What Is the Anti-Dumping Duty Procedure

What is an anti-dumping duty?

Anti-dumping duties are special tariffs imposed on imported goods to prevent unfair competition with domestic products. These duties aim to level the playing field when foreign manufacturers export products at prices lower than the normal value in their home market.

The concept of “dumping” in international trade refers to the practice of selling goods in a foreign market at prices below the cost of production or below the selling price in the exporter’s domestic market. This practice can harm domestic industries in the importing country by undercutting local producers and potentially driving them out of business.

Anti-dumping duties serve several key purposes:

Protection of domestic industries: By imposing additional costs on unfairly priced imports, anti-dumping duties help shield local manufacturers from predatory pricing practices.

Promotion of fair competition: These duties aim to ensure that foreign and domestic producers compete on equal terms, preventing artificially low prices from distorting the market.

Preservation of jobs: By safeguarding domestic industries, anti-dumping measures can help maintain employment levels in the importing country.

Enforcement of international trade rules: Anti-dumping duties are a tool for enforcing World Trade Organization (WTO) agreements on fair trade practices.

The calculation of anti-dumping duties involves determining the extent of dumping and the injury caused to the domestic industry. The duty is typically set at a level that eliminates the price difference between the dumped imports and the fair market value.

Key characteristics of anti-dumping duties include:

Product-specific application: Duties are applied to specific products from particular countries or even specific manufacturers.

Time-limited nature: Anti-dumping measures are usually imposed for a fixed period, often five years, subject to review and possible extension.

Variable rates: The duty rate can vary depending on the exporter and the extent of dumping found.

Compliance with WTO rules: Countries imposing anti-dumping duties must follow WTO guidelines to ensure fairness and transparency in the process.

It’s crucial to distinguish anti-dumping duties from other trade measures:

| Measure | Purpose | Application |

|---|---|---|

| Anti-dumping duties | Counter unfair pricing practices | Applied to specific products from specific countries |

| Countervailing duties | Offset foreign government subsidies | Target subsidized imports |

| Safeguard measures | Protect against sudden import surges | Applied more broadly, regardless of fair pricing |

Understanding anti-dumping duties is essential for businesses engaged in international trade, as these measures can significantly impact pricing strategies, supply chain decisions, and overall competitiveness in global markets.

How is an anti-dumping investigation initiated?

An anti-dumping investigation is a complex process that begins when a domestic industry believes it is being harmed by unfairly priced imports. The initiation of such an investigation involves several key steps and considerations.

Filing a petition

The process typically starts when domestic producers or their representatives file a formal petition with the relevant government authority. In the United States, this would be the Department of Commerce (DOC) and the International Trade Commission (ITC). The petition must include:

Detailed evidence of dumping: This includes data on export prices and normal values in the exporter’s home market.

Proof of material injury: The petitioners must demonstrate that the domestic industry has suffered or is threatened with material injury due to the dumped imports.

Industry support: The petition should represent a significant portion of the domestic industry producing the like product.

Evaluation of the petition

Once received, the investigating authorities evaluate the petition to determine if it meets the necessary requirements:

Sufficiency of evidence: The authorities assess whether the provided information is adequate to justify initiating an investigation.

Standing: They verify if the petition has sufficient support from the domestic industry.

Scope of investigation: The authorities define the product scope and the countries to be investigated.

Initiation decision

If the petition meets the required criteria, the investigating authority will initiate the anti-dumping investigation. This decision typically occurs within 20-45 days of receiving the petition, depending on the country’s regulations.

Notification and publication

Upon deciding to initiate an investigation, the authorities:

Notify interested parties: This includes known exporters, importers, and the governments of exporting countries.

Publish a notice: An official notice is published in government publications, detailing the product under investigation, the alleged dumping margin, and the investigation timeline.

Self-initiation by authorities

In rare cases, government authorities may initiate an anti-dumping investigation on their own, without receiving a formal petition. This typically occurs when:

Clear evidence of dumping exists: The authorities have substantial information indicating dumping and injury.

National interest is at stake: The government perceives a significant threat to a crucial domestic industry.

Preliminary screening

Before full initiation, some jurisdictions conduct a preliminary screening:

Pre-initiation consultations: Authorities may consult with the exporting country to clarify the situation.

Initial assessment: A quick review to determine if the case has merit before committing resources to a full investigation.

Confidentiality considerations

Throughout the initiation process, authorities must balance transparency with the need to protect confidential business information:

Public information: Non-confidential versions of the petition and related documents are made available for public review.

Confidential data protection: Sensitive business information is kept confidential to protect the interests of involved parties.

The initiation of an anti-dumping investigation is a critical phase that sets the stage for the entire process. It requires careful preparation by petitioners and thorough evaluation by authorities to ensure that only cases with sufficient merit proceed to full investigation.

What are the key steps in the anti-dumping investigation process?

The anti-dumping investigation process is a structured sequence of events designed to determine whether dumping is occurring and if it is causing material injury to the domestic industry. Understanding these key steps is crucial for all parties involved in international trade.

Questionnaire distribution and data collection

Once an investigation is initiated, the investigating authority sends detailed questionnaires to:

Foreign producers/exporters: To gather information on production costs, domestic sales prices, and export prices.

Domestic producers: To collect data on production, sales, profits, and other indicators of industry health.

Importers: To obtain information on import volumes, prices, and market conditions.

These questionnaires are comprehensive and typically require extensive financial and operational data.

On-site verifications

After receiving responses, investigators often conduct on-site verifications:

Purpose: To confirm the accuracy and completeness of submitted information.

Scope: Examines company records, production facilities, and interviews key personnel.

Duration: Can last several days to a week, depending on the complexity of the case.

Dumping margin calculation

Investigators analyze the collected data to determine if dumping is occurring:

Normal value determination: Establishes the fair market price in the exporter’s home market.

Export price calculation: Determines the price at which the product is sold in the importing country.

Dumping margin: Calculated as the difference between normal value and export price, expressed as a percentage of the export price.

Injury analysis

Parallel to the dumping investigation, authorities assess whether the domestic industry is suffering material injury:

Economic indicators: Examine factors such as production volume, market share, profits, employment, and capacity utilization.

Causal link: Determine if any injury is caused by dumped imports rather than other factors.

Public hearings and submissions

During the investigation, interested parties have opportunities to present their views:

Written submissions: Parties can submit arguments and evidence to support their positions.

Public hearings: Provide a forum for oral presentations and cross-examination of opposing views.

Preliminary determinations

Investigating authorities issue preliminary findings on dumping and injury:

Timing: Usually within 60-180 days after initiation, depending on the jurisdiction.

Provisional measures: May be imposed based on these preliminary findings.

Final determinations

After considering all evidence and arguments, authorities make final determinations:

Dumping determination: Confirms whether dumping has occurred and at what margin.

Injury determination: Concludes whether the domestic industry has suffered material injury due to dumped imports.

Causation analysis: Establishes a causal link between dumping and injury.

Implementation of measures

If both dumping and injury are found, anti-dumping measures are implemented:

Duty calculation: Based on the dumping margin, unless a lesser duty would be sufficient to remove injury.

Duration: Typically imposed for five years, subject to review.

The following table summarizes the typical timeline of an anti-dumping investigation:

| Investigation Stage | Approximate Timing |

|---|---|

| Initiation | Day 0 |

| Questionnaire responses due | Day 30-60 |

| Preliminary determination | Day 60-180 |

| Verification visits | Day 120-240 |

| Final determination | Day 180-365 |

| Implementation of measures | Day 200-395 |

This timeline can vary significantly depending on the complexity of the case and the specific regulations of the investigating country.

Throughout the investigation process, all parties must adhere to strict deadlines and procedural requirements. Failure to comply can result in decisions based on available facts, which may be less favorable to non-cooperating parties.

How are preliminary determinations and provisional measures implemented?

Preliminary determinations and provisional measures are critical components of the anti-dumping investigation process, serving as interim steps before the final determination. These elements provide temporary relief to the domestic industry while allowing for a thorough investigation to be completed.

Nature of preliminary determinations

Preliminary determinations are initial findings made by the investigating authority:

Purpose: To assess whether there is sufficient evidence of dumping and injury to justify continuing the investigation.

Timing: Typically issued within 60-180 days after the initiation of the investigation, depending on the jurisdiction.

Scope: Covers both the existence of dumping and the presence of material injury to the domestic industry.

Basis for decision: Made on the best information available at that point in the investigation.

Implementation of provisional measures

If the preliminary determination is affirmative, provisional measures may be imposed:

Forms of measures:

– Provisional duties: Additional tariffs on the imported goods.

– Security deposits: Importers may be required to post bonds or cash deposits.

Duration: Usually limited to 4-6 months, with possible extensions in some cases.

Calculation: Based on the preliminarily determined dumping margin.

Threshold for implementation:

– Evidence of dumping

– Preliminary finding of injury to domestic industry

– Determination that measures are necessary to prevent injury during the investigation

Legal basis and WTO compliance

Provisional measures must comply with international trade rules:

WTO Agreement on Anti-Dumping: Sets guidelines for the application of provisional measures.

National legislation: Must align with WTO rules while potentially adding specific national requirements.

Transparency requirements: Decisions must be published and explained to all interested parties.

Impact on trade flows

The implementation of provisional measures can have immediate effects:

Import patterns: May lead to a decrease in imports of the subject merchandise.

Price adjustments: Exporters might adjust their prices to avoid or minimize the impact of duties.

Market uncertainty: Can create temporary disruptions in supply chains and market dynamics.

Procedural aspects

The process of implementing provisional measures involves several steps:

Notification: All interested parties are informed of the preliminary determination and any provisional measures.

Public notice: A detailed explanation of the findings and measures is published.

Customs instructions: Relevant customs authorities are directed to begin collecting provisional duties or securities.

Rights of interested parties

During this phase, affected parties retain certain rights:

Access to information: Non-confidential versions of the preliminary determination are made available.

Opportunity to comment: Parties can submit responses to the preliminary findings.

Continued participation: The right to participate in the ongoing investigation is maintained.

Retroactive application

In some cases, provisional measures may be applied retroactively:

Conditions: Usually limited to situations where there is a history of dumping causing injury or where the importer was aware of the dumping.

Time limit: Typically no more than 90 days before the application of provisional measures.

The following table illustrates the key differences between preliminary and final determinations:

| Aspect | Preliminary Determination | Final Determination |

|---|---|---|

| Timing | Early in investigation | End of investigation |

| Basis | Limited available information | Complete investigation data |

| Measures | Provisional and temporary | Definitive and longer-term |

| Duty collection | Often refundable if final determination differs | Generally non-refundable |

| Legal weight | Interim finding | Binding decision (subject to appeal) |

Preliminary determinations and provisional measures play a crucial role in balancing the need for immediate action to protect domestic industries with the requirement for a thorough and fair investigation. They provide a mechanism for addressing potential harm during the investigation period while allowing for a comprehensive analysis before final measures are imposed.

What happens during the final determination and duty order phase?

The final determination and duty order phase represents the culmination of the anti-dumping investigation process. This critical stage involves a comprehensive analysis of all gathered evidence, leading to definitive decisions on dumping, injury, and the imposition of anti-dumping duties.

Final determination process

The investigating authorities conduct a thorough review of all collected data and arguments:

Comprehensive analysis: All questionnaire responses, verification findings, and submitted arguments are carefully examined.

Final calculations: Dumping margins are recalculated based on the most up-to-date and verified information.

Injury reassessment: A final evaluation of the impact on the domestic industry is conducted.

Causation analysis: The link between dumped imports and injury to the domestic industry is reexamined.

Decision-making

Based on the analysis, authorities make final determinations on key aspects:

Dumping: Confirm whether dumping has occurred and at what margin for each exporter.

Injury: Conclude whether the domestic industry has suffered material injury or is threatened with such injury.

Causal link: Establish whether the dumped imports are a cause of the injury.

Public interest considerations: Some jurisdictions may consider broader economic impacts before imposing duties.

Issuance of the final determination

The final determination is a formal document that:

Details findings: Provides a comprehensive explanation of the investigation’s conclusions.

Specifies duty rates: Lists the anti-dumping duty rates for each affected exporter.

Addresses key issues: Responds to significant arguments raised by interested parties during the investigation.

Duty order implementation

If the final determination is affirmative, a duty order is issued:

Publication: The order is officially published, typically in a government gazette or official journal.

Customs instructions: Detailed instructions are provided to customs authorities for implementing the duties.

Scope of application: Clearly defines the products subject to the duties and any exceptions.

Retroactive application: In some cases, duties may be applied retroactively, typically not exceeding 90 days before the date of application of provisional measures.

Duty collection and adjustment

The implementation of the duty order involves several practical aspects:

Collection method: Duties are typically collected as a percentage of the import value or as a specific amount per unit.

Adjustment of provisional measures: Any difference between provisional and final duties is addressed, often resulting in refunds or additional collections.

Customs procedures: Importers must declare the applicable anti-dumping duties when clearing goods through customs.

Duration and review

Anti-dumping duty orders are not permanent:

Typical duration: Usually imposed for five years, subject to review.

Sunset reviews: Conducted near the end of the five-year period to determine if duties should be continued.

Changed circumstances reviews: Can be requested to reassess the need for continued imposition of duties.

Impact on trade

The imposition of final anti-dumping duties can have significant effects:

Trade flows: May lead to reduced imports from affected countries or shifts to alternative suppliers.

Market dynamics: Can influence pricing strategies of both importers and domestic producers.

Supply chain adjustments: Companies may need to restructure their sourcing or production strategies.

The following table outlines the key components of a typical anti-dumping duty order:

| Component | Description |

|---|---|

| Product scope | Detailed description of covered products |

| Country of origin | Specific countries subject to the order |

| Exporter-specific rates | Individual duty rates for investigated exporters |

| All-others rate | General rate for non-investigated exporters |

| Effective date | Date from which duties apply |

| Duration | Typically five years, subject to review |

| Review provisions | Procedures for requesting duty reassessments |

The final determination and duty order phase is crucial as it establishes the long-term framework for addressing the dumping issue. It requires careful consideration of all evidence and potential impacts, balancing the protection of domestic industries with the broader interests of the economy and international trade relations.

How do reviews and appeals work in anti-dumping cases?

Reviews and appeals are integral components of the anti-dumping process, providing mechanisms for reassessing decisions and ensuring fairness in the application of anti-dumping measures. These procedures allow for adjustments to duty rates, reconsideration## How do reviews and appeals work in anti-dumping cases?

Reviews and appeals are integral components of the anti-dumping process, providing mechanisms for reassessing decisions and ensuring fairness in the application of anti-dumping measures. These procedures allow for adjustments to duty rates, reconsideration of findings, and opportunities for parties to contest unfavorable determinations.

Types of reviews

There are generally two main types of reviews conducted in anti-dumping cases:

Administrative reviews: These reviews occur periodically, typically annually, to assess whether the anti-dumping duties imposed remain appropriate. They involve:

- Re-evaluation of dumping margins: Investigators review new data from exporters and importers to determine if the original dumping margin remains valid.

- Injury assessment: Authorities reassess the impact on the domestic industry, considering any changes in market conditions.

Sunset reviews: Conducted near the end of the five-year period following the imposition of duties, sunset reviews evaluate whether the continued imposition of anti-dumping duties is necessary. Key aspects include:

- Assessment of ongoing injury: Authorities determine if the domestic industry is still facing injury from dumped imports.

- Causation analysis: Investigators evaluate whether the injury is still linked to the dumped imports or if other factors have emerged.

Requesting a review

Interested parties can request a review under specific circumstances:

- For administrative reviews: Exporters, importers, or domestic producers can file requests based on new evidence or changes in circumstances.

- For sunset reviews: Typically initiated by domestic producers or government authorities before the expiration of existing duties.

The following table summarizes the key differences between administrative and sunset reviews:

| Aspect | Administrative Review | Sunset Review |

|---|---|---|

| Timing | Periodic (usually annually) | Near end of duty period (5 years) |

| Purpose | Re-evaluate dumping margins and injury | Determine need for continued duties |

| Initiation | Requested by interested parties | Often initiated by authorities |

| Duration | Varies based on complexity | Typically takes several months |

Appeals process

If parties disagree with the findings of an investigation or a review, they have the right to appeal:

Judicial appeals: In many jurisdictions, parties can challenge final determinations in court. This process typically involves:

- Filing a complaint: Parties submit legal documents outlining their objections to the determination.

- Judicial review: Courts assess whether the investigating authority followed proper procedures and made decisions based on substantial evidence.

Scope of judicial review: Courts generally do not re-evaluate factual findings but focus on procedural correctness and adherence to legal standards.

Administrative appeals: Some jurisdictions allow for administrative appeals within trade agencies. This involves:

- Internal review processes: Agencies may have specific procedures for parties to contest decisions without going to court.

- Reconsideration requests: Parties can request that authorities re-examine their findings based on new evidence or legal arguments.

The appeals process can be lengthy and complex, often taking months or even years to resolve. It provides an essential check on governmental authority, ensuring that decisions are fair and justified.

What are the compliance requirements for importers and exporters?

Compliance with anti-dumping regulations is crucial for both importers and exporters engaged in international trade. Understanding these requirements helps avoid legal issues and potential financial penalties.

Importers’ compliance obligations

Importers must adhere to several key compliance requirements when dealing with products subject to anti-dumping duties:

-

Duties payment: Importers are responsible for paying any applicable anti-dumping duties at the time of customs clearance. Failure to do so can result in significant penalties.

-

Documentation accuracy: Importers must provide accurate documentation related to the value and origin of imported goods. This includes invoices, shipping documents, and any relevant certificates.

-

Recordkeeping requirements: Importers should maintain detailed records of all transactions involving subject merchandise for a specified period (often five years). This documentation may be requested during audits or investigations.

-

Cooperation with authorities: Importers are expected to cooperate with customs authorities during investigations or audits by providing requested information promptly.

-

Disclosure obligations: If an importer becomes aware that they are importing goods subject to anti-dumping duties, they must disclose this information to customs authorities immediately.

Exporters’ compliance obligations

Exporters also face specific compliance requirements when exporting goods potentially subject to anti-dumping measures:

-

Accurate pricing information: Exporters must provide accurate data regarding their pricing practices in both their home markets and export markets. This includes maintaining records that demonstrate compliance with fair pricing standards.

-

Responding to questionnaires: During investigations, exporters are required to respond promptly and accurately to questionnaires issued by investigating authorities. Failure to provide complete information may lead to adverse findings.

-

On-site verifications cooperation: Exporters must allow investigators access to their facilities for verification purposes as part of the investigation process.

-

Notification obligations: Exporters should notify their governments if they believe they are being subjected to unfair trade practices or if they receive inquiries from foreign authorities regarding potential dumping allegations.

Compliance with these requirements is essential for both importers and exporters as non-compliance can lead to severe consequences such as increased duties, legal penalties, and reputational damage.

The following table outlines key compliance obligations for importers and exporters:

| Entity | Compliance Requirement | Description |

|---|---|---|

| Importers | Duties payment | Pay applicable anti-dumping duties at customs clearance |

| Importers | Documentation accuracy | Provide accurate invoices, shipping documents, etc. |

| Importers | Recordkeeping | Maintain transaction records for five years |

| Importers | Cooperation with authorities | Promptly provide requested information during audits |

| Importers | Disclosure obligations | Inform customs about imported goods subject to duties |

| Exporters | Accurate pricing information | Maintain records demonstrating fair pricing practices |

| Exporters | Responding to questionnaires | Provide complete responses during investigations |

| Exporters | On-site verifications cooperation | Allow access for investigators during verifications |

| Exporters | Notification obligations | Inform governments about potential unfair practices |

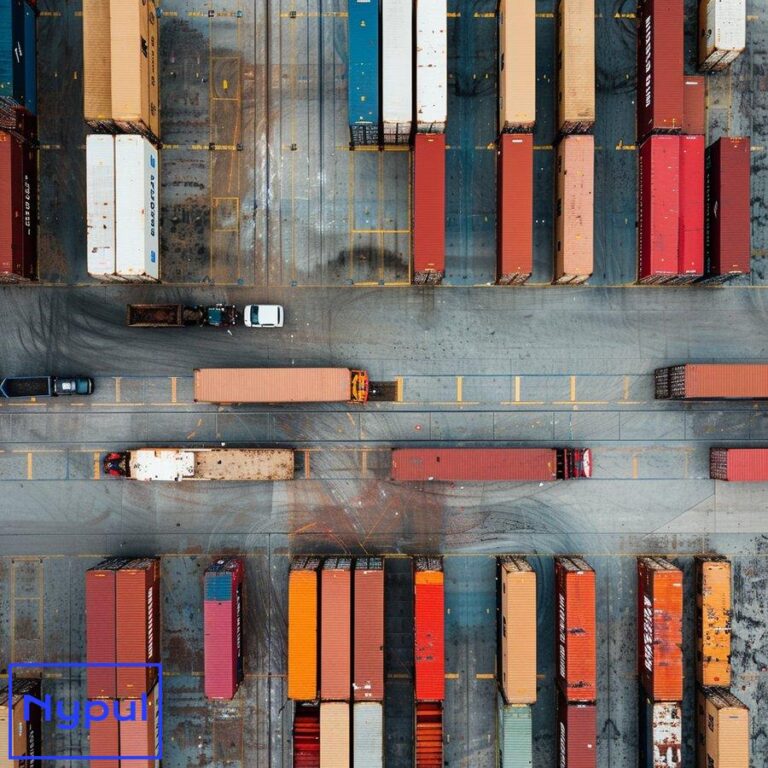

How do anti-dumping duties impact international trade and logistics?

Anti-dumping duties significantly influence international trade dynamics and logistics operations. Their implementation affects pricing strategies, market access, supply chain management, and overall competitiveness in global markets.

Market access implications

The imposition of anti-dumping duties can restrict market access for foreign producers:

-

Higher costs for importers: Duties increase the cost of imported goods, making them less competitive compared to domestic products. This can lead to reduced sales volumes for foreign exporters.

-

Shift in sourcing strategies: Importers may seek alternative suppliers from countries not subject to anti-dumping measures or explore domestic sourcing options.

-

Market share erosion for exporters: Foreign producers facing high duties may lose market share in importing countries as consumers gravitate toward lower-priced domestic alternatives.

Pricing strategies

Anti-dumping duties compel businesses involved in international trade to reevaluate their pricing strategies:

-

Adjustment of export prices: Exporters may need to raise prices in response to imposed duties or find ways to reduce production costs without compromising quality.

-

Impact on profit margins: Higher prices can lead to reduced profit margins for both exporters and importers as they navigate increased costs associated with compliance and duty payments.

-

Long-term price stabilization efforts: Some companies may engage in long-term strategies aimed at stabilizing prices through cost reductions or product differentiation.

Supply chain management

The presence of anti-dumping duties necessitates careful consideration within supply chain operations:

-

Supplier diversification strategies: Companies may diversify their supplier base by seeking alternative sources from countries not affected by duties or exploring local production options.

-

Logistics adjustments: Increased costs associated with duties may prompt businesses to optimize logistics operations by reevaluating transportation routes or warehousing strategies.

-

Inventory management challenges: Fluctuating duty rates can complicate inventory management as businesses must anticipate changes in demand based on pricing shifts caused by duties.

The following table highlights key impacts of anti-dumping duties on international trade dynamics:

| Impact Area | Description |

|---|---|

| Market access implications | Restricted access due to higher costs; potential loss of market share |

| Pricing strategies | Need for price adjustments; impact on profit margins; long-term stabilization efforts |

| Supply chain management | Supplier diversification; logistics adjustments; inventory management challenges |

Anti-dumping duties serve as a tool for protecting domestic industries but also create ripple effects throughout international trade networks. Businesses engaged in global commerce must remain vigilant about these measures’ implications while adapting their strategies accordingly. Understanding these impacts is crucial for maintaining competitiveness in an increasingly interconnected world economy.