What Is Custom Modernization

What is customs modernization?

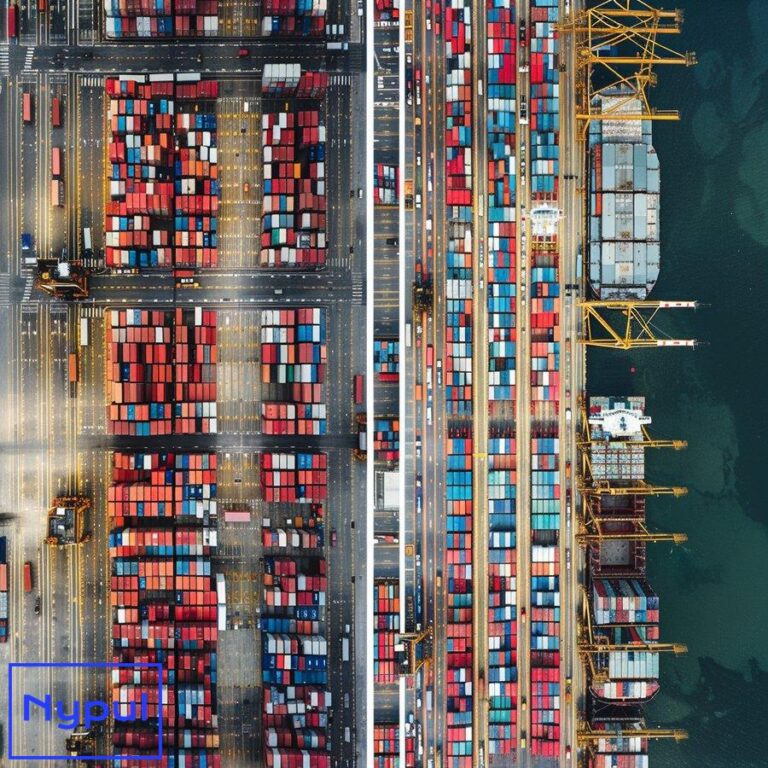

Customs modernization represents a comprehensive overhaul of traditional customs processes and systems to enhance efficiency, transparency, and effectiveness in international trade operations. This transformation involves the integration of advanced technologies, streamlined procedures, and updated regulatory frameworks to meet the evolving demands of global commerce.

At its core, customs modernization aims to simplify and expedite the movement of goods across borders while maintaining robust security measures and ensuring compliance with trade regulations. The process encompasses various aspects of customs operations, including:

Digital transformation: Implementing electronic systems for customs declarations, risk assessment, and data exchange between traders and customs authorities.

Process reengineering: Streamlining customs procedures to reduce bureaucracy and minimize delays in cargo clearance.

Risk management: Adopting sophisticated risk assessment techniques to focus resources on high-risk shipments while facilitating the flow of low-risk goods.

Capacity building: Enhancing the skills and knowledge of customs personnel to effectively utilize modern tools and techniques.

Legal and regulatory reforms: Updating customs laws and regulations to align with international best practices and standards.

The World Customs Organization (WCO) plays a pivotal role in promoting customs modernization globally. Through its instruments and tools, such as the Revised Kyoto Convention and the SAFE Framework of Standards, the WCO provides guidelines for countries to modernize their customs administrations.

Customs modernization is not a one-time event but an ongoing process that requires continuous adaptation to emerging technologies and changing trade patterns. As global supply chains become increasingly complex and interconnected, the need for efficient and adaptable customs systems becomes more critical.

The impact of customs modernization extends beyond the customs administration itself. It affects various stakeholders in the international trade ecosystem, including:

Importers and exporters: Benefiting from faster clearance times and reduced compliance costs.

Logistics providers: Experiencing improved predictability and efficiency in cross-border operations.

Government agencies: Gaining enhanced capabilities for revenue collection, trade statistics, and enforcement of trade regulations.

Consumers: Enjoying access to a wider range of products at potentially lower prices due to reduced trade barriers.

Customs modernization initiatives often form part of broader trade facilitation efforts, as outlined in the World Trade Organization’s Trade Facilitation Agreement (TFA). The TFA provides a framework for countries to implement measures that simplify, harmonize, and modernize customs procedures.

As countries progress in their customs modernization journey, they typically move through several stages:

- Basic automation of manual processes

- Integration of electronic systems across customs functions

- Implementation of advanced risk management techniques

- Establishment of single window systems for trade

- Adoption of blockchain and artificial intelligence technologies

The ultimate goal of customs modernization is to create a seamless, paperless, and intelligent customs environment that supports economic growth, enhances trade competitiveness, and ensures effective border control.

Why is customs modernization important for global trade?

Customs modernization plays a crucial role in facilitating global trade and fostering economic growth. Its importance stems from the increasing complexity of international commerce and the need for efficient, secure, and transparent cross-border transactions. Here’s why customs modernization is essential for global trade:

Enhanced trade facilitation: Modernized customs systems significantly reduce the time and cost associated with cross-border trade. By streamlining processes and eliminating redundant paperwork, customs modernization enables faster clearance of goods, reducing bottlenecks at ports and border crossings. This efficiency is particularly crucial for perishable goods and just-in-time supply chains.

Improved compliance and risk management: Advanced customs systems employ sophisticated risk assessment algorithms to identify high-risk shipments while facilitating the smooth flow of low-risk cargo. This targeted approach enhances security without impeding legitimate trade, striking a balance between trade facilitation and regulatory compliance.

Increased revenue collection: Modernized customs administrations are better equipped to accurately assess and collect duties and taxes. Electronic systems reduce the potential for human error and corruption, ensuring that governments receive their due revenue from international trade.

Support for economic integration: As regional economic blocs and free trade agreements proliferate, customs modernization becomes essential for implementing preferential trade arrangements. Modern customs systems can efficiently handle complex rules of origin and tariff schedules, facilitating regional economic integration.

Enhanced transparency and predictability: Digital customs systems provide greater visibility into the clearance process, allowing traders to track their shipments and anticipate potential issues. This transparency reduces uncertainty and helps businesses plan their operations more effectively.

Promotion of small and medium-sized enterprises (SMEs): Simplified and digitalized customs procedures lower the barriers to entry for SMEs in international trade. By reducing compliance costs and complexity, customs modernization enables smaller businesses to participate in global markets.

Improved data quality and trade statistics: Modernized customs systems generate more accurate and timely trade data. This high-quality information is invaluable for policymakers, researchers, and businesses in analyzing trade patterns and making informed decisions.

Support for e-commerce: The rapid growth of cross-border e-commerce requires customs administrations to handle a high volume of small shipments efficiently. Modernized customs systems are better equipped to process these transactions while maintaining appropriate controls.

Alignment with international standards: Customs modernization often involves adopting internationally recognized standards and best practices, such as those promoted by the World Customs Organization. This harmonization facilitates smoother interactions between different customs administrations and promotes global interoperability.

Environmental benefits: By reducing paper-based processes and optimizing the flow of goods, customs modernization contributes to lower carbon emissions associated with international trade. Digital systems also enable better tracking and control of environmentally sensitive goods.

The importance of customs modernization is further underscored by its inclusion in major international agreements and initiatives:

WTO Trade Facilitation Agreement: This landmark agreement, which entered into force in 2017, explicitly calls for the modernization of customs procedures and the adoption of digital technologies to facilitate trade.

United Nations Sustainable Development Goals (SDGs): Customs modernization contributes to several SDGs, particularly Goal 8 (Decent Work and Economic Growth) and Goal 9 (Industry, Innovation, and Infrastructure), by promoting efficient trade practices and supporting economic development.

OECD Trade Facilitation Indicators: The Organization for Economic Co-operation and Development (OECD) has developed a set of indicators to measure countries’ progress in trade facilitation, with customs modernization being a key component.

To illustrate the impact of customs modernization on trade performance, consider the following table comparing key trade indicators before and after implementing modernization initiatives in a hypothetical country:

| Indicator | Before Modernization | After Modernization | Improvement |

|---|---|---|---|

| Average clearance time | 5 days | 1 day | 80% reduction |

| Customs revenue collection | $1 billion | $1.3 billion | 30% increase |

| Number of physical inspections | 30% of shipments | 10% of shipments | 67% reduction |

| Compliance cost for traders | $500 per shipment | $200 per shipment | 60% reduction |

| SME participation in exports | 15% of total exports | 25% of total exports | 67% increase |

This table demonstrates the significant improvements that can be achieved through customs modernization across various aspects of trade performance.

As global trade continues to evolve, driven by technological advancements and changing consumer behaviors, the importance of customs modernization will only grow. Countries that invest in modernizing their customs systems position themselves to attract investment, participate more effectively in global value chains, and drive economic growth through enhanced trade competitiveness.

How does customs modernization enhance trade facilitation?

Customs modernization is a cornerstone of trade facilitation, significantly improving the efficiency and effectiveness of cross-border trade processes. By leveraging technology, streamlining procedures, and adopting risk-based approaches, modernized customs systems contribute to smoother, faster, and more cost-effective international trade operations. Here’s how customs modernization enhances trade facilitation:

Streamlined documentation and data submission: Modern customs systems enable electronic submission of trade documents and data, replacing cumbersome paper-based processes. This digital transformation allows traders to submit information once, which can then be shared across various government agencies, reducing redundancy and the potential for errors.

Automated risk assessment and selectivity: Advanced algorithms analyze submitted data to assess the risk level of shipments. This automated process allows customs authorities to focus their resources on high-risk consignments while expediting the clearance of low-risk goods. Consequently, compliant traders benefit from faster processing times and reduced physical inspections.

Pre-arrival processing: Modernized customs systems support the submission and processing of import declarations before goods arrive at the border. This pre-arrival processing enables customs authorities to conduct risk assessments and make clearance decisions in advance, significantly reducing waiting times at ports and border crossings.

Coordinated border management: Customs modernization facilitates better coordination among various border agencies. Integrated systems allow for simultaneous processing by different authorities, eliminating duplicative inspections and reducing clearance times.

Single Window systems: A key component of customs modernization, Single Window platforms provide a single point of entry for traders to submit all required documentation and data to multiple government agencies. This integration streamlines the clearance process, reduces compliance costs, and enhances transparency.

Automated calculation of duties and taxes: Modern customs systems can automatically calculate applicable duties, taxes, and fees based on the submitted declaration data. This automation reduces errors, ensures consistency in revenue collection, and provides traders with predictable costs.

Enhanced transparency and predictability: Digital customs platforms offer real-time tracking of shipment status and clearance progress. This visibility allows traders to better plan their supply chain operations and address any issues promptly.

Simplified procedures for trusted traders: Modernized customs administrations often implement Authorized Economic Operator (AEO) programs, which offer simplified procedures and expedited clearance for certified compliant traders. These programs incentivize compliance and further facilitate trade for reliable operators.

Support for e-commerce: As cross-border e-commerce continues to grow, modernized customs systems are better equipped to handle high volumes of small shipments. Simplified procedures for low-value consignments and integration with e-commerce platforms facilitate smoother transactions for online retailers and consumers.

Data exchange and interoperability: Modern customs systems support the exchange of data between different countries’ customs administrations. This interoperability enhances risk management, speeds up clearance processes, and supports mutual recognition of controls and certifications.

Post-clearance audit: Modernized customs administrations shift from transaction-based controls to system-based audits. This approach allows for faster release of goods at the border, with compliance verified through post-clearance audits, further facilitating trade while maintaining regulatory oversight.

Mobile applications and self-service options: Many modernized customs systems offer mobile applications and self-service kiosks, allowing traders to access services, submit declarations, and track shipments on-the-go. These tools enhance convenience and accessibility for trade stakeholders.

To illustrate the impact of customs modernization on trade facilitation, consider the following table comparing key trade facilitation indicators before and after implementing a modernized customs system:

| Trade Facilitation Indicator | Before Modernization | After Modernization | Improvement |

|---|---|---|---|

| Average import clearance time | 7 days | 24 hours | 86% reduction |

| Percentage of shipments physically inspected | 40% | 10% | 75% reduction |

| Time to prepare and submit customs documents | 3 days | 2 hours | 97% reduction |

| Cost to comply with border requirements (per container) | $500 | $150 | 70% reduction |

| Percentage of declarations processed electronically | 20% | 95% | 375% increase |

| Number of agencies requiring separate submissions | 5 | 1 (Single Window) | 80% reduction |

This table demonstrates the significant improvements in trade facilitation that can be achieved through customs modernization across various aspects of the clearance process.

The enhancement of trade facilitation through customs modernization aligns with several international initiatives and agreements:

WTO Trade Facilitation Agreement (TFA): Many of the measures implemented through customs modernization directly support countries’ commitments under the TFA, such as pre-arrival processing, risk management, and single window systems.

World Customs Organization (WCO) instruments: Customs modernization efforts often incorporate WCO tools and standards, such as the SAFE Framework of Standards and the Revised Kyoto Convention, which promote harmonized and efficient customs procedures.

UN/CEFACT recommendations: The United Nations Centre for Trade Facilitation and Electronic Business provides recommendations and standards for trade facilitation, many of which are implemented through customs modernization initiatives.

By enhancing trade facilitation, customs modernization contributes to several broader economic and developmental goals:

Increased trade volumes: Faster and more efficient customs processes encourage higher trade volumes by reducing the time and cost associated with cross-border transactions.

Improved competitiveness: Countries with modernized customs systems are more attractive to foreign investors and are better positioned to participate in global value chains.

Support for SMEs: Simplified procedures and reduced compliance costs make it easier for small and medium-sized enterprises to engage in international trade.

Enhanced government revenue: While facilitating trade, modernized customs systems also improve the accuracy and efficiency of revenue collection, potentially increasing government income from trade-related taxes and duties.

Better resource allocation: By automating routine tasks and focusing on risk-based interventions, customs administrations can allocate their resources more effectively, improving overall border management.

As global trade continues to evolve, driven by technological advancements and changing business models, the role of customs modernization in enhancing trade facilitation becomes increasingly critical. Countries that invest in modernizing their customs systems not only improve their trade performance but also contribute to the overall efficiency and resilience of global supply chains.

What are the key components of a modernized customs system?

A modernized customs system comprises several interconnected components that work together to enhance efficiency, transparency, and effectiveness in managing cross-border trade. These key components form the foundation of a modern customs administration, enabling it to meet the challenges of 21st-century global commerce. Here are the essential elements of a modernized customs system:

Integrated Customs Management System (ICMS): This is the core IT infrastructure that serves as the backbone of a modernized customs administration. The ICMS integrates various customs functions into a single, cohesive platform, enabling seamless processing of declarations, risk assessment, and data management.

Key features of an ICMS include:

– Electronic submission and processing of customs declarations

– Automated calculation of duties and taxes

– Integration with other government agencies’ systems

– Real-time tracking of shipment status

– Generation of trade statistics and reports

Risk Management System (RMS): A sophisticated risk assessment engine that analyzes declaration data to identify high-risk shipments requiring intervention while facilitating the rapid clearance of low-risk goods. The RMS uses advanced algorithms and machine learning to continuously refine its risk profiles based on historical data and emerging trends.

Single Window System: A platform that allows traders to submit all required regulatory documents and data through a single entry point. The Single Window system routes information to relevant government agencies, eliminating the need for multiple submissions and reducing processing times.

Authorized Economic Operator (AEO) Program: A trust-based scheme that offers simplified procedures and expedited clearance for certified compliant traders. AEO programs are a key component of modern customs systems, promoting voluntary compliance and partnership between customs and the private sector.

Non-Intrusive Inspection (NII) Technology: Advanced scanning equipment, such as X-ray and gamma-ray scanners, that allow customs officials to inspect cargo without physically opening containers. NII technology enhances security while minimizing disruptions to trade flows.

Post-Clearance Audit (PCA) System: A mechanism for verifying compliance after goods have been released, allowing for faster clearance at the border. PCA systems include tools for selecting audit targets, managing audit processes, and tracking audit results.

Advance Ruling System: A facility that allows traders to obtain binding decisions from customs authorities on specific matters (e.g., tariff classification, origin) before importing or exporting goods. This system enhances predictability and consistency in customs treatment.

Data Exchange and Interoperability Framework: Protocols and systems that enable the secure exchange of customs data between different countries and with other government agencies. This component supports mutual recognition of controls and enhances risk management capabilities.

Performance Measurement System: Tools and metrics for monitoring and evaluating the effectiveness of customs operations. This system helps identify areas for improvement and track progress in modernization efforts.

Capacity Building and Training Platform: A comprehensive system for enhancing the skills and knowledge of customs personnel, including e-learning modules, simulation tools, and competency assessment frameworks.

Customs Laboratory Information Management System (LIMS): A specialized system for managing customs laboratory operations, including sample tracking, test result recording, and integration with the main customs management system.

Grievance Redressal Mechanism: A system for handling complaints and appeals from traders, ensuring transparency and fairness in customs decision-making processes.

Business Intelligence and Analytics Tools: Advanced data analysis capabilities that allow customs administrations to derive insights from vast amounts of trade data, supporting evidence-based decision-making and policy formulation.

To illustrate how these components interact within a modernized customs system, consider the following table outliningTo illustrate how these components interact within a modernized customs system, consider the following table outlining their relationships and functions:

| Component | Function | Interactions |

|---|---|---|

| Integrated Customs Management System (ICMS) | Central platform for processing customs transactions | Interfaces with RMS, Single Window, and other systems |

| Risk Management System (RMS) | Analyzes data to identify high-risk shipments | Works with ICMS to flag shipments for inspection |

| Single Window System | Single entry point for regulatory submissions | Connects with ICMS and various government agency systems |

| Authorized Economic Operator (AEO) Program | Simplifies procedures for compliant traders | Integrates with ICMS for expedited processing |

| Non-Intrusive Inspection (NII) Technology | Inspects cargo without opening containers | Provides data to RMS for risk assessment |

| Post-Clearance Audit (PCA) System | Verifies compliance after clearance | Uses data from ICMS and RMS for audit selection |

| Advance Ruling System | Provides binding decisions on customs matters | Interacts with ICMS to ensure consistency in treatment |

| Data Exchange and Interoperability Framework | Facilitates secure data sharing between entities | Enhances risk management and compliance verification |

| Performance Measurement System | Tracks effectiveness of customs operations | Informs capacity building and modernization strategies |

| Capacity Building and Training Platform | Develops skills of customs personnel | Utilizes data from performance measurement for training needs |

| Customs Laboratory Information Management System (LIMS) | Manages laboratory testing processes | Integrates results into ICMS for compliance verification |

| Grievance Redressal Mechanism | Handles complaints from traders | Ensures transparency in interactions with customs authorities |

| Business Intelligence and Analytics Tools | Analyzes trade data for insights | Supports decision-making across all components |

These components work synergistically to create a responsive, efficient, and transparent customs environment that can adapt to the challenges of modern trade.

Which technologies are driving customs modernization?

Several key technologies are at the forefront of driving customs modernization, transforming how customs administrations operate and interact with stakeholders. These technologies enhance efficiency, improve security, and facilitate compliance in international trade. Here are the primary technologies influencing customs modernization:

Electronic Data Interchange (EDI): EDI allows for the electronic exchange of trade documents between businesses and customs authorities. This technology reduces paperwork, speeds up processing times, and minimizes errors associated with manual data entry.

Blockchain Technology: Blockchain provides a secure, immutable ledger for tracking goods throughout the supply chain. Its transparency enhances trust among stakeholders, reduces fraud, and facilitates compliance verification by allowing real-time access to shipment information.

Artificial Intelligence (AI) and Machine Learning: AI algorithms analyze vast amounts of trade data to identify patterns and predict risks. Machine learning enhances risk management capabilities by continuously improving algorithms based on new data inputs. This technology enables customs administrations to focus resources on high-risk shipments while expediting low-risk ones.

Internet of Things (IoT): IoT devices, such as smart sensors and GPS trackers, provide real-time monitoring of shipments. These devices enhance visibility throughout the supply chain, allowing customs authorities to track the movement of goods and respond promptly to any anomalies.

Cloud Computing: Cloud-based solutions enable customs administrations to store and process large volumes of data securely. This technology facilitates collaboration among various government agencies and stakeholders by providing access to shared resources and information.

Data Analytics Tools: Advanced analytics tools help customs authorities derive actionable insights from trade data. These tools support decision-making processes related to risk assessment, resource allocation, and performance measurement.

Mobile Applications: Mobile technology enhances accessibility for traders by providing self-service options for submitting declarations, tracking shipments, and accessing customs services. Mobile apps streamline interactions between businesses and customs authorities.

Robotics Process Automation (RPA): RPA automates repetitive tasks within customs operations, such as data entry and document verification. This technology increases efficiency by freeing up human resources for more complex tasks that require critical thinking.

Non-Intrusive Inspection (NII) Technologies: NII technologies, including X-ray scanners and gamma-ray imaging systems, allow for the inspection of cargo without physically opening containers. These technologies enhance security while minimizing disruptions to trade flows.

Geographic Information Systems (GIS): GIS technology assists in mapping trade routes, analyzing traffic patterns at ports, and optimizing resource allocation. This tool supports better planning and decision-making in customs operations.

To illustrate the impact of these technologies on customs modernization, consider the following table comparing traditional versus modernized customs processes:

| Aspect | Traditional Customs Process | Modernized Customs Process |

|---|---|---|

| Documentation Submission | Paper-based forms submitted manually | Electronic submission via EDI or Single Window |

| Risk Assessment | Manual review of declarations with limited data analysis | Automated risk assessment using AI algorithms |

| Clearance Time | Average clearance time of several days due to manual processes | Average clearance time reduced to hours through automation |

| Inspection Methods | Physical inspections leading to delays | Non-intrusive inspections enhancing security without delays |

| Data Sharing Between Agencies | Limited communication leading to inefficiencies | Real-time data exchange facilitated by cloud computing |

| Compliance Verification | Post-clearance audits conducted sporadically | Continuous monitoring using advanced analytics tools |

This table highlights how modern technologies significantly improve efficiency, security, and compliance in customs operations.

How does customs modernization benefit governments and businesses?

Customs modernization offers numerous benefits that positively impact both governments and businesses engaged in international trade. By streamlining processes, enhancing security measures, and improving compliance mechanisms, modernized customs systems create a more conducive environment for trade. Here are some key benefits:

For Governments:

-

Increased Revenue Collection: Modernized systems improve the accuracy of duty assessments and reduce revenue leakage due to fraud or errors. Enhanced compliance mechanisms lead to higher tax collections from international trade activities.

-

Enhanced Border Security: Advanced risk management techniques allow governments to identify high-risk shipments more effectively while facilitating the flow of legitimate trade. This balance enhances national security without impeding economic activity.

-

Improved Trade Statistics: Modernized systems generate accurate real-time trade data that governments can use for policy formulation, economic analysis, and strategic planning. High-quality statistics support informed decision-making at all levels.

-

Capacity Building: Investments in modernization often include training programs for customs personnel. This capacity building enhances staff skills and knowledge, leading to more effective administration of customs processes.

-

Stronger International Relations: By adopting best practices in customs modernization aligned with international standards, governments can strengthen bilateral relations with trading partners through mutual recognition agreements.

-

Support for Economic Development: Efficient customs procedures attract foreign investment by reducing barriers to entry for international businesses. A streamlined trade environment fosters economic growth through increased trade volumes.

For Businesses:

-

Reduced Compliance Costs: Streamlined processes lower the costs associated with meeting regulatory requirements. Businesses benefit from fewer delays, reduced paperwork, and lower fees related to compliance activities.

-

Faster Clearance Times: Modernized systems significantly reduce cargo clearance times at borders. Faster processing enables businesses to respond quickly to market demands and maintain efficient supply chains.

-

Improved Predictability: Enhanced visibility into the clearance process allows businesses to better plan their logistics operations. Predictable clearance times reduce uncertainty in supply chain management.

-

Access to New Markets: Simplified procedures enable small and medium-sized enterprises (SMEs) to engage in international trade more easily. By lowering barriers to entry, modernization opens up opportunities in new markets.

-

Enhanced Customer Satisfaction: Faster delivery times resulting from efficient customs processes improve customer satisfaction levels. Businesses can offer competitive shipping options that meet consumer expectations.

-

Increased Competitiveness: Companies operating in countries with modernized customs systems gain a competitive edge over those in regions with outdated procedures. Efficient cross-border operations enable businesses to thrive in global markets.

To illustrate these benefits quantitatively, consider the following table comparing key performance indicators before and after implementing a modernized customs system:

| Performance Indicator | Before Modernization | After Modernization | Improvement |

|---|---|---|---|

| Average Clearance Time | 5 days | 1 day | 80% reduction |

| Compliance Costs per Shipment | $500 | $200 | 60% reduction |

| Revenue Collection | $1 billion | $1.3 billion | 30% increase |

| Percentage of On-Time Deliveries | 70% | 90% | 29% increase |

| Number of SMEs Engaged in Exports | 15% | 25% | 67% increase |

This table emphasizes how both governments and businesses can experience substantial improvements through effective customs modernization initiatives.

What challenges do countries face when implementing customs modernization?

While the benefits of customs modernization are significant, countries often encounter several challenges during implementation. These challenges can hinder progress toward achieving efficient customs systems that facilitate international trade effectively. Here are some common obstacles faced by countries:

Limited Financial Resources: Many developing countries struggle with budget constraints that limit their ability to invest in modernizing their customs infrastructure. Insufficient funding can delay the adoption of new technologies or hinder necessary training programs for personnel.

Resistance to Change: Customs officials may resist changes due to concerns about job security or a lack of familiarity with new technologies. Overcoming this resistance requires effective change management strategies that involve engaging stakeholders throughout the process.

Inadequate Infrastructure: Poor physical infrastructure at ports or border crossings can impede the implementation of modernized systems. Upgrading facilities is often necessary alongside technological advancements but may require significant investment.

Lack of Technical Expertise: Implementing modernized systems requires specialized knowledge in areas such as IT infrastructure development, data analytics, cybersecurity, and risk management. Countries may face difficulties finding qualified personnel or may need extensive training programs.

Fragmented Regulatory Frameworks: In some cases, outdated laws or fragmented regulatory frameworks hinder the implementation of streamlined processes associated with modernization efforts. Comprehensive legal reforms may be necessary but can be time-consuming.

Interagency Coordination Challenges: Effective implementation often requires collaboration among multiple government agencies involved in border management. Poor communication or lack of coordination can lead to inefficiencies that undermine modernization efforts.

Cybersecurity Risks: As countries digitize their customs processes, they become more vulnerable to cyber threats that could compromise sensitive trade information or disrupt operations. Developing robust cybersecurity measures is crucial but can be challenging given limited resources.

Balancing Trade Facilitation with Security Needs: While modernization aims at facilitating trade flows efficiently, it must also ensure adequate security measures are in place. Striking this balance can be complex as it requires careful consideration of risk management strategies without compromising economic activity.

To illustrate these challenges quantitatively, consider the following table summarizing common obstacles faced during implementation:

| Challenge | Description |

|---|---|

| Limited Financial Resources | Budget constraints hinder investment in modernization |

| Resistance to Change | Customs officials may resist new processes or technologies |

| Inadequate Infrastructure | Poor facilities impede implementation efforts |

| Lack of Technical Expertise | Difficulty finding qualified personnel |

| Fragmented Regulatory Frameworks | Outdated laws complicate streamlined procedures |

| Interagency Coordination Challenges | Inefficient communication among government agencies |

| Cybersecurity Risks | Increased vulnerability due to digitalization |

| Balancing Trade Facilitation/Security Needs | Complexity in ensuring both efficiency & security |

Addressing these challenges requires a comprehensive approach involving stakeholder engagement, capacity building initiatives tailored specifically toward overcoming identified obstacles while ensuring sustainable funding mechanisms are established over time.

How can businesses prepare for and adapt to customs modernization?

As countries embark on their journey toward customs modernization, businesses must proactively prepare for changes that will impact their operations within international trade frameworks. Here are strategies businesses can employ:

Stay Informed About Regulatory Changes: Businesses should regularly monitor updates regarding changes in regulations related specifically towards custom practices within target markets they operate within globally; this includes understanding new documentation requirements or compliance obligations resulting from modernized systems being implemented by respective authorities across borders.

Invest in Technology Solutions: To remain competitive amidst evolving landscapes shaped by technological advancements associated with custom’s modernization efforts—businesses should consider investing into relevant software solutions which streamline internal processes surrounding import/export activities; this includes adopting electronic invoicing platforms & utilizing integrated logistics management tools designed specifically around meeting evolving requirements imposed through digital transformation initiatives undertaken by local/customs administrations globally

Enhance Supply Chain Visibility: Implementing tracking systems that provide real-time visibility into shipment status helps businesses anticipate potential delays caused by changes within custom’s processing timelines; leveraging IoT devices/sensors enables organizations access critical information about goods movement throughout entire supply chains—allowing timely interventions when necessary

Engage With Customs Authorities Early On: Establishing open lines communication channels between organizations & respective custom’s authorities early-on ensures clarity around expectations regarding compliance obligations—this proactive engagement fosters collaborative relationships which ultimately lead smoother transitions during periods where significant changes occur

Train Employees on New Procedures & Technologies: Providing employees comprehensive training around updated policies/procedures resulting from custom’s modernization initiatives ensures staff remains equipped handle shifts effectively—this includes familiarizing teams not only about new documentation requirements but also any technological tools utilized internally facilitate seamless interactions external partners/customs officials

Adopt Risk Management Practices: Developing robust risk management frameworks allows organizations identify potential vulnerabilities associated changes arising from custom’s modernization efforts; conducting regular assessments helps mitigate risks while ensuring adherence required standards imposed upon them as they navigate evolving landscapes dictated by regulatory bodies

To summarize how businesses can adapt effectively amidst ongoing transformations occurring across borders—consider below table outlining key strategies alongside corresponding actions taken:

| Strategy | Corresponding Actions |

|---|---|

| Stay Informed About Regulatory Changes | |

| Attend industry seminars/webinars focused on custom’s practices | |

| Subscribe newsletters from relevant authorities | |

| Engage legal counsel specializing in international trade law |

|| Invest in Technology Solutions || Research software solutions tailored towards streamlining import/export activities|

|| Implement electronic invoicing platforms enhancing documentation accuracy|

|| Utilize integrated logistics management tools supporting overall efficiency|

|| Enhance Supply Chain Visibility || Implement tracking systems providing real-time shipment status updates|

|| Leverage IoT devices/sensors enabling visibility throughout entire supply chains|

|| Engage With Customs Authorities Early On || Establish open lines communication channels fostering collaborative relationships|

|| Schedule regular meetings discussing expectations surrounding compliance obligations|

|| Train Employees on New Procedures & Technologies || Provide comprehensive training sessions covering updated policies/procedures|

|| Familiarize teams about new documentation requirements/technological tools utilized|

|| Adopt Risk Management Practices || Develop robust risk management frameworks identifying potential vulnerabilities|

|| Conduct regular assessments mitigating risks ensuring adherence required standards|

By adopting these strategies proactively—businesses position themselves favorably amidst ongoing transformations driven largely through custom’s modernization initiatives undertaken globally; ultimately enhancing competitiveness while ensuring smooth transitions during periods where significant changes occur within respective markets they operate across borders.