What Is a Customs Bonded Area

A customs bonded area, also known as a bonded warehouse or customs warehouse, is a designated location where imported goods can be stored without payment of customs duties and taxes. These secure facilities operate under the supervision of customs authorities and provide a temporary haven for merchandise awaiting further distribution, processing, or re-exportation.

Customs bonded areas serve as crucial intermediaries in international trade, offering importers and exporters a range of benefits and flexibility in managing their goods. These areas are typically located near ports, airports, or other strategic points of entry, facilitating efficient handling of international shipments.

Key Features of Customs Bonded Areas

Duty Deferment: One of the primary advantages of customs bonded areas is the ability to defer payment of duties and taxes. Importers can store their goods in these facilities without immediately paying the associated customs charges, which can significantly improve cash flow management.

Secure Storage: Customs bonded areas provide a high level of security for stored goods. These facilities are equipped with advanced surveillance systems, access controls, and other security measures to protect valuable merchandise from theft or damage.

Customs Supervision: All activities within a customs bonded area are closely monitored by customs authorities. This oversight ensures compliance with regulations and prevents unauthorized movement or manipulation of goods.

Time Limitations: While customs bonded areas offer extended storage periods, there are typically time limits on how long goods can remain in these facilities. The specific duration may vary depending on local regulations and the type of goods involved.

Permitted Activities: Depending on the type of customs bonded area, certain value-added activities may be allowed. These can include repackaging, sorting, labeling, or minor processing of goods, subject to customs approval.

Understanding the concept of customs bonded areas is essential for businesses engaged in international trade. These facilities play a vital role in streamlining logistics, reducing upfront costs, and providing flexibility in inventory management. As we delve deeper into the operations, benefits, and regulations surrounding customs bonded areas, it becomes clear that they are indispensable components of modern global commerce.

How do customs bonded areas operate?

Customs bonded areas operate under a complex system of regulations, procedures, and oversight to ensure the smooth flow of international trade while maintaining compliance with customs laws. The functioning of these areas involves several key processes and stakeholders working in tandem.

Admission of Goods

When goods arrive at a customs bonded area, they undergo a specific admission process:

Documentation: Importers or their agents must submit detailed documentation, including manifests, invoices, and packing lists, to customs authorities.

Inspection: Customs officials may conduct physical inspections or use non-intrusive inspection technologies to verify the contents of shipments.

Bonding: A bond is posted to guarantee payment of potential duties and taxes. This bond acts as a form of insurance for customs authorities.

Inventory Management

Once admitted, goods are carefully tracked and managed within the customs bonded area:

Inventory Systems: Advanced inventory management systems are employed to maintain real-time records of all stored goods, their location, and status.

Segregation: Different types of goods may be segregated based on their classification, duty status, or handling requirements.

Permitted Activities

Customs bonded areas may allow certain activities to be performed on stored goods:

Manipulation: Depending on the type of bonded area, goods may be repackaged, sorted, or undergo minor processing.

Quality Control: Importers may be permitted to inspect their goods for quality assurance purposes.

Withdrawal and Export

When goods are ready to leave the customs bonded area, specific procedures must be followed:

Duty Payment: If goods are destined for domestic consumption, applicable duties and taxes must be paid before withdrawal.

Re-exportation: Goods can be re-exported without paying duties, subject to proper documentation and customs clearance.

Customs Oversight

Customs authorities maintain a constant presence in bonded areas:

Regular Audits: Customs officials conduct periodic audits to ensure compliance with regulations and accurate record-keeping.

Security Measures: Strict security protocols are enforced to prevent unauthorized access or tampering with stored goods.

Operational Flow in Customs Bonded Areas

To illustrate the typical operational flow within a customs bonded area, consider the following table:

| Stage | Process | Responsible Party |

|---|---|---|

| 1. Arrival | Goods arrive at the port of entry | Carrier |

| 2. Documentation | Submission of required documents | Importer/Customs Broker |

| 3. Inspection | Physical or non-intrusive inspection | Customs Authorities |

| 4. Bonding | Posting of customs bond | Importer/Customs Broker |

| 5. Admission | Entry of goods into bonded area | Bonded Warehouse Operator |

| 6. Storage | Secure storage and inventory management | Bonded Warehouse Operator |

| 7. Manipulation | Permitted activities (if applicable) | Bonded Warehouse Operator |

| 8. Withdrawal | Preparation for domestic release or re-export | Importer/Exporter |

| 9. Duty Payment | Payment of duties (for domestic consumption) | Importer |

| 10. Release/Export | Final clearance and exit from bonded area | Customs Authorities |

This operational flow demonstrates the intricate process involved in managing goods within a customs bonded area, from arrival to final disposition. Each stage requires careful coordination between various stakeholders to ensure compliance with customs regulations and efficient handling of merchandise.

Technological Integration

Modern customs bonded areas leverage advanced technologies to enhance their operations:

Electronic Data Interchange (EDI): EDI systems facilitate seamless communication between customs authorities, warehouse operators, and importers/exporters.

RFID Tracking: Radio-frequency identification technology may be used to track the movement of goods within the facility.

Automated Reporting: Software solutions generate real-time reports on inventory levels, duty liabilities, and compliance status.

The operation of customs bonded areas involves a delicate balance between facilitating trade and ensuring regulatory compliance. By adhering to strict procedures and leveraging modern technologies, these facilities play a crucial role in the global supply chain, offering businesses the flexibility and efficiency needed to compete in international markets.

What are the benefits of using customs bonded areas?

Customs bonded areas offer a multitude of advantages for businesses engaged in international trade. These facilities provide strategic solutions to common challenges faced by importers, exporters, and manufacturers operating in the global marketplace.

Financial Benefits

Duty Deferment: One of the primary financial advantages of using customs bonded areas is the ability to defer payment of duties and taxes. This deferment allows businesses to delay the outlay of significant sums until goods are ready for domestic consumption or re-export.

Cash Flow Improvement: By postponing duty payments, companies can better manage their cash flow, allocating resources to other critical business operations or investments.

Duty Elimination on Re-exports: Goods that are re-exported from a customs bonded area may be exempt from duties altogether, providing substantial savings for businesses engaged in transshipment or re-export activities.

Operational Advantages

Inventory Management Flexibility: Customs bonded areas allow businesses to store goods for extended periods, providing greater flexibility in inventory management and distribution planning.

Consolidation Opportunities: Importers can consolidate multiple shipments in a bonded area before distribution, potentially reducing transportation costs and streamlining logistics.

Value-Added Services: Depending on the type of bonded area, businesses may be able to perform certain value-added activities such as repackaging, labeling, or minor processing, enhancing product marketability.

Strategic Benefits

Market Responsiveness: The ability to store goods near target markets without immediate duty payment allows businesses to respond quickly to changes in demand.

Global Distribution Hub: Customs bonded areas can serve as strategic hubs for global distribution networks, facilitating efficient cross-border trade.

Competitive Advantage: Utilizing customs bonded areas can provide a competitive edge by reducing costs and improving supply chain efficiency.

Compliance and Security

Regulatory Compliance: Operating within a customs bonded area ensures adherence to customs regulations, reducing the risk of non-compliance penalties.

Enhanced Security: The stringent security measures in place at customs bonded areas protect valuable merchandise from theft, damage, or unauthorized access.

Quantifying the Benefits

To illustrate the potential financial impact of using customs bonded areas, consider the following example:

| Scenario | Without Bonded Area | With Bonded Area |

|---|---|---|

| Import Value | $1,000,000 | $1,000,000 |

| Duty Rate | 10% | 10% |

| Immediate Duty Payment | $100,000 | $0 |

| Storage Duration | N/A | 6 months |

| Re-export Percentage | 0% | 30% |

| Final Duty Payment | $100,000 | $70,000 |

| Cash Flow Benefit | $0 | $30,000 + Interest |

In this example, using a customs bonded area results in a $30,000 reduction in duty payments for re-exported goods and provides a six-month cash flow benefit on the remaining $70,000 in duties.

Industry-Specific Advantages

Automotive Sector: Manufacturers can store components duty-free, assembling them as needed for just-in-time production.

Electronics Industry: High-value electronic components can be securely stored and distributed globally without upfront duty payments.

Fashion and Apparel: Seasonal goods can be stored and released to markets at optimal times, managing inventory more effectively.

Pharmaceutical Industry: Temperature-sensitive products can be stored in specialized bonded facilities with appropriate climate controls.

The benefits of using customs bonded areas extend beyond mere financial considerations. These facilities offer strategic advantages that can significantly enhance a company’s competitive position in the global market. By leveraging the flexibility, security, and financial benefits of customs bonded areas, businesses can optimize their supply chains, improve cash flow management, and respond more effectively to market demands.

As international trade continues to evolve, customs bonded areas remain a vital tool for companies seeking to navigate the complexities of global commerce. The ability to defer duties, consolidate shipments, and perform value-added activities in a secure, compliant environment makes these facilities an indispensable component of modern logistics strategies.

What types of goods are allowed in customs bonded areas?

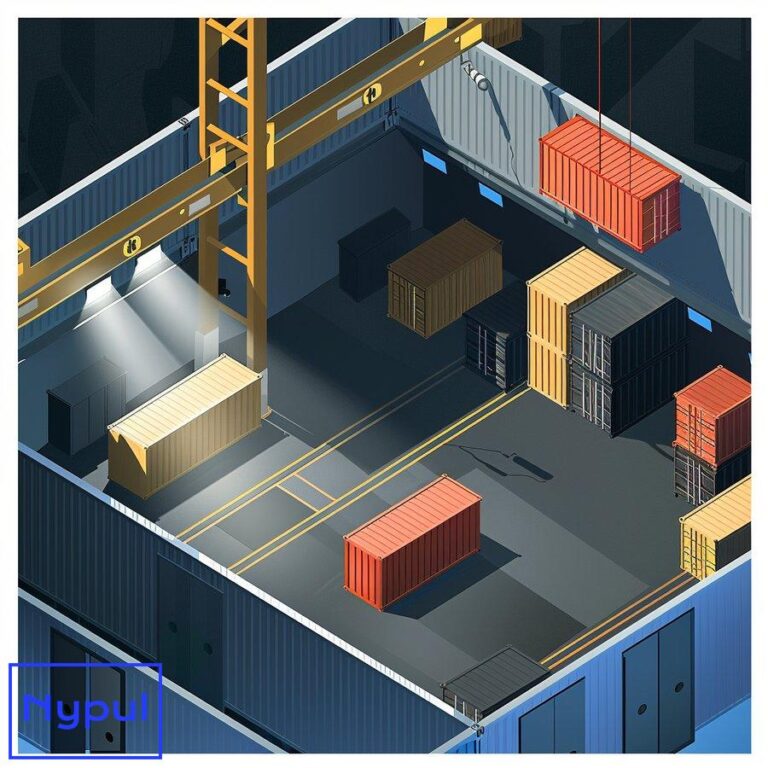

![]()

Customs bonded areas accommodate a wide range of goods, subject to specific regulations and restrictions. Understanding the types of merchandise permitted in these facilities is crucial for businesses looking to leverage the benefits of bonded storage and processing.

General Merchandise

Consumer Goods: A vast array of consumer products, including electronics, clothing, and household items, can be stored in customs bonded areas.

Industrial Equipment: Machinery, tools, and other industrial equipment often find temporary homes in bonded facilities while awaiting distribution or installation.

Raw Materials: Manufacturing inputs and raw materials are commonly stored in bonded areas, allowing for duty-free storage until needed for production.

Specialized Categories

Perishable Goods: Many customs bonded areas are equipped to handle perishable items such as food products, requiring temperature-controlled environments.

Hazardous Materials: Certain bonded facilities are authorized to store hazardous substances, adhering to strict safety protocols and regulations.

High-Value Items: Luxury goods, precious metals, and other high-value merchandise can be securely stored in bonded areas with enhanced security measures.

Restricted and Controlled Goods

Alcoholic Beverages: Spirits, wines, and other alcoholic products are often stored in bonded areas due to specific tax and regulatory requirements.

Tobacco Products: Cigarettes and other tobacco items are frequently held in bonded facilities, subject to strict inventory controls.

Firearms and Ammunition: Specialized bonded areas may be authorized to store firearms and related products, adhering to rigorous security standards.

Goods Subject to Quotas: Products with import quotas can be stored in bonded areas until quota allocations become available.

Prohibited Items

While customs bonded areas accommodate a wide range of goods, certain items are typically prohibited:

Illegal Substances: Narcotics and other illegal drugs are strictly forbidden in bonded facilities.

Counterfeit Goods: Products that infringe on intellectual property rights are not permitted in customs bonded areas.

Goods Prohibited by Law: Any items banned from import by national or international laws cannot be stored in bonded facilities.

Classification of Goods in Customs Bonded Areas

To provide a clearer understanding of how different types of goods are categorized in customs bonded areas, consider the following table:

| Category | Examples | Special Requirements |

|---|---|---|

| General Merchandise | Electronics, Clothing, Furniture | Standard inventory management |

| Perishables | Fresh Produce, Dairy Products | Temperature-controlled storage |

| Hazardous Materials | Chemicals, Flammable Liquids | Specialized safety protocols |

| High-Value Items | Jewelry, Artwork, Rare Collectibles | Enhanced security measures |

| Controlled Substances | Alcohol, Tobacco | Strict inventory controls |

| Industrial Goods | Machinery, Raw Materials | Heavy-duty storage facilities |

| Pharmaceutical Products | Medicines, Medical Devices | Climate-controlled environments |

| Automotive Parts | Engines, Body Panels | Organized storage systems |

| Textiles and Apparel | Fabrics, Garments | Protection from moisture and pests |

| Technology Products | Computers, Semiconductors | Electrostatic discharge protection |

This classification helps customs authorities, warehouse operators, and importers understand the specific requirements and handling procedures for different types of goods stored in bonded areas.

Regulatory Considerations

Customs Classification: All goods entering a bonded area must be properly classified according to the Harmonized System (HS) code, which determines applicable duties and regulations.

Documentation Requirements: Detailed documentation, including commercial invoices, packing lists, and certificates of origin, must accompany goods admitted to bonded facilities.

Time Limitations: While bonded areas offer extended storage periods, many jurisdictions impose time limits on how long specific types of goods can remain in bond.

Inspection and Verification

Random Checks: Customs authorities may conduct random inspections of goods stored in bonded areas to verify compliance with regulations.

Non-Intrusive Inspection Technologies: Advanced scanning equipment may be used to inspect containerized goods without physical unpacking.

Sample Analysis: In some cases, samples of stored goods may be taken for laboratory analysis to confirm classification or compliance with safety standards.

The types of goods allowed in customs bonded areas reflect the diverse needs of international trade. From everyday consumer products to specialized industrial equipment, these facilities accommodate a vast array of merchandise. However, the storage and handling of goods in bonded areas are subject to strict regulations and oversight to ensure compliance with customs laws, safety standards, and international trade agreements.

Businesses considering the use of customs bonded areas must carefully evaluate the nature of their goods and the specific regulations governing their storage and handling. By understanding the types of merchandise permitted in these facilities and the associated requirements, companies can effectively leverage bonded areas to optimize their supply chain operations and gain a competitive edge in the global marketplace.

Who are the key players in customs bonded areas and what are their roles?

Customs bonded areas involve a complex ecosystem of stakeholders, each playing a crucial role in the smooth operation of these facilities. Understanding the key players and their responsibilities is essential for businesses looking to navigate the intricacies of bonded storage and international trade.

Customs Authorities

Customs authorities are the primary overseers of bonded areas, responsible for enforcing regulations and ensuring compliance:

Regulatory Oversight: They establish and enforce rules governing the operation of customs bonded areas.

Inspections and Audits: Customs officials conduct regular inspections and audits to verify compliance with regulations and accuracy of inventory records.

Clearance Procedures: They manage the clearance process for goods entering or leaving the bonded area.

Bonded Warehouse Operators

These entities manage the day-to-day operations of customs bonded facilities:

Facility Management: They maintain the physical infrastructure and security systems of the bonded area.

Inventory Control: Operators are responsible for accurate tracking and reporting of all goods stored in the facility.

Compliance Assurance: They ensure adherence to customs regulations and maintain required documentation.

Importers and Exporters

Businesses that utilize customs bonded areas for storing and processing their goods:

Strategic Planning: They make decisions on using bonded facilities to optimize their supply chain and cash flow.

Documentation Submission: Importers and exporters provide necessary documentation for goods entering or leaving the bonded area.

Duty Payment: They are responsible for paying applicable duties and taxes when goods are withdrawn for domestic consumption.