What Is the ISF 102 Rule

What is the ISF 10+2 Rule and why was it implemented?

The Importer Security Filing (ISF) 10+2 rule is a crucial regulation in international trade that significantly impacts the way goods are imported into the United States. This rule, implemented by U.S. Customs and Border Protection (CBP), requires importers and carriers to provide specific information about cargo before it arrives in the U.S. The “10” refers to the data elements importers must submit, while the “+2” represents additional requirements for carriers.

The ISF 10+2 rule was implemented in response to the increasing need for enhanced security measures in global trade. Following the events of September 11, 2001, the U.S. government recognized the importance of gathering more detailed information about incoming shipments to identify potential security threats. The rule aims to improve CBP’s ability to assess and mitigate risks associated with cargo entering the country.

Key objectives of the ISF 10+2 rule include:

Risk assessment: CBP uses the information provided through ISF to evaluate the potential risks associated with each shipment. This allows for more targeted inspections and efficient allocation of resources.

Supply chain visibility: The rule enhances transparency in the supply chain by requiring detailed information about the parties involved in each shipment.

Terrorism prevention: By gathering advance information, CBP can better identify and intercept shipments that may pose a security threat to the United States.

Trade facilitation: While primarily a security measure, the ISF 10+2 rule also aims to streamline the import process for compliant traders.

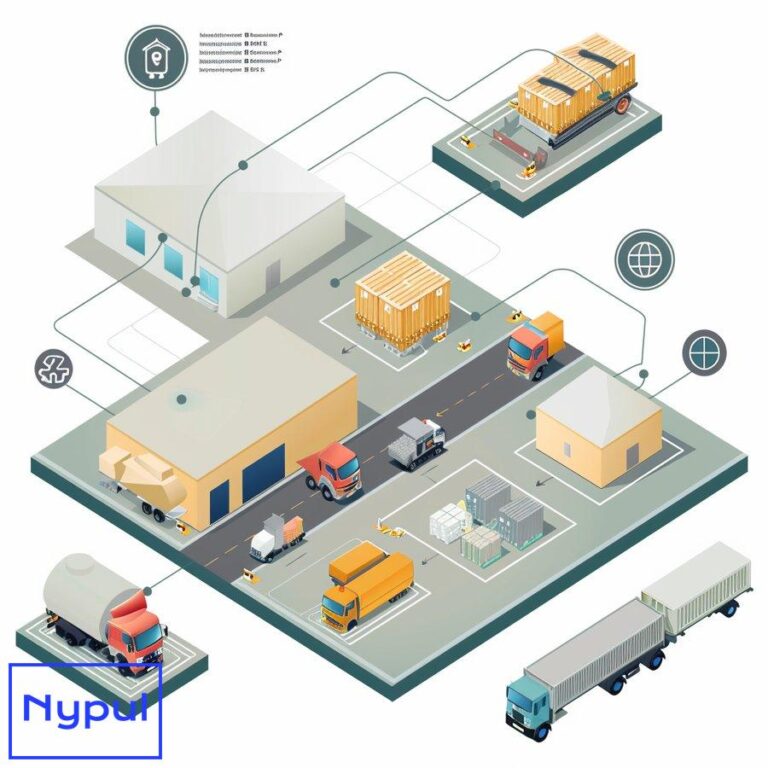

The implementation of the ISF 10+2 rule has had a significant impact on importers, carriers, and other stakeholders in the supply chain. It has necessitated changes in business processes, data management systems, and communication protocols to ensure compliance with the new requirements.

To better understand the scope of the ISF 10+2 rule, let’s examine the key components and their implications for international trade:

| Component | Description | Impact |

|---|---|---|

| 10 Importer Requirements | Data elements that importers must submit | Increased responsibility for importers to gather and transmit accurate information |

| 2 Carrier Requirements | Additional data elements carriers must provide | Enhanced visibility into vessel and container movements |

| Filing Deadline | 24 hours before cargo is laden aboard a vessel | Requires advance planning and coordination among supply chain partners |

| Penalties for Non-compliance | Fines and potential delays in cargo release | Financial and operational risks for non-compliant parties |

The ISF 10+2 rule represents a significant shift in how international trade is conducted, placing greater emphasis on security and information sharing. As we delve deeper into the specific requirements and implications of this rule, it becomes clear that compliance is not just a legal obligation but also a critical factor in maintaining efficient and secure supply chains.

How do the “10” elements of ISF impact importers?

The “10” elements of the Importer Security Filing (ISF) have a profound impact on importers, requiring them to gather and submit detailed information about their shipments. These elements are designed to provide U.S. Customs and Border Protection (CBP) with a comprehensive view of the cargo entering the United States. Let’s examine each of these elements and their implications for importers:

Manufacturer (or Supplier) Name and Address: This element identifies the entity that produces or supplies the goods. Importers must ensure they have accurate and up-to-date information about their manufacturers or suppliers.

Seller Name and Address: The seller is the last known entity to whom the goods are sold or agreed to be sold. This information helps CBP track the chain of ownership of the goods.

Buyer Name and Address: The buyer is the last known entity to whom the goods are sold or agreed to be sold. Importers must provide accurate information about the entity purchasing the goods.

Ship To Name and Address: This refers to the first deliver-to party scheduled to physically receive the goods after release from customs custody. Importers need to have clear communication with their customers or distribution centers to provide this information accurately.

Container Stuffing Location: For full container load shipments, this is the physical location where the container was stuffed with cargo. For consolidated shipments, it’s the location of the container stuffing or goods loading. This information helps CBP trace the origin of the container’s contents.

Consolidator Name and Address: This applies to consolidated shipments and identifies the party who stuffed the container or arranged for its stuffing. Importers working with consolidators must ensure they have this information readily available.

Importer of Record Number/FTZ Applicant Identification Number: This is typically the IRS number, EIN, or Social Security number of the entity liable for payment of all duties and responsible for meeting statutory and regulatory requirements. Importers must ensure this information is accurate to avoid delays or penalties.

Consignee Number: This is usually the IRS number, EIN, or Social Security number of the individual or firm in the U.S. to which the shipment will be delivered. Importers need to have this information for each shipment.

Country of Origin: This identifies the country of manufacture, production, or growth of the article. Importers must be diligent in determining and reporting the correct country of origin for each item in their shipments.

Commodity Harmonized Tariff Schedule Number: This is the Harmonized Tariff Schedule (HTS) number to the 6-digit level. Importers need to ensure accurate classification of their goods, which can be challenging for complex or diverse product lines.

The impact of these 10 elements on importers is significant:

Data Management: Importers must establish robust systems to collect, store, and manage the required information for each shipment. This often necessitates investment in new software or upgrades to existing systems.

Supply Chain Visibility: To provide accurate ISF information, importers need greater visibility into their supply chains. This may require closer collaboration with suppliers, manufacturers, and logistics partners.

Compliance Burden: The responsibility for providing accurate and timely ISF information falls on the importer. This increases the compliance burden and potential liability for importers.

Operational Changes: Many importers have had to adjust their operational processes to ensure they can gather and submit ISF information within the required timeframes.

Risk Management: Inaccurate or late ISF filings can result in penalties or delays. Importers must implement risk management strategies to mitigate these potential issues.

Cost Implications: Compliance with ISF requirements often leads to increased costs for importers, including potential investments in technology, staff training, and process improvements.

To illustrate the complexity of managing these 10 elements, consider the following table outlining potential challenges and solutions for each element:

| ISF Element | Potential Challenge | Solution |

|---|---|---|

| Manufacturer Name and Address | Multiple suppliers for a single shipment | Implement a supplier management system to track and update supplier information |

| Seller Name and Address | Changes in ownership during transit | Establish procedures for updating ISF information when ownership changes |

| Buyer Name and Address | Multiple buyers for a consolidated shipment | Develop a system to link individual purchases to consolidated shipments |

| Ship To Name and Address | Last-minute changes in delivery location | Create a process for rapid communication of delivery changes to ISF filers |

| Container Stuffing Location | Limited visibility into consolidator operations | Partner with consolidators who can provide timely and accurate information |

| Consolidator Name and Address | Working with multiple consolidators | Maintain a database of approved consolidators with their current information |

| Importer of Record Number | Changes in corporate structure affecting IOR | Regularly review and update importer of record information |

| Consignee Number | Shipments to new customers without established EIN | Establish a process for quickly obtaining and verifying consignee numbers |

| Country of Origin | Products with components from multiple countries | Implement a system to track and determine correct country of origin |

| Commodity HTS Number | Complex products with multiple possible classifications | Invest in training or external expertise for accurate HTS classification |

By understanding and effectively managing these 10 elements, importers can navigate the complexities of ISF compliance and maintain smooth operations in their international trade activities. The key lies in developing robust systems, fostering strong partnerships across the supply chain, and maintaining a proactive approach to compliance management.

What are the “+2” carrier requirements?

The “+2” in the ISF 10+2 rule refers to two additional data elements that vessel carriers are required to submit to U.S. Customs and Border Protection (CBP). These requirements are distinct from the 10 elements importers must provide and play a crucial role in enhancing supply chain security and visibility. Let’s delve into these carrier requirements and their implications for the shipping industry.

Vessel Stow Plan

The first of the “+2” requirements is the Vessel Stow Plan. This is a detailed diagram or report that shows the position of each container on a vessel. Carriers must submit this plan to CBP no later than 48 hours after the vessel’s departure from the last foreign port. For voyages less than 48 hours in duration, the Vessel Stow Plan must be submitted prior to the vessel’s arrival at the first U.S. port.

Key aspects of the Vessel Stow Plan include:

Container Information: Each container’s identification number and location on the vessel.

Vessel Details: Information about the vessel, including its name, operator, and voyage number.

Port Information: Details about the last foreign port and the first U.S. port of call.

The Vessel Stow Plan serves several important purposes:

Risk Assessment: It allows CBP to identify high-risk containers based on their location on the vessel.

Efficient Inspections: CBP can plan and execute targeted inspections more effectively with knowledge of container positions.

Discrepancy Detection: The plan helps identify discrepancies between reported and actual cargo on board.

Container Status Messages (CSMs)

The second “+2” requirement is the submission of Container Status Messages. CSMs are used to track the movement and status changes of containers en route to the United States. Carriers must submit CSMs to CBP within 24 hours of creation or receipt, except for certain events that must be reported within 24 hours of occurrence.

CSMs typically include the following information:

Container Number: The unique identifier for each container.

Event Code: A code indicating the type of event (e.g., gate-in, loaded on vessel, discharged).

Date and Time: When the event occurred.

Location: Where the event took place.

The importance of CSMs in the ISF 10+2 rule cannot be overstated:

Real-time Tracking: CSMs provide near real-time visibility into container movements.

Anomaly Detection: Unusual patterns or deviations from expected routes can be identified.

Supply Chain Integrity: CSMs help verify the integrity of the supply chain by tracking each container’s journey.

Enhanced Security: By monitoring container movements, CBP can better identify potential security threats.

To illustrate the types of events captured by CSMs and their significance, consider the following table:

| Event Code | Description | Significance |

|---|---|---|

| Gate-in | Container arrives at port of loading | Marks the beginning of the container’s journey |

| Loaded | Container is loaded onto the vessel | Confirms the container is on its intended vessel |

| Discharged | Container is unloaded from the vessel | Indicates arrival at a port (may be transshipment) |

| Gate-out | Container leaves the port of discharge | Marks the end of the sea journey |

| Stuffed | Container is filled with cargo | Important for verifying container contents |

| Stripped | Container is emptied of cargo | Useful for tracking cargo at destination |

| Sealed | Security seal is applied to the container | Critical for maintaining cargo security |

| Seal Change | Container’s seal is changed | May indicate inspection or tampering |

The “+2” carrier requirements have significant implications for the shipping industry:

Technological Investment: Carriers have had to invest in systems capable of generating and transmitting Vessel Stow Plans and CSMs in the required formats and timeframes.

Operational Changes: Shipping lines have adapted their processes to ensure timely collection and submission of the required data.

Increased Responsibility: Carriers bear additional responsibility for providing accurate and timely information to CBP.

Compliance Costs: Meeting these requirements often involves additional costs for carriers, which may be passed on to customers.

Data Management: Carriers must manage large volumes of data and ensure its accuracy and timeliness.

Collaboration: Closer collaboration between carriers, terminal operators, and other stakeholders is necessary to gather and verify the required information.

Risk Management: Carriers need to implement robust risk management strategies to address potential issues with data submission or accuracy.

The “+2” carrier requirements of the ISF 10+2 rule represent a significant enhancement to supply chain visibility and security. By providing detailed information about container locations and movements, these requirements enable CBP to better assess and mitigate risks associated with incoming cargo. While compliance with these requirements presents challenges for carriers, it ultimately contributes to a more secure and efficient global trade environment.

Who is responsible for filing ISF and when?

The responsibility for filing the Importer Security Filing (ISF) primarily falls on the importer, but the timing and specific responsibilities can vary depending on the nature of the shipment and the parties involved. Understanding who is responsible for filing ISF and when is crucial for ensuring compliance with U.S. Customs and Border Protection (CBP) regulations.

Primary Responsibility

The ISF Importer is the party required to submit the ISF. The ISF Importer is defined as:

The goods’ owner: The entity purchasing the imported merchandise is typically responsible for filing the ISF.

The goods’ purchaser: In cases where the goods are not owned, the purchaser assumes responsibility.

The goods’ consignee: When there is no owner or purchaser, the consignee becomes responsible.

The agent: An authorized agent can file on behalf of the above parties.

It’s important to note that while the importer bears ultimate responsibility, they often delegate the actual filing to a customs broker or freight forwarder. However, this delegation does not absolve the importer of liability for compliance.

Filing Timeframe

The timing of ISF filing is critical and varies based on the type of shipment:

Standard Shipments: For most shipments, the ISF must be filed at least 24 hours before the cargo is laden aboard a vessel destined for the United States.

Foreign Remaining on Board (FROB): For cargo remaining on board the vessel and not entering the U.S., the ISF must be filed prior to lading.

Immediate Exportation (IE) and Transportation and Exportation (T&E): These in-transit shipments require ISF filing 24 hours before arrival at the U.S. port.

Freight Remaining on Board (FOB): For freight remaining on the vessel at the U.S. port, ISF must be filed prior to arrival.

To illustrate the complexities of ISF filing responsibilities and timing, consider the following table:

| Shipment Type | Responsible Party | Filing Deadline |

|---|---|---|

| Standard Import | Importer of Record | 24 hours before lading |

| FROB | Carrier | Prior to lading |

| IE/T&E | Party filing IE/T&E | 24 hours before U.S. arrival |

| FOB | Carrier | Prior to U.S. arrival |

| Split Shipments | Importer of Record | 24 hours before lading of first portion |

Special Considerations

Several factors can affect ISF filing responsibilities and timing:

Bulk and Break Bulk Cargo: While still subject to ISF requirements, these shipments may have more flexible timing requirements.

First-Time Importers: New importers may face challenges in gathering all required information and may need to rely heavily on brokers or forwarders.

Consolidated Shipments: In cases of multiple importers sharing a container, each importer is responsible for filing their own ISF.

Changes in Shipment Details: If key details change after initial filing, the ISF Importer is responsible for updating the information as soon as possible.

Implications for Supply Chain Participants

The ISF filing requirements have significant implications for various parties in the supply chain:

Importers: Must establish systems and processes to gather and submit accurate ISF information within the required timeframes.

Customs Brokers: Often tasked with filing ISF on behalf of importers, brokers need to ensure they have complete and accurate information.

Freight Forwarders: May be involved in collecting and transmitting ISF data, especially for consolidated shipments.

Carriers: Responsible for the “+2” requirements and may assist in coordinating ISF filings for certain types of shipments.

Suppliers: Need to provide timely and accurate information to importers to facilitate ISF filing.

Best Practices for ISF Filing

To ensure compliance with ISF requirements, consider the following best practices:

Establish Clear Procedures: Develop and document clear procedures for gathering and submitting ISF information.

Leverage Technology: Implement software solutions that can automate data collection and submission processes.

Train Staff: Ensure all relevant personnel understand ISF requirements and their role in the process.

Maintain Strong Partnerships: Foster close relationships with suppliers, carriers, and customsbrokers to ensure accurate and timely information exchange.

Monitor Compliance: Regularly review ISF submissions and compliance metrics to identify areas for improvement.

By understanding their responsibilities and adhering to the specified filing timelines, importers can mitigate risks associated with ISF compliance and maintain smooth operations in their international trade activities.

How does ISF compliance affect supply chain operations?

Compliance with the Importer Security Filing (ISF) 10+2 rule has significant implications for supply chain operations. The requirement for detailed information submission impacts various aspects of logistics, risk management, and operational efficiency. Understanding these effects is crucial for importers, carriers, and other stakeholders in the supply chain.

Enhanced Visibility and Transparency

ISF compliance fosters greater visibility throughout the supply chain. By requiring importers to submit detailed information about shipments, CBP can better track cargo movements and assess potential risks. This increased visibility allows stakeholders to:

-

Monitor Shipment Status: Real-time tracking of shipments enables importers to stay informed about their cargo’s location and status.

-

Identify Potential Delays: Early identification of issues can help stakeholders address potential delays before they escalate.

-

Coordinate with Partners: Enhanced transparency facilitates better communication and coordination among supply chain partners, leading to improved collaboration.

Risk Management

ISF compliance plays a critical role in risk management within the supply chain. By providing detailed information about shipments, importers can:

-

Assess Risks: Accurate ISF filings allow importers to evaluate potential risks associated with their shipments, including security threats and regulatory compliance issues.

-

Implement Mitigation Strategies: With a clearer understanding of risks, importers can develop strategies to mitigate them, such as adjusting shipping routes or enhancing security measures.

-

Facilitate Inspections: CBP can conduct targeted inspections based on the information provided in ISF filings, reducing the likelihood of random inspections that can disrupt operations.

Operational Efficiency

Compliance with ISF requirements necessitates changes in operational processes that can lead to improved efficiency. Key areas impacted include:

-

Data Management Systems: Importers may need to invest in technology solutions that streamline data collection and submission processes, leading to more efficient operations.

-

Supplier Coordination: Enhanced collaboration with suppliers ensures timely access to necessary information for ISF filings, reducing delays in shipment processing.

-

Training and Development: Investing in staff training on ISF compliance fosters a culture of accountability and ensures that employees understand their roles in maintaining compliance.

To illustrate the impact of ISF compliance on supply chain operations, consider the following table outlining key benefits and challenges:

| Aspect | Benefits | Challenges |

|---|---|---|

| Visibility | Improved tracking of shipments | Increased data management requirements |

| Risk Management | Enhanced risk assessment capabilities | Need for ongoing monitoring and updates |

| Operational Efficiency | Streamlined processes through technology | Costs associated with system upgrades |

| Collaboration | Better communication among partners | Potential resistance to change from stakeholders |

Overall, ISF compliance is not merely a regulatory obligation; it is a catalyst for enhancing supply chain operations. By embracing the requirements of the ISF 10+2 rule, stakeholders can improve visibility, manage risks more effectively, and drive operational efficiencies that contribute to a more resilient supply chain.

What are the penalties for non-compliance with ISF regulations?

Non-compliance with the Importer Security Filing (ISF) 10+2 rule can result in significant penalties for importers and carriers. Understanding these penalties is crucial for businesses engaged in international trade. The consequences of failing to comply with ISF regulations can vary depending on the nature of the violation and its impact on U.S. Customs and Border Protection (CBP) operations.

Types of Penalties

Penalties for non-compliance with ISF regulations generally fall into two categories:

-

Monetary Penalties: CBP imposes fines for various violations related to ISF filings. These fines can range from $5,000 up to $10,000 per violation, depending on the severity of the infraction. Common reasons for monetary penalties include:

-

Late filing of ISF

- Incomplete or inaccurate information

-

Failure to file an ISF altogether

-

Operational Penalties: In addition to monetary fines, non-compliance may lead to operational consequences such as:

-

Delays in cargo release: Non-compliant shipments may be subject to additional inspections or holds at ports.

- Increased scrutiny: Frequent violations may result in heightened scrutiny from CBP on future shipments.

- Loss of trusted trader status: Importers who are part of programs like Customs-Trade Partnership Against Terrorism (C-TPAT) may risk losing their status due to repeated non-compliance.

Mitigating Factors

While penalties for non-compliance can be severe, several factors may mitigate the consequences:

-

Voluntary Disclosure: If an importer discovers a violation before CBP does and voluntarily discloses it, they may receive reduced penalties or avoid them altogether.

-

First-Time Offenses: First-time violations may be treated more leniently than repeated infractions.

-

Good Faith Efforts: Demonstrating that reasonable efforts were made to comply with ISF requirements may also influence penalty assessments.

To provide clarity on potential penalties associated with specific violations, consider the following table:

| Violation Type | Description | Potential Penalty |

|---|---|---|

| Late Filing | Filing ISF after cargo has been laden aboard | $5,000 – $10,000 per violation |

| Incomplete Information | Missing one or more required data elements | $5,000 – $10,000 per violation |

| Failure to File | Not submitting an ISF at all | $5,000 – $10,000 per violation |

| Repeated Violations | Multiple infractions over time | Increased fines or operational penalties |

Understanding these penalties emphasizes the importance of ensuring compliance with ISF regulations. Businesses must prioritize accurate data collection and timely submissions to avoid facing financial repercussions or operational disruptions that could impact their supply chains.

How do exceptions and special cases apply to ISF filing?

While the Importer Security Filing (ISF) 10+2 rule establishes clear requirements for most shipments entering the United States, there are exceptions and special cases that importers should be aware of. Understanding these exceptions is essential for ensuring compliance while navigating unique circumstances that may arise during international trade.

Exceptions

Several exceptions exist within the framework of ISF filing requirements:

-

Foreign Cargo Remaining on Board (FROB): Cargo that remains on board a vessel without entering U.S. territory is exempt from certain ISF requirements. However, an ISF must still be filed prior to lading if it will remain aboard during transit.

-

Immediate Exportation (IE): Shipments designated as IE are not subject to standard ISF filing requirements if they are not intended for entry into U.S. commerce but rather for immediate exportation from a U.S. port.

-

Transportation & Exportation (T&E): Similar to IE shipments, T&E cargo is not subject to standard filing requirements if it is simply transiting through U.S. ports without entering domestic commerce.

Special Cases

Certain scenarios may warrant special consideration regarding ISF filing:

-

Consolidated Shipments: When multiple importers share a single container shipment, each importer must file their own separate ISF detailing their respective goods. This requires careful coordination among all parties involved.

-

Split Shipments: If a shipment is split into multiple parts sent at different times or via different routes, each portion must have its own ISF filed prior to lading.

-

Changes in Shipment Details: If key details change after initial filing—such as changes in consignee or destination—importers must promptly update their filings accordingly.

Implications for Compliance

Understanding exceptions and special cases helps importers navigate complexities within the ISF framework:

-

Avoiding Unnecessary Penalties: Awareness of exceptions allows importers to avoid unnecessary penalties by ensuring they only file when required.

-

Streamlining Processes: Recognizing when special cases apply enables importers to streamline their processes while maintaining compliance with CBP regulations.

To illustrate how exceptions apply within different contexts, consider the following table outlining common scenarios:

| Scenario Type | Description | Filing Requirement |

|---|---|---|

| FROB | Cargo remains on board without entering U.S. territory | Must file prior to lading if remaining aboard |

| IE | Immediate exportation from U.S. port without entry into commerce | Not subject to standard filing requirements |

| T&E | Cargo transiting through U.S. ports without entering commerce | Not subject to standard filing requirements |

| Consolidated | Multiple importers sharing a single container shipment | Each importer must file separate ISFs |

| Split Shipments | Shipment divided into multiple parts sent separately | Each portion requires its own ISF |

By understanding these exceptions and special cases related to ISF filing requirements, importers can navigate complexities effectively while ensuring compliance with U.S. Customs regulations. This knowledge empowers businesses engaged in international trade while minimizing risks associated with non-compliance.

What challenges do importers face in ISF compliance?

Compliance with the Importer Security Filing (ISF) 10+2 rule presents several challenges for importers engaged in international trade. These challenges stem from various factors such as data management complexities, communication barriers among stakeholders, evolving regulations, and technological limitations. Recognizing these challenges is essential for developing effective strategies that ensure compliance while maintaining operational efficiency.

Data Management Complexities

One of the primary challenges faced by importers relates to data management:

-

Volume of Information: The requirement for detailed information submission means that importers must manage large volumes of data across multiple shipments simultaneously.

-

Accuracy Requirements: Ensuring accuracy across all submitted data elements is critical; even minor inaccuracies can lead to significant penalties or delays in cargo release.

-

Integration Issues: Many importers struggle with integrating existing systems or software solutions capable of capturing all required data elements efficiently.

Communication Barriers

Effective communication among various stakeholders is vital for successful ISF compliance:

-

Supplier Coordination: Importers often rely on suppliers for accurate information regarding goods; miscommunication or delays from suppliers can hinder timely filings.

-

Collaboration with Brokers/Forwarders: Importers frequently engage customs brokers or freight forwarders for assistance; maintaining clear communication channels is essential but can be challenging due to differing priorities or workflows among parties involved.

Evolving Regulations

The landscape surrounding international trade regulations continues evolving rapidly:

-

Regulatory Changes: Importers must stay informed about changes in regulations affecting ISF requirements; failure to adapt promptly could lead them into non-compliance scenarios unknowingly.

-

Training Needs: As regulations evolve, ongoing training becomes necessary; however, keeping staff updated on changing rules adds additional complexity within organizations already managing numerous responsibilities simultaneously.

Technological Limitations

Many importers face technological hurdles when attempting compliance:

-

Legacy Systems: Organizations relying on outdated systems may struggle with capturing necessary data efficiently; upgrading technology often requires significant investment—financially and time-wise—leading some businesses reluctant toward modernization efforts altogether due diligence being necessary here too!

-

Automation Challenges: While automation offers opportunities for streamlining processes related directly back towards improving accuracy levels across submissions made—implementing automated solutions presents its own set challenges including cost considerations along implementation timelines which could further complicate matters overall!

Implications for Compliance

The challenges faced by importers regarding ISF compliance have far-reaching implications:

- Increased Risk Exposure:

-

Failure points arising from any one challenge can expose businesses financially due penalties incurred resulting from late filings or inaccurate submissions made throughout process itself!

-

Operational Disruptions:

-

Delays caused by miscommunication between parties involved could lead directly back towards disruptions affecting overall supply chain efficiency negatively impacting customer satisfaction levels too!

-

Financial Burdens:

- Investments needed toward addressing technological limitations could strain budgets considerably especially if unexpected costs arise during implementation phases themselves!

To summarize these challenges succinctly consider this table outlining key issues faced by importers during their journey toward achieving successful adherence towards meeting all aspects required under current legislation governing imports entering United States territory today!

| Challenge Type | Description | Implications |

|---|---|---|

| Data Management | Managing large volumes & ensuring accuracy | Increased risk exposure & operational disruptions |

| Communication Barriers | Coordinating effectively among suppliers & brokers | Potential delays & miscommunication |

| Evolving Regulations | Adapting quickly enough amidst changing rules | Risk exposure due lack knowledge |

| Technological Limitations | Upgrading systems & automating processes | Financial burdens due implementation costs |

By recognizing these challenges inherent within complying fully under current guidelines established through Importer Security Filing (ISF) rules—importing entities will be better equipped navigate complexities successfully while minimizing risks associated non-compliance!

In conclusion, navigating the intricacies surrounding adherence toward fulfilling obligations mandated under Importer Security Filing (ISF) rules requires diligence across multiple fronts—from managing vast amounts information accurately through collaborating effectively amongst various stakeholders involved throughout entire process itself!