How Are Packages Processed Through Customs

What happens when a package arrives at customs?

When an international package arrives at the destination country, it must go through customs clearance before it can be delivered to the recipient. The process typically involves the following steps:

-

The package is transported to the customs facility at the port of entry (e.g., airport, seaport, or land border crossing) by the shipping carrier.

-

Customs officials review the shipping documents (e.g., commercial invoice, packing list, and airway bill) to determine the contents, value, and origin of the package.

-

The package may be selected for further inspection based on risk assessment criteria, such as the type of goods, country of origin, or importer history.

-

If the package is selected for inspection, customs officials may open it and physically examine the contents.

-

Customs duties and taxes are calculated based on the value and type of goods, and the importer (either the recipient or the shipping carrier) is responsible for paying these fees.

-

Once the package clears customs, it is released to the shipping carrier for delivery to the recipient.

The entire customs clearance process can take anywhere from a few hours to several weeks, depending on the complexity of the shipment, the volume of packages being processed, and any issues that may arise during the review process.

How are customs documents reviewed and processed?

Customs documents are reviewed and processed to ensure compliance with import regulations and to assess any applicable duties and taxes. The key documents involved in the customs clearance process include:

- Commercial invoice: This document lists the items in the shipment, their value, and the terms of sale.

- Packing list: This document details the contents of each package in the shipment.

- Airway bill or bill of lading: This document serves as the contract of carriage between the shipper and the carrier.

When a package arrives at customs, the shipping documents are reviewed to verify the accuracy and completeness of the information provided. This includes:

- Confirming the identity of the shipper and recipient

- Verifying the description and quantity of goods

- Ensuring the declared value matches the actual value of the goods

- Checking for any prohibited or restricted items

If the documents are incomplete or contain errors, customs officials may request additional information or documentation from the importer or shipper. In some cases, the package may be held until the necessary information is provided.

Once the documents are reviewed and any issues are resolved, customs officials use the information to determine the appropriate tariff classification and calculate any applicable duties and taxes.

What methods are used to assess risk in package screening?

Customs authorities use various methods to assess the risk associated with incoming packages and determine which ones require further inspection. These methods include:

-

Risk profiling: Customs officials analyze data on the shipper, recipient, contents, and origin of the package to identify potential risks.

-

Targeting and selectivity criteria: Customs authorities develop specific criteria to identify high-risk packages based on factors such as the type of goods, country of origin, and importer history.

-

Intelligence gathering: Customs officials collect and analyze information from various sources, including law enforcement agencies, to identify potential threats and emerging trends.

-

Automated targeting systems: Many customs authorities use computer systems that analyze shipment data and assign risk scores to packages based on predefined algorithms.

-

Random sampling: Customs officials may randomly select a percentage of packages for inspection to ensure compliance and identify any potential risks that may have been missed by other screening methods.

-

Advance electronic data: Customs authorities require advance electronic data on the contents and origin of packages to conduct risk assessments before the shipment arrives at the port of entry.

By using a combination of these methods, customs authorities aim to strike a balance between facilitating legitimate trade and ensuring the safety and security of the public.

How are duties and taxes calculated for imported packages?

Customs duties and taxes are calculated based on the value and type of goods being imported. The specific rates and methods used to calculate these fees vary by country, but generally follow these principles:

-

Tariff classification: Customs officials assign a tariff code to the goods based on their description and composition. These codes correspond to specific duty rates.

-

Customs value: The customs value is the basis for calculating duties and taxes. It typically includes the price paid for the goods, plus any costs associated with shipping and insurance.

-

Duty rates: Each tariff code has a corresponding duty rate, which is applied to the customs value to determine the amount of duty owed. Duty rates can vary based on the type of goods, country of origin, and trade agreements.

-

Sales tax or value-added tax (VAT): In addition to customs duties, many countries also charge a sales tax or VAT on imported goods. These taxes are calculated as a percentage of the customs value plus any applicable duties.

-

Excise taxes: Certain goods, such as alcohol, tobacco, and fuel, may be subject to additional excise taxes based on their quantity or value.

-

De minimis value: Many countries have a de minimis value threshold, below which no duties or taxes are charged. This threshold varies by country and can range from $0 to $800 or more.

To illustrate the calculation, let’s consider a package containing a $100 shirt imported into a country with a 10% duty rate and a 15% sales tax:

| Item | Value |

|---|---|

| Shirt | $100 |

| Shipping | $20 |

| Customs Value | $120 |

| Duty (10%) | $12 |

| Sales Tax (15%) | $19.80 |

| Total Fees | $31.80 |

In this example, the importer would be required to pay $31.80 in customs duties and sales tax before the package can be released from customs.

What are the steps in physical examination of packages?

When a package is selected for physical inspection by customs officials, the process typically involves the following steps:

-

Identification: The package is identified and separated from the rest of the shipment for further examination.

-

Documentation review: Customs officials review the shipping documents to verify the contents and value of the package.

-

X-ray scanning: The package may be scanned using X-ray technology to detect any anomalies or hidden items.

-

Physical search: If necessary, the package is opened, and its contents are physically examined by customs officials.

-

Sampling: For certain types of goods, such as food or pharmaceuticals, customs officials may take samples for further testing or analysis.

-

Repackaging: After the inspection is complete, the package is carefully repackaged to ensure its integrity and prevent any damage.

-

Clearance: If no issues are found during the inspection, the package is cleared for release to the shipping carrier for delivery to the recipient.

The physical examination process can be time-consuming and may cause delays in the delivery of the package. However, it is a necessary step to ensure compliance with import regulations and to protect the public from any potential risks associated with the imported goods.

How do customs handle different types of shipments?

Customs authorities handle different types of shipments based on their specific characteristics and the potential risks associated with them. Here are some examples of how customs handle various types of shipments:

Express shipments

Express shipments, such as those delivered by courier services like FedEx or DHL, are typically processed through a separate channel from regular mail. These shipments are often subject to expedited clearance procedures, but may still be selected for further inspection based on risk assessment criteria.

Perishable goods

Perishable goods, such as fresh produce or live animals, are given priority treatment by customs to minimize delays and ensure their timely delivery. These shipments may be subject to additional inspections to ensure compliance with food safety and animal health regulations.

Bulk shipments

Bulk shipments, such as those containing raw materials or industrial equipment, are often processed differently than smaller, individual packages. These shipments may be subject to more detailed documentation review and physical inspection to ensure accuracy and compliance with import regulations.

Prohibited and restricted items

Certain items, such as weapons, drugs, or counterfeit goods, are prohibited from being imported into the country. Others, such as alcohol, tobacco, or certain types of wildlife, may be subject to restrictions and additional documentation requirements. Customs officials are responsible for identifying and seizing these items to protect the public and ensure compliance with the law.

Personal effects

Personal effects, such as household goods or personal belongings, are typically subject to less stringent clearance procedures than commercial shipments. However, they may still be subject to inspection and may be subject to duties and taxes depending on the value and contents of the shipment.

By handling different types of shipments based on their specific characteristics and potential risks, customs authorities aim to facilitate legitimate trade while ensuring the safety and security of the public.

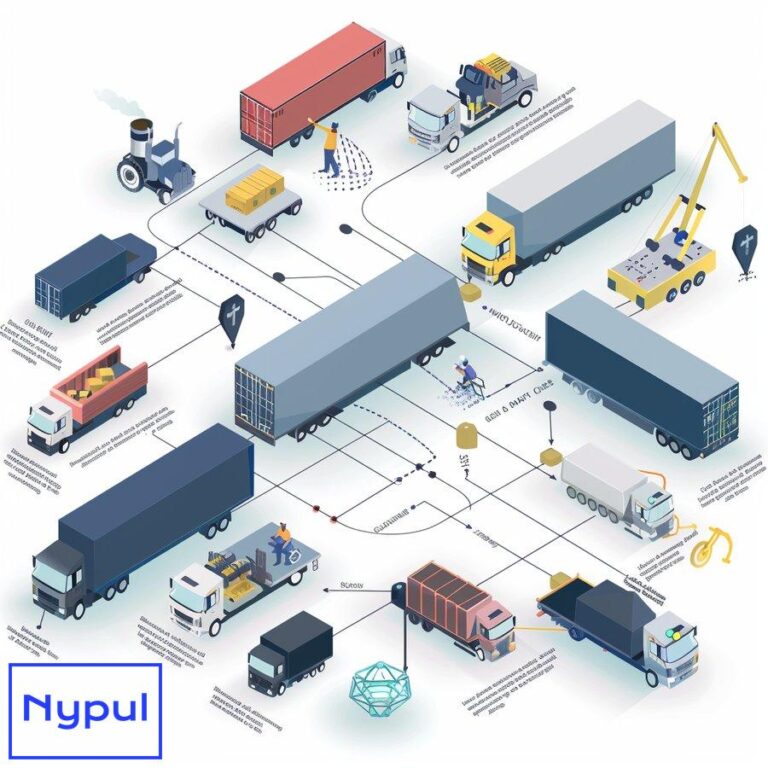

What role does technology play in customs processing?

Technology plays a crucial role in modernizing and streamlining customs processing. Here are some examples of how technology is used in customs processing:

-

Automated targeting systems: Many customs authorities use computer systems that analyze shipment data and assign risk scores to packages based on predefined algorithms.

-

X-ray and scanning technology: Customs officials use advanced X-ray and scanning technology to inspect packages for hidden items or anomalies without physically opening them.

-

Radio frequency identification (RFID): RFID tags are used to track and monitor shipments as they move through the supply chain, providing real-time data on the location and status of each package.

-

Blockchain technology: Blockchain technology is being explored by some customs authorities to create secure, transparent, and tamper-proof records of trade transactions and shipment data.

-

Artificial intelligence and machine learning: AI and machine learning algorithms are being used to analyze large volumes of data and identify patterns and trends that may indicate potential risks or fraudulent activity.

-

Electronic data interchange (EDI): EDI systems are used to exchange shipment data electronically between customs authorities, shipping carriers, and importers, reducing paperwork and streamlining the clearance process.

-

Single window systems: Single window systems allow importers and exporters to submit all required documentation and information through a single electronic portal, simplifying the customs clearance process.

By leveraging technology, customs authorities are able to process shipments more efficiently, identify potential risks more effectively, and facilitate legitimate trade while ensuring compliance with import regulations.