Does Customs Check Shipping Containers

How often do customs check shipping containers?

Customs authorities around the world face a daunting task: inspecting millions of shipping containers that enter their ports each year. The sheer volume of global trade makes it impossible to check every single container. Instead, customs agencies employ a risk-based approach, focusing their resources on containers that pose the highest potential risk.

The frequency of customs inspections varies widely depending on several factors:

Country of origin: Shipments from countries known for high rates of smuggling or contraband may face more frequent inspections. For example, containers originating from regions associated with drug trafficking might undergo more scrutiny than those from low-risk countries.

Importer history: Companies with a track record of compliance and accurate documentation typically experience fewer inspections. Conversely, new importers or those with past violations may see their shipments checked more often.

Nature of goods: Certain types of products, such as food, pharmaceuticals, or hazardous materials, are subject to more frequent inspections due to safety and regulatory concerns.

Intelligence and alerts: Customs agencies rely on intelligence gathering and information sharing to target specific shipments that may warrant closer examination.

While exact inspection rates are not publicly disclosed for security reasons, estimates suggest that customs authorities physically inspect between 2% to 10% of all incoming containers, depending on the country and specific circumstances. However, this doesn’t mean the remaining containers go unchecked. Many countries employ non-intrusive inspection (NII) technologies, such as X-ray scanners, to screen a much larger percentage of containers without physically opening them.

For instance, the United States Customs and Border Protection (CBP) aims to scan 100% of containers entering U.S. ports using radiation detection and imaging technology. Physical inspections are then conducted on a smaller subset of containers flagged during this initial screening process.

It’s important to note that inspection rates can fluctuate based on current events, security threats, or changes in trade policies. During periods of heightened alert or in response to specific intelligence, customs agencies may increase their inspection rates temporarily.

For importers and exporters, understanding these inspection patterns can help in planning shipments and managing expectations. While it’s impossible to predict with certainty whether a specific container will be inspected, being aware of the factors that influence inspection rates can aid in risk assessment and compliance efforts.

What criteria does customs use to select containers for inspection?

Customs authorities worldwide employ sophisticated risk assessment systems to determine which containers warrant closer examination. These systems analyze a multitude of data points to identify shipments that pose potential risks to national security, public health, or economic interests. Understanding these criteria can help businesses navigate the complexities of international trade more effectively.

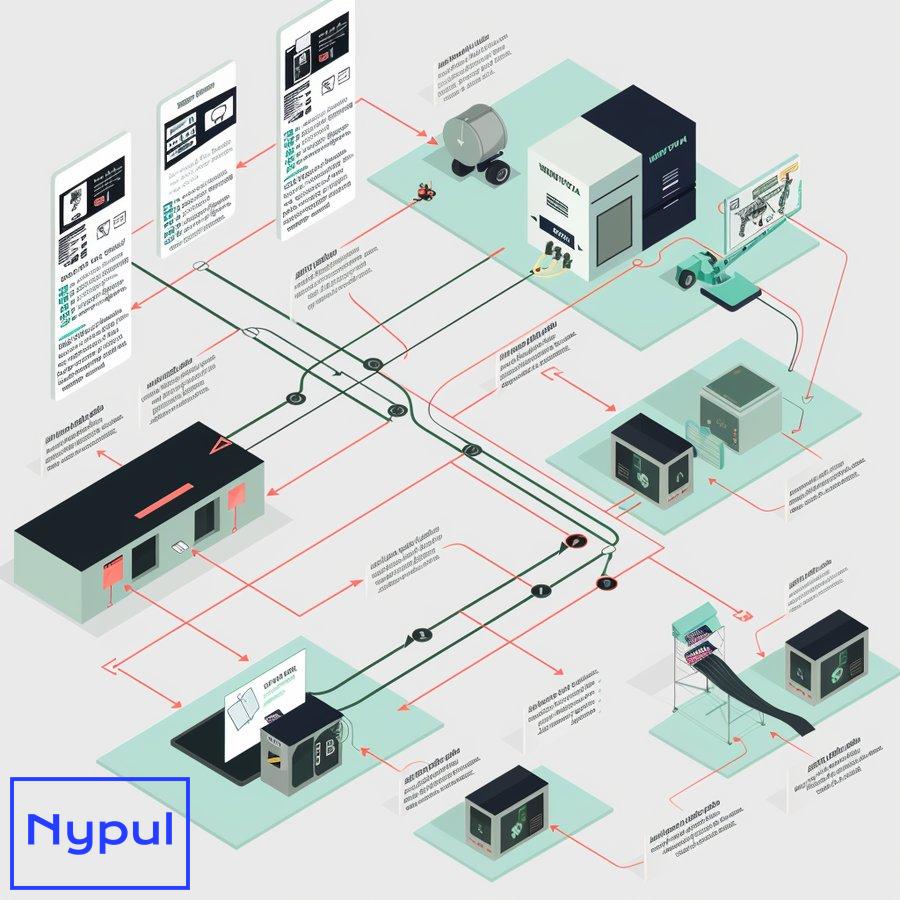

Risk-based targeting systems

Modern customs agencies utilize advanced algorithms and data analytics to assess the risk level of each incoming shipment. These systems consider various factors and assign a risk score to each container. Containers with higher risk scores are more likely to be selected for inspection.

Key components of risk-based targeting include:

Historical data: Past violations, discrepancies, or suspicious patterns associated with specific shippers, importers, or routes influence risk assessments.

Intelligence information: Customs agencies collaborate with law enforcement and intelligence services to identify potential threats or high-risk shipments.

Manifest analysis: Detailed examination of cargo manifests and bills of lading can reveal inconsistencies or red flags that warrant further investigation.

Country of origin: Shipments from countries known for specific risks (e.g., drug production, counterfeiting) may face increased scrutiny.

Nature of goods: Certain product categories, such as agricultural products, pharmaceuticals, or high-value electronics, are often subject to more rigorous inspection protocols.

Specific criteria for inspection

While customs agencies don’t disclose their exact selection criteria to maintain the integrity of their screening processes, several factors are known to influence the likelihood of inspection:

First-time importers: New entrants to the import/export business often face higher inspection rates as they lack an established compliance history.

Unusual shipping routes: Containers that follow atypical or circuitous routes may raise suspicions and trigger inspections.

Discrepancies in documentation: Inconsistencies between customs declarations, commercial invoices, and other shipping documents can lead to further examination.

High-risk commodities: Goods that are frequently associated with smuggling, intellectual property violations, or safety concerns are more likely to be inspected.

Random selection: To maintain the unpredictability of inspections and assess overall compliance rates, a certain percentage of containers are randomly selected for examination.

Specific intelligence: Information from law enforcement agencies, tipoffs, or international alerts may result in targeted inspections of particular shipments.

Compliance programs and trusted trader initiatives

Many customs authorities offer programs that allow compliant traders to benefit from reduced inspection rates and expedited clearance processes. These programs, such as the Customs-Trade Partnership Against Terrorism (C-TPAT) in the United States or the Authorized Economic Operator (AEO) program in the European Union, require businesses to meet stringent security and compliance standards.

Participants in these programs typically experience:

Lower inspection rates: Trusted traders are considered lower risk and are less likely to have their shipments selected for physical inspection.

Expedited processing: When inspections do occur, participants often receive priority handling to minimize delays.

Enhanced predictability: Reduced variability in customs processing times allows for more accurate supply chain planning.

The following table illustrates how different factors might influence the likelihood of customs inspection:

| Factor | Low Risk | Medium Risk | High Risk |

|---|---|---|---|

| Importer history | Established, compliant importer | Occasional minor discrepancies | New importer or history of violations |

| Country of origin | Low-risk country | Moderate-risk country | High-risk country (e.g., known for contraband) |

| Nature of goods | Non-sensitive goods | Regulated goods | High-risk or restricted goods |

| Documentation | Complete, accurate | Minor discrepancies | Major inconsistencies or missing documents |

| Shipping route | Direct, common route | Indirect but explainable route | Unusual or suspicious route |

| Intelligence | No alerts | General cautions | Specific intelligence or alerts |

By understanding these criteria, businesses can take proactive steps to minimize their risk profile and reduce the likelihood of customs inspections. This includes maintaining accurate documentation, participating in trusted trader programs, and staying informed about current customs regulations and risk factors in their specific industry and trade lanes.

What types of customs examinations do shipping containers undergo?

Customs authorities employ a range of examination techniques to assess the contents of shipping containers and ensure compliance with import regulations. These examinations vary in their level of intrusiveness and the resources required to conduct them. Understanding the different types of customs examinations can help importers and exporters prepare for potential inspections and manage their supply chain expectations.

Non-intrusive inspections (NII)

Non-intrusive inspections represent the first line of defense in customs screening processes. These methods allow customs officials to examine container contents without physically opening them, saving time and resources while minimizing disruption to legitimate trade.

X-ray and gamma-ray scanning: Large-scale imaging systems produce detailed images of container contents, allowing customs officers to identify anomalies or hidden compartments. These scans can detect a wide range of contraband, including drugs, weapons, and undeclared goods.

Radiation detection: Specialized equipment detects the presence of radioactive materials, which is crucial for preventing the smuggling of nuclear materials or dirty bomb components.

Vapor and trace detection: Advanced sensors can detect minute particles or vapors associated with narcotics, explosives, or other prohibited substances.

Physical examinations

When non-intrusive inspections raise suspicions or when random checks are conducted, customs authorities may proceed with physical examinations of container contents.

Tailgate examination: Customs officers open the container doors and conduct a visual inspection of the cargo without fully unloading it. This quick check can verify that the contents match the declared goods and detect any obvious discrepancies.

Partial unloading: A portion of the cargo is removed and inspected in detail. This method is often used when X-ray scans reveal suspicious areas within the container.

Intensive examination: The entire contents of the container are unloaded and thoroughly inspected. This is the most time-consuming and resource-intensive type of examination, typically reserved for high-risk shipments or when other inspection methods have raised significant concerns.

Specialized examinations

Certain types of goods require specialized inspection procedures to ensure compliance with specific regulations or to protect public health and safety.

Agricultural inspections: Fresh produce, plants, and other agricultural products may undergo examinations by plant health inspectors to detect pests or diseases.

Food and drug inspections: Shipments of food products, pharmaceuticals, or medical devices may be subject to inspections by food safety authorities or drug regulators to ensure they meet quality and safety standards.

Intellectual property rights (IPR) examinations: Customs officers may inspect goods suspected of infringing on trademarks, copyrights, or patents. This often involves collaboration with rights holders to verify the authenticity of products.

Document verification

While not a physical examination of the container itself, document verification is a crucial part of the customs clearance process.

Customs declaration review: Officers carefully examine customs declarations, commercial invoices, packing lists, and other relevant documents to ensure consistency and compliance with import regulations.

License and permit verification: For regulated goods, customs authorities verify that all necessary import licenses, permits, or certificates are valid and match the shipment details.

Post-clearance audits

Some customs agencies conduct post-clearance audits, which involve a detailed examination of an importer’s records and business practices after goods have been released from customs control.

Records review: Customs officers examine financial records, import documentation, and inventory data to ensure compliance with customs regulations over an extended period.

Site visits: In some cases, customs officials may visit the importer’s premises to verify inventory and business practices.

The following table summarizes the key characteristics of different types of customs examinations:

| Examination Type | Intrusiveness | Time Required | Resource Intensity | Detection Capability |

|---|---|---|---|---|

| X-ray/Gamma-ray Scanning | Low | Minutes | Moderate | High for physical anomalies |

| Radiation Detection | Very Low | Seconds | Low | Specific to radioactive materials |

| Tailgate Examination | Moderate | 15-30 minutes | Low | Limited to visible discrepancies |

| Partial Unloading | High | Hours | Moderate | Good for targeted areas |

| Intensive Examination | Very High | Several hours to days | High | Comprehensive |

| Agricultural Inspection | Moderate to High | Variable | Moderate | Specific to pests and diseases |

| Document Verification | N/A | Variable | Low to Moderate | Limited to paperwork discrepancies |

| Post-clearance Audit | N/A | Days to weeks | High | Comprehensive for long-term compliance |

By understanding these examination types, businesses can better prepare for potential inspections and take steps to facilitate smooth customs clearance. This may include ensuring accurate documentation, properly securing cargo, and maintaining clear communication channels with customs authorities and logistics partners.

What happens during a customs container inspection?

When a shipping container is selected for inspection, it undergoes a systematic process designed to verify its contents, ensure compliance with import regulations, and detect any potential security threats or contraband. The inspection process can vary depending on the country, the type of goods being imported, and the level of scrutiny deemed necessary. Here’s a detailed look at what typically occurs during a customs container inspection:

Notification and container isolation

The inspection process begins when customs authorities notify the relevant parties that a container has been selected for examination. This notification may be sent to the importer, customs broker, or freight forwarder handling the shipment.

Container identification: The selected container is identified and isolated from the general cargo area.

Documentation review: Customs officers review all relevant documentation, including the customs declaration, commercial invoice, packing list, and any required permits or certificates.

Initial assessment

Before opening the container, customs officers may conduct preliminary checks to gather more information about the shipment.

Seal verification: The integrity of the container seal is checked to ensure it hasn’t been tampered with during transit.

External inspection: Officers visually inspect the exterior of the container for any signs of damage, modifications, or hidden compartments.

Non-intrusive inspection (if applicable): In many cases, the container will undergo X-ray or gamma-ray scanning to provide an initial view of its contents without opening it.

Container opening and examination

If further inspection is deemed necessary, the container will be opened for a more thorough examination.

Breaking the seal: The container seal is broken in the presence of customs officers and, if permitted, representatives of the importer or their agent.

Initial survey: Officers conduct a visual survey of the cargo upon opening the doors to compare the visible contents with the declared goods.

Unloading process: Depending on the level of inspection required, the container may be partially or fully unloaded. This process is typically carried out by customs-approved laborers or warehouse staff.

Detailed inspection

The intensity of the inspection can vary based on the initial findings and the risk assessment of the shipment.

Visual inspection: Officers carefully examine the unloaded goods, checking for any discrepancies with the declared items or signs of concealed contraband.

Physical examination: Goods may be physically handled, opened, or tested to verify their nature, quantity, and quality.

Sampling: In some cases, samples of the goods may be taken for laboratory analysis, particularly for food products, chemicals, or other regulated items.

Use of specialized equipment: Officers may employ tools such as density meters, fiber optic scopes, or drug and explosive detection devices to conduct more detailed examinations.

Documentation of findings

Throughout the inspection process, customs officers meticulously document their observations and any discrepancies found.

Photographic evidence: Officers may take photographs or videos to document the condition of the goods and any notable findings.

Inspection report: A detailed report is prepared, outlining the inspection process, findings, and any actions taken.

Resolution and next steps

Based on the inspection results, customs authorities determine the appropriate course of action.

Clearance: If no issues are found, the shipment is cleared for release and can proceed through the importation process.

Further investigation: In cases where discrepancies or suspicious items are discovered, the shipment may be held for further investigation or legal action.

Penalties or seizures: If violations are confirmed, customs may impose penalties, seize goods, or take other enforcement actions as required by law.

Reloading and sealing

Once the inspection is complete and assuming the goods are cleared for release, the container is prepared for onward transportation.

Careful repacking: Goods are repacked into the container, ideally in their original condition and arrangement.

New seal application: A new customs seal is applied to the container to ensure the integrity of the shipment for the remainder of its journey.

Communication of results

The outcome of the inspection is communicated to relevant parties, including the importer, customs broker, and other government agencies if applicable.

Release notification: If cleared, a formal release notification is issued, allowing the container to be collected and moved to its final destination.

Detention notice: In cases where issues are found, a detention notice may be issued, outlining the reasons for holding the shipment and any required actions.

The following table summarizes the key stages of a typical customs container inspection:

| Stage | Activities | Typical Duration | Key Personnel Involved |

|---|---|---|---|

| Notification and Isolation | Container selection, documentation review | 1-2 hours | Customs officers, terminal operators |

| Initial Assessment | Seal check, external inspection, NII scanning | 30 minutes – 2 hours | Customs officers, scanning technicians |

| Container Opening | Breaking seal, initial survey | 15-30 minutes | Customs officers, importer representatives (if present) |

| Detailed Inspection | Unloading, physical examination, sampling | 2-8 hours (or more for intensive inspections) | Customs officers, laborers, specialized inspectors |

| Documentation of Findings | Photography, report writing | 1-2 hours | Customs officers |

| Resolution and Next Steps | Decision-making, clearance or further action | Variable | Customs officers, supervisors |

| Reloading and Sealing | Repacking, new seal application | 1-3 hours | Laborers, customs officers |

| Communication of Results | Issuing release or detention notices | 30 minutes – 1 hour | Customs officers, administrative staff |

Understanding this process can help importers and their partners prepare for potential inspections, ensuring they have all necessary documentation readily available and that their goods are properly packed and declared. It’s important to note that while customs inspections can cause delays and additional costs, they play a crucial role in maintaining the security and integrity of international trade.

Why might customs flag a container for inspection?

Customs authorities around the world employ sophisticated risk assessment systems to determine which containers warrant closer examination. Understanding the reasons why a container might be flagged for inspection can help businesses navigate the complexities of international trade more effectively and take proactive steps to minimize the likelihood of delays. Here are the primary factors that may lead customs to flag a container for inspection:

Risk-based targeting

Customs agencies use advanced algorithms and data analytics to assess the risk level of each incoming shipment. Containers may be flagged based on:

Historical data: Past violations or discrepancies associateRisk-based targeting

Customs agencies use advanced algorithms and data analytics to assess the risk level of each incoming shipment. Containers may be flagged based on:

Historical data: Past violations or discrepancies associated with specific importers, shippers, or routes can increase the likelihood of inspection for future shipments.

Intelligence information: Alerts from law enforcement or intelligence agencies regarding specific threats or suspicious activities can lead to targeted inspections.

Manifest analysis: Inconsistencies or red flags in shipping documents, such as discrepancies between the declared goods and their actual nature, can trigger further scrutiny.

Country of origin: Containers originating from countries known for high rates of smuggling, drug production, or other illicit activities may face increased inspection rates.

Nature of goods: Certain types of products—such as agricultural items, pharmaceuticals, electronics, and high-value goods—are more likely to be flagged due to their potential for safety risks or regulatory violations.

Compliance history

Importers with a history of compliance issues are more likely to have their shipments flagged for inspection. Factors influencing this include:

Previous violations: If an importer has been found in violation of customs regulations in the past, their future shipments may be scrutinized more closely.

Inaccurate documentation: Frequent discrepancies in shipping documents can raise red flags and lead customs to investigate further.

New importers: Companies that are new to importing may face higher inspection rates as they lack an established compliance record.

Suspicious shipping patterns

Unusual shipping routes or patterns can also prompt customs authorities to flag containers for inspection. Indicators include:

Indirect routes: Containers that take circuitous paths or deviate from typical shipping lanes may raise suspicions about their contents.

Frequent changes in shipping partners: Consistent changes in freight forwarders or carriers can indicate potential attempts to evade scrutiny.

High-risk ports of call: If a container stops at ports known for high levels of smuggling or illegal activity, it may be flagged for further inspection upon arrival at its final destination.

Random selection

To maintain the unpredictability of inspections and assess overall compliance rates, customs agencies often employ random selection processes. This means that even shipments that appear compliant can be flagged for inspection simply due to chance. This randomness is crucial for deterring potential violators who might otherwise attempt to exploit predictable inspection patterns.

The following table summarizes common reasons why customs might flag a container for inspection:

| Reason | Description |

|---|---|

| Historical Data | Past violations associated with importers or shippers increase scrutiny. |

| Intelligence Alerts | Specific threats identified by law enforcement lead to targeted inspections. |

| Manifest Discrepancies | Inconsistencies between declared goods and actual contents raise red flags. |

| Country of Origin | High-risk countries known for smuggling face increased inspection rates. |

| Nature of Goods | Certain products, like pharmaceuticals and electronics, are more likely to be flagged. |

| Compliance History | Importers with previous violations face higher scrutiny on future shipments. |

| Suspicious Patterns | Unusual shipping routes or frequent changes in partners raise suspicions. |

| Random Selection | Some containers are selected randomly to maintain unpredictability in inspections. |

By understanding these factors, businesses can take proactive measures to ensure compliance with customs regulations and minimize the likelihood of their containers being flagged for inspection. This includes maintaining accurate documentation, establishing strong relationships with reliable logistics partners, and staying informed about current customs regulations and risk factors relevant to their specific industry and trade lanes.

How do customs inspections impact shipping timelines and costs?

Customs inspections can significantly affect the timelines and costs associated with international shipping. Understanding these impacts is essential for businesses engaged in global trade, as it allows them to plan effectively and manage expectations regarding delivery schedules and expenses. Here’s an overview of how customs inspections influence shipping timelines and costs:

Delays in delivery

When a container is selected for inspection, it can lead to delays at various stages of the shipping process:

Initial processing delays: The time taken for customs authorities to notify parties about an inspection can cause initial delays in cargo movement.

Inspection duration: Depending on the type of examination conducted (non-intrusive vs. physical), inspections can take anywhere from a few hours to several days. Intensive examinations that require unloading the entire container are particularly time-consuming.

Post-inspection processing delays: Once an inspection is complete, additional time may be required for documentation review and clearance before the shipment can proceed.

These delays can disrupt supply chains, particularly if businesses rely on just-in-time inventory management practices that require timely deliveries.

Increased costs

Customs inspections can also lead to increased costs that businesses must account for when planning international shipments:

Demurrage charges: If a container is held up at the port due to an inspection, importers may incur demurrage charges from shipping lines for extended use of the container beyond the agreed free time period.

Storage fees: Delays caused by inspections may result in additional storage fees at terminals or warehouses while awaiting clearance.

Administrative costs: The need for additional paperwork, documentation review, or legal consultations related to compliance issues can increase administrative expenses.

Potential penalties or fines: If violations are discovered during an inspection, businesses may face fines or penalties imposed by customs authorities, further increasing costs.

The following table summarizes how customs inspections affect shipping timelines and costs:

| Impact | Description |

|---|---|

| Delays | Inspections can cause significant delays at various stages of shipping. |

| Demurrage Charges | Extended container use due to delays may incur additional fees from carriers. |

| Storage Fees | Delays may result in extra charges for storing containers at terminals or warehouses. |

| Administrative Costs | Increased paperwork and compliance-related expenses add to overall costs. |

| Potential Penalties | Discovering violations during inspections may lead to fines imposed by customs. |

To mitigate these impacts, businesses should adopt proactive strategies such as ensuring accurate documentation, maintaining compliance with regulations, and establishing strong relationships with logistics partners who understand customs processes. By doing so, they can minimize delays and associated costs while ensuring smoother operations in international trade.

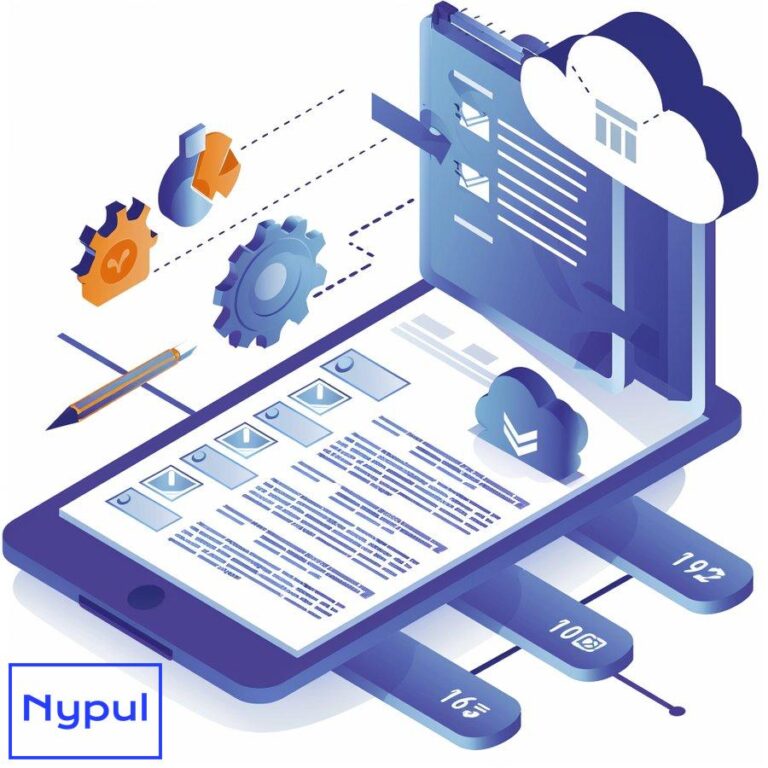

What documentation is required for customs clearance?

Customs clearance is a critical step in the importation process that requires accurate and complete documentation. Proper documentation ensures compliance with regulations and facilitates smooth processing through customs authorities. Understanding what documents are required for customs clearance is essential for importers seeking to avoid delays and penalties during shipping. Here’s an overview of key documents typically required:

1. Customs Declaration

The customs declaration is a formal document submitted by importers detailing the contents of a shipment. It includes information such as:

- Description of goods

- Quantity

- Value

- Country of origin

- Harmonized System (HS) codes

Accurate completion of this document is crucial as it serves as the basis for determining duties and taxes owed on imported goods.

2. Commercial Invoice

The commercial invoice is a critical document that outlines the transaction between the buyer and seller. It includes:

- Seller’s name and address

- Buyer’s name and address

- Invoice number

- Date of issue

- Detailed description of goods

- Unit price and total value

This document helps customs authorities verify the accuracy of declared values against what is reported on the customs declaration.

3. Packing List

The packing list provides detailed information about how goods are packed within a shipment. It typically includes:

- Itemized list of contents

- Weight and dimensions

- Packaging type (e.g., boxes, pallets)

The packing list assists customs officers during inspections by providing clarity on what should be present within each container.

4. Bill of Lading

The bill of lading serves as a contract between the shipper and carrier while also acting as a receipt for goods shipped. It contains essential information such as:

- Shipper’s details

- Consignee’s details

- Shipment route

- Description of goods

This document is vital for tracking shipments while also providing proof that goods were loaded onto a vessel or truck.

5. Import Permits or Licenses

Certain products require specific permits or licenses before they can be imported into a country due to regulatory restrictions (e.g., pharmaceuticals, agricultural products). Importers must ensure they obtain these permits prior to shipment arrival.

6. Certificates of Origin

A certificate of origin certifies where the goods were produced or manufactured. This document may be required to determine eligibility for preferential tariff treatment under free trade agreements (FTAs).

7. Insurance Documents

Proof of insurance coverage protects against loss or damage during transit. These documents provide evidence that adequate insurance has been obtained for valuable shipments.

8. Other Supporting Documents

Depending on the nature of the goods being imported, additional supporting documents may be required:

- Health certificates (for food products)

- Phytosanitary certificates (for plants)

- Certificates of conformity (for regulated products)

The following table summarizes key documents required for customs clearance:

| Document Type | Description |

|---|---|

| Customs Declaration | Formal statement detailing shipment contents; basis for duties/taxes assessment. |

| Commercial Invoice | Transaction record between buyer/seller; includes item details & value information. |

| Packing List | Detailed breakdown of how goods are packed; aids customs during inspections. |

| Bill of Lading | Contract receipt between shipper/carrier; tracks shipment route & contents verification. |

| Import Permits/Licenses | Required approvals for specific regulated products prior to importation. |

| Certificates of Origin | Certifies product manufacturing location; important for tariff treatment eligibility under FTAs. |

| Insurance Documents | Proof coverage against loss/damage during transit; protects shipment value during transport. |

| Other Supporting Documents | Additional certifications based on product type (e.g., health certificates). |

Ensuring all necessary documentation is accurate and complete will help facilitate smooth customs clearance processes while minimizing potential delays or penalties associated with non-compliance.

What are the legal aspects of customs container inspections?

Understanding the legal aspects surrounding customs container inspections is crucial for importers seeking compliance with international trade regulations while minimizing risks associated with penalties or legal disputes arising from non-compliance issues during inspections.

1. Legal Authority

Customs authorities possess legal authority under national laws governing international trade regulations to inspect containers entering their jurisdiction without prior notice when deemed necessary based on risk assessments outlined previously in this article.

2. Compliance Obligations

Importers have a legal obligation to comply with all applicable laws governing imports into their country—including providing accurate documentation regarding their shipments’ contents—and ensuring adherence throughout every stage leading up until final delivery at destination points within respective jurisdictions where applicable laws apply locally too!

Failure by an importer/importing entity could result not only in penalties but also possible seizure/detention actions taken against contraband found within inspected containers leading potentially towards civil/criminal liabilities depending upon severity involved!

3. Rights During Inspections

During inspections conducted by customs officials—importers have certain rights including but not limited too:

-

Right To Be Present: Importers have the right (if applicable)to have representatives present during physical examinations conducted upon request.

-

Right To Appeal Decisions Made By Customs Authorities: If any adverse findings arise following an examination—importers retain rights allowing them opportunities appealing decisions made against them through established channels outlined within respective jurisdictions’ governing bodies overseeing such matters accordingly!

4. Confidentiality Issues

Customs authorities are obligated under laws governing privacy protection concerning sensitive business information obtained during investigations—therefore safeguarding confidentiality where necessary unless disclosure becomes mandated through legal proceedings initiated thereafter!

5. Penalties And Enforcement Actions

If violations occur during inspections—customs authorities possess powers imposing penalties ranging from fines levied against non-compliant parties up until potential criminal charges pursued depending upon severity involved! Enforcement actions taken include seizure/detention actions against contraband discovered within inspected containers leading potentially towards civil/criminal liabilities depending upon severity involved!

The following table summarizes key legal aspects related specifically towards customs container inspections:

| Legal Aspect | Description |

|---|---|

| Legal Authority | Customs have authority under national laws governing international trade regulations allowing them inspecting containers without prior notice when necessary based upon risk assessments conducted beforehand! |

| Compliance Obligations | Importers must comply fully with all applicable laws governing imports—including providing accurate documentation regarding shipments’ contents throughout every stage leading up until final delivery! |

| Rights During Inspections | Importers have rights including presence during examinations & ability appealing decisions made against them through established channels! |

| Confidentiality Issues | Customs obligated safeguarding sensitive business information obtained during investigations unless disclosure mandated through legal proceedings initiated thereafter! |

| Penalties And Enforcement Actions | Violations result penalties ranging from fines up until potential criminal charges pursued depending upon severity involved! |

By understanding these legal aspects surrounding customs container inspections—importers can better navigate complexities associated within international trade ensuring compliance while minimizing risks involved throughout entire process effectively!

How is technology improving customs screening processes?

Advancements in technology play a pivotal role in enhancing customs screening processes worldwide—enabling more efficient detection capabilities while streamlining operations ultimately benefiting both authorities overseeing these processes & businesses engaged within international trade alike! Here’s how technology is transforming customs screening:

1. Non-Intrusive Inspection Technologies (NII)

Non-intrusive inspection technologies allow customs officials examining containers without physically opening them—saving time & resources while minimizing disruption legitimate trade flows! Key technologies include:

-

X-ray Scanners: High-energy X-ray machines produce detailed images revealing hidden compartments & anomalies within containers—allowing rapid identification suspicious items without unloading cargo!

-

Gamma-ray Imaging: Similar principles apply here utilizing gamma rays instead X-rays—providing even greater penetration capabilities especially useful when inspecting dense materials!

2. Automated Risk Assessment Systems

Modern automated risk assessment systems leverage big data analytics machine learning algorithms analyzing vast amounts historical data identifying trends patterns helping prioritize high-risk shipments requiring closer scrutiny based upon various factors discussed earlier!

These systems continuously improve over time learning from new data inputs refining targeting criteria accordingly ensuring effective allocation resources towards highest-risk areas!

3. Blockchain Technology

Blockchain technology enhances transparency traceability throughout supply chains enabling real-time tracking shipments reducing opportunities fraud! By recording every transaction securely decentralized ledger—customs authorities gain visibility into entire journey each shipment takes—from manufacturer all way until final destination point!

This transparency fosters trust among stakeholders while facilitating faster resolution disputes arising concerning discrepancies found during inspections!

4. Drones And Robotics

Drones equipped advanced imaging technologies assist conducting aerial surveys ports warehouses identifying potential security threats detecting unauthorized access areas restricted access zones enhancing overall security measures implemented across facilities!

Robotics also plays role automating repetitive tasks reducing human error speeding up processing times improving efficiency overall!

5. Data Sharing Platforms

Collaboration among governments private sector stakeholders facilitated through data-sharing platforms allows seamless exchange information intelligence regarding high-risk shipments improving collective response capabilities addressing emerging threats effectively!

These platforms enable real-time communication among different agencies facilitating coordinated efforts tackling smuggling trafficking activities across borders effectively enhancing overall security measures implemented globally!

The following table summarizes key technological advancements improving customs screening processes:

| Technology Type | Description |

|---|---|

| Non-Intrusive Inspection Technologies (NII) | Allow examination containers without opening them using X-ray/gamma-ray imaging techniques! |

| Automated Risk Assessment Systems | Leverage big data analytics machine learning algorithms analyzing historical data identifying trends patterns prioritizing high-risk shipments requiring closer scrutiny! |

| Blockchain Technology | Enhances transparency traceability throughout supply chains enabling real-time tracking shipments reducing opportunities fraud! |

| Drones And Robotics | Assist conducting aerial surveys ports warehouses identifying potential security threats enhancing overall security measures implemented across facilities! |

| Data Sharing Platforms | Facilitate seamless exchange information intelligence among governments private sector stakeholders improving collective response capabilities addressing emerging threats effectively! |

By embracing these technological advancements—customs authorities enhance screening processes ultimately benefiting legitimate traders facilitating smoother operations ensuring security integrity maintained throughout global supply chains effectively!

In conclusion—the interplay between technology regulatory frameworks continues shaping future landscape surrounding international trade ensuring efficient secure movement goods across borders remains paramount importance safeguarding interests all parties involved effectively!