What Is the Customs Compliance Program

What is a customs compliance program?

A customs compliance program is a comprehensive system designed by businesses engaged in international trade to ensure adherence to customs laws, regulations, and procedures. This structured approach encompasses policies, procedures, and practices that guide a company’s import and export activities, aiming to minimize errors, reduce risks, and maintain legal compliance.

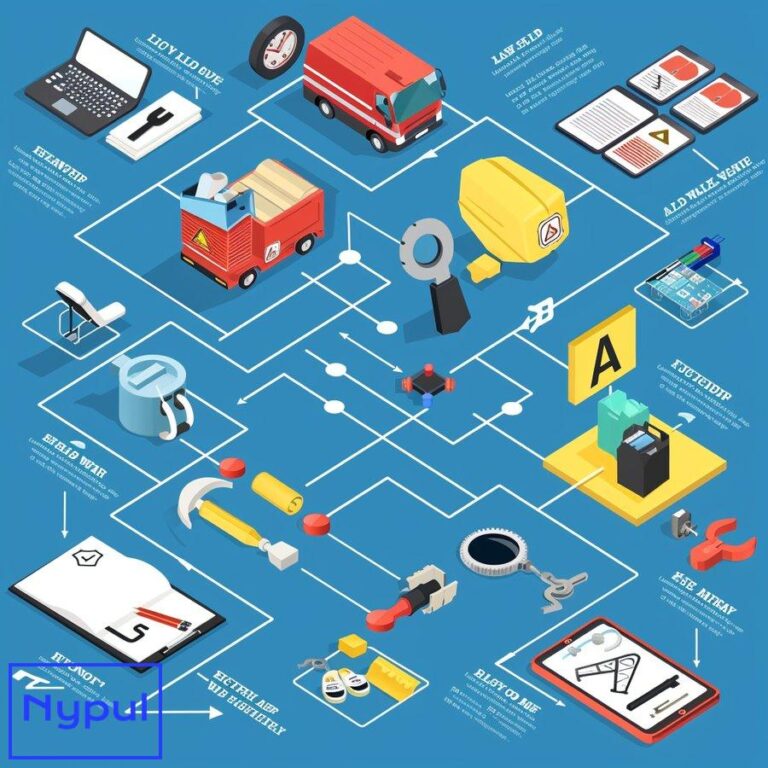

![]()

At its core, a customs compliance program serves as a proactive measure to navigate the complex landscape of international trade regulations. It acts as a safeguard against potential violations that could result in penalties, fines, or trade disruptions. The program typically covers various aspects of customs operations, including:

Classification of goods: Ensuring accurate assignment of Harmonized System (HS) codes to products for proper duty assessment and regulatory compliance.

Valuation: Implementing methods to correctly determine the customs value of imported goods, considering all relevant costs and adjustments.

Origin determination: Establishing procedures to accurately claim and document the country of origin for preferential treatment under trade agreements.

Documentation: Maintaining comprehensive and accurate records of all import and export transactions, including commercial invoices, packing lists, and certificates of origin.

Duty payment: Ensuring timely and accurate payment of customs duties, taxes, and fees associated with international shipments.

Restricted and prohibited goods: Implementing controls to prevent the import or export of restricted or prohibited items without proper licenses or permits.

Internal audits: Conducting regular reviews of customs processes and transactions to identify and correct potential compliance issues.

Training: Providing ongoing education and training to employees involved in customs-related activities to keep them updated on regulations and best practices.

A well-structured customs compliance program not only helps businesses avoid legal troubles but also streamlines their international trade operations. It can lead to cost savings through reduced errors, faster clearance times, and potential participation in trusted trader programs offered by customs authorities.

The scope and complexity of a customs compliance program may vary depending on the size of the business, the volume of international trade, and the specific industries involved. However, the fundamental goal remains consistent: to create a culture of compliance within the organization and establish a systematic approach to managing customs-related risks and obligations.

Why are customs compliance programs important for businesses?

Customs compliance programs play a crucial role in the success and sustainability of businesses engaged in international trade. Their importance extends beyond mere regulatory adherence, impacting various aspects of a company’s operations and reputation.

Risk mitigation: A robust customs compliance program serves as a shield against potential legal and financial risks associated with international trade. By implementing systematic checks and balances, businesses can significantly reduce the likelihood of customs violations, which could otherwise result in hefty fines, penalties, or even criminal charges. This proactive approach to risk management helps protect the company’s bottom line and reputation.

Operational efficiency: Well-designed compliance programs streamline customs processes, leading to improved operational efficiency. By standardizing procedures and maintaining accurate documentation, businesses can expedite customs clearance, reduce delays, and minimize disruptions to their supply chain. This efficiency translates into cost savings and improved customer satisfaction through timely deliveries.

Competitive advantage: Companies with established customs compliance programs often gain a competitive edge in the global marketplace. They are viewed as reliable and trustworthy partners by both customers and regulatory authorities. This reputation can lead to preferential treatment, such as expedited clearance or reduced inspection rates, further enhancing operational efficiency and customer service.

Access to trade benefits: Many countries offer trusted trader programs or Authorized Economic Operator (AEO) status to companies with demonstrated compliance records. These programs provide various benefits, including reduced customs inspections, priority processing, and simplified procedures. A robust compliance program is often a prerequisite for participation in such initiatives, opening doors to significant trade facilitations.

Cost savings: While implementing a compliance program requires initial investment, it often leads to long-term cost savings. By preventing errors and violations, businesses avoid costly penalties and reduce the need for post-entry corrections. Additionally, accurate classification and valuation of goods ensure that companies pay the correct amount of duties and taxes, avoiding both overpayment and underpayment scenarios.

Supply chain visibility: Customs compliance programs typically involve detailed record-keeping and documentation practices. This comprehensive approach provides businesses with enhanced visibility into their supply chain operations, enabling better decision-making and strategic planning.

Stakeholder confidence: A commitment to customs compliance demonstrates a company’s dedication to ethical business practices. This commitment instills confidence among stakeholders, including investors, partners, and customers, potentially leading to increased business opportunities and improved relationships with regulatory authorities.

Adaptability to regulatory changes: The global trade landscape is constantly evolving, with frequent changes in regulations and trade agreements. A well-maintained compliance program helps businesses stay abreast of these changes and adapt their processes accordingly, ensuring continued compliance and avoiding disruptions to their international operations.

Intellectual property protection: For businesses dealing with proprietary technologies or branded products, customs compliance programs can include measures to protect intellectual property rights. This protection helps prevent the import or export of counterfeit goods, safeguarding the company’s brand value and market position.

Corporate social responsibility: In an era where ethical business practices are increasingly valued, maintaining a strong customs compliance program demonstrates a company’s commitment to responsible trade. This commitment can enhance the company’s reputation and align with broader corporate social responsibility initiatives.

The importance of customs compliance programs is underscored by the potential consequences of non-compliance. The following table illustrates some of the risks associated with inadequate customs compliance:

| Risk Category | Potential Consequences |

|---|---|

| Financial | Fines, penalties, increased duties, loss of trade benefits |

| Legal | Civil or criminal charges, import/export restrictions |

| Operational | Shipment delays, supply chain disruptions, increased inspections |

| Reputational | Loss of customer trust, negative publicity, damaged brand image |

| Strategic | Loss of market access, competitive disadvantage, missed business opportunities |

By implementing and maintaining a robust customs compliance program, businesses can effectively mitigate these risks while reaping the numerous benefits associated with responsible and efficient international trade practices.

How does the legal framework shape customs compliance?

The legal framework surrounding international trade plays a pivotal role in shaping customs compliance programs. This complex web of laws, regulations, and international agreements forms the foundation upon which businesses must build their compliance strategies. Understanding this legal landscape is crucial for developing effective customs compliance programs that meet both national and international standards.

National customs laws: Each country has its own set of customs laws that govern the import and export of goods. These laws typically outline the basic requirements for customs declarations, duty payments, and documentation. For example, in the United States, the Tariff Act of 1930 and its subsequent amendments form the basis of customs law, while the Union Customs Code (UCC) serves a similar function for European Union member states. Compliance programs must be tailored to meet the specific requirements of each country where a business operates.

International trade agreements: Bilateral and multilateral trade agreements significantly impact customs compliance. These agreements often include provisions for preferential tariff rates, rules of origin, and simplified customs procedures. For instance, the United States-Mexico-Canada Agreement (USMCA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) contain specific rules that businesses must follow to benefit from reduced tariffs. Compliance programs need to incorporate mechanisms to ensure adherence to these agreement-specific requirements.

World Trade Organization (WTO) rules: The WTO establishes global rules for international trade, including principles for customs valuation, import licensing procedures, and trade facilitation. The WTO Customs Valuation Agreement, for example, provides standardized methods for determining the customs value of imported goods. Compliance programs must align with these international standards to ensure consistency across different markets.

Harmonized System (HS) Convention: The International Convention on the Harmonized Commodity Description and Coding System provides a standardized system for classifying goods in international trade. Accurate classification is crucial for determining applicable duties and regulations. Compliance programs must include robust procedures for product classification in accordance with the HS nomenclature.

Anti-dumping and countervailing duty laws: Many countries have laws to protect domestic industries from unfair trade practices. These laws allow for the imposition of additional duties on imports that are sold below fair market value or benefit from government subsidies. Compliance programs must include mechanisms to monitor and comply with these special duty requirements.

Export control regulations: Laws such as the U.S. Export Administration Regulations (EAR) and the International Traffic in Arms Regulations (ITAR) govern the export of sensitive goods and technologies. Compliance programs for companies dealing with controlled items must incorporate stringent measures to prevent unauthorized exports and ensure proper licensing.

Sanctions and embargoes: Economic sanctions and trade embargoes imposed by national governments or international bodies restrict trade with specific countries, entities, or individuals. Compliance programs must include robust screening procedures to avoid transactions with sanctioned parties.

Intellectual property laws: Customs authorities play a crucial role in enforcing intellectual property rights at the border. Compliance programs should include measures to prevent the import or export of counterfeit goods and to protect the company’s own intellectual property.

Data protection and privacy laws: With the increasing digitization of customs processes, compliance programs must also consider data protection regulations such as the European Union’s General Data Protection Regulation (GDPR) when handling personal information in cross-border transactions.

Environmental and safety regulations: Many countries have specific regulations governing the import of products that may pose environmental or safety risks. For example, the EU’s Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation impacts the import of chemical substances. Compliance programs must address these product-specific regulatory requirements.

The following table illustrates how different legal frameworks impact various aspects of customs compliance:

| Legal Framework | Key Impact Areas | Compliance Program Considerations |

|---|---|---|

| National Customs Laws | Documentation, duty payment, prohibited goods | Country-specific procedures, accurate declarations |

| Trade Agreements | Preferential tariffs, rules of origin | Origin determination, certificate management |

| WTO Rules | Valuation, trade facilitation | Standardized valuation methods, simplified procedures |

| HS Convention | Product classification | Regular classification reviews, HS code management |

| Anti-dumping Laws | Special duties | Monitoring of duty rates, origin tracking |

| Export Controls | Restricted items, licensing | Export screening, license management |

| Sanctions | Prohibited transactions | Denied party screening, transaction monitoring |

| IP Laws | Counterfeit goods | Brand protection measures, customs recordation |

| Data Protection | Information handling | Secure data management, privacy compliance |

| Environmental Regulations | Product safety, restricted substances | Product testing, documentation of compliance |

The legal framework for customs compliance is dynamic, with frequent updates and amendments to laws and regulations. This ever-changing landscape necessitates that compliance programs be flexible and adaptable. Businesses must establish systems for monitoring legal changes and quickly incorporating them into their compliance procedures.

Moreover, the interpretation and enforcement of these laws can vary between jurisdictions and even between different customs officers within the same country. This variability underscores the importance of maintaining open communication channels with customs authorities and seeking clarification on ambiguous regulations.

Ultimately, the legal framework serves as both a guide and a challenge for businesses in developing their customs compliance programs. By thoroughly understanding and adhering to this complex legal landscape, companies can create robust compliance strategies that not only meet regulatory requirements but also optimize their international trade operations.

What are the core elements of an effective customs compliance program?

An effective customs compliance program is built on several core elements that work together to ensure comprehensive coverage of all aspects of customs operations. These elements form the foundation of a robust compliance strategy, enabling businesses to navigate the complexities of international trade with confidence and efficiency.

Management commitment and support: The cornerstone of any successful compliance program is unwavering support from top management. This commitment should be reflected in the allocation of resources, the establishment of clear compliance policies, and the integration of compliance objectives into the company’s overall business strategy. Management should lead by example, fostering a culture of compliance throughout the organization.

Written policies and procedures: Detailed, written policies and procedures serve as the roadmap for customs compliance. These documents should cover all aspects of the company’s import and export activities, including:

- Product classification

- Valuation methodologies

- Origin determination

- Documentation requirements

- Record-keeping practices

- Duty payment procedures

- Handling of restricted or prohibited goods

- Internal audit processes

These policies should be regularly reviewed and updated to reflect changes in regulations and business practices.

Risk assessment and management: A systematic approach to identifying, assessing, and mitigating customs-related risks is crucial. This involves:

- Conducting regular risk assessments to identify potential compliance vulnerabilities

- Developing risk mitigation strategies

- Implementing controls to address identified risks

- Continuously monitoring and reassessing risk factors

Training and education: Ongoing training is essential to ensure that all employees involved in customs-related activities are knowledgeable about relevant regulations and company procedures. Training programs should:

- Cover both general customs principles and company-specific procedures

- Be tailored to different roles within the organization

- Include regular refresher courses and updates on regulatory changes

- Incorporate practical exercises and real-world scenarios

Internal controls and monitoring: Robust internal controls help prevent, detect, and correct compliance issues. Key components include:

- Segregation of duties to prevent conflicts of interest

- Automated systems to enforce compliance procedures

- Regular reconciliations of customs data with financial records

- Monitoring of key performance indicators (KPIs) related to customs compliance

Record-keeping and documentation: Comprehensive and accurate record-keeping is crucial for demonstrating compliance to customs authorities. An effective program should include:

- A centralized system for storing and retrieving customs-related documents

- Clear retention policies that meet or exceed legal requirements

- Regular audits of documentation for completeness and accuracy

- Procedures for handling and protecting sensitive information

Self-assessment and internal audits: Regular self-assessments and internal audits help identify compliance gaps and areas for improvement. These should include:

- Scheduled and random audits of customs transactions

- Reviews of compliance procedures and their effectiveness

- Assessments of employee knowledge and adherence to policies

- Documentation of audit findings and corrective actions

Corrective action procedures: When compliance issues are identified, there should be clear procedures for:

- Investigating the root cause of the problem

- Implementing corrective actions

- Monitoring the effectiveness of these actions

- Updating policies and procedures to prevent recurrence

Technology and automation: Leveraging technology can significantly enhance the effectiveness of a compliance program. Key technological components may include:

- Customs management software for classification, valuation, and documentation

- Automated screening tools for restricted parties and embargoed countries

- Data analytics for identifying trends and potential compliance issues

- Integration with enterprise resource planning (ERP) systems for seamless data flow

Relationship management with customs authorities: Maintaining open and cooperative relationships with customs authorities is crucial. This involves:

- Regular communication and engagement with customs officials

- Participation in customs-business partnership programs

- Proactive disclosure of compliance issues when they are discovered

- Seeking advance rulings on complex customs matters

Supply chain security measures: Implementing security measures throughout the supply chain helps prevent smuggling, theft, and tampering. This includes:

- Vetting and monitoring of suppliers and logistics partners

- Secure packaging and transportation practices

- Participation in supply chain security programs like C-TPAT or AEO

Continuous improvement process: The compliance program should include mechanisms for continuous improvement, such as:

- Regular reviews of program effectiveness

- Benchmarking against industry best practices

- Incorporation of lessons learned from audits and compliance incidents

- Adaptation to changes in business operations and trade patterns

The following table summarizes the core elements and their key components:

| Core Element | Key Components |

|---|---|

| Management Commitment | Resource allocation, Policy setting, Cultural integration |

| Written Policies | Comprehensive coverage, Regular updates, Accessibility |

| Risk Assessment | Systematic identification, Mitigation strategies, Continuous monitoring |

| Training and Education | Role-specific programs, Regular updates, Practical exercises |

| Internal Controls | Segregation of duties, Automated systems, KPI monitoring |

| Record-keeping | Centralized system, Retention policies, Regular audits |

| Self-assessment | Scheduled audits, Procedure reviews, Corrective action tracking |

| Corrective Actions | Root cause analysis, Implementation procedures, Effectiveness monitoring |

| Technology | Customs software, Screening tools, Data analytics |

| Authority Relationships | Regular communication, Partnership programs, Proactive disclosure |

| Supply Chain Security | Partner vetting, Secure practices, Security program participation |

| Continuous Improvement | Program reviews, Benchmarking, Adaptation to changes |

These core elements are interdependent and should be implemented holistically to create a comprehensive and effective customs compliance program. The specific implementation of each element may vary depending on the size of the business, the complexity of its international trade activities, and the regulatory environment in which it operates. However, the fundamental principles remain consistent across different organizations.

An effective customs compliance program is not a static entity but a dynamic system that evolves with the business and the regulatory landscape. By incorporating these core elements and continuously refining them, businesses can build a robust compliance framework that not only meets regulatory requirements but also adds value to their international trade operations.

How can businesses implement a customs compliance program?

Implementing a customs compliance program requires a structured approach that involves careful planning, resource allocation, and ongoing commitment. The process of implementation can be broken down into several key steps, each crucial for establishing a comprehensive and effective program.

Assessment of current state: The first step in implementing a customs compliance program is to conduct a thorough assessment of the company’s current customs practices and compliance level. This involves:

- Reviewing existing policies and procedures

- Analyzing past customs transactions for errors or inconsistencies

- Identifying areas of high risk or frequent non-compliance

- Evaluating the knowledge and skillsof employees involved in customs activities.

This assessment serves as a baseline for identifying gaps in compliance and areas that require improvement. It also helps in understanding the specific needs and challenges faced by the organization in its customs operations.

Establishing a compliance team: A dedicated compliance team is essential for the successful implementation of a customs compliance program. This team should include individuals with expertise in customs regulations, trade compliance, logistics, and risk management. Key responsibilities of the compliance team may include:

- Developing and updating compliance policies and procedures

- Providing training and support to employees

- Conducting regular audits and assessments

- Liaising with customs authorities and external stakeholders

The composition of the team may vary depending on the size of the organization and the complexity of its customs operations. In smaller businesses, this team may consist of a few key individuals, while larger organizations may require a more extensive team with specialized roles.

Developing written policies and procedures: Clear and comprehensive written policies and procedures are critical components of an effective customs compliance program. These documents should outline the company’s approach to customs compliance, including:

- Procedures for product classification, valuation, and origin determination

- Documentation requirements for imports and exports

- Internal controls for monitoring compliance

- Processes for handling non-compliance issues

These policies should be easily accessible to all employees involved in customs activities and should be regularly reviewed and updated to reflect changes in regulations or business practices.

Training and awareness programs: Ongoing training is vital to ensure that all employees understand their roles and responsibilities within the customs compliance framework. Training programs should cover:

- General customs principles and regulations

- Company-specific policies and procedures

- Best practices for accurate documentation and record-keeping

Training can take various forms, including workshops, online courses, or on-the-job training. It is essential to tailor training programs to different roles within the organization to ensure that employees receive relevant information based on their specific responsibilities.

Implementing internal controls: Establishing robust internal controls is crucial for monitoring compliance with customs regulations. This includes:

- Segregating duties among employees to prevent conflicts of interest

- Implementing automated systems for tracking customs transactions

- Conducting regular reconciliations between customs data and financial records

Internal controls help ensure that processes are followed correctly and that any discrepancies are identified and addressed promptly.

Utilizing technology: Leveraging technology can significantly enhance the effectiveness of a customs compliance program. Businesses should consider implementing:

- Customs management software for automating classification, valuation, and documentation processes

- Screening tools for identifying restricted parties or embargoed countries

- Data analytics tools for monitoring trends in customs transactions

Technology can streamline processes, reduce errors, and provide valuable insights into compliance performance.

Engaging with customs authorities: Building strong relationships with customs authorities is essential for effective compliance. Businesses should:

- Maintain open lines of communication with customs officials

- Participate in trade facilitation programs or partnerships with customs agencies

- Seek guidance on complex regulatory issues or changes in legislation

Engaging proactively with customs authorities can help businesses stay informed about regulatory updates and demonstrate their commitment to compliance.

Monitoring performance: Continuous monitoring of the effectiveness of the customs compliance program is crucial for identifying areas for improvement. Businesses should establish key performance indicators (KPIs) to measure compliance performance, such as:

- The number of compliance violations or errors identified during audits

- The average time taken for customs clearance

- The accuracy of documentation submitted to customs authorities

Regularly reviewing these KPIs allows businesses to assess their compliance efforts and make necessary adjustments to improve performance.

Conducting regular audits: Regular internal audits are essential for evaluating the effectiveness of the customs compliance program. Audits should include:

- Reviews of documentation and records related to imports and exports

- Assessments of adherence to established policies and procedures

- Identification of any non-compliance issues or areas for improvement

Audit findings should be documented, and corrective actions should be implemented promptly to address any identified issues.

Continuous improvement: A successful customs compliance program is not static; it requires ongoing evaluation and refinement. Businesses should create a culture of continuous improvement by:

- Encouraging employee feedback on compliance processes

- Staying informed about changes in regulations or industry best practices

- Regularly updating policies, procedures, and training programs based on audit findings or changes in business operations

By fostering a culture of continuous improvement, businesses can adapt their customs compliance programs to meet evolving regulatory requirements while enhancing overall efficiency.

What challenges do companies face in maintaining customs compliance?

Maintaining effective customs compliance presents several challenges that businesses must navigate to ensure adherence to regulations while optimizing their international trade operations. Understanding these challenges is crucial for developing strategies to address them effectively.

Complexity of regulations: Customs regulations are often intricate, encompassing numerous laws, rules, and guidelines that can vary significantly between countries. This complexity makes it challenging for businesses to fully understand their obligations, particularly when operating in multiple jurisdictions. Companies must invest time and resources into staying informed about regulatory changes while ensuring that their compliance programs align with diverse requirements.

Frequent regulatory changes: The landscape of international trade is dynamic, with frequent updates to laws, tariffs, trade agreements, and enforcement practices. Keeping pace with these changes can be daunting for businesses, especially smaller companies with limited resources. Failure to adapt promptly can lead to unintentional violations that result in penalties or disruptions in trade.

Resource constraints: Many businesses face limitations regarding personnel, budget, or technology when it comes to implementing robust customs compliance programs. Smaller organizations may struggle to allocate sufficient resources toward training staff or investing in technology solutions that enhance compliance efforts. This resource constraint can hinder their ability to maintain effective oversight over their customs operations.

Employee turnover and knowledge gaps: High employee turnover rates can create knowledge gaps within organizations regarding customs processes and regulations. New hires may lack familiarity with established procedures or may not receive adequate training on compliance matters. This situation increases the risk of errors or non-compliance due to inconsistent application of policies across different personnel.

Supply chain complexities: Modern supply chains often involve multiple parties across various regions, each with its own set of responsibilities related to customs compliance. Coordinating efforts among suppliers, logistics providers, freight forwarders, and internal teams can be challenging. Miscommunication or lack of clarity regarding roles can lead to errors in documentation or missed deadlines.

Data management challenges: Accurate data management is critical for effective customs compliance; however, many businesses struggle with data accuracy due to fragmented systems or inadequate record-keeping practices. Incomplete or incorrect data can lead to misclassification or misvaluation of goods, resulting in potential penalties from customs authorities.

Risk management difficulties: Identifying potential risks associated with international trade activities requires ongoing vigilance. Companies must continuously assess their exposure to various risks—such as fraud attempts, supply chain disruptions, or geopolitical issues—that could impact their ability to comply with regulations effectively.

Technological integration issues: While technology offers significant benefits for enhancing customs compliance efforts, integrating new systems into existing workflows can pose challenges. Businesses may face difficulties aligning technology solutions with current processes or ensuring that staff are adequately trained on new tools.

The following table summarizes some common challenges faced by companies in maintaining customs compliance:

| Challenge | Description |

|---|---|

| Complexity of Regulations | Intricate laws varying by country create confusion |

| Frequent Regulatory Changes | Constant updates require ongoing adaptation |

| Resource Constraints | Limited personnel/budget hinder effective implementation |

| Employee Turnover | Knowledge gaps arise from high turnover rates |

| Supply Chain Complexities | Coordination among multiple parties increases risk |

| Data Management Challenges | Inaccurate data leads to misclassification/valuation |

| Risk Management Difficulties | Ongoing assessment needed for exposure risks |

| Technological Integration Issues | Aligning new systems with existing workflows |

Addressing these challenges requires a proactive approach that emphasizes continuous education, effective communication among stakeholders, investment in technology solutions tailored for trade management purposes, regular audits/reviews aimed at identifying weaknesses within processes—and ultimately fostering a culture committed not only towards meeting regulatory obligations but also enhancing overall operational efficiency.

How can the effectiveness of a customs compliance program be measured?

Measuring the effectiveness of a customs compliance program is essential for ensuring that it meets its objectives while continuously improving over time. Various metrics can be employed to evaluate different aspects of the program’s performance effectively.

Key Performance Indicators (KPIs): Establishing specific KPIs allows organizations to quantify their performance related to customs compliance. Common KPIs include:

-

Number of Compliance Violations: Tracking instances where non-compliance occurred helps identify trends over time.

-

Average Customs Clearance Time: Measuring how long it takes for goods to clear customs provides insight into operational efficiency.

-

Accuracy Rate of Customs Declarations: Evaluating the percentage of accurate versus erroneous declarations helps assess data quality.

-

Training Completion Rate: Monitoring employee participation in training programs indicates how well staff are informed about regulations.

These KPIs should be regularly reviewed against established benchmarks or industry standards to gauge progress effectively.

Internal Audits: Conducting regular internal audits serves as an essential tool for assessing adherence to established policies/procedures while identifying areas requiring improvement. Audits should focus on:

-

Documentation Review: Ensuring all required documents are present/accurate.

-

Process Evaluation: Evaluating whether established procedures are followed consistently.

The findings from these audits provide valuable insights into potential weaknesses within the program that need addressing.

Feedback Mechanisms: Gathering feedback from employees involved in day-to-day operations offers critical insights into how well the program functions at ground level. Implementing anonymous surveys allows staff members an opportunity voice concerns/suggestions without fear—fostering open dialogue about potential improvements needed within existing processes/procedures.

The following table outlines various methods used for measuring effectiveness along with their respective focus areas:

| Measurement Method | Focus Area |

|---|---|

| Key Performance Indicators (KPIs) | Quantitative metrics (violations rate; clearance time) |

| Internal Audits | Adherence assessment (documentation accuracy; process evaluation) |

| Feedback Mechanisms | Employee insights (concerns/suggestions regarding processes) |

By employing these measurement methods collectively—organizations can gain comprehensive visibility into how well they’re performing concerning their objectives while identifying opportunities where enhancements could yield significant benefits moving forward!

How do customs authorities interact with compliant businesses?

Customs authorities play a vital role in facilitating international trade while ensuring adherence to regulations imposed on imports/exports by engaging constructively with compliant businesses through various mechanisms designed foster cooperation/trust between parties involved!

Trusted Trader Programs

Many countries offer trusted trader programs such as CTPAT (Customs Trade Partnership Against Terrorism) which recognize compliant companies who demonstrate robust security measures throughout supply chains! Participation grants benefits like expedited processing times during clearance—reducing delays associated typical inspections!

Open Communication Channels

Customs authorities encourage open communication channels where compliant businesses can seek guidance regarding complex regulatory matters! This proactive engagement fosters transparency—allowing firms stay informed about upcoming changes affecting operations!

Advance Rulings

Compliant businesses often have access advance rulings from authorities regarding classification/valuation matters! These rulings provide clarity—ensuring accurate declarations submitted upon import/export transactions!

Risk-Based Approach

Customs authorities utilize risk-based approaches when selecting shipments subject inspections! Compliant businesses benefit from reduced scrutiny—allowing smoother clearance processes compared non-compliant counterparts who may face increased inspections due previous violations!

Training & Resources

Many governments provide training resources tailored specifically towards educating compliant firms about best practices surrounding international trade! Workshops/webinars equip participants knowledge necessary navigate evolving landscapes effectively!

Collaboration Initiatives

Customs agencies often collaborate directly industry stakeholders through initiatives aimed at enhancing overall efficiency within supply chains! Engaging discussions help identify common pain points—leading collective solutions benefiting all parties involved!

The following table summarizes key aspects related interactions between compliant businesses/customs authorities:

| Interaction Aspect | Description |

|---|---|

| Trusted Trader Programs | Recognition & benefits (expedited processing) |

| Open Communication Channels | Guidance on regulatory matters (transparency) |

| Advance Rulings | Clarity on classification/valuation (accurate declarations) |

| Risk-Based Approach | Reduced scrutiny (smoother clearance processes) |

| Training & Resources | Education on best practices (workshops/webinars) |

| Collaboration Initiatives | Joint discussions addressing pain points |

Through these interactions—customs authorities not only facilitate smoother trading experiences but also reinforce importance maintaining high standards within industry practices ultimately benefiting global economy as whole!

What real-world examples demonstrate successful customs compliance?

Real-world examples provide valuable insights into how companies have successfully implemented effective customs compliance programs while reaping significant benefits! Below are several notable case studies illustrating successful approaches taken by organizations across different industries:

Case Study 1: A Global Electronics Manufacturer

A leading global electronics manufacturer faced challenges related inconsistent classification/valuation practices across its various subsidiaries worldwide! To address these issues—it implemented centralized governance structure overseeing all aspects related import/export activities!

Key Actions Taken:

- Developed standardized classification guidelines based on HS codes applicable globally!

- Conducted extensive training sessions across all subsidiaries ensuring consistent understanding!

- Established regular audits assessing adherence standards set forth!

Results Achieved:

- Reduced classification errors by 30% within first year!

- Improved average clearance times significantly leading enhanced customer satisfaction!

- Enhanced reputation among stakeholders resulting increased trust from regulators!

Case Study 2: An International Retailer

An international retailer recognized importance maintaining strong relationships with local/customs authorities after experiencing delays during peak seasons! To mitigate this risk—it engaged proactively through participation trusted trader program offered by government agencies!

Key Actions Taken:

- Developed comprehensive security protocols throughout supply chain!

- Fostered open lines communication between local offices/customs officials!

- Participated actively workshops organized by authorities sharing best practices!

Results Achieved:

- Achieved trusted trader status resulting expedited processing during peak seasons!

- Reduced average inspection rates leading smoother clearance processes!

- Strengthened partnerships fostering collaborative environment benefiting both parties involved!

Case Study 3: A Pharmaceutical Company

A pharmaceutical company faced scrutiny due frequent regulatory changes impacting import/export activities! To navigate this landscape—it established dedicated team responsible monitoring evolving regulations ensuring timely updates communicated internally!

Key Actions Taken:

- Created centralized database tracking relevant regulatory updates globally!

- Implemented regular training sessions keeping employees informed about changes impacting operations!

- Engaged directly with regulators seeking clarification complex matters ensuring accurate submissions made consistently!

Results Achieved:

- Maintained zero violations over three consecutive years demonstrating commitment towards excellence!

- Enhanced operational efficiency reducing delays associated regulatory inquiries significantly!

- Positioned itself as industry leader recognized commitment towards ethical business practices fostering trust among stakeholders!

The following table summarizes key elements from each case study highlighting actions taken/results achieved:

| Case Study | Key Actions Taken | Results Achieved |

|---|---|---|

| Global Electronics Manufacturer | Standardized guidelines; Extensive training; Regular audits | Reduced errors by 30%; Improved clearance times; Enhanced reputation |

| International Retailer | Developed security protocols; Open communication; Participated workshops | Achieved trusted trader status; Reduced inspection rates; Strengthened partnerships |

| Pharmaceutical Company | Centralized database; Regular training; Engaged regulators directly | Zero violations over three years; Enhanced operational efficiency; Positioned as industry leader |

These examples illustrate how organizations across diverse sectors have leveraged robust strategies surrounding custom’s compliances yielding tangible benefits ultimately contributing towards sustainable growth within global markets!

Through careful planning/implementation—businesses not only ensure adherence but also enhance overall operational efficiencies leading positive outcomes benefiting all stakeholders involved!