Does Customs Duty Include Freight

What is customs duty and why is it imposed?

Customs duty, a critical component of international trade, is a tax levied on goods when they cross international borders. This financial obligation serves multiple purposes, primarily acting as a revenue source for governments and a protective measure for domestic industries.

The concept of customs duty dates back centuries, evolving alongside global commerce. Today, it remains a fundamental aspect of international trade policy, influencing economic strategies and trade relationships between nations.

Definition and Purpose

Customs duty is essentially a tariff or tax imposed on goods when transported across international borders. The primary purposes of this duty are:

Revenue Generation: Governments collect substantial income through customs duties, contributing to national budgets and funding various public services.

Trade Regulation: By imposing duties, countries can control the flow of goods, influencing import and export patterns to align with national economic objectives.

Industry Protection: Higher duties on certain products can shield domestic industries from foreign competition, allowing local businesses to thrive and maintain market share.

Economic Balance: Customs duties help balance trade deficits by discouraging excessive imports and promoting domestic production.

Types of Customs Duties

Customs duties come in various forms, each serving specific purposes:

Ad Valorem Duty: This is the most common type, calculated as a percentage of the goods’ value. For example, a 5% ad valorem duty on a $1000 item would result in a $50 duty.

Specific Duty: Based on other units of measurement such as weight, volume, or quantity. For instance, $5 per kilogram or $2 per liter.

Compound Duty: A combination of ad valorem and specific duties. For example, 5% of the value plus $2 per kilogram.

Tariff-rate Quotas: These involve applying a lower duty rate to a specific quantity of imported goods, with higher rates for quantities exceeding this limit.

Anti-dumping Duty: Imposed on imports priced below fair market value to protect domestic industries from unfair competition.

Countervailing Duty: Levied to offset subsidies provided by foreign governments to their exporters.

Calculation Basis

The calculation of customs duties typically involves several factors:

- Value of Goods: The declared value of the imported items.

- Country of Origin: Some countries have preferential trade agreements, affecting duty rates.

- Harmonized System (HS) Code: A standardized numerical method of classifying traded products.

- Applicable Duty Rate: Determined by the importing country’s tariff schedule.

Impact on Global Trade

Customs duties significantly influence international trade dynamics:

Trade Barriers: High duties can act as barriers to trade, potentially leading to reduced imports and international tensions.

Consumer Prices: Duties often result in higher prices for imported goods, affecting consumer choices and spending patterns.

Supply Chain Decisions: Companies may alter their sourcing strategies or manufacturing locations to optimize duty expenses.

Economic Relationships: Duties play a crucial role in trade negotiations and can be used as leverage in international relations.

Challenges and Controversies

The implementation of customs duties is not without challenges:

Complexity: The intricate nature of duty calculations and varying regulations across countries can lead to confusion and compliance issues.

Trade Disputes: Disagreements over duty rates or practices can escalate into full-scale trade wars, impacting global economic stability.

Smuggling and Fraud: High duty rates may incentivize illegal activities to evade payments, requiring robust enforcement measures.

Economic Inefficiencies: Protectionist duties can lead to market distortions and reduced overall economic efficiency.

Understanding customs duty is crucial for businesses engaged in international trade. It affects pricing strategies, profit margins, and overall competitiveness in the global marketplace. As trade policies continue to evolve, staying informed about customs duty regulations and their implications remains essential for successful cross-border commerce.

How are freight costs calculated in international shipping?

Freight costs in international shipping are a crucial component of global trade, significantly impacting the final price of goods and the profitability of businesses. Understanding how these costs are calculated is essential for importers, exporters, and logistics professionals to make informed decisions and optimize their shipping strategies.

Factors Influencing Freight Costs

Several key factors contribute to the calculation of freight costs in international shipping:

Distance: The geographical distance between the origin and destination ports plays a significant role in determining shipping costs. Longer distances generally result in higher freight charges.

Mode of Transport: Different transportation methods (sea, air, rail, or road) have varying cost structures. Sea freight is typically the most economical for large volumes over long distances, while air freight is faster but more expensive.

Cargo Type and Nature: The characteristics of the goods being shipped, including their weight, volume, value, and any special handling requirements, influence the freight cost.

Container Type and Size: For sea freight, the type and size of containers used (e.g., 20-foot, 40-foot, refrigerated) affect the pricing.

Fuel Prices: Fluctuations in fuel costs directly impact shipping rates, often reflected in fuel surcharges.

Season and Demand: Peak shipping seasons and high-demand routes can lead to increased freight rates.

Currency Exchange Rates: For international shipments, currency fluctuations can affect the final cost in the shipper’s or receiver’s local currency.

Regulatory Compliance: Costs associated with adhering to international shipping regulations and customs requirements.

Insurance: The cost of insuring the cargo during transit.

Additional Services: Charges for services like packing, warehousing, or last-mile delivery.

Calculation Methods

Freight costs are typically calculated using one of the following methods:

Per Container Rate: A flat rate charged for a full container load (FCL), regardless of the weight or volume of goods inside.

Weight-based Rate: Calculated per kilogram or ton of cargo, commonly used for air freight and less-than-container load (LCL) shipments.

Volume-based Rate: Based on the cubic meters or cubic feet occupied by the cargo, often used for bulky but lightweight items.

Value-based Rate: A percentage of the cargo’s declared value, typically used for high-value goods.

Freight Ton Rate: A combination of weight and volume, where 1 freight ton equals either 1,000 kg or 1 cubic meter, whichever is greater.

Specific Commodity Rates: Special rates for certain types of goods, often negotiated for regular large-volume shipments.

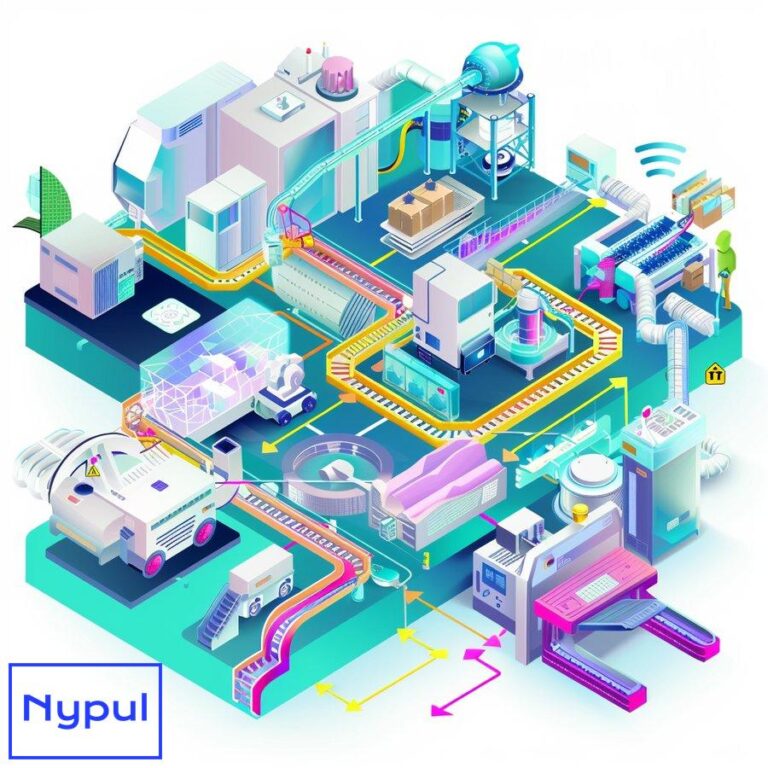

Breakdown of Freight Costs

To provide a clearer picture of how freight costs are structured, let’s break down the typical components:

| Cost Component | Description | Typical Percentage of Total Cost |

|---|---|---|

| Base Freight Rate | The core charge for transporting goods | 40-60% |

| Fuel Surcharge | Additional fee to cover fluctuating fuel prices | 10-20% |

| Terminal Handling Charges | Fees for loading/unloading at ports | 5-15% |

| Documentation Fees | Charges for preparing and processing shipping documents | 2-5% |

| Insurance | Cost of insuring the cargo during transit | 1-3% |

| Customs Clearance | Fees for customs brokerage services | 3-7% |

| Inland Transportation | Costs for moving goods to/from ports | 10-20% |

| Miscellaneous Charges | Additional fees like security surcharges, peak season surcharges, etc. | 5-10% |

Calculation Example

Let’s consider a hypothetical example of calculating freight costs for a sea shipment:

Scenario: Shipping a 40-foot container from Shanghai to Los Angeles

- Base Ocean Freight Rate: $2,500

- Fuel Surcharge (15%): $375

- Terminal Handling Charges: $300

- Documentation Fees: $100

- Insurance (1% of cargo value, assuming $100,000): $1,000

- Customs Clearance: $200

- Inland Transportation (to final destination): $800

- Peak Season Surcharge: $200

Total Freight Cost: $5,475

This example illustrates how various components contribute to the final freight cost. The actual percentages and amounts can vary significantly based on the specific circumstances of each shipment.

Strategies for Cost Optimization

Understanding freight cost calculations enables businesses to implement effective strategies for optimization:

Consolidation: Combining smaller shipments into full container loads can reduce per-unit shipping costs.

Negotiation: Large-volume shippers can often negotiate better rates with carriers.

Timing: Avoiding peak seasons and choosing optimal shipping times can lead to cost savings.

Mode Selection: Choosing the most appropriate transportation mode based on urgency, cost, and cargo characteristics.

Route Optimization: Selecting the most efficient shipping routes to minimize distance and transit time.

Technology Adoption: Utilizing freight management software and digital platforms for better rate comparisons and shipment tracking.

Long-term Contracts: Establishing long-term agreements with carriers for more stable and potentially lower rates.

Freight cost calculation in international shipping is a complex process influenced by numerous factors. By understanding these components and calculation methods, businesses can make more informed decisions, accurately forecast expenses, and implement effective strategies to optimize their shipping costs. As global trade continues to evolve, staying abreast of changes in freight pricing models and market trends remains crucial for maintaining competitiveness in the international marketplace.

When is freight included in customs duty calculations?

The inclusion of freight costs in customs duty calculations is a critical aspect of international trade that significantly impacts the overall cost of importing goods. Understanding when and how freight is factored into these calculations is essential for importers to accurately predict their expenses and comply with customs regulations.

General Rule

The general principle governing the inclusion of freight in customs duty calculations is based on the valuation method used by the importing country. The two primary methods are:

- CIF (Cost, Insurance, and Freight)

- FOB (Free on Board)

Under the CIF method, freight is included in the customs value, while under the FOB method, it is not. However, the application of these methods can vary depending on the specific regulations of each country.

Scenarios Where Freight is Included

CIF Valuation Method: Countries using the CIF method for customs valuation include freight costs in the dutiable value of imported goods. This approach is common in many countries, particularly in Europe and parts of Asia.

Delivered Duty Paid (DDP) Incoterms: When goods are shipped under DDP terms, the seller is responsible for all costs, including freight and duties. In this case, freight is typically included in the customs value.

Specific Country Regulations: Some countries may require the inclusion of freight costs in duty calculations regardless of the general valuation method used.

Certain Types of Goods: For specific categories of products, customs authorities might require the inclusion of freight costs in the dutiable value, even if they generally use an FOB-based system.

When Freight is Provided Free of Charge: If the buyer receives free shipping from the seller, customs authorities may still assign a value to this service and include it in duty calculations.

Scenarios Where Freight is Excluded

FOB Valuation Method: Countries using the FOB method, such as the United States, generally do not include freight costs in the customs value for duty calculation purposes.

Ex Works (EXW) Incoterms: Under EXW terms, the buyer is responsible for all transportation costs from the seller’s premises. In this case, freight is typically not included in the customs value.

Separate Freight Invoicing: When freight is invoiced separately from the goods and clearly distinguishable, some countries may allow its exclusion from duty calculations, even under a CIF system.

Specific Exemptions: Certain trade agreements or customs regulations may provide exemptions for including freight in duty calculations for specific types of goods or trade routes.

Impact on Importers

The inclusion or exclusion of freight in customs duty calculations can have significant financial implications for importers:

Cost Increase: When freight is included, it increases the base value on which duty is calculated, potentially leading to higher overall import costs.

Variability in Duty Amounts: Fluctuations in freight costs can cause variations in the duty payable, even for identical goods, if freight is included in the calculations.

Compliance Complexity: Importers must be aware of and comply with the specific requirements of each country they import into, which can be challenging when dealing with multiple markets.

Strategic Considerations: The treatment of freight in duty calculations can influence decisions on shipping methods, routes, and terms of sale.

Best Practices for Importers

To navigate the complexities of freight inclusion in customs duty calculations, importers should consider the following practices:

Stay Informed: Keep up-to-date with the customs valuation methods and regulations of target import countries.

Accurate Documentation: Maintain clear and detailed records of all costs associated with each shipment, including itemized freight charges.

Consult Experts: Work with customs brokers or trade compliance specialists who are familiar with the specific requirements of different countries.

Review Incoterms: Choose appropriate Incoterms for international transactions, considering their impact on duty calculations.

Leverage Technology: Utilize customs management software to help calculate duties accurately and track changes in regulations.

Plan for Variability: Factor in potential fluctuations in duty amounts due to freight cost changes when budgeting for imports.

Seek Rulings: For complex cases, consider requesting advance rulings from customs authorities to clarify how freight will be treated in duty calculations.

Understanding when freight is included in customs duty calculations is crucial for accurate cost estimation and compliance in international trade. The treatment of freight can vary significantly between countries and even between different types of transactions or goods within the same country. Importers must remain vigilant and adaptable, constantly updating their knowledge and practices to navigate this complex aspect of global commerce effectively.

How does the CIF method affect customs duty?

![]()

The Cost, Insurance, and Freight (CIF) method is a widely used approach in international trade for determining the customs value of imported goods. This method significantly impacts customs duty calculations and, consequently, the overall cost of importing goods. Understanding how CIF affects customs duty is crucial for importers, exporters, and customs professionals.

Definition of CIF

CIF stands for Cost, Insurance, and Freight. Under this Incoterm (International Commercial Term), the seller is responsible for:

- The cost of goods

- Insurance for the shipment

- Freight charges to the destination port

The buyer takes responsibility for the goods once they arrive at the port of destination.

CIF and Customs Valuation

When a country uses the CIF method for customs valuation, the dutiable value of imported goods includes:

- The price paid for the goods (Cost)

- The insurance premium paid to cover the goods during transit (Insurance)

- The transportation costs to the port of importation (Freight)

This comprehensive valuation basis typically results in a higher dutiable value compared to methods that exclude freight and insurance costs.

Impact on Customs Duty

The use of the CIF method has several significant effects on customs duty:

Higher Dutiable Value: By including insurance and freight costs, the CIF method increases the base value on which duty is calculated. This typically leads to higher duty payments compared to methods that exclude these costs.

Increased Predictability: CIF provides a more comprehensive and standardized approach to valuation, potentially reducing disputes over the inclusion or exclusion of certain costs.

Simplified Calculations: For customs authorities, the CIF method can simplify the valuation process as it includes all major costs in a single package.

Influence on Trade Decisions: The use of CIF can impact decisions on shipping methods, insurance coverage, and even supplier selection, as all these factors contribute to the dutiable value.

Example Calculation

To illustrate the impact of the CIF method on customs duty, let’s consider an example:

Scenario: Importing electronics from China to a country using the CIF method for valuation.

| Component | Cost |

|---|---|

| Cost of Goods | $10,000 |

| Insurance | $200 |

| Freight | $800 |

| Total CIF Value | $11,000 |

Assuming a customs duty rate of 5%:

Duty under CIF method: $11,000 × 5% = $550

If the same country were to use a method excluding insurance and freight (similar to FOB):

Duty under FOB-like method: $10,000 × 5% = $500

The difference of $50 in this example demonstrates how the CIF method can lead to higher duty payments.

Advantages of the CIF Method

Comprehensive Valuation: CIF provides a more complete picture of the true cost of importing goods.

Standardization: It offers a standardized approach that can simplify international trade procedures.

Revenue Generation: For governments, CIF typically results in higher duty collection, contributing more to national revenues.

Fairness in Competition: By including all costs up to the point of importation, CIF can create a more level playing field for domestic producers competing with imports.

Challenges and Considerations

While the CIF method offers several advantages, it also presents certain challenges:

Higher Import Costs: The inclusion of freight and insurance in the dutiable value canChallenges and Considerations

While the CIF method offers several advantages, it also presents certain challenges:

Higher Import Costs: The inclusion of freight and insurance in the dutiable value can lead to significantly higher import costs for businesses. This is particularly impactful for low-margin industries where every dollar counts.

Complexity in Pricing: Sellers may need to adjust their pricing strategies to account for the additional costs associated with CIF, which could complicate negotiations and contracts.

Insurance Variability: The cost of insurance can vary widely depending on the type of goods and their value, leading to unpredictable duty amounts.

Regulatory Compliance: Importers must ensure that they accurately declare all costs associated with CIF to avoid penalties or disputes with customs authorities.

Best Practices for Importers Using CIF

To effectively navigate the complexities of CIF and its impact on customs duty, importers should consider the following best practices:

-

Accurate Cost Assessment: Ensure that all components of the CIF value are accurately calculated and documented, including freight and insurance costs.

-

Negotiate Terms Wisely: When negotiating contracts with suppliers, consider the implications of CIF versus other Incoterms like FOB or DDP to optimize costs.

-

Monitor Insurance Options: Explore various insurance providers to find competitive rates that can help reduce overall CIF costs.

-

Stay Informed on Regulations: Keep abreast of changes in customs regulations that may affect how CIF is treated in duty calculations.

-

Utilize Customs Brokers: Work with experienced customs brokers who can assist in navigating the complexities of CIF valuations and ensure compliance with local regulations.

Understanding how the CIF method affects customs duty is essential for importers looking to manage their costs effectively. By being aware of the implications of this valuation method, businesses can make informed decisions that align with their financial goals while ensuring compliance with international trade regulations.

What is the FOB method and how does it impact duty?

The Free on Board (FOB) method is another critical Incoterm used in international trade, influencing how customs duties are calculated for imported goods. Understanding FOB is essential for importers and exporters alike, as it determines responsibility for costs and risks associated with shipping goods across borders.

Definition of FOB

FOB stands for Free on Board, which indicates that the seller is responsible for all costs and risks up to the point where the goods are loaded onto a vessel at the port of shipment. Once the goods are on board, the responsibility shifts to the buyer. This distinction is crucial for determining how customs duties are calculated.

How FOB Affects Customs Valuation

Under the FOB method, only the cost of goods is typically included in the customs value for duty calculation. Freight and insurance costs incurred after loading are not included in this valuation. This difference can significantly impact duty payments compared to methods like CIF.

Impact on Customs Duty

The use of FOB has several implications for customs duty calculations:

-

Lower Dutiable Value: Since freight and insurance are excluded from the dutiable value under FOB, this often results in lower customs duties compared to CIF.

-

Cost Control for Buyers: Buyers can negotiate freight and insurance separately, allowing them more control over these expenses and potentially leading to cost savings.

-

Simplified Pricing Structure: FOB provides a clearer pricing structure as it separates product costs from shipping expenses, making it easier for buyers to understand total landed costs.

-

Flexibility in Shipping Arrangements: Buyers have greater flexibility in choosing their preferred shipping methods and carriers without impacting their customs duties directly.

Example Calculation

To illustrate how FOB affects customs duty calculations, consider a scenario where an importer purchases machinery from Germany:

| Component | Cost |

|---|---|

| Cost of Goods | $50,000 |

| Freight (not included) | $2,000 |

| Insurance (not included) | $500 |

| Total FOB Value | $50,000 |

Assuming a customs duty rate of 5%:

Duty under FOB method: $50,000 × 5% = $2,500

In contrast, if using a CIF method where freight and insurance were included:

Total CIF Value would be $52,500 ($50,000 + $2,000 + $500), leading to a duty payment of $2,625.

This example highlights how using FOB can lead to lower customs duties compared to CIF due to its exclusion of shipping-related costs from the dutiable value.

Advantages of Using FOB

-

Cost Efficiency: Importers can potentially save money on customs duties due to lower dutiable values.

-

Negotiating Power: Buyers have more leverage when negotiating shipping terms since they control freight arrangements post-loading.

-

Transparency in Costs: Clear separation between product cost and shipping expenses enhances transparency in pricing.

-

Reduced Risk Exposure: Buyers assume responsibility only after goods are loaded onto the vessel, minimizing risk during transit before that point.

Challenges Associated with FOB

-

Responsibility Shift: Once goods are loaded onto a vessel, any damage or loss during transit becomes the buyer’s responsibility.

-

Complex Logistics Management: Buyers must manage logistics independently post-loading, which can complicate supply chain operations.

-

Potential Higher Freight Costs: Buyers may face higher freight charges if they do not have established relationships with carriers or if they lack volume discounts.

-

Customs Compliance Risks: Importers must ensure they comply with all regulations regarding valuation at their own risk once they take responsibility for shipping.

Best Practices for Importers Using FOB

-

Negotiate Favorable Terms: Work closely with suppliers to negotiate favorable FOB terms that benefit both parties.

-

Understand Responsibilities Clearly: Ensure clarity on responsibilities before and after loading to avoid disputes later.

-

Establish Reliable Shipping Partnerships: Develop relationships with trusted freight forwarders or carriers who can offer competitive rates.

-

Maintain Accurate Documentation: Keep detailed records of all transactions related to FOB shipments for compliance purposes.

-

Stay Updated on Regulations: Regularly review changes in international trade regulations that may affect customs duties under FOB terms.

The Free on Board (FOB) method significantly impacts how customs duties are calculated by excluding freight and insurance from dutiable values. This approach offers advantages such as lower duty payments but also comes with challenges related to risk management and logistics control. By understanding these dynamics, importers can make informed decisions that optimize their international trade operations while ensuring compliance with relevant regulations.

How do different countries handle freight in customs duty?

The treatment of freight costs in customs duty calculations varies significantly across countries due to differing regulations and practices within international trade frameworks. Understanding these differences is crucial for importers operating in multiple markets or considering expansion into new regions.

General Trends in Customs Duty Treatment

Countries typically adopt one of two primary methods—CIF or FOB—to determine how freight is handled in customs duty calculations:

-

CIF Methodology: Many countries include freight (and often insurance) in calculating dutiable value under this method.

-

FOB Methodology: Some countries exclude freight from dutiable values under this approach, focusing solely on the cost of goods.

Country-Specific Practices

Here’s an overview of how different countries handle freight in relation to customs duties:

United States

- The U.S. primarily uses an FOB-like approach where only the cost of goods is considered for calculating customs duties.

- Freight charges incurred after loading onto a vessel are not included in dutiable values.

- This practice allows importers greater control over shipping arrangements but requires careful management of logistics post-loading.

European Union

- Many EU member states follow a CIF approach where both freight and insurance are included in determining dutiable values.

- This results in higher overall import costs due to increased duty payments based on comprehensive valuations.

- Importers must be diligent about declaring accurate values that reflect all associated shipping costs.

Canada

- Canada generally adopts a mixed approach; however, it often aligns more closely with an FOB methodology similar to that used by the U.S.

- Freight charges incurred after loading typically do not factor into dutiable values.

- Importers benefit from lower duty payments but must manage logistics independently once goods leave the seller’s premises.

Australia

- Australia tends toward a CIF methodology where both freight and insurance are included in calculating dutiable values.

- This practice leads to higher overall import costs but provides clarity about total expenses associated with imports.

- Importers must ensure compliance by accurately reporting all relevant shipping costs when declaring goods at customs.

China

- China primarily utilizes a CIF approach; thus, both freight and insurance are included when calculating dutiable values.

- Importers face higher duties due to this comprehensive valuation method but benefit from streamlined processes as all major costs are accounted for upfront.

- Accurate documentation is essential for compliance when importing into China under these regulations.

Implications for Importers

The varying treatment of freight in customs duty calculations across countries has several implications:

-

Cost Variability: Importers must account for differing duty amounts based on whether freight is included or excluded from valuations when planning budgets.

-

Logistics Strategy Adjustments: Depending on country practices, importers may need different logistics strategies—especially when managing responsibilities related to shipping arrangements post-loading.

-

Regulatory Compliance Complexity: Navigating multiple regulatory environments requires careful attention to detail regarding how each country treats freight costs within its customs framework.

-

Negotiation Leverage Variations: The ability to negotiate favorable terms may differ based on whether sellers include shipping costs upfront or if buyers have control over those expenses post-loading.

Best Practices for Global Importers

To effectively manage differences in how countries handle freight concerning customs duties, global importers should consider these best practices:

-

Research Country Regulations Thoroughly: Understand specific customs regulations related to freight treatment before entering new markets or expanding operations internationally.

-

Engage Local Experts or Brokers: Work with local customs brokers who possess expertise regarding regional practices and can provide guidance tailored to specific markets.

-

Maintain Comprehensive Documentation: Keep detailed records of all transactions related to imports—including invoices reflecting accurate cost breakdowns—to facilitate compliance during audits or inspections.

-

Adapt Logistics Strategies Accordingly: Tailor logistics strategies based on each country’s practices regarding freight treatment; consider using different Incoterms where advantageous.

-

Implement Technology Solutions for Compliance Management: Utilize software solutions designed specifically for managing international trade compliance efficiently across various jurisdictions.

Understanding how different countries handle freight concerning customs duties is essential for effective international trade management. By recognizing these differences and adapting strategies accordingly, businesses can optimize their operations while ensuring compliance with local regulations governing imports across diverse markets.

What are the cost implications for importers?

Importing goods involves various costs beyond just purchasing products; understanding these financial implications is crucial for businesses engaged in international trade. Among these costs are customs duties influenced by factors such as valuation methods (CIF vs. FOB), shipping arrangements, regulatory requirements, and additional fees associated with logistics management.

Breakdown of Costs Associated with Importing

When assessing cost implications for importers, it’s essential first to understand the various components involved:

- Customs Duties

- Based on dutiable value (CIF vs. FOB)

- Varies by country-specific regulations

-

Can significantly impact overall import expenses

-

Freight Charges

- Costs associated with transporting goods from origin to destination

- Influenced by distance, mode of transport (air vs sea), cargo type

-

May include additional surcharges based on fuel prices or peak seasons

-

Insurance Costs

- Premiums paid to cover potential loss/damage during transit

- Varies based on cargo value/type

-

Often required by lenders or buyers as part of contractual agreements

-

Customs Brokerage Fees

- Charges incurred when utilizing third-party services for navigating complex customs procedures

- Essential for ensuring compliance with local regulations

-

Can vary significantly depending on service providers

-

Handling Fees

- Terminal handling charges at ports/airports

- Costs incurred during loading/unloading operations

-

Typically charged per container or shipment basis

-

Inland Transportation Costs

- Expenses related to moving goods from ports/airports inland

- Varies based on distance traveled and mode used (trucking vs rail)

-

Often overlooked but critical when budgeting total landed cost

-

Miscellaneous Charges

- Additional fees such as storage charges at ports/warehouses

- Security surcharges imposed during times of heightened security concerns

- Other unforeseen expenses that may arise throughout shipping process

Financial Implications Based on Valuation Methods

The choice between using CIF or FOB directly affects overall importing expenses due primarily due its influence over calculated duties:

Cost Implications Under CIF Methodology

- Higher Dutiable Values:

-

Including both freight & insurance leads directly into increased base amounts upon which duties assessed—resulting often higher total payment obligations upon clearance through Customs Authorities

-

Increased Cash Flow Requirements:

-

Importers may need larger upfront capital reserves available since total landed cost rises considerably under this structure

-

Budgeting Challenges:

-

Fluctuations within market rates concerning transportation/insurance create unpredictability—making accurate forecasting difficult

-

Potential Competitive Disadvantage:

- Higher overall expenses could hinder competitiveness against domestic producers who do not face similar burdensome tariffs/duties

Cost Implications Under FOB Methodology

1.Lower Dutiable Values:

– Excluding transportation-related expenses reduces taxable amounts—resulting typically lower overall payment obligations upon clearance through Customs Authorities

2.Greater Control Over Shipping Arrangements:

– Buyers maintain flexibility negotiating separate contracts ensuring optimal rates—potentially leading significant savings

3.Simplified Budgeting Processes:

– Clear separation between product pricing & logistical expenditures allows easier forecasting & planning

4.Potential Risk Exposure Post-Shipment:

– While initial savings exist through lower duties—responsibility shifts entirely upon loading; any damage/loss becomes buyer’s liability thereafter

Strategies for Managing Cost Implications

To mitigate financial impacts associated with importing goods globally—companies should consider implementing effective strategies:

1.Stay Informed About Regulatory Changes:

– Regularly review updates regarding tariff structures & regulatory shifts affecting imports within target markets

2.Negotiate Favorably With Suppliers:

– Leverage relationships ensuring optimal pricing structures inclusive/exclusive transport arrangements aligned best interests

3.Utilize Technology Solutions:

– Invest resources into software designed specifically managing logistics efficiently across various jurisdictions

4.Develop Strong Partnerships With Freight Forwarders:

– Establish reliable partnerships allowing access competitive rates while ensuring smooth transitions throughout entire supply chain

5.Monitor Market Trends Closely:

– Keep abreast fluctuations impacting transportation/insurance pricing enabling proactive decision-making around shipments

Understanding cost implications associated with importing goods plays an essential role within successful international trade operations; by recognizing key components influencing overall expenses—businesses can develop effective strategies optimizing profitability while maintaining compliance necessary navigate complex landscape global commerce successfully .

How can importers optimize their customs duty and freight expenses?

Optimizing customs duty and freight expenses is critical for businesses engaged in international trade seeking competitive advantages while maintaining profitability margins amidst fluctuating market conditions . By implementing strategic approaches tailored specifically towards reducing these financial burdens , companies can enhance operational efficiency , improve cash flow management ,and ultimately drive growth opportunities within global markets .

Strategies For Optimizing Customs Duty Expenses

1.Understand Valuation Methods Thoroughly :

– Familiarize yourself thoroughly about applicable valuation methods (CIF vs.FOB) utilized respective target markets ; assess potential impacts each option will have upon overall imported good’s final landed cost .

2.Evaluate Tariff Classification :

– Ensure accurate tariff classification assigned imported products based upon Harmonized System codes ; incorrect classifications may lead unnecessary overpayment obligations resulting penalties .

3.Explore Trade Agreements :

– Investigate available free trade agreements (FTAs) applicable specific regions/countries ; leveraging preferential tariff rates could significantly reduce overall duty liabilities .

4.Request Advance Rulings :

– Seek advance rulings from relevant authorities clarifying treatment certain aspects concerning classification , valuation ,or origin status prior shipment arrival ; this proactive measure helps mitigate risks non-compliance penalties later down line .

5.Maintain Accurate Documentation :

– Keep comprehensive records related transactions including invoices reflecting itemized breakdowns relevant cost components ; proper documentation ensures transparency during audits/compliance checks facilitating smoother clearance processes .

Strategies For Optimizing Freight Expenses

1.Negotiate Favorable Shipping Contracts :

– Develop strong relationships established carriers/freight forwarders allowing negotiation better pricing structures based volume commitments made regularly .

2.Consolidate Shipments :

– Combine smaller shipments into full container loads whenever possible reducing per-unit shipping costs ; this approach maximizes utilization container space while minimizing transportation fees incurred .

3.Select Appropriate Transportation Modes :

– Evaluate different modes available depending urgency/cost considerations ; airfreight might be quicker but often comes at premium compared sea-freight options which typically offer greater economies scale .

4.Monitor Fuel Surcharges :

– Stay informed about fluctuations fuel prices impacting transportation rates ; proactively adjust budgets accordingly mitigating unexpected increases incurred due surcharges imposed carriers .

5.Utilize Technology Solutions :

– Leverage digital platforms designed specifically managing logistics effectively tracking shipments throughout entire journey providing real-time insights enhancing decision-making processes .

6.Plan Shipments Strategically :

– Avoid peak seasons/high-demand periods when possible since increased demand usually leads higher rates charged carriers ; planning ahead allows better control over timing/costs associated imports .

7.Review Insurance Options Regularly :

– Compare various providers offering cargo insurance policies ensuring competitive premiums without compromising coverage quality protecting against potential losses/damages incurred during transit .

8.Assess Last-Mile Delivery Solutions :

– Evaluate last-mile delivery options carefully considering efficiency/cost-effectiveness ; partnering reliable local couriers could streamline processes reducing delays experienced final stages shipment arrival .

By implementing these strategies tailored towards optimizing both custom duties &freight expenses ,importer’s position themselves advantageously navigating complex landscape international trade effectively while maximizing profitability opportunities available . Staying informed about changing regulations coupled proactive planning enables businesses remain competitive amidst evolving market dynamics driving long-term growth success globally .