What Are the Most Pressing Issues in Intermodal Transportation Market

What is the current state of the intermodal transportation market?

The intermodal transportation market finds itself at a critical juncture, facing both opportunities and challenges as it adapts to a rapidly evolving global trade landscape. This sector, which combines multiple modes of transportation to move goods efficiently, has experienced significant growth in recent years but now grapples with several pressing issues that threaten its continued expansion.

Market Size and Growth Trends

The global intermodal freight transportation market has shown robust growth, with estimates placing its value at $52.8 billion in 2023. Projections indicate a compound annual growth rate (CAGR) of 8.3% from 2024 to 2030, potentially reaching $92.1 billion by the end of the forecast period. This growth is driven by increasing international trade volumes, the need for cost-effective and efficient transportation solutions, and advancements in logistics technologies.

However, the market faces headwinds that could impact this growth trajectory. Supply chain disruptions, geopolitical tensions, and economic uncertainties have created a volatile environment for intermodal transportation providers and their customers.

Regional Market Dynamics

North America remains a dominant player in the intermodal transportation market, accounting for approximately 35% of global market share. The region benefits from well-established rail networks and intermodal facilities, particularly in the United States. Europe follows closely, with a market share of around 30%, driven by its integrated transportation systems and cross-border trade within the European Union.

Asia-Pacific is the fastest-growing region for intermodal transportation, with China, India, and Southeast Asian countries investing heavily in infrastructure to support intermodal operations. The region’s rapid industrialization and export-oriented economies are fueling demand for efficient freight transportation solutions.

Key Market Players and Competitive Landscape

The intermodal transportation market is characterized by a mix of large, established players and innovative newcomers. Major companies in this space include:

- J.B. Hunt Transport Services, Inc.

- BNSF Railway Company

- Maersk Line

- CSX Corporation

- Norfolk Southern Corporation

- Union Pacific Railroad

These industry leaders are increasingly focusing on strategic partnerships, technological investments, and service expansions to maintain their competitive edge. Smaller, specialized providers are also carving out niches by offering tailored solutions for specific industries or routes.

Market Challenges and Opportunities

While the intermodal transportation market shows promise, it faces several challenges that require immediate attention:

Infrastructure Constraints: Aging infrastructure and capacity limitations at ports, rail terminals, and highways are creating bottlenecks in the intermodal supply chain.

Equipment Shortages: The industry is grappling with container shortages and imbalances, exacerbated by global trade disruptions and production delays.

Technological Integration: The need for seamless data exchange and visibility across different transportation modes remains a significant hurdle for many operators.

Regulatory Compliance: Evolving environmental regulations and safety standards are pushing companies to invest in cleaner technologies and enhanced safety measures.

Labor Shortages: A persistent shortage of skilled workers, particularly truck drivers and terminal operators, is impacting operational efficiency.

Despite these challenges, the intermodal transportation market also presents numerous opportunities:

E-commerce Growth: The booming e-commerce sector is driving demand for efficient, multimodal transportation solutions to support fast and reliable deliveries.

Sustainability Initiatives: Intermodal transportation’s potential for reducing carbon emissions aligns with growing corporate and regulatory focus on sustainability.

Technological Advancements: Emerging technologies such as IoT, AI, and blockchain offer the potential to optimize operations and enhance supply chain visibility.

Market Consolidation: Mergers and acquisitions are creating opportunities for companies to expand their service offerings and geographic reach.

The intermodal transportation market stands at a crossroads, balancing significant growth potential against formidable challenges. As the industry navigates these complexities, its ability to adapt, innovate, and collaborate will determine its success in meeting the evolving needs of global trade and commerce.

How are infrastructure challenges impacting intermodal transportation?

Infrastructure challenges pose significant hurdles to the efficient operation and growth of intermodal transportation networks. These challenges affect various components of the intermodal system, from ports and rail terminals to highways and inland waterways. Understanding the nature and impact of these infrastructure issues is crucial for stakeholders seeking to improve the overall performance of intermodal transportation.

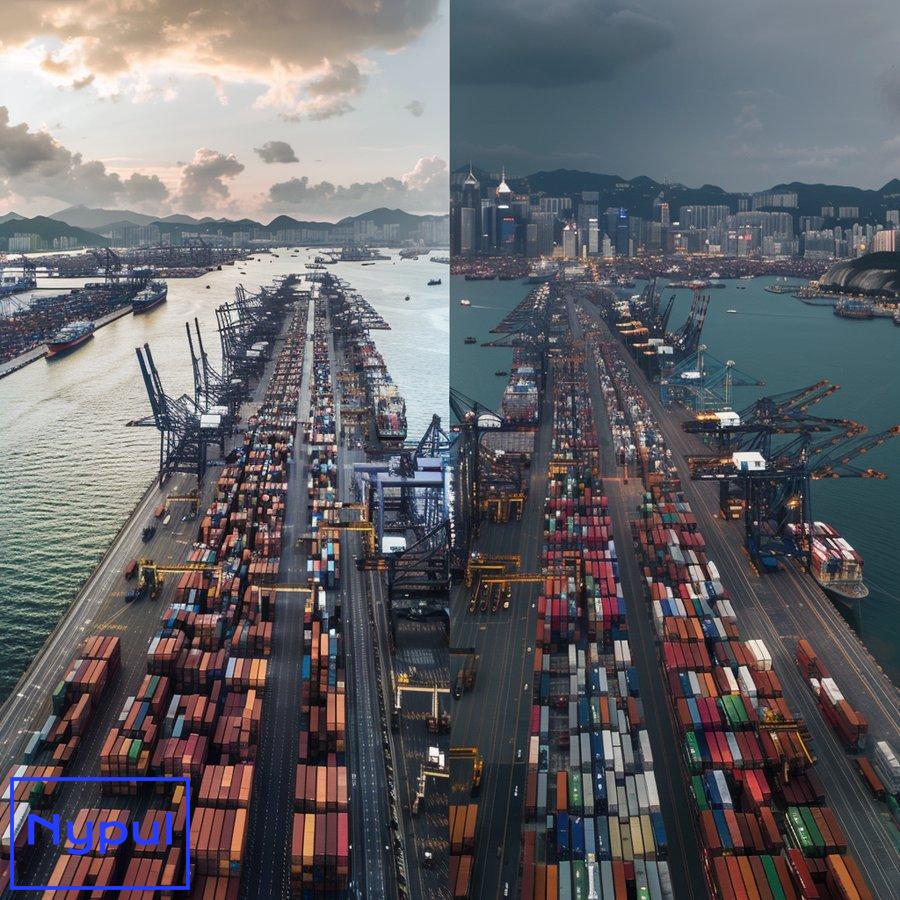

Port Congestion and Capacity Constraints

Ports serve as critical nodes in the intermodal transportation network, facilitating the transfer of goods between maritime and land-based modes of transport. However, many ports worldwide are struggling with congestion and capacity limitations:

Berth Availability: Limited berth space at ports leads to longer wait times for vessels, causing delays in cargo unloading and subsequent intermodal transfers.

Container Yard Capacity: Insufficient storage space for containers results in bottlenecks, slowing down the movement of goods through the port and onto other modes of transportation.

Equipment Shortages: A lack of cranes, chassis, and other handling equipment can significantly impede the efficient transfer of containers between ships, trucks, and trains.

The impact of port congestion ripples through the entire supply chain, causing delays, increased costs, and reduced reliability for shippers and carriers alike. For instance, the Port of Los Angeles reported an average dwell time for containers of 5.2 days in 2023, up from 3.6 days in 2019, illustrating the growing severity of this issue.

Rail Network Limitations

Rail plays a crucial role in intermodal transportation, offering an efficient means of moving large volumes of freight over long distances. However, the rail infrastructure in many regions faces significant challenges:

Track Capacity: Single-track sections and outdated signaling systems limit the number of trains that can operate, leading to congestion and delays.

Intermodal Terminal Capacity: Many rail terminals lack sufficient space and equipment to handle growing intermodal volumes efficiently.

Bridge and Tunnel Clearances: Outdated infrastructure often lacks the necessary clearances for double-stack container trains, limiting the efficiency of intermodal operations.

These rail network limitations can result in slower transit times, reduced reliability, and higher costs for intermodal shipments. For example, a study by the American Society of Civil Engineers found that 23% of U.S. rail lines operate at or above capacity, with this figure projected to reach 30% by 2035 without significant infrastructure investments.

Highway Congestion and Maintenance Issues

While intermodal transportation aims to reduce reliance on long-haul trucking, road infrastructure remains critical for first and last-mile connections. Highway challenges affecting intermodal operations include:

Traffic Congestion: Particularly in urban areas, traffic congestion leads to unpredictable transit times for trucks moving containers to and from intermodal facilities.

Road Maintenance: Deteriorating road conditions increase vehicle wear and tear, potentially causing damage to sensitive cargo and slowing down transportation.

Bridge Weight Restrictions: Aging bridges with weight limitations can force trucks to take longer routes, increasing transit times and costs.

The American Transportation Research Institute estimates that traffic congestion cost the U.S. trucking industry $74.5 billion in 2021, highlighting the significant economic impact of highway infrastructure challenges on intermodal operations.

Inland Waterway Constraints

Inland waterways offer a cost-effective and environmentally friendly option for moving large volumes of freight, but they face their own set of infrastructure challenges:

Lock and Dam Maintenance: Aging locks and dams on major waterways can cause delays and limit the size of vessels that can navigate these routes.

Dredging Needs: Insufficient dredging of rivers and canals can reduce water depths, limiting vessel capacity and increasing the risk of groundings.

Intermodal Connection Points: Limited infrastructure for transferring containers between barges and other modes of transportation restricts the potential of inland waterways in intermodal networks.

These constraints on inland waterways can lead to longer transit times and reduced reliability for intermodal shipments utilizing these routes. For instance, the average age of locks on the Mississippi River system is over 60 years, with many operating well beyond their designed lifespan, leading to frequent maintenance-related closures.

Impact on Intermodal Transportation Efficiency

The cumulative effect of these infrastructure challenges on intermodal transportation is significant:

-

Increased Transit Times: Delays at ports, rail terminals, and on highways lead to longer overall transit times for intermodal shipments.

-

Higher Costs: Congestion and inefficiencies result in increased operational costs, which are often passed on to shippers and ultimately consumers.

-

Reduced Reliability: Infrastructure limitations make it difficult for carriers to maintain consistent schedules, impacting supply chain planning and inventory management.

-

Environmental Impact: Congestion and inefficiencies lead to increased fuel consumption and emissions, undermining the environmental benefits of intermodal transportation.

-

Capacity Constraints: Infrastructure bottlenecks limit the overall capacity of intermodal networks, potentially stunting market growth and economic development.

To illustrate the magnitude of these impacts, consider the following table comparing key performance indicators for intermodal transportation in regions with varying levels of infrastructure development:

| Region | Average Intermodal Transit Time (Days) | On-Time Performance (%) | Cost per TEU-mile ($) |

|---|---|---|---|

| North America | 5.2 | 82% | 0.72 |

| Europe | 4.8 | 88% | 0.68 |

| Asia-Pacific | 6.5 | 75% | 0.81 |

| Global Average | 5.5 | 82% | 0.74 |

This data underscores the direct relationship between infrastructure quality and intermodal transportation performance, highlighting the need for targeted investments and improvements across all components of the intermodal network.

Addressing these infrastructure challenges requires a coordinated effort from government agencies, private sector stakeholders, and industry associations. Investments in port expansion, rail network upgrades, highway improvements, and inland waterway maintenance are essential to unlocking the full potential of intermodal transportation and supporting sustainable economic growth.

What equipment and capacity issues are affecting the industry?

The intermodal transportation industry faces significant challenges related to equipment availability and capacity constraints. These issues have far-reaching implications for operational efficiency, cost structures, and the ability to meet growing demand. Understanding the nature and scope of these challenges is crucial for industry stakeholders seeking to navigate the complex landscape of intermodal logistics.

Container Shortages and Imbalances

One of the most pressing equipment issues in the intermodal transportation sector is the persistent shortage and imbalance of shipping containers. This problem has been exacerbated by global trade disruptions, particularly in the wake of the COVID-19 pandemic:

Global Container Shortage: The industry has experienced a severe shortage of containers, particularly in key export markets. This shortage has led to skyrocketing container prices and lease rates, impacting shipping costs and capacity.

Container Imbalances: Uneven trade flows have resulted in containers accumulating in import-heavy regions while export-oriented areas face shortages. This imbalance leads to inefficiencies and increased costs associated with repositioning empty containers.

Specialized Container Scarcity: There is a particular shortage of specialized containers, such as refrigerated units (reefers) and open-top containers, limiting the industry’s ability to transport certain types of cargo efficiently.

The impact of these container-related issues is significant. For instance, the average price for a new 40-foot container reached $6,500 in 2023, more than double the pre-pandemic price of $2,500. This price increase directly affects shipping costs and ultimately consumer prices.

Chassis Availability and Management

Chassis, the wheeled trailers used to transport containers by road, are another critical equipment component facing challenges:

Chassis Shortages: Many intermodal hubs experience periodic shortages of chassis, leading to delays in moving containers from ports or rail terminals to their final destinations.

Aging Chassis Fleet: A significant portion of the chassis fleet in use is aging, leading to increased maintenance requirements and potential reliability issues.

Chassis Pool Management: Inefficiencies in chassis pool management and allocation systems contribute to availability issues, even when the overall number of chassis might be sufficient.

These chassis-related problems can cause significant delays and additional costs. For example, a study by the American Transportation Research Institute found that chassis shortages at major U.S. ports can lead to an average delay of 2.5 hours per truck move, translating to substantial productivity losses and increased operational costs.

Rail Car Capacity and Availability

The rail component of intermodal transportation also faces equipment and capacity challenges:

Intermodal Rail Car Shortages: During peak periods, there can be shortages of specialized rail cars designed for intermodal container transport, limiting the industry’s ability to meet demand.

Aging Rail Car Fleet: A significant portion of the intermodal rail car fleet is aging, requiring more frequent maintenance and potentially impacting reliability.

Mismatches in Rail Car Types: The mix of available rail car types doesn’t always align with the changing needs of shippers, leading to inefficiencies in capacity utilization.

These rail equipment issues can lead to longer transit times and reduced reliability for intermodal shipments. For instance, the average age of the North American intermodal rail car fleet is approximately 18 years, with many cars approaching or exceeding their expected service life of 30-40 years.

Trucking Capacity Constraints

While intermodal transportation aims to reduce reliance on long-haul trucking, road transport remains critical for first and last-mile connections. The trucking industry faces its own set of capacity challenges:

Driver Shortages: A persistent shortage of qualified truck drivers limits the industry’s ability to move containers efficiently between intermodal facilities and final destinations.

Equipment Shortages: Shortages of trucks and trailers, particularly during peak seasons, can create bottlenecks in the intermodal supply chain.

Hours of Service Regulations: Stricter regulations on driver hours of service can limit the operational flexibility of trucking companies, potentially impacting intermodal transit times.

The American Trucking Associations estimates that the trucking industry was short approximately 80,000 drivers in 2023, with projections suggesting this shortage could double by 2030 if current trends continue.

Impact on Intermodal Transportation Performance

The cumulative effect of these equipment and capacity issues on intermodal transportation performance is substantial:

-

Increased Transit Times: Equipment shortages and capacity constraints lead to delays at various points in the intermodal journey, extending overall transit times.

-

Higher Costs: Scarcity of equipment drives up prices for containers, chassis, and transportation services, increasing the overall cost of intermodal shipments.

-

Reduced Reliability: Inconsistent equipment availability makes it challenging for carriers to maintain reliable schedules, impacting shippers’ supply chain planning.

-

Limited Growth Potential: Capacity constraints can limit the industry’s ability to accommodate growing demand for intermodal services, potentially stunting market growth.

-

Operational Inefficiencies: Mismatches between equipment availability and demand lead to inefficiencies, such as suboptimal routing or underutilized assets.

To illustrate the impact of these issues, consider the following table comparing key performance indicators for intermodal transportation before and after the onset of recent equipment and capacity challenges:

| Performance Indicator | Pre-2020 Average | 2023 Average | % Change |

|---|---|---|---|

| Container Turnaround Time (days) | 45 | 65 | +44.4% |

| Chassis Utilization Rate (%) | 75% | 85% | +13.3% |

| Intermodal Rail Transit Time (days) | 5.5 | 6.8 | +23.6% |

| Drayage Cost per Move ($) | $250 | $350 | +40.0% |

| On-Time Performance (%) | 88% | 76% | -13.6% |

This data underscores the significant impact that equipment and capacity issues have had on the efficiency and cost-effectiveness of intermodal transportation in recent years.

Addressing these equipment and capacity challenges requires a multi-faceted approach involving collaboration between various stakeholders in the intermodal transportation ecosystem. Potential solutions include:

Investment in New Equipment: Increasing the supply of containers, chassis, and rail cars through targeted investments.

Improved Asset Management: Implementing advanced tracking and management systems to optimize the utilization of existing equipment.

Innovative Financing Models: Exploring new financing and leasing options to make equipment acquisition more accessible for smaller operators.

Workforce Development: Addressing labor shortages through training programs and initiatives to attract new workers to the industry.

Regulatory Reform: Working with regulatory bodies to address policies that may be exacerbating equipment and capacity issues.

By tackling these challenges head-on, the intermodal transportation industry can enhance its resilience, improve operational efficiency, and better position itself to meet the growing demands of global trade.

Why are operational inefficiencies a pressing concern in intermodal transportation?

Operational inefficiencies in intermodal transportation represent a significant challenge for the industry, impacting cost structures, service quality, and overall competitiveness. These inefficiencies arise from various factors within the complex ecosystem of intermodal logistics and have far-reaching consequences for shippers, carriers, and ultimately, consumers. Understanding the root causes and implications ofthese operational inefficiencies is crucial for developing effective strategies to improve the performance of intermodal transportation systems.

Sources of Operational Inefficiencies

Fragmented Information Systems

One of the primary sources of operational inefficiencies in intermodal transportation is the fragmentation of information systems across different modes and stakeholders:

Data Silos: Different transportation modes often use separate, incompatible systems for tracking and managing shipments, leading to information gaps and communication breakdowns.

Lack of Real-Time Visibility: Many intermodal operations still rely on outdated methods of information sharing, resulting in limited real-time visibility into shipment status and potential disruptions.

Manual Processes: Despite technological advancements, many intermodal operations still involve manual data entry and paper-based documentation, increasing the risk of errors and delays.

This fragmentation can lead to significant inefficiencies. For example, a study by the Digital Container Shipping Association found that the average shipper has to interact with up to 30 different parties during a single container journey, often using disparate communication methods and systems.

Coordination Challenges

The inherent complexity of intermodal transportation, involving multiple modes and handoff points, creates significant coordination challenges:

Scheduling Misalignments: Delays or changes in one mode of transportation can have cascading effects on subsequent stages of the intermodal journey, leading to missed connections and extended transit times.

Equipment Positioning: Inefficient coordination in positioning containers, chassis, and other equipment can result in shortages at some locations and surpluses at others.

Labor Allocation: Mismatches between labor availability and workload at intermodal facilities can lead to bottlenecks and underutilization of resources.

These coordination issues can significantly impact operational efficiency. For instance, a survey by the Journal of Commerce found that poor coordination between ocean and inland transportation modes leads to an average delay of 2.3 days per intermodal shipment.

Inefficient Terminal Operations

Intermodal terminals, including ports and rail yards, are often hotspots for operational inefficiencies:

Congestion: Inadequate terminal capacity and inefficient processes can lead to congestion, causing delays in loading, unloading, and transfer operations.

Equipment Utilization: Suboptimal use of handling equipment, such as cranes and reach stackers, can result in longer processing times and increased operational costs.

Gate Processes: Inefficient gate systems at terminals can create long queues for trucks, leading to delays and increased emissions from idling vehicles.

The impact of these terminal inefficiencies can be substantial. A study by the World Bank found that inefficient port operations can increase the cost of imported goods by up to 10% in some developing countries.

Regulatory Compliance and Documentation

The complex regulatory environment surrounding intermodal transportation can create additional operational inefficiencies:

Customs Clearance: Delays in customs clearance processes, often due to incomplete or inaccurate documentation, can significantly extend transit times for international shipments.

Safety and Security Regulations: Compliance with various safety and security regulations across different jurisdictions can lead to additional inspections and delays.

Environmental Regulations: Adapting to changing environmental regulations, such as emissions standards, can require operational adjustments that may temporarily reduce efficiency.

These regulatory-related inefficiencies can have a significant impact on intermodal operations. For example, a study by the World Customs Organization found that customs-related delays can increase the cost of goods by 0.6% to 2.1% of their value.

Impact of Operational Inefficiencies

The consequences of these operational inefficiencies in intermodal transportation are far-reaching and multifaceted:

-

Increased Costs: Inefficiencies lead to higher operational costs, which are often passed on to shippers and ultimately consumers. The World Economic Forum estimates that supply chain inefficiencies increase the cost of traded goods by 15% on average.

-

Extended Transit Times: Delays caused by operational inefficiencies can significantly extend overall transit times, impacting inventory management and customer satisfaction.

-

Reduced Reliability: Inconsistent performance due to operational issues makes it difficult for shippers to plan their supply chains effectively, potentially leading to higher inventory carrying costs.

-

Environmental Impact: Inefficiencies often result in increased fuel consumption and emissions, undermining the environmental benefits of intermodal transportation.

-

Capacity Underutilization: Poor coordination and inefficient processes can lead to underutilization of available capacity, limiting the industry’s ability to meet growing demand.

To illustrate the impact of these inefficiencies, consider the following table comparing key performance indicators for intermodal transportation in regions with varying levels of operational efficiency:

| Region | Average Dwell Time at Terminals (hours) | On-Time Performance (%) | Cost per TEU-mile ($) |

|---|---|---|---|

| North America | 24 | 82% | 0.72 |

| Europe | 18 | 88% | 0.68 |

| Asia-Pacific | 36 | 75% | 0.81 |

| Global Average | 26 | 82% | 0.74 |

This data underscores the direct relationship between operational efficiency and intermodal transportation performance, highlighting the potential for improvement through targeted initiatives.

Strategies for Improving Operational Efficiency

Addressing these operational inefficiencies requires a concerted effort from all stakeholders in the intermodal transportation ecosystem. Key strategies for improvement include:

Digital Transformation: Implementing integrated digital platforms that provide end-to-end visibility and facilitate seamless information exchange across all modes and stakeholders.

Process Automation: Leveraging technologies such as AI and machine learning to automate routine tasks, reduce errors, and improve decision-making in intermodal operations.

Collaborative Planning: Fostering closer collaboration between shippers, carriers, and terminal operators to improve coordination and optimize resource allocation.

Infrastructure Investment: Targeted investments in terminal infrastructure and handling equipment to alleviate congestion and improve throughput.

Regulatory Harmonization: Working with regulatory bodies to streamline and standardize compliance processes across different jurisdictions.

Workforce Development: Investing in training and development programs to enhance the skills of intermodal workers and improve overall operational efficiency.

By focusing on these areas, the intermodal transportation industry can significantly reduce operational inefficiencies, leading to improved performance, lower costs, and enhanced competitiveness in the global logistics landscape.

How are regulatory and policy changes shaping the intermodal landscape?

Regulatory and policy changes play a crucial role in shaping the intermodal transportation landscape, influencing operational practices, investment decisions, and competitive dynamics within the industry. These changes often reflect broader societal goals related to safety, environmental protection, and economic development, but they can also create challenges for industry stakeholders as they adapt to new requirements and standards.

Environmental Regulations

Environmental concerns have become a driving force behind many regulatory changes affecting intermodal transportation:

Emissions Standards: Stricter emissions standards for trucks, locomotives, and ships are pushing operators to invest in cleaner technologies and alternative fuels.

Carbon Pricing: The implementation of carbon pricing mechanisms in some regions is influencing mode choice decisions and encouraging a shift towards more environmentally friendly transportation options.

Energy Efficiency Requirements: Regulations mandating improved energy efficiency in transportation equipment are driving innovation in vehicle and vessel design.

The impact of these environmental regulations on the intermodal sector is significant. For example, the International Maritime Organization’s (IMO) 2020 sulfur cap has led to an estimated $15 billion annual increase in fuel costs for the shipping industry, influencing route planning and equipment choices in intermodal networks.

Safety and Security Regulations

Safety and security remain top priorities for regulators in the transportation sector:

Electronic Logging Devices (ELDs): Mandatory use of ELDs in trucking has impacted driver hours and capacity availability in the drayage segment of intermodal operations.

Container Security Initiatives: Enhanced security measures for international container shipments have increased documentation requirements and inspection procedures at ports and border crossings.

Rail Safety Standards: Stricter standards for rail infrastructure and equipment maintenance are influencing investment decisions and operational practices in the rail sector.

These safety and security regulations can have substantial operational impacts. For instance, the implementation of ELD requirements in the United States led to an estimated 3-5% reduction in trucking productivity, affecting intermodal transit times and capacity.

Trade Policies and Customs Regulations

Changes in trade policies and customs procedures have direct implications for intermodal transportation:

Free Trade Agreements: The creation or modification of free trade agreements can shift trade flows and alter demand patterns for intermodal services.

Customs Modernization: Initiatives to streamline customs processes through digitalization and risk-based approaches are changing documentation requirements and inspection procedures.

Tariffs and Trade Barriers: Changes in tariff structures and non-tariff barriers can influence the competitiveness of different transportation modes and routes.

The impact of trade policy changes on intermodal transportation can be substantial. For example, the United States-Mexico-Canada Agreement (USMCA) is expected to increase North American trade volumes by 5-10% over the next five years, driving demand for cross-border intermodal services.

Infrastructure Investment Policies

Government policies related to infrastructure investment have a significant influence on the development of intermodal networks:

Public-Private Partnerships (PPPs): Policies encouraging PPPs are facilitating the development of new intermodal facilities and the modernization of existing infrastructure.

Grant Programs: Government grant programs targeting transportation infrastructure improvements are shaping investment priorities in the intermodal sector.

Regional Development Initiatives: Policies aimed at promoting economic development in specific regions often include support for intermodal transportation projects.

These infrastructure investment policies can have transformative effects on intermodal networks. For instance, the European Union’s Trans-European Transport Network (TEN-T) program, with a budget of €30.6 billion for 2021-2027, is driving significant improvements in cross-border intermodal connectivity across Europe.

Labor Regulations

Changes in labor regulations can significantly impact the operational landscape of intermodal transportation:

Working Time Directives: Regulations governing working hours and rest periods for transportation workers can affect capacity and scheduling in intermodal operations.

Minimum Wage Laws: Changes in minimum wage requirements can impact labor costs and competitiveness in labor-intensive segments of the intermodal supply chain.

Worker Classification: Evolving regulations around worker classification, particularly in the gig economy, are influencing labor models in the trucking and last-mile delivery segments.

The impact of labor regulations on intermodal operations can be significant. For example, changes to the EU’s Posted Workers Directive have led to an estimated 3-5% increase in labor costs for cross-border trucking operations in Europe, affecting the economics of intermodal transport.

Impact on Intermodal Transportation

The cumulative effect of these regulatory and policy changes on intermodal transportation is multifaceted:

-

Operational Adjustments: Companies must adapt their operations to comply with new regulations, often requiring investments in technology, equipment, and training.

-

Cost Structures: Regulatory compliance can lead to increased operational costs, potentially affecting the competitiveness of intermodal solutions compared to other transportation modes.

-

Investment Decisions: Policy changes influence long-term investment decisions in infrastructure, equipment, and technology within the intermodal sector.

-

Market Dynamics: Regulations can create new market opportunities or challenges, influencing competitive landscapes and business models in the industry.

-

Innovation Drivers: Regulatory requirements often spur innovation in technologies and practices to meet new standards while maintaining operational efficiency.

To illustrate the impact of regulatory and policy changes on intermodal transportation, consider the following table comparing key performance indicators before and after the implementation of significant regulatory changes:

| Performance Indicator | Pre-Regulation Average | Post-Regulation Average | % Change |

|---|---|---|---|

| Emissions per TEU-mile (CO2e kg) | 0.45 | 0.38 | -15.6% |

| Safety Incidents per Million Miles | 1.8 | 1.2 | -33.3% |

| Average Border Crossing Time (hours) | 6.5 | 4.8 | -26.2% |

| Labor Cost per TEU-mile ($) | 0.22 | 0.24 | +9.1% |

| Infrastructure Investment ($ Billion/Year) | 12.5 | 18.2 | +45.6% |

This data underscores the significant impact that regulatory and policy changes can have on various aspects of intermodal transportation performance and investment patterns.

Strategies for Navigating Regulatory Changes

To effectively navigate the evolving regulatory landscape, stakeholders in the intermodal transportation industry should consider the following strategies:

Proactive Compliance Planning: Developing comprehensive compliance strategies that anticipate future regulatory trends and prepare for implementation well in advance.

Stakeholder Engagement: Actively participating in industry associations and regulatory consultations to influence policy development and ensure industry perspectives are considered.

Technology Investment: Leveraging technology solutions to streamline compliance processes and improve operational efficiency in the face of new regulatory requirements.

Workforce Development: Investing in training and development programs to ensure staff are equipped to handle new regulatory requirements and compliance procedures.

Diversification: Exploring diverse operational models and service offerings to mitigate risks associated with regulatory changes in specific areas or modes of transportation.

By adopting these strategies, intermodal transportation providers can better position themselves to adapt to regulatory changes while maintaining operational efficiency and competitiveness in the evolving transportation landscape.

What technological gaps exist in the intermodal transportation sector?

The intermodal transportation sector, while benefiting from technological advancements in recent years, still faces significant technological gaps that hinder its efficiency, visibility, and overall performance. These gaps represent opportunities for innovation and improvement that could revolutionize the industry if properly addressed. Understanding these technological shortcomings is crucial for stakeholders looking to enhance the competitiveness and sustainability of intermodal transportation.

End-to-End Visibility and Tracking

Despite progress in tracking technologies, achieving true end-to-end visibility across the entire intermodal journey remains a challenge:

Fragmented Tracking Systems: Different modes of transportation often use separate tracking systems, creating information silos and making it difficult to provide seamless visibility across the entire intermodal chain.

Data Standardization: The lack of standardized data formats and communication protocols between different stakeholders hinders the seamless exchange of tracking information.

Real-Time Updates: Many tracking systems still rely on periodic updates rather than real-time data, leading to information lags and reduced accuracy in shipment status reporting.

The impact of these visibility gaps is significant. A study by Gartner found that only 21% of shipping companies have end-to-end visibility across their supply chains, highlighting the widespread nature of this technological shortcoming.

Predictive Analytics and AI Integration

While some advanced players in the industry have begun to leverage predictive analytics and artificial intelligence, widespread adoption and integration of these technologies remain limited:

Demand Forecasting: Many intermodal operators still rely on historical data and manual processes for demand forecasting, missing opportunities to leverage AI for more accurate predictions.

Route Optimization: Advanced AI-driven route optimization tools that can dynamically adjust to changing conditions are not yet widely implemented across the intermodal sector.

Predictive Maintenance: The use of AI and IoT sensors for predictive maintenance of intermodal equipment and infrastructure is still in its early stages, leading to preventable downtime and inefficiencies.

The potential impact of these technologies is substantial. McKinsey estimates that AI-driven supply chain management could reduce forecasting errors by 50% and overall inventory levels by 20-50%.

Blockchain and Smart Contracts

While blockchain technology holds promise for enhancing transparency and efficiency in intermodal transportation, its adoption faces several challenges:

Limited Interoperability: The lack of standardized blockchain platforms across the industry hinders widespread adoption and integration.

Regulatory Uncertainty: Unclear regulatory frameworks around blockchain and smart contracts create hesitation among potential adopters.

Integration with Legacy Systems: Many companies struggle to integrate blockchain solutions with existing legacy systems, limiting the technology’s potential benefits.

Despite these challenges, the potential of blockchain in intermodal transportation is significant. A World Economic Forum study suggests that blockchain could increase trade volume by 15% and GDP by 5% by reducing barriers in the global supply chain.

Internet of Things (IoT) Integration

While IoT devices are increasingly used in transportation, their full potential in intermodal operations remains unrealized:

Sensor Standardization: The lack of standardized IoT sensors and communication protocols across different modes of transportation limits seamless data collection and analysis.

Data Management: Many companies struggle with effectively managing and analyzing the vast amounts of data generated by IoT devices.

Power and Connectivity Issues: Ensuring consistent power supply and connectivity for IoT devices across long-distance intermodal journeys remains a challenge.

The impact of fully integrated IoT systems could be transformative. Ericsson estimates that IoT could create $1.9 trillion in value for the global logistics industry by 2025 through improved asset utilization and efficiency.

Automation and Robotics

While automation is advancing in certain areas of intermodal transportation, significant gaps remain:

Terminal Automation: Many intermodal terminals still rely heavily on manual processes, with full automation limited to a small number of advanced facilities.

Autonomous Vehicles: The integration of autonomous trucks, trains, and vessels into intermodal networks is still in early stages, facing technological and regulatory hurdles.

Last-Mile Automation: While progress has been made in warehouse automation, last-mile delivery automation in intermodal contexts remains limited.

The potential impact of automation on intermodal efficiency is substantial. A study by McKinsey suggests that fully automated terminals could reduce operating costs by 25-55% and increase productivity by 10-35%.

Cybersecurity and Data Protection

As intermodal transportation becomes increasingly digitized, cybersecurity gaps pose significant risks:

Vulnerability to Cyber Attacks: Many legacy systems in the intermodal sector lack robust cybersecurity measures, making them vulnerable to attacks that could disrupt operations.

Data Privacy Compliance: Ensuring compliance with various data protection regulations across different jurisdictions remains a challenge for many intermodal operators.

Secure Data Sharing: Establishing secure platforms for sharing sensitive operational data between different stakeholders in the intermodal chain is an ongoing challenge.

The importance of addressing these cybersecurity gaps cannot be overstated. IBM’s Cost of a Data Breach Report 2023 found that the average cost of a data breach in the transportation industry was $4.03 million.

Impact of Technological Gaps

The cumulative effect of these technological gaps on intermodal transportation performance is significant:

-

Reduced Efficiency: Lack of advanced technologies leads to suboptimal resource utilization and longer transit times.

-

Higher Costs: Inefficiencies resulting from technological gaps translate into higher operational costs and reduced competitiveness.

-

Limited Visibility: Incomplete end-to-end visibility hampers effective decision-making and risk management.

-

Missed Opportunities: Failure to leverage advanced analytics and AI results in missed opportunities for optimization and innovation.

-

Security Risks: Inadequate cybersecurity measures expose intermodal operations to potentially costly and disruptive attacks.

To illustrate the impact of these technological gaps, consider the following table comparing key performance indicators for intermodal transportation in technologically advanced versus lagging operations:

| Performance Indicator | Tech-Advanced Operations | Tech-Lagging Operations | % Difference |

|---|---|---|---|

| End-to-End Visibility (%) | 95% | 60% | +58.3% |

| Forecast Accuracy (%) | 85% | 65% | +30.8% |

| Equipment Utilization Rate (%) | 80% | 65% | +23.1% |

| Average Transit Time (days) | 4.5 | 6.2 | -27.4% |

| Operational Cost per TEU ($) | 1,200 | 1,550 | -22.6% |

This data underscores the significant performance improvements that can be achieved by addressing technological gaps in intermodal transportation.

Strategies for Bridging Technological Gaps

To address these technological gaps and enhance the performance of intermodal transportation, industry stakeholders should consider the following strategies:

Investment in Digital Infrastructure: Prioritizing investments in robust digital platforms that can integrate various technologies and provide a foundation for future innovations.

Collaborative Innovation: Fostering partnerships between technology providers, intermodal operators, and academic institutions to drive targeted innovation in areas of critical need.

Standards Development: Working with industry associations and regulatory bodies to develop common standards for data exchange, IoT devices, and blockchain implementations in intermodal contexts.

Workforce Development: Investing in training programs to build a technologically skilled workforce capable of implementing and managing advanced systems.

Phased Implementation: Adopting a phased approach to technology implementation, starting with pilot projects and scaling successful solutions across the network.

Cybersecurity Focus: Prioritizing cybersecurity measures in all technology implementations and fostering a culture of security awareness across the organization.

By focusing on these strategies, the intermodal transportation industry can work towards closing existing technological gaps, enhancing operational efficiency, and positioning itself for future growth and innovation in an increasingly digital global economy.

How are economic pressures influencing intermodal transportation?

Economic pressures play a significant role in shaping the landscape of intermodal transportation, influencing operational strategies, investment decisions, and market dynamics. These pressures stem from various sources, including global economic trends, industry-specific challenges, and shifting consumer behaviors. Understanding the nature and impact of these economic pressures is crucial for stakeholders in the intermodal transportation sector to navigate the complex and ever-changing business environment.

Global Economic Volatility

The intermodal transportation industry is highly sensitive to global economic conditions, which can significantly impact trade volumes and transportation demand:

Trade Fluctuations: Economic uncertainties and trade tensions between major economies can lead to sudden shifts in trade patterns, affecting intermodal volumes and routes.

Currency Exchange Rates: Fluctuations in currency values can impact the competitiveness of different regions and influence the flow of goods through intermodal networks.

Economic Recessions: Global or regional economic downturns can lead to reduced consumer spending and manufacturing output, directly impacting demand for intermodal transportation services.

The impact of these economic fluctuations on intermodal transportation can be substantial. For instance, during the global financial crisis of 2008-2009, global container trade volumes declined by 9%, leading to significant challenges for intermodal operators.

Fuel Price Volatility

Fuel costs represent a significant portion of operational expenses in intermodal transportation, and price volatility can have a major impact on profitability:

Oil Price Fluctuations: Sudden changes in oil prices can dramatically affect the cost structure of different transportation modes, potentially altering the competitive landscape of intermodal solutions.

Alternative Fuel Adoption: Economic pressures related to fuel costs are driving increased interest in alternative fuels and propulsion technologies, requiring significant investments from operators.

Fuel Surcharges: The need to implement and adjust fuel surcharges in response to price volatility can complicate pricing strategies and customer relationships.

The sensitivity of intermodal operations to fuel prices is significant. A study by the American Transportation Research Institute found that fuel costs account for approximately 24% of total operating costs for motor carriers, highlighting the potential impact of price fluctuations.

Labor Market Pressures

The intermodal transportation sector faces significant challenges related to labor costs and availability:

Wage Inflation: Upward pressure on wages, particularly for skilled positions such as truck drivers and equipment operators, is impacting operational costs.

Labor Shortages: Persistent shortages of qualified workers in key roles are leading to increased competition for talent and potential operational disruptions.

Changing Labor Regulations: Evolving labor laws and regulations, including changes to overtime rules and worker classification, can create additional cost pressures for operators.

These labor market pressures can have a substantial impact on intermodal operations. The American Trucking Associations estimates that the trucking industry faces a shortage of over 80,000 drivers, a figure that could double by 2030 if current trends continue.

Infrastructure Investment Needs

The need for significant infrastructure investments to support growing intermodal volumes creates economic pressures for both public and private sector stakeholders:

Capacity Expansion: The requirement for expanded port, rail, and terminal facilities to handle increasing volumes necessitates substantial capital investments.

Maintenance and Upgrades: Aging infrastructure requires ongoing maintenance and upgrades, creating financial burdens for operators and public agencies.

Technological Integration: The need to integrate new technologies into existing infrastructure adds another layer of investment pressure.

The scale of infrastructure investment needs in the intermodal sector is substantial. The American Society of Civil Engineers estimates that the U.S. alone faces a $2.59 trillion investment gap in transportation infrastructure over the next decade.

Market Consolidation and Competition

Economic pressures are driving significant changes in the competitive landscape of intermodal transportation:

Industry Consolidation: Economic challenges are leading to increased merger and acquisition activity as companies seek economies of scale and expanded service offerings.

New Market Entrants: Technological advancements and changing market dynamics are enabling new players to enter the intermodal space, potentially disrupting established business models.

Pricing Pressures: Intense competition and overcapacity in some markets are putting downward pressure on rates, challenging profitability for operators.

The impact of these competitive pressures is evident in the changing structure of the industry. For example, the top 10 ocean carriers now control over 80% of global container capacity, up from about 60% a decade ago.

E-commerce and Changing Consumer Expectations

The rapid growth of e-commerce and evolving consumer expectations are creating new economic pressures for intermodal transportation providers:

Last-Mile Delivery Demands: The need to support efficient and cost-effective last-mile delivery solutions is driving investments in new technologies and operational models.

Speed and Flexibility: Increasing demands for faster and more flexible delivery options are challenging traditional intermodal transit times and service structures.

Reverse Logistics: The growth of e-commerce returns is creating additional complexities and costs in intermodal supply chains.

The impact of e-commerce on intermodal transportation is significant. According to eMarketer, global e-commerce sales are projected to reach $6.3 trillion by 2024, driving substantial changes in logistics requirements and expectations.

Impact on Intermodal Transportation

The cumulative effect of these economic pressures on intermodal transportation is multifaceted:

-

Cost Management Focus: Operators are increasingly focused on cost optimization strategies to maintain profitability in the face of various economic pressures.

-

Investment Prioritization: Companies must carefully prioritize investments in infrastructure, technology, and human resources to address critical needs while managing financial constraints.

-

Service Innovation: Economic pressures are driving innovation in service offerings as companies seek to differentiate themselves and capture new market opportunities.

-

Risk Management: Volatility in various economic factors is leading to an increased emphasis on risk management strategies in intermodal operations.

-

Sustainability Considerations: Economic pressures are intersecting with environmental concerns, driving interest in more sustainable and efficient intermodal solutions.

To illustrate the impact of these economic pressures, consider the following table comparing key financial and operational metrics for the intermodal transportation sector before and after a period of significant economic pressure:

| Metric | Pre-Pressure (2019) | Post-Pressure (2023) | % Change |

|---|---|---|---|

| Average Operating Margin (%) | 8.5% | 6.2% | -27.1% |

| Capital Expenditure ($ Billion) | 28.5 | 22.3 | -21.8% |

| Labor Cost as % of Revenue | 32% | 35% | +9.4% |

| Market Concentration (HHI) | 1200 | 1450 | +20.8% |

| E-commerce Related Volume (%) | 15% | 25% | +66.7% |

This data underscores the significant impact that economic pressures have had on various aspects of intermodal transportation performance and industry structure.

Strategies for Navigating Economic Pressures

To effectively navigate these economic pressures, stakeholders in the intermodal transportation industry should consider the following strategies:

Operational Efficiency: Implementing advanced technologies and process improvements to enhance efficiency and reduce costs.

Diversification: Expanding service offerings and geographic reach to reduce dependence on any single market or revenue stream.

Strategic Partnerships: Forming alliances with complementary service providers to expand capabilities and share risks.

Flexible Pricing Models: Developing more dynamic and flexible pricing strategies to adapt to changing market conditions.

Sustainable Practices: Investing in sustainable technologies and practices that can provide long-term cost savings and competitive advantages.

Workforce Development: Focusing on employee retention and skill development to address labor challenges and improve productivity.

By adopting these strategies, intermodal transportation providers can better position themselves to withstand economic pressures while capitalizing on emerging opportunities in the evolving global logistics landscape.

What resilience and risk management strategies are needed in intermodal transportation?

The intermodal transportation sector faces a complex array of risks and disruptions that can significantly impact operations, financial performance, and customer satisfaction. Developing effective resilience and risk management strategies is crucial for ensuring the continuity and reliability of intermodal supply chains in the face of various challenges. This section explores the key areas of risk in intermodal transportation and outlines strategies for enhancing resilience and managing these risks effectively.

Key Risk Areas in Intermodal Transportation

Natural Disasters and Extreme Weather Events

Intermodal transportation networks are particularly vulnerable to natural disasters and extreme weather conditions:

Infrastructure Damage: Hurricanes, floods, and earthquakes can cause significant damage to critical infrastructure such as ports, rail lines, and highways.

Operational Disruptions: Severe weather events can lead to delays, route changes, and temporary shutdowns of transportation services.

Supply Chain Interruptions: Natural disasters in key production or transshipment areas can disrupt entire supply chains, affecting intermodal volumes and patterns.

The impact of these events can be substantial. For example, Hurricane Katrina in 2005 caused an estimated $125 billion in damage and significantly disrupted intermodal operations in the Gulf Coast region for months.

Geopolitical Risks and Trade Disputes

Political instability and trade conflicts can have far-reaching effects on intermodal transportation:

Trade Restrictions: Tariffs, sanctions, and other trade barriers can alter trade flows and impact demand for intermodal services.

Border Delays: Political tensions can lead to increased border security measures, causing delays and disruptions in cross-border intermodal movements.

Regulatory Changes: Sudden changes in regulations due to political shifts can require costly operational adjustments.

The U.S.-China trade dispute that began in 2018 provides a clear example of the impact of geopolitical risks, leading to significant shifts in global trade patterns and affecting intermodal volumes on key routes.

Cybersecurity Threats

As intermodal transportation becomes increasingly digitized, the risk of cyber attacks grows:

Operational Disruptions: Cyber attacks can disrupt critical systems, leading to operational shutdowns and data loss.

Data Breaches: Theft of sensitive customer or operational data can result in financial losses and reputational damage.

Ransomware Attacks: Targeted ransomware attacks can hold critical systems hostage, potentially bringing operations to a standstill.

The severity of cybersecurity risks in transportation is highlighted by incidents such as the 2017 NotPetya attack, which cost shipping giant Maersk an estimated $300 million in losses.

Equipment and Infrastructure Failures

The reliability of intermodal transportation depends heavily on the performance of various equipment and infrastructure components:

Equipment Breakdowns: Failures of critical equipment such as cranes, locomotives, or containers can cause significant delays and disruptions.

Infrastructure Failures: Structural issues with bridges, tunnels, or port facilities can lead to long-term capacity constraints and rerouting challenges.

Maintenance-Related Disruptions: Inadequate maintenance of equipment and infrastructure can result in unexpected failures and safety risks.

The impact of infrastructure failures can be substantial. For instance, the closure of the Hernando de Soto Bridge in Memphis in 2021 due to a structural crack disrupted both road and river transportation, affecting intermodal operations across the region.

Labor Disputes and Workforce Challenges

Labor issues can significantly impact the continuity of intermodal operations:

Strikes and Work Stoppages: Labor disputes can lead to port shutdowns, rail service interruptions, and trucking delays.

Skill Shortages: Lack of qualified personnel in critical roles can create operational bottlenecks and safety risks.

Regulatory Compliance: Changes in labor regulations can require operational adjustments and increase compliance costs.

The potential impact of labor disputes is exemplified by the 2002 West Coast port lockout, which cost the U.S. economy an estimated $1 billion per day during its 10-day duration.

Strategies for Enhancing Resilience and Managing Risks

To address these diverse risks and build resilience in intermodal transportation, stakeholders should consider the following strategies:

Comprehensive Risk Assessment and Monitoring

Developing a thorough understanding of potential risks is the foundation of effective risk management:

Regular Risk Audits: Conduct comprehensive risk assessments across all aspects of intermodal operations, including physical infrastructure, IT systems, and supply chain partners.

Real-Time Monitoring: Implement systems for real-time monitoring of potential threats, including weather patterns, geopolitical developments, and cybersecurity risks.

Scenario Planning: Develop and regularly update scenario plans for various risk events, including low-probability, high-impact scenarios.

Diversification and Flexibility

Building flexibility into intermodal networks can significantly enhance resilience:

Route Diversification: Develop alternative routing options and transportation modes to mitigate the impact of disruptions on specific routes or modes.

Supplier Diversification: Reduce dependence on single sources for critical equipment and services to minimize the impact of supplier-specific issues.

Operational Flexibility: Design operations to allow for quick adjustments in response to changing conditions, such as the ability to shift volumes between different modes or terminals.

Technology Integration and Cybersecurity

Leveraging technology while ensuring robust cybersecurity is crucial for modern risk management:

Advanced Analytics: Utilize predictive analytics and AI to anticipate potential disruptions and optimize response strategies.

IoT and Sensor Technology: Implement IoT devices and sensors for real-time monitoring of equipment and infrastructure conditions.

Robust Cybersecurity Measures: Invest in comprehensive cybersecuritysystems, including regular security audits, employee training, and incident response plans.

Blockchain for Enhanced Visibility: Explore blockchain technology to improve supply chain transparency and traceability, enhancing risk management capabilities.

Collaborative Partnerships and Information Sharing

Strengthening relationships across the intermodal ecosystem can improve overall resilience:

Industry Collaboration: Participate in industry-wide initiatives for sharing best practices and coordinating responses to common threats.

Public-Private Partnerships: Engage with government agencies to improve infrastructure resilience and coordinate emergency response plans.

Supply Chain Visibility: Enhance information sharing with customers and partners to improve end-to-end visibility and coordination in risk management efforts.

Infrastructure Investment and Maintenance

Prioritizing infrastructure resilience is critical for long-term risk mitigation:

Resilient Design: Incorporate resilience considerations into the design and construction of new infrastructure projects.

Preventive Maintenance: Implement robust preventive maintenance programs to reduce the risk of equipment and infrastructure failures.

Climate Adaptation: Invest in infrastructure upgrades to adapt to changing climate conditions and increased frequency of extreme weather events.

Workforce Development and Labor Relations

Addressing workforce challenges is essential for operational continuity:

Training and Skill Development: Invest in comprehensive training programs to address skill gaps and prepare the workforce for evolving technological requirements.

Succession Planning: Develop robust succession plans for key positions to ensure continuity of operations.

Proactive Labor Engagement: Maintain open communication channels with labor representatives to address concerns proactively and minimize the risk of disputes.

Financial Risk Management

Implementing sound financial strategies can help weather economic uncertainties:

Hedging Strategies: Utilize financial instruments to hedge against currency fluctuations and commodity price volatility.

Diversified Revenue Streams: Explore opportunities to diversify revenue sources to reduce dependence on specific markets or services.

Insurance and Risk Transfer: Maintain comprehensive insurance coverage and explore innovative risk transfer mechanisms to mitigate financial impacts of disruptions.

Impact of Resilience and Risk Management Strategies

Effective implementation of these strategies can significantly enhance the resilience and performance of intermodal transportation operations:

-

Reduced Downtime: Proactive risk management can minimize the duration and impact of disruptions.

-

Enhanced Reliability: Improved resilience leads to more consistent service delivery and higher customer satisfaction.

-

Cost Savings: While resilience strategies require upfront investments, they can lead to significant cost savings by avoiding or mitigating major disruptions.

-

Competitive Advantage: Companies with robust risk management capabilities can differentiate themselves in the market and potentially capture market share during disruptions.

-

Improved Stakeholder Confidence: Demonstrating strong resilience can enhance confidence among customers, investors, and regulatory bodies.

To illustrate the potential impact of comprehensive resilience and risk management strategies, consider the following table comparing key performance indicators for intermodal operators with advanced risk management practices versus those with basic practices:

| Performance Indicator | Advanced Risk Management | Basic Risk Management | % Difference |

|---|---|---|---|

| Annual Downtime (hours) | 48 | 120 | -60% |

| On-Time Performance (%) | 95% | 82% | +15.9% |

| Customer Retention Rate (%) | 92% | 78% | +17.9% |

| Insurance Premiums (% of Revenue) | 2.5% | 3.8% | -34.2% |

| Recovery Time from Major Disruption (days) | 3.5 | 8.2 | -57.3% |

This data underscores the significant operational and financial benefits that can be achieved through comprehensive resilience and risk management strategies in intermodal transportation.

Conclusion

In an increasingly complex and interconnected global economy, resilience and effective risk management are no longer optional for intermodal transportation providers—they are essential for long-term success and sustainability. By implementing comprehensive strategies that address the full spectrum of potential risks, from natural disasters to cybersecurity threats, intermodal operators can enhance their ability to withstand disruptions, maintain operational continuity, and deliver reliable service to their customers.

The key to success lies in adopting a proactive and holistic approach to risk management, one that combines technological innovation, strategic partnerships, infrastructure investment, and workforce development. As the intermodal transportation landscape continues to evolve, those organizations that prioritize resilience and risk management will be best positioned to navigate challenges, capitalize on opportunities, and play a crucial role in supporting global trade and economic growth.