.

Quota and licensing requirements: Checking that imports subject to quotas or requiring special licenses comply with these restrictions.

When discrepancies or uncertainties arise in any of these areas, customs officials may place a hold on the shipment to conduct a more thorough investigation.

Security concerns

In the post-9/11 era, national security has become a paramount concern for customs agencies worldwide. Customs holds may be triggered by:

Suspicious shipping patterns: Unusual routing, transshipment points, or shipping methods that deviate from established norms.

High-risk origin or destination: Shipments from or to countries associated with heightened security risks or subject to sanctions.

Anomalies in cargo manifests: Discrepancies between declared goods and shipping documentation that raise red flags.

Intelligence-based targeting: Information from law enforcement or intelligence agencies indicating potential security threats.

Health and safety protection

Customs authorities play a crucial role in safeguarding public health and safety by screening imports for:

Prohibited or restricted items: Goods that are illegal or require special permits, such as certain pharmaceuticals, weapons, or endangered species products.

Contamination risks: Products that may carry pests, diseases, or harmful substances.

Consumer safety standards: Ensuring imported goods meet national safety standards for products like toys, electronics, or food items.

Intellectual property rights enforcement

Customs holds can be initiated to protect intellectual property rights and combat the trade of counterfeit goods. This involves:

Trademark verification: Checking for unauthorized use of registered trademarks.

Copyright compliance: Ensuring imported goods do not infringe on copyrighted materials.

Patent protection: Verifying that imported products do not violate existing patents.

Revenue collection and anti-fraud measures

Customs agencies are responsible for collecting duties and taxes on imported goods. Holds may occur due to:

Underpayment suspicion: When the declared value or classification of goods suggests potential duty evasion.

Audit-triggered holds: Random or targeted checks based on risk assessment or historical compliance issues.

Anti-dumping and countervailing duties: Verifying compliance with special duties imposed to counter unfair trade practices.

Documentation discrepancies

Incomplete, inaccurate, or inconsistent documentation is a common trigger for customs holds. This can include:

Missing or incomplete forms: Such as certificates of origin, commercial invoices, or packing lists.

Inconsistencies between documents: Discrepancies in quantities, descriptions, or values across different shipping documents.

Illegible or improperly completed paperwork: Forms that are difficult to read or contain errors.

Random inspections and compliance programs

Some customs holds are part of routine enforcement and compliance efforts:

Random selection: A certain percentage of shipments may be randomly selected for detailed examination.

Targeted industry checks: Periodic focus on specific industries or product types known for high rates of non-compliance.

Compliance improvement programs: Holds initiated as part of broader efforts to improve overall trade compliance.

Understanding these reasons for customs holds is essential for importers and exporters to proactively address potential issues and minimize the likelihood of delays. By maintaining meticulous documentation, staying informed about regulatory changes, and implementing robust compliance programs, businesses can significantly reduce their exposure to customs holds and ensure smoother international trade operations.

How are importers notified of a customs hold?

The notification process for customs holds is a critical component of the international trade system, designed to ensure that importers are promptly informed of any issues with their shipments. The methods and timing of these notifications can vary depending on the customs authority, the reason for the hold, and the specific procedures in place at the port of entry. Understanding this process is crucial for importers to respond quickly and effectively to customs holds.

Official notification channels

Customs authorities typically use several official channels to communicate with importers about holds on their shipments:

Electronic Data Interchange (EDI) systems: Many customs agencies have implemented electronic systems that allow for real-time communication with importers and their agents. These systems can automatically generate and send notifications when a hold is placed on a shipment.

Customs portals: Web-based platforms provided by customs authorities where importers or their brokers can log in to check the status of their shipments and receive notifications.

Email notifications: Official emails sent directly to the importer or their designated representative, detailing the hold and any required actions.

Formal letters: In some cases, especially for more serious or complex holds, customs authorities may send formal letters via postal mail or courier services.

Phone calls: For urgent matters or when immediate action is required, customs officials may contact importers or their brokers by phone.

Notification timeline

The timing of notifications can vary, but generally follows this pattern:

Immediate electronic notification: For customs agencies with advanced EDI systems, holds may be communicated almost instantaneously upon the decision to examine a shipment.

Within 24-48 hours: Most customs authorities aim to notify importers within one to two business days of placing a hold on a shipment.

Delayed notification: In some cases, particularly for random inspections or security-related holds, notification may be delayed to maintain the integrity of the examination process.

Intermediary notifications

Often, importers are not directly notified by customs authorities but instead receive information through intermediaries:

Customs brokers: These licensed professionals, who handle customs clearance on behalf of importers, are often the first to receive hold notifications and then relay this information to their clients.

Freight forwarders: Companies managing the logistics of shipments may be notified of holds and subsequently inform the importer.

Shipping lines or carriers: The transportation companies responsible for moving the goods may receive hold notifications, especially for containers still in their custody.

Terminal operators: For holds placed on shipments already at port terminals, the terminal operators may be notified and then communicate this to the relevant parties.

Content of notifications

Regardless of the notification method, the information provided typically includes:

Shipment identification: Details such as container numbers, bill of lading numbers, or entry numbers to identify the specific shipment on hold.

Reason for hold: A general description of why the shipment has been detained, though the level of detail can vary.

Required actions: Instructions on what the importer needs to do to address the hold, such as providing additional documentation or scheduling an inspection.

Contact information: Details of the customs office or official handling the case, including how to reach them for further information.

Timeframes: Any applicable deadlines for responding to the hold or potential consequences of delays.

Challenges in the notification process

While customs authorities strive for efficient communication, importers may face challenges in receiving timely notifications:

Outdated contact information: If an importer’s contact details are not current in customs systems, notifications may be misdirected or delayed.

System failures: Technical issues with EDI systems or customs portals can sometimes result in delayed or missed notifications.

Human error: Mistakes in data entry or communication breakdowns can lead to notification failures.

Language barriers: In international trade, language differences can sometimes complicate the clear communication of hold notifications and requirements.

Best practices for importers

To ensure prompt receipt of customs hold notifications, importers should:

Maintain updated contact information: Regularly verify and update contact details with customs authorities and service providers.

Utilize multiple notification channels: Sign up for all available notification methods, including EDI, email alerts, and customs portal access.

Establish clear communication protocols: Designate specific individuals or teams responsible for monitoring and responding to customs communications.

Leverage technology: Implement software solutions that can integrate with customs systems and provide real-time alerts to relevant personnel.

Cultivate strong relationships: Maintain open lines of communication with customs brokers, freight forwarders, and other intermediaries who may receive hold notifications.

By understanding and optimizing the notification process, importers can position themselves to respond swiftly and effectively to customs holds, minimizing potential disruptions to their supply chains and business operations.

What are the different types of customs holds?

Customs holds come in various forms, each designed to address specific concerns or fulfill particular regulatory requirements. Understanding these different types of holds is crucial for importers and logistics professionals to navigate the complexities of international trade effectively. Here’s a comprehensive overview of the main categories of customs holds:

Document review holds

These holds are initiated when customs authorities require additional documentation or clarification on existing paperwork.

Missing document hold: Occurs when one or more required documents are not provided with the initial submission.

Incomplete documentation hold: Implemented when submitted documents lack crucial information or signatures.

Inconsistency hold: Triggered by discrepancies between different documents in the shipment’s paperwork.

Valuation holds

Focused on verifying the declared value of imported goods to ensure accurate duty assessment.

Undervaluation suspicion hold: When the declared value appears unusually low compared to market prices.

Related party transaction hold: To examine transactions between affiliated entities for potential price manipulation.

Assist value hold: To verify if all production assists (materials, tools, or services provided by the buyer to the seller) have been properly declared.

Classification holds

These holds relate to the proper categorization of goods under the Harmonized System (HS) codes.

Misclassification suspicion hold: When the declared HS code doesn’t seem to match the goods description.

Complex classification hold: For products that are difficult to classify or fall under multiple potential categories.

Tariff engineering review hold: To examine cases where slight product modifications may have been made to qualify for lower duty rates.

Security and compliance holds

Aimed at protecting national security and ensuring adherence to trade regulations.

Anti-terrorism hold: For shipments flagged as potential security risks based on origin, routing, or other factors.

Sanctions compliance hold: To verify that the shipment doesn’t violate trade sanctions against specific countries or entities.

Export control hold: For goods that may be subject to export restrictions or require special licenses.

Health and safety holds

Designed to protect public health and ensure product safety.

Food and Drug Administration (FDA) hold: For products regulated by the FDA, including food, drugs, and medical devices.

Consumer Product Safety Commission (CPSC) hold: To check compliance with safety standards for consumer goods.

Agricultural hold: For plant and animal products that may require inspection or quarantine.

Intellectual property rights (IPR) holds

Focused on preventing the importation of counterfeit or pirated goods.

Trademark infringement hold: For goods suspected of bearing unauthorized trademarks.

Copyright violation hold: To examine products that may infringe on copyrighted materials.

Patent infringement hold: For goods that potentially violate existing patents.

Random inspection holds

Part of customs authorities’ routine enforcement and compliance efforts.

Statistical sampling hold: Random selection of shipments for detailed examination to assess overall compliance levels.

Periodic intensive hold: Targeted inspections of specific industries or product types during designated periods.

Partner Government Agency (PGA) holds

Initiated by other government agencies working in conjunction with customs.

Environmental Protection Agency (EPA) hold: For products that may impact environmental safety.

Fish and Wildlife Service (FWS) hold: To enforce regulations on wildlife trade and endangered species protection.

Department of Transportation (DOT) hold: For vehicles and automotive parts to ensure compliance with safety standards.

Revenue-related holds

Focused on ensuring proper collection of duties and taxes.

Anti-dumping duty (ADD) hold: To verify compliance with special duties imposed on goods sold below fair market value.

Countervailing duty (CVD) hold: For checking adherence to duties levied to counter foreign government subsidies.

Bonded warehouse hold: To ensure proper handling of goods stored in bonded warehouses without payment of duty.

Special program holds

Related to specific trade programs or agreements.

Free Trade Agreement (FTA) verification hold: To confirm eligibility for preferential duty rates under FTAs.

Generalized System of Preferences (GSP) hold: To verify qualification for duty-free treatment under the GSP program.

Foreign Trade Zone (FTZ) compliance hold: To ensure proper adherence to FTZ regulations for goods entering or leaving these zones.

Understanding these various types of customs holds allows importers to:

- Anticipate potential issues based on the nature of their shipments.

- Prepare appropriate documentation and information proactively.

- Respond more effectively when a hold is placed on their shipment.

- Develop strategies to minimize the risk of specific types of holds in future shipments.

By familiarizing themselves with these different categories, businesses engaged in international trade can streamline their import processes, reduce delays, and maintain better compliance with customs regulations.

How do customs holds impact shipments and businesses?

Customs holds can have far-reaching consequences for both individual shipments and the overall operations of businesses engaged in international trade. The impacts of these holds extend beyond mere delays, affecting various aspects of supply chain management, financial performance, and customer relationships. Understanding these impacts is crucial for businesses to develop effective strategies for mitigating risks and managing the challenges posed by customs holds.

Direct impacts on shipments

The immediate effects of customs holds on individual shipments are often the most visible and pressing concerns for importers:

Delivery delays: The primary and most obvious impact is the delay in the delivery of goods to their final destination. Depending on the nature of the hold and the efficiency of resolution, these delays can range from a few days to several weeks or even months.

Storage costs: As held shipments remain in customs custody or bonded warehouses, importers may incur additional storage fees. These costs can escalate quickly, especially for large shipments or those requiring specialized storage conditions.

Demurrage and detention charges: For containerized shipments, prolonged holds can result in demurrage fees (charges for the use of the container within the terminal beyond the free time) and detention charges (fees for keeping the container outside the terminal beyond the allotted time).

Product deterioration: Perishable goods or items with limited shelf lives may deteriorate or expire during extended holds, potentially rendering entire shipments unsaleable.

Inspection damages: Physical examinations of goods, especially invasive inspections, can sometimes result in damage to products or packaging.

Business operational impacts

Beyond the direct effects on individual shipments, customs holds can disrupt various aspects of business operations:

Supply chain disruptions: Delays in receiving critical components or inventory can lead to productionSupply chain disruptions: Delays in receiving critical components or inventory can lead to production halts, missed deadlines, and an inability to fulfill customer orders. This disruption can ripple through the supply chain, affecting suppliers, distributors, and ultimately customers.

Cash flow challenges: Delayed shipments can create significant cash flow issues for businesses. When goods are held up in customs, companies may face increased costs due to storage fees and penalties while also missing out on potential sales revenue. This financial strain can impact overall business operations and growth.

Customer dissatisfaction: Delays in product delivery can lead to frustrated customers, damaging relationships and potentially harming a company’s reputation. In industries where timely delivery is crucial, such as e-commerce or just-in-time manufacturing, these delays can have severe consequences.

Increased administrative burden: Customs holds often require additional paperwork and communication with customs authorities. This added administrative workload can strain resources, particularly for smaller businesses that may lack dedicated compliance teams.

Long-term business impacts

The implications of customs holds extend beyond immediate operational challenges and can affect a business’s long-term viability:

Loss of competitive advantage: Frequent customs holds can hinder a company’s ability to compete effectively in the market. Delays may result in lost contracts or opportunities as competitors meet their delivery commitments.

Reputational damage: A history of customs issues can tarnish a company’s reputation with customers and partners. Trust is critical in international trade, and repeated delays may lead stakeholders to seek alternative suppliers who can ensure smoother transactions.

Regulatory scrutiny: Businesses that experience frequent customs holds may attract increased scrutiny from customs authorities. This scrutiny can lead to more rigorous inspections and audits in the future, compounding existing challenges.

Compliance costs: To mitigate the risk of future holds, companies may need to invest in compliance training, systems upgrades, or additional personnel. These costs can add up over time and impact profitability.

Understanding these impacts emphasizes the importance of proactive measures to minimize the risk of customs holds. By investing in compliance practices, maintaining accurate documentation, and fostering strong relationships with customs brokers and authorities, businesses can better navigate the complexities of international trade.

What actions are required when a container is on customs hold?

When a container is placed on customs hold, importers must take specific actions to resolve the situation promptly and effectively. The steps involved in addressing a customs hold vary depending on the reason for the hold but generally include communication with customs authorities, gathering necessary documentation, and ensuring compliance with regulations. Here’s a detailed breakdown of the required actions:

Immediate assessment of the situation

Upon notification of a customs hold, importers should:

-

Review the notification details: Carefully examine any communication received from customs to understand the reason for the hold and any specific requirements outlined.

-

Identify key personnel: Designate individuals within the organization responsible for managing the response to the hold. This may include compliance officers, logistics managers, or legal advisors.

-

Contact relevant parties: If applicable, reach out to customs brokers or freight forwarders involved in the shipment for their insights and assistance based on their experience with similar situations.

Gathering necessary documentation

Once the situation has been assessed, importers must compile relevant documentation to address the concerns raised by customs:

-

Required documents review: Identify which documents are needed based on the reason for the hold. Common documents include:

-

Commercial invoice

- Bill of lading

- Packing list

- Certificates of origin

- Import licenses

-

Any additional supporting documentation

-

Ensure accuracy and completeness: Verify that all documents are complete, accurate, and properly signed. Inconsistencies or missing information can exacerbate delays.

-

Prepare additional information if needed: Depending on the nature of the hold, it may be necessary to provide further explanations or clarifications regarding product specifications or pricing.

Communication with customs authorities

Effective communication with customs officials is critical for resolving holds:

-

Establish contact promptly: Reach out to the designated contact person at customs as soon as possible to discuss the hold and gather information on next steps.

-

Provide requested information quickly: Respond promptly to any requests from customs for additional documentation or clarification to demonstrate cooperation and expedite resolution.

-

Maintain clear records of communication: Document all interactions with customs officials for future reference and accountability.

-

Follow up regularly: If resolution takes longer than expected, maintain regular contact with customs officials to stay updated on progress and address any emerging issues promptly.

Compliance with regulations

To facilitate a smooth resolution process, importers should ensure compliance with all applicable regulations:

-

Review compliance procedures: Assess internal processes related to import compliance to identify any areas needing improvement that could prevent future holds.

-

Address any identified issues immediately: If specific compliance issues are identified during discussions with customs officials, take immediate corrective actions.

-

Consult legal or compliance experts if necessary: For complex situations involving potential legal implications or disputes with customs authorities, consider seeking advice from legal counsel or trade compliance experts.

-

Prepare for inspections if required: If customs officials indicate that a physical inspection will occur as part of resolving the hold, ensure that arrangements are made for access to the goods being examined.

By taking these proactive steps when faced with a customs hold, importers can significantly enhance their chances of resolving issues quickly while minimizing disruptions to their supply chains.

How can importers work with customs brokers to resolve holds?

Customs brokers play a vital role in facilitating international trade by acting as intermediaries between importers and customs authorities. When faced with a customs hold, working effectively with a customs broker can streamline communication and expedite resolution processes. Here’s how importers can collaborate with their brokers during such situations:

Selecting an experienced customs broker

Choosing a knowledgeable broker is crucial for effective problem-solving:

-

Verify credentials and experience: Ensure that the broker is licensed by relevant authorities (e.g., U.S. Customs and Border Protection) and has experience handling similar shipments or industries.

-

Assess industry expertise: Brokers familiar with specific products or regulatory requirements will be better equipped to navigate complex situations involving holds.

-

Evaluate communication skills: Effective communication is essential; choose a broker who demonstrates responsiveness and clarity in their interactions.

-

Check references and reviews: Seek feedback from other clients about their experiences working with potential brokers regarding issue resolution capabilities.

Establishing clear lines of communication

Once an experienced broker has been selected:

-

Share all relevant information promptly: Provide your broker with complete details about the shipment in question—this includes all documentation related to the hold as well as any prior communications received from customs authorities.

-

Discuss previous experiences with holds: Inform your broker about any past issues encountered during imports so they can anticipate potential complications based on historical patterns.

-

Set expectations for updates: Establish how frequently you expect updates regarding progress on resolving the hold so that you remain informed throughout the process.

-

Encourage proactive engagement with customs officials: Empower your broker by encouraging them to reach out directly to customs authorities on your behalf when necessary—this allows them greater access to information regarding your shipment’s status.

-

Utilize technology for real-time tracking: If available, leverage technology platforms offered by your broker that allow you both access real-time updates about shipment status—including alerts regarding holds—enhancing transparency throughout this process.

By fostering strong collaboration between importers and their chosen custom brokers during times when containers are placed on hold by authorities—businesses stand better positioned not only resolve current challenges but also prevent similar occurrences moving forward!

What documentation is needed to clear a customs hold?

Clearing a customs hold typically requires specific documentation tailored to address the reasons behind that particular hold situation effectively! Importers must prepare comprehensive records demonstrating compliance while providing clarity about their shipments’ contents & origin! Below are key types of documents commonly required during this process:

- Commercial Invoice

- A detailed invoice outlining product descriptions & quantities.

- Must include pricing information & terms of sale.

-

Essential for verifying declared values & tariff classifications!

-

Bill of Lading

- A legal document issued by carriers confirming receipt & transport.

- Serves as proof ownership & shipment details.

-

Necessary for establishing chain custody between parties involved!

-

Packing List

- An itemized list detailing contents within each package/container.

- Helps facilitate inspections by providing clarity about what’s included!

-

Should match quantities stated elsewhere (e.g., invoices).

-

Certificates of Origin

- Documents verifying where goods were produced/manufactured.

- Important for determining eligibility under trade agreements.

-

May be required if products qualify under specific tariff benefits!

-

Import Licenses/Permits

- Depending upon product type/country regulations—specific licenses may be needed!

-

Must ensure all necessary permits are obtained before attempting clearance!

-

Additional Supporting Documentation

- Any other relevant documentation requested by Customs (e.g., FDA approvals).

-

May include technical specifications or safety certifications depending upon goods being imported!

-

Customs Bond

- A financial guarantee ensuring payment duties/taxes owed upon clearance.

-

Required if importer doesn’t have established creditworthiness within Customs systems!

-

Affidavit/Declaration Statements

- Signed statements attesting accuracy/completeness provided information!

-

May be requested during inspections especially if discrepancies arise!

-

Proof of Payment

- Documentation showing payment made against duties/taxes owed!

- Essential if applicable fees were assessed prior release!

10.Inspection Reports

– If physical inspections occurred—any resulting reports detailing findings should also be included!

– Important evidence demonstrating adherence regulatory standards!

By preparing these documents thoroughly & ensuring they’re accurate—importers increase likelihood successful resolution when facing Customs Holds! This diligence not only expedites clearance but also fosters positive relationships between businesses & regulatory agencies involved—ultimately enhancing overall trade efficiency!

How can importers prevent future customs holds?

Preventing future customs holds requires proactive measures focused on compliance education & operational best practices! By implementing strategies designed around minimizing risks associated with international trade regulations—importers enhance efficiency while safeguarding against potential disruptions! Here’s how businesses can effectively mitigate risks leading up these situations:

1.Maintain Accurate Documentation

– Ensure all shipping documents are complete & accurate before submission!

– Regularly review templates used (invoices/packing lists) ensuring consistency across different shipments!

2.Invest in Compliance Training

– Provide ongoing training programs focused on international trade regulations!

– Educate staff about proper classification/valuation procedures minimizing errors leading up Holds!

3.Engage Experienced Customs Brokers

– Collaborate closely experienced professionals who understand nuances surrounding your industry!

– Utilize their expertise navigating complex regulatory environments effectively reducing risk exposure!

4.Implement Quality Control Procedures

– Develop internal checks ensuring accuracy/documentation consistency before shipments leave facility!

– Conduct regular audits reviewing past shipments identifying areas needing improvement!

5.Stay Informed About Regulatory Changes

– Monitor changes within local/global trade policies affecting imports/exports!

– Subscribe industry newsletters/join associations providing updates regarding pertinent developments impacting operations!

6.Utilize Technology Solutions

– Leverage software tools facilitating real-time tracking/document management improving efficiency throughout logistics processes!

– Consider implementing automated systems reducing human error while enhancing visibility across supply chains!

7.Conduct Risk Assessments

– Regularly evaluate potential risks associated particular products/countries—adjust strategies accordingly!

– Identify high-risk areas requiring additional oversight/resources ensuring adherence standards!

8.Foster Strong Relationships With Customs Officials

– Build rapport through open communication channels establishing trust between parties involved!

– Engage proactively addressing concerns before they escalate into Holds—demonstrating commitment towards compliance!

9.Develop Contingency Plans

– Create plans outlining steps taken should Holds occur again—ensuring swift response minimizing disruptions!

– Include protocols identifying key personnel responsible managing such incidents effectively!

10.Review Past Experiences

– Analyze previous Holds encountered assessing root causes—implement corrective measures preventing recurrence!

– Document lessons learned creating knowledge base accessible team members involved future transactions!

By adopting these preventive strategies—importers not only reduce likelihood facing Customs Holds but also foster smoother operations overall! Enhanced compliance practices ultimately contribute towards building stronger relationships across supply chains benefiting everyone involved within international trade landscape!