Which of the Following Are the Responsibility of a Customs Broker

What is a customs broker and why are they important?

Customs brokers play a crucial role in international trade, serving as intermediaries between importers/exporters and customs authorities. These licensed professionals possess extensive knowledge of customs regulations, tariffs, and international trade laws. Their expertise helps businesses navigate the complex world of cross-border commerce.

The importance of customs brokers stems from their ability to facilitate smooth and compliant international transactions. They ensure that goods move efficiently across borders while adhering to all relevant laws and regulations. This is particularly valuable for businesses that lack in-house expertise in customs procedures or those dealing with complex shipments.

Key Functions of Customs Brokers

Regulatory Compliance: Customs brokers stay up-to-date with ever-changing customs regulations and ensure that their clients’ shipments meet all legal requirements.

Documentation Management: They handle the preparation and submission of all necessary customs documents, reducing the risk of errors that could lead to delays or penalties.

Duty and Tax Calculation: Customs brokers accurately calculate and manage the payment of duties, taxes, and fees associated with international shipments.

Problem Resolution: When issues arise during the customs clearance process, brokers use their expertise and relationships with customs officials to resolve problems quickly.

Advisory Services: They provide valuable advice to clients on matters such as tariff classification, valuation, and trade agreements that can impact the cost and feasibility of international transactions.

The importance of customs brokers becomes even more apparent when considering the potential consequences of non-compliance or errors in the customs process. These can include:

- Shipment delays

- Costly fines and penalties

- Legal issues

- Damage to business reputation

- Loss of import/export privileges

By engaging the services of a customs broker, businesses can mitigate these risks and focus on their core operations while leaving the intricacies of customs clearance to the experts.

The Evolution of Customs Brokerage

The role of customs brokers has evolved significantly over the years, adapting to changes in global trade patterns, technology, and regulatory environments. While their core function remains the same, modern customs brokers often offer a wider range of services and utilize advanced technologies to streamline processes.

| Traditional Customs Broker Role | Modern Customs Broker Role |

|---|---|

| Manual document processing | Electronic data interchange (EDI) |

| Limited scope of services | Comprehensive logistics solutions |

| Reactive problem-solving | Proactive risk management |

| Local expertise | Global trade knowledge |

| Paper-based record-keeping | Cloud-based data management |

As international trade continues to grow in complexity, the importance of customs brokers is likely to increase. Their specialized knowledge and ability to navigate the intricate web of global trade regulations make them indispensable partners for businesses engaged in cross-border commerce.

What are the primary responsibilities of a customs broker?

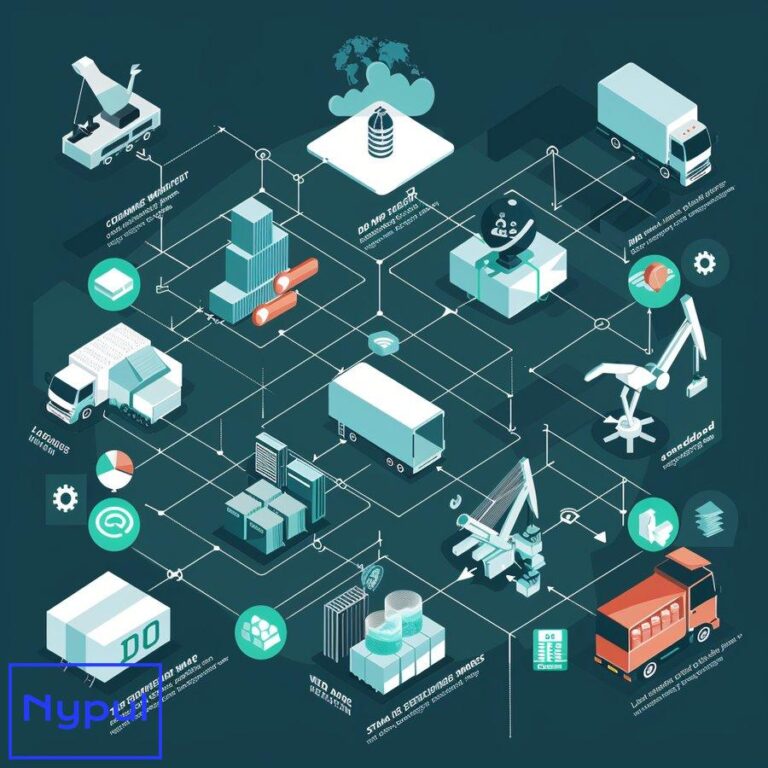

Customs brokers shoulder a wide range of responsibilities to ensure the smooth flow of international trade. Their primary duties revolve around facilitating the import and export of goods while ensuring compliance with customs regulations. Let’s delve into the core responsibilities that define the role of a customs broker.

Customs Clearance Facilitation

The most fundamental responsibility of a customs broker is to manage the customs clearance process. This involves:

Document Preparation: Customs brokers meticulously prepare and submit all required documentation to customs authorities. This includes commercial invoices, packing lists, certificates of origin, and any other necessary permits or licenses.

Classification of Goods: Accurately classifying goods according to the Harmonized System (HS) code is crucial. This classification determines the applicable duties and taxes, as well as any restrictions or quotas that may apply to the shipment.

Valuation Determination: Customs brokers assess the value of goods for customs purposes, ensuring compliance with customs valuation methods and regulations.

Duty and Tax Calculation: Based on the classification and valuation, brokers calculate the correct amount of duties, taxes, and fees payable on imported goods.

Regulatory Compliance

Ensuring compliance with customs regulations is a critical responsibility of customs brokers. This encompasses:

Staying Informed: Customs brokers must keep abreast of changes in customs laws, regulations, and procedures across different jurisdictions.

Advising Clients: They provide guidance to importers and exporters on compliance matters, helping them avoid potential violations and penalties.

Conducting Audits: Many customs brokers offer internal compliance audits to identify and address any issues before they become problems during official customs inspections.

Liaison with Customs Authorities

Customs brokers act as a bridge between their clients and customs officials. Their responsibilities in this area include:

Communication: They interact with customs authorities on behalf of their clients, addressing queries, providing additional information, and resolving any issues that arise during the clearance process.

Representation: In case of disputes or investigations, customs brokers may represent their clients before customs authorities, helping to navigate complex legal and procedural matters.

Risk Management

Effective risk management is an increasingly important aspect of a customs broker’s responsibilities:

Identifying Risks: Brokers assess potential risks associated with specific shipments, such as compliance issues, valuation disputes, or security concerns.

Implementing Controls: They develop and implement strategies to mitigate identified risks, such as enhanced documentation procedures or pre-clearance inspections.

Monitoring and Reporting: Customs brokers often provide ongoing monitoring of shipments and report any anomalies or potential issues to their clients.

Technology Integration

In the modern era, customs brokers are responsible for leveraging technology to enhance their services:

Electronic Filing: Most customs brokers now use electronic systems to file customs entries and other required documents.

Data Management: They maintain secure databases of client information, shipment histories, and customs rulings for quick reference and reporting.

Integration with Client Systems: Many brokers offer integration with their clients’ enterprise resource planning (ERP) systems to streamline data exchange and improve efficiency.

Additional Value-Added Services

Beyond these core responsibilities, many customs brokers offer additional services to support their clients’ international trade operations:

Trade Consulting: Providing advice on trade agreements, tariff engineering, and supply chain optimization.

Warehousing and Distribution: Some brokers offer storage and distribution services in addition to customs clearance.

Training and Education: Conducting workshops and seminars to educate clients on customs procedures and compliance requirements.

The responsibilities of customs brokers are multifaceted and crucial for the smooth operation of international trade. By managing these diverse tasks, customs brokers enable businesses to navigate the complexities of global commerce efficiently and compliantly.

How do customs brokers ensure compliance with customs regulations?

Ensuring compliance with customs regulations is a cornerstone of a customs broker’s responsibilities. This task requires a comprehensive approach that combines expertise, diligence, and strategic planning. Here’s an in-depth look at how customs brokers work to maintain compliance:

Continuous Education and Training

Customs brokers must stay current with ever-changing customs regulations, trade agreements, and international commerce laws. They achieve this through:

Regular Training: Participating in ongoing professional development programs and workshops to stay informed about regulatory changes.

Industry Associations: Maintaining memberships in professional organizations that provide updates on customs and trade-related matters.

Government Publications: Closely monitoring official publications and notices from customs authorities and other relevant government agencies.

Rigorous Documentation Management

Accurate and complete documentation is crucial for customs compliance. Customs brokers ensure this by:

Document Review: Thoroughly examining all import/export documents for accuracy, completeness, and consistency.

Record Keeping: Maintaining detailed records of all transactions, typically for at least five years, as required by most customs authorities.

Electronic Data Management: Utilizing advanced software systems to store, retrieve, and manage customs-related documents efficiently.

Proper Classification and Valuation

Correct classification and valuation of goods are fundamental to customs compliance. Customs brokers ensure accuracy by:

HS Code Determination: Carefully analyzing product specifications to assign the correct Harmonized System (HS) code for each item.

Valuation Methods: Applying appropriate customs valuation methods in accordance with the World Trade Organization (WTO) Valuation Agreement.

Rulings and Precedents: Utilizing customs rulings and legal precedents to support classification and valuation decisions.

Risk Assessment and Management

Customs brokers employ risk management strategies to identify and mitigate potential compliance issues:

Pre-Entry Risk Analysis: Conducting thorough assessments of shipments before submission to customs to identify potential red flags.

Compliance Programs: Developing and implementing internal compliance programs for clients to prevent violations.

Audit Preparation: Assisting clients in preparing for customs audits by ensuring all documentation and procedures are in order.

Leveraging Technology for Compliance

Modern customs brokers use advanced technology to enhance compliance efforts:

Automated Screening: Employing software that automatically checks shipments against restricted party lists and embargoed countries.

Data Analytics: Utilizing data analysis tools to identify patterns and anomalies that may indicate compliance risks.

Integration with Customs Systems: Ensuring seamless integration with government electronic customs systems for accurate and timely filing.

Collaboration with Customs Authorities

Maintaining positive relationships with customs officials is crucial for ensuring compliance:

Open Communication: Fostering open lines of communication with customs authorities to clarify regulations and resolve issues promptly.

Participation in Customs Programs: Encouraging clients to participate in trusted trader programs, such as the Customs-Trade Partnership Against Terrorism (C-TPAT) in the United States.

Proactive Problem Resolution: Addressing potential compliance issues proactively with customs authorities before they escalate.

Client Education and Support

Customs brokers play a vital role in educating their clients about compliance requirements:

Compliance Workshops: Conducting training sessions for clients on customs regulations and best practices.

Regular Updates: Providing clients with timely information on regulatory changes that may affect their operations.

Customized Compliance Strategies: Developing tailored compliance strategies based on each client’s specific import/export profile.

Continuous Improvement

Customs brokers implement continuous improvement processes to enhance compliance efforts:

Performance Metrics: Tracking key performance indicators related to compliance, such as error rates and clearance times.

Post-Entry Reviews: Conducting regular reviews of completed entries to identify areas for improvement.

Feedback Loops: Establishing systems to incorporate lessons learned from each transaction into future compliance efforts.

By employing these comprehensive strategies, customs brokers play a crucial role in ensuring that their clients’ international trade activities remain compliant with customs regulations. This not only helps avoid costly penalties and delays but also contributes to the overall integrity and efficiency of global trade.

What types of documentation do customs brokers handle?

Customs brokers are responsible for managing a wide array of documentation essential for the smooth clearance of goods through customs. These documents serve as the foundation for customs declarations, duty calculations, and regulatory compliance. Here’s a comprehensive overview of the key types of documentation handled by customs brokers:

Commercial Documents

Commercial Invoice: This document is the cornerstone of most international transactions. It includes crucial details such as:

– Description of goods

– Quantity

– Unit price and total value

– Terms of sale

– Buyer and seller information

Packing List: A detailed inventory of the shipment contents, including:

– Number of packages

– Dimensions and weights

– Marking and numbering of packages

Proforma Invoice: Used for preliminary price quotations or when a final commercial invoice is not yet available.

Transport Documents

Bill of Lading (B/L): For sea shipments, this document serves as:

– Receipt of goods by the carrier

– Contract of carriage

– Document of title to the goods

Air Waybill (AWB): Similar to a B/L but for air shipments. It is not a document of title.

Inland Bill of Lading: Used for overland transportation within a country.

Customs-Specific Documents

Customs Entry Form: The official declaration to customs authorities, detailing the goods being imported or exported.

Customs Bond: A financial guarantee ensuring payment of duties, taxes, and penalties if the importer fails to comply with customs regulations.

Importer Security Filing (ISF): Required for U.S.-bound ocean shipments, providing advance cargo information.

Origin and Preference Documents

Certificate of Origin: Declares the country where goods were manufactured or substantially transformed.

Generalized System of Preferences (GSP) Form A: For claiming preferential duty rates under GSP programs.

Free Trade Agreement Certificates: Such as USMCA (formerly NAFTA) certificates for North American trade.

Regulatory and Compliance Documents

Import/Export Licenses: Required for certain controlled goods or restricted markets.

Permits and Certificates: Specific documents required by various government agencies, such as:

– FDA (Food and Drug Administration) forms for food and medical products

– USDA (United States Department of Agriculture) certificates for plant and animal products

– EPA (Environmental Protection Agency) forms for certain chemicals or emissions-producing goods

Safety Data Sheets (SDS): Required for hazardous materials, detailing handling and safety information.

Financial Documents

Letter of Credit: A bank guarantee of payment, often used in international transactions.

Insurance Certificate: Proof of insurance coverage for the shipment.

Foreign Exchange Declarations: Required in some countries for currency control purposes.

Special Shipment Documents

ATA Carnet: A passport for goods, allowing temporary admission of items without payment of duties and taxes.

TIB (Temporary Importation under Bond): Similar to ATA Carnet but specific to the U.S., allowing temporary import of goods.

Dangerous Goods Declaration: Required for shipments containing hazardous materials.

Post-Entry Documents

Post-Entry Amendments: Used to correct errors or omissions in the original entry after goods have been released.

Drawback Claims: Documentation for claiming refunds on duties paid for imported goods that are subsequently exported.

Customs Valuation Forms

Customs Valuation Declaration: Detailed breakdown of the transaction value for customs purposes.

Related Party Declaration: Disclosure of any relationship between buyer and seller that might affect the declared value.

Table: Common Customs Documents and Their Primary Purposes

| Document Type | Primary Purpose |

|---|---|

| Commercial Invoice | Describes goods and states their value |

| Packing List | Details contents and packaging of shipment |

| Bill of Lading | Serves as receipt, contract, and title for sea shipments |

| Customs Entry Form | Official declaration of imported/exported goods |

| Certificate of Origin | Declares country where goods were produced |

| Import/Export Licenses | Authorizes trade in controlled goods |

| Letter of Credit | Guarantees payment in international transactions |

| ATA Carnet | Facilitates temporary admission of goods |

Customs brokers must be adept at handling all these document types, ensuring they are complete, accurate, and submitted in compliance with customs regulations. Their expertise in managing this complex web of documentation is crucial for preventing delays, avoiding penalties, and facilitating smooth international trade operations.

How do customs brokers calculate and manage duties, taxes, and fees?

Calculating and managing duties, taxes, and fees is a critical function of customs brokers. This process requires a deep understanding of customs regulations, tariff schedules, and international trade agreements. Here’s a detailed look at how customs brokers approach this complex task:

Tariff Classification

The first step in calculating duties is determining the correct tariff classification for the imported goods:

Harmonized System (HS) Codes: Customs brokers use the internationally standardized Harmonized System to classify goods. This system assigns a six-digit code to every product.

Country-Specific Extensions: Many countries add additional digits to the HS code for more specific classification. For example, the U.S. uses a 10-digit system called the Harmonized Tariff Schedule (HTS).

Classification Tools: Brokers often use specialized software and databases to assist in determining the correct classification.

Customs Valuation

Accurate valuation of goods is crucial for calculating duties and taxes:

Transaction Value Method: This is the primary method used, based on the price actually paid or payable for the goods.

Alternative Valuation Methods: When the transaction value cannot be used, brokers apply other methods in a prescribed hierarchical order, such as:

– Value of identical goods

– Value of similar goods

– Deductive value

– Computed value

Additions and Deductions: Brokers must consider various additions (e.g., royalties, assists) and deductions (e.g., post-importation costs) to determine the customs value.

Duty Rate Determination

Once the classification and valuation are established, brokers determine the applicable duty rate:

Tariff Schedules: Consulting the relevant country’s tariff schedule to find the rate associated with the HS code.

Preferential Rates: Checking if the goods qualify for reduced rates under free trade agreements or preference programs.

Anti-Dumping and Countervailing Duties: Determining if any special duties apply to the goods based on trade remedy measures.

Tax Calculation

In addition to duties, various taxes may apply to imported goods:

Value-Added Tax (VAT) or Goods and Services Tax (GST): Calculated based on the customs value plus duty.

Excise Taxes: Applied to specific products like alcohol, tobacco, or fuel.