What Does ACE Mean in Transportation

What is ACE in transportation?

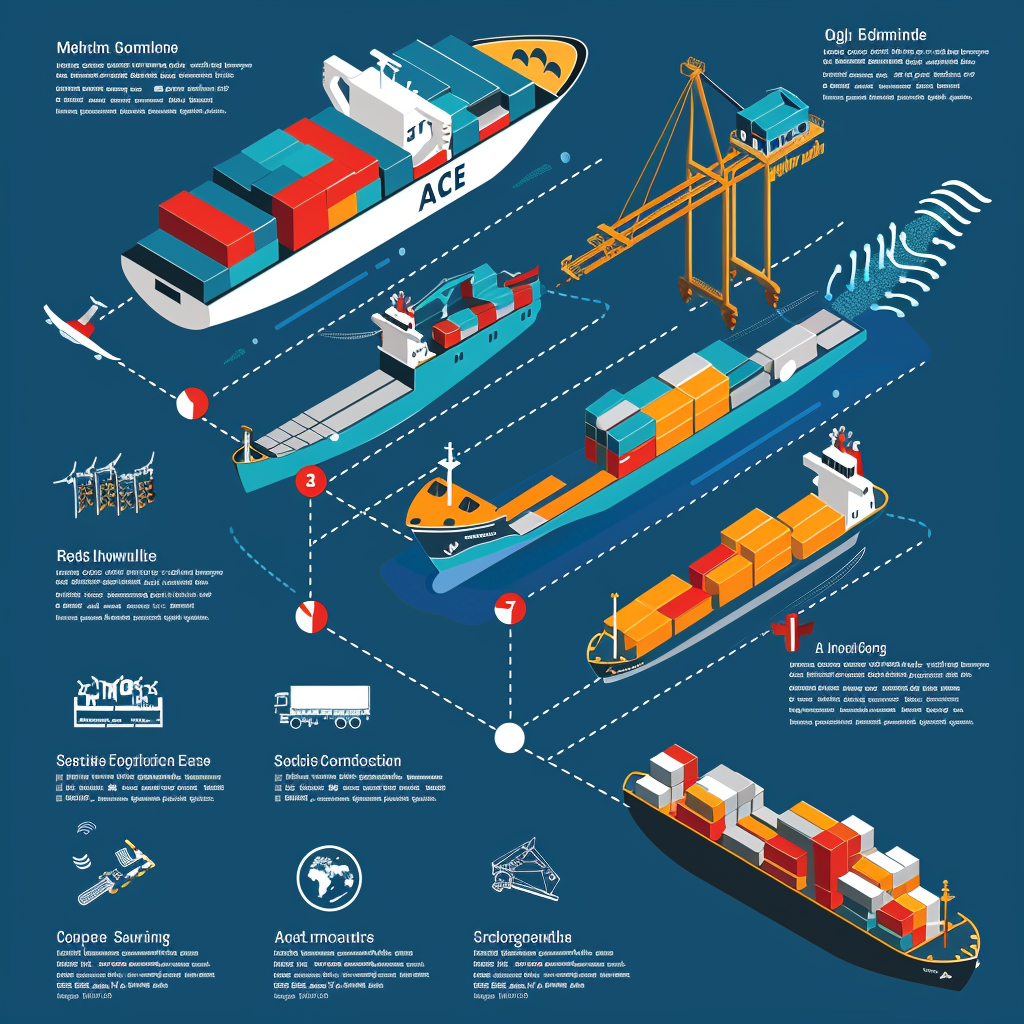

ACE, which stands for Automated Commercial Environment, is a comprehensive electronic system developed and implemented by U.S. Customs and Border Protection (CBP) to facilitate trade processes and enhance border security. ACE serves as the primary system through which the trade community reports imports and exports and the government determines admissibility of goods entering the United States.

The ACE system represents a significant advancement in the modernization of U.S. trade operations. It replaces older systems, such as the Automated Commercial System (ACS), with a more efficient and integrated platform. ACE is designed to streamline and automate various trade-related processes, including cargo processing, entry filing, and data exchange between government agencies and the trade community.

Key Features of ACE

Single Window: ACE functions as a “Single Window” system, providing a centralized access point for all trade-related transactions with CBP and participating government agencies. This consolidation eliminates the need for multiple data submissions to different agencies, reducing redundancy and improving efficiency.

Real-time Processing: The system enables real-time processing of trade transactions, allowing for quicker decision-making and reduced waiting times for cargo clearance.

Data Integration: ACE integrates data from various sources, including carriers, importers, exporters, and government agencies, to create a comprehensive view of trade activities.

Risk Assessment: By leveraging advanced analytics and data integration, ACE enhances CBP’s ability to assess risks associated with incoming shipments, improving targeting and enforcement efforts.

Compliance Management: The system provides tools for trade participants to manage their compliance with U.S. trade regulations, including the ability to track and review their trade activities.

ACE plays a crucial role in facilitating legitimate trade while strengthening border security. It enables CBP and other government agencies to make more informed decisions about cargo admissibility, collect appropriate duties and fees, and identify potential security threats or trade violations.

For transportation and logistics professionals, understanding ACE is essential as it directly impacts how goods move across U.S. borders. The system affects various aspects of international trade, from cargo manifest filing to entry summary processing, making it a fundamental component of modern trade operations.

As we delve deeper into the functionalities and benefits of ACE in subsequent sections, it becomes clear that this system is not just a technological upgrade but a transformative tool reshaping the landscape of international trade and transportation.

How does ACE streamline trade processes?

ACE significantly streamlines trade processes by digitizing and automating numerous procedures that were previously manual and time-consuming. This modernization effort has revolutionized how trade participants interact with U.S. Customs and Border Protection (CBP) and other government agencies involved in international trade.

Centralized Information Management

ACE serves as a central repository for trade-related information, eliminating the need for multiple data submissions to different agencies. This centralization reduces redundancy, minimizes errors, and saves time for all parties involved in the trade process.

Example: An importer can submit required documentation once through ACE, and the system distributes the information to relevant government agencies, such as the Food and Drug Administration (FDA) or the Environmental Protection Agency (EPA), as needed.

Automated Data Validation

The system incorporates automated data validation checks, which help identify and correct errors in submissions before they reach CBP officers. This proactive approach reduces processing delays and improves the overall quality of trade data.

Real-time Communication

ACE facilitates real-time communication between trade participants and government agencies. This immediate exchange of information allows for quicker resolution of issues and faster decision-making.

Example: If CBP requires additional information about a shipment, they can request it through ACE, and the importer or broker can respond promptly, potentially avoiding delays in cargo release.

Risk Management and Targeting

By integrating data from various sources, ACE enhances CBP’s ability to assess risks associated with incoming shipments. This improved risk management allows for more targeted inspections, focusing resources on high-risk cargo while expediting the clearance of low-risk shipments.

Paperless Processing

ACE supports paperless processing of trade transactions, reducing the reliance on physical documents. This shift to electronic documentation not only speeds up processes but also reduces costs associated with paper handling and storage.

Example: Carriers can submit electronic manifests through ACE, eliminating the need for paper documentation and allowing for faster processing at ports of entry.

Streamlined Reporting

The system simplifies reporting requirements by providing standardized electronic forms and templates. This standardization makes it easier for trade participants to comply with regulations and for CBP to process and analyze the submitted information.

Integration with Partner Government Agencies (PGAs)

ACE integrates with other government agencies involved in trade regulation, creating a “Single Window” for all trade-related transactions. This integration streamlines the process of obtaining necessary permits and approvals from multiple agencies.

Example: An importer of agricultural products can submit required information through ACE, which then routes the data to both CBP and the U.S. Department of Agriculture for necessary clearances.

Enhanced Visibility

ACE provides trade participants with greater visibility into their transactions and account status. Importers, exporters, and brokers can access real-time information about their shipments, duties, and compliance status, enabling better planning and decision-making.

Automated Duty and Fee Calculations

The system automates the calculation of duties, taxes, and fees based on the information provided in entry filings. This automation reduces errors in calculations and speeds up the payment process.

Flexible Data Submission

ACE offers multiple options for data submission, including web-based forms, Electronic Data Interchange (EDI), and web services. This flexibility allows trade participants to choose the method that best fits their operational needs and technical capabilities.

Post-Entry Correction and Reconciliation

ACE streamlines post-entry processes by allowing electronic submission of post-entry corrections and reconciliations. This feature enables importers to easily correct errors or update information after the initial entry filing.

Example: If an importer discovers a classification error after entry, they can submit a post-entry correction through ACE, simplifying the process of addressing the issue and ensuring compliance.

By implementing these streamlined processes, ACE significantly reduces the time and resources required for trade transactions. The system’s efficiency gains translate into faster cargo clearance, reduced costs, and improved compliance for all parties involved in international trade.

The streamlining effects of ACE extend beyond individual transactions, contributing to overall improvements in supply chain management and trade facilitation. As trade participants become more familiar with ACE and leverage its capabilities, the system’s role in optimizing trade processes continues to grow, reinforcing its position as a cornerstone of modern trade operations in the United States.

What are the core components of ACE?

ACE is a comprehensive system composed of several interconnected components, each designed to address specific aspects of the trade process. Understanding these core components is crucial for trade participants to effectively utilize the system and optimize their operations. Here are the key components of ACE:

ACE Secure Data Portal

The ACE Secure Data Portal serves as the primary interface for trade participants to interact with the system. It provides a web-based platform for accessing various ACE functionalities and submitting trade-related information.

Key Features:

– User account management

– Access to reports and trade data

– Electronic submission of forms and documentation

– Communication with CBP and other government agencies

ACE Cargo Release

This component focuses on the processing and release of cargo entering the United States. It automates the decision-making process for cargo admissibility and expedites the release of goods that meet all requirements.

Key Features:

– Electronic submission of entry data

– Automated risk assessment

– Real-time cargo status updates

– Integration with Partner Government Agency (PGA) requirements

ACE Entry Summary

The Entry Summary component handles the final declaration of imported goods, including the calculation and collection of duties, taxes, and fees.

Key Features:

– Electronic filing of entry summaries

– Automated duty and fee calculations

– Post-entry correction capabilities

– Reconciliation processing

ACE Manifest

This component manages the submission and processing of cargo manifests for all modes of transportation (air, ocean, rail, and truck).

Key Features:

– Electronic manifest filing

– In-bond movement tracking

– Automated manifest validation

– Integration with cargo release processes

ACE Exports

The Exports component facilitates the reporting and processing of export shipments, ensuring compliance with export regulations and gathering accurate trade statistics.

Key Features:

– Electronic Export Information (EEI) filing

– Export compliance checks

– Integration with the Automated Export System (AES)

– Export data reporting and analysis

ACE Reports

This component provides trade participants with access to a wide range of reports and data analysis tools, enabling them to monitor their trade activities and compliance status.

Key Features:

– Customizable report generation

– Trade activity summaries

– Compliance monitoring tools

– Historical data access

ACE Accounts and Revenue

This component manages financial aspects of trade transactions, including the collection of duties, taxes, and fees, as well as the management of trade accounts.

Key Features:

– Automated clearance of payments

– Management of bonds and sureties

– Periodic Monthly Statement processing

– Refund and drawback processing

ACE Partner Government Agency (PGA) Integration

This component facilitates the integration of ACE with other government agencies involved in regulating international trade.

Key Features:

– Data sharing between CBP and PGAs

– Automated PGA forms and filings

– Coordinated cargo clearance processes

– Unified risk assessment across agencies

ACE Document Image System (DIS)

The DIS allows for the electronic submission and processing of trade-related documents that cannot be submitted through other ACE components.

Key Features:

– Electronic document upload and storage

– Document linking to specific trade transactions

– Automated document routing to appropriate CBP personnel

– Reduction in paper-based processing

ACE Interoperability

This component ensures that ACE can communicate and exchange data with other systems, both within CBP and with external stakeholders.

Key Features:

– Integration with legacy CBP systems

– Data exchange with foreign customs authorities

– Connectivity with trade participant systems

– Support for various data exchange protocols (EDI, XML, etc.)

To illustrate how these components work together, consider the following table outlining a typical import process flow in ACE:

| Process Step | ACE Component | Action |

|---|---|---|

| 1. Pre-arrival | ACE Manifest | Carrier submits electronic manifest |

| 2. Arrival | ACE Cargo Release | CBP processes cargo for release |

| 3. Entry | ACE Cargo Release | Importer/broker submits entry data |

| 4. PGA Review | PGA Integration | Relevant agencies review and clear shipment |

| 5. Release | ACE Cargo Release | CBP issues cargo release message |

| 6. Payment | ACE Accounts and Revenue | Duties and fees are calculated and paid |

| 7. Entry Summary | ACE Entry Summary | Importer/broker files entry summary |

| 8. Post-Entry | ACE Reports | Trade participant reviews transaction data |

These core components of ACE work in concert to create a comprehensive trade processing environment. By understanding and effectively utilizing these components, trade participants can optimize their operations, improve compliance, and benefit from the efficiencies offered by the ACE system.

The modular nature of ACE allows for ongoing enhancements and additions to the system, ensuring that it can adapt to evolving trade regulations and technological advancements. As CBP continues to develop and refine ACE, trade participants must stay informed about new features and capabilities to fully leverage the system’s potential in their trade operations.

How does ACE handle manifest filing and cargo release?

ACE revolutionizes the manifest filing and cargo release processes, transforming them from time-consuming, paper-based procedures into streamlined, electronic operations. This transformation significantly reduces processing times, improves data accuracy, and enhances visibility for all parties involved in the movement of goods across U.S. borders.

Manifest Filing in ACE

Manifest filing is a critical step in the import process, providing CBP with advance notice of incoming shipments. ACE handles manifest filing through its electronic manifest (e-Manifest) capabilities, which are available for all modes of transportation: air, ocean, rail, and truck.

Key Aspects of ACE Manifest Filing:

Electronic Submission: Carriers submit manifests electronically through ACE, eliminating the need for paper documentation. This can be done via the ACE Secure Data Portal or through Electronic Data Interchange (EDI) for high-volume filers.

Advance Filing: ACE supports advance manifest filing, allowing carriers to submit information before the cargo arrives at the U.S. port of entry. The required timeframes vary by mode of transportation:

– Air: 4 hours prior to arrival

– Ocean: 24 hours before lading for most cargo

– Rail: 2 hours prior to arrival at the U.S. border

– Truck: 1 hour prior to arrival for Free and Secure Trade (FAST) shipments, 30 minutes for non-FAST shipments

Data Validation: ACE automatically validates manifest data, checking for completeness and consistency. This helps identify and correct errors before the shipment arrives, reducing delays at the port of entry.

In-bond Movements: ACE facilitates the electronic processing of in-bond movements, allowing for more efficient tracking and control of cargo moving between ports or to bonded warehouses.

Manifest Update Capabilities: Carriers can update manifest information in ACE as needed, ensuring that CBP has the most current and accurate data about incoming shipments.

Integration with Cargo Release: The manifest data in ACE is integrated with the cargo release process, providing a foundation for risk assessment and admissibility decisions.

Cargo Release in ACE

Cargo release is the process by which CBP determines whether goods can enter the commerce of the United States. ACE streamlines this process through automation and integration with other trade processes.

Key Features of ACE Cargo Release:

Entry Filing: Importers or their brokers can file entry data electronically through ACE. This includes information about the importer, the goods being imported, and the intended use of the goods.

Automated Risk Assessment: ACE uses the submitted manifest and entry data to perform automated risk assessments. This helps CBP identify high-risk shipments that may require additional scrutiny while expediting the release of low-risk cargo.

Partner Government Agency (PGA) Integration: ACE facilitates the sharing of cargo information with other government agencies that may have regulatory authority over certain imports. This integration allows for coordinated decision-making on cargo admissibility.

Real-time Status Updates: Trade participants can track the status of their shipments in real-time through ACE, receiving updates on holds, examinations, or releases.

Paperless Processing: In many cases, ACE enables the release of cargo without the need for paper documentation, significantly speeding up the process.

Automated Holds and Releases: Based on risk assessments and PGA requirements, ACE can automatically place holds on shipments or issue releases, reducing the need for manual intervention by CBP officers.

Simplified Entry: ACE supports the Simplified Entry process, which allows importers to submit a streamlined set of data elements earlier in the import process, facilitating faster risk assessment and potential early release decisions.

To illustrate the interaction between manifest filing and cargo release in ACE, consider the following table outlining a typical import scenario:

| Step | Process | ACE Action |

|---|---|---|

| 1 | Advance Manifest Filing | Carrier submits e-Manifest through ACE |

| 2 | Data Validation | ACE validates manifest data and flags any issues |

| 3 | Risk Assessment | ACE performs initial automated risk assessment |

| 4 | Entry Filing | Importer/broker submits entry data through ACE |

| 5 | PGA Review | ACE routes relevant data to PGAs for review |

| 6 | Hold/Release Decision | ACE processes automated holds or releases based on risk and PGA input |

| 7 | Examination (if required) | CBP officer reviews flagged shipments in ACE |

| 8 | Final Release | ACE issues electronic release message to carrier and importer |

The integration of manifest filing and cargo release processes in ACE offers several benefits:

Improved Efficiency: By automating data submission and processing, ACE reduces the time required for cargo clearance, often allowing for the release of goods immediately upon arrival.

Enhanced Compliance: The system’s data validation and risk assessment capabilities help ensure that all required information is provided and regulations are followed.

Better Resource Allocation: Automated risk assessment allows CBP to focus its resources on high-risk shipments, facilitating the flow of legitimate trade.

Increased Visibility: Trade participants have real-time access to shipment status, enabling better planning and communication throughout the supply chain.

Reduced Costs: The shift to electronic processing reduces paperwork, storage, and handling costs associated with traditional paper-based systems.

Data Accuracy: Electronic submission and validation of data in ACE improve the overall accuracy of trade information, benefiting both CBP and trade participants.

ACE’s handling of manifest filing and cargo release represents a significant advancement in trade facilitation. By digitizing and integrating these crucial processes, ACE not only speeds up the movement of goods but also enhances security and compliance in international trade. As the system continues to evolve, it## What is the role of ACE in entry summary and post-release processes?

ACE plays a pivotal role in the entry summary and post-release processes, ensuring that importers comply with U.S. Customs and Border Protection (CBP) regulations while facilitating efficient trade operations. The entry summary process is essential for declaring imported goods, calculating duties, and ensuring compliance with trade laws. Post-release processes involve managing any corrections or updates to entries after goods have been released into U.S. commerce.

Entry Summary Process in ACE

The entry summary is a critical document that provides CBP with detailed information about imported goods. It must be filed within a specific timeframe after the cargo is released from CBP custody.

Key Aspects of the Entry Summary Process:

Electronic Filing: ACE allows importers or their brokers to submit entry summaries electronically, streamlining the process and reducing the reliance on paper documentation.

Automated Duty Calculations: The system calculates applicable duties, taxes, and fees based on the data provided in the entry summary. This automation minimizes errors and speeds up the payment process.

Submission Deadlines: Importers must file their entry summaries within 10 days of cargo release for most shipments. ACE tracks these deadlines and alerts users to any pending submissions.

Post-Entry Corrections: If an importer discovers an error in their entry summary after submission, ACE provides a mechanism for making corrections electronically. This feature simplifies the process of addressing discrepancies and ensures compliance with CBP regulations.

Reconciliation Process: ACE supports reconciliation filings, allowing importers to make adjustments to previously submitted entry summaries when additional information becomes available or when discrepancies are identified. This process can be particularly useful for complex transactions involving multiple data elements.

Post-Release Processes in ACE

Once goods are released into U.S. commerce, various post-release processes may need to be managed. ACE facilitates these processes through its integrated platform.

Key Features of Post-Release Processes:

Document Management: ACE allows importers to electronically submit and manage documents related to post-release activities, such as requests for refunds or duty drawbacks.

Automated Alerts and Notifications: The system provides automated notifications regarding any issues or requirements related to post-release activities, helping importers stay compliant and informed.

Compliance Monitoring: ACE enables importers to monitor their compliance status through reporting tools that track their trade activities, including any post-release corrections made.

Data Analysis and Reporting: Trade participants can access a variety of reports that analyze their entry summary submissions and post-release activities, providing insights into compliance trends and areas for improvement.

To illustrate how ACE integrates the entry summary and post-release processes, consider the following table outlining typical steps involved:

| Step | Process | ACE Action |

|---|---|---|

| 1 | Entry Summary Submission | Importer/broker submits electronic entry summary through ACE |

| 2 | Duty Calculation | ACE automatically calculates duties based on entry data |

| 3 | Compliance Check | ACE verifies compliance with CBP regulations |

| 4 | Post-Release Monitoring | Importer monitors compliance status through ACE reports |

| 5 | Post-Entry Correction | Importer submits correction electronically via ACE if needed |

| 6 | Reconciliation Filing | Importer files reconciliation if discrepancies arise |

| 7 | Document Submission | Importer submits documents for refunds or drawbacks through ACE |

The integration of entry summary and post-release processes within ACE offers several advantages:

Increased Efficiency: By automating data processing and calculations, ACE reduces the time required for filing entry summaries and managing post-release activities.

Enhanced Compliance: The system’s built-in checks help ensure that all required information is submitted accurately and on time, minimizing the risk of penalties or audits.

Improved Visibility: Trade participants have access to real-time information about their entry summaries and post-release activities, allowing for better decision-making.

Cost Savings: The reduction in paperwork and manual processing translates into lower operational costs for importers and brokers.

ACE’s role in the entry summary and post-release processes underscores its importance as a comprehensive tool for managing trade compliance. By facilitating electronic submissions, automating calculations, and providing robust reporting capabilities, ACE enhances the overall efficiency of trade operations while ensuring adherence to U.S. customs regulations.

How does ACE benefit carriers and freight forwarders?

ACE offers numerous benefits to carriers and freight forwarders by streamlining operations, enhancing communication, and improving overall efficiency in international trade. By leveraging the capabilities of ACE, these stakeholders can optimize their logistics processes while ensuring compliance with U.S. Customs and Border Protection (CBP) regulations.

Benefits for Carriers

Carriers play a vital role in transporting goods across borders. The features of ACE provide significant advantages for carriers involved in international shipping.

Key Benefits for Carriers:

Faster Cargo Processing: With electronic manifest filing through ACE, carriers can submit cargo information ahead of arrival at U.S. ports. This advance notice allows CBP to conduct risk assessments before cargo arrives, facilitating faster processing upon arrival.

Real-time Status Updates: Carriers can access real-time updates on their shipments through ACE, enabling them to monitor cargo status throughout transit. This visibility helps carriers manage logistics more effectively.

Reduced Paperwork: By transitioning to electronic documentation, carriers can minimize reliance on paper-based systems. This shift reduces administrative burdens associated with paperwork handling and storage.

Improved Communication with CBP: The integration of manifest data with cargo release processes allows for better communication between carriers and CBP. Carriers receive timely notifications regarding holds or inspections, enabling them to respond quickly.

Enhanced Risk Management: Through automated risk assessments conducted by ACE, carriers can better understand potential issues related to their shipments before they arrive at port. This proactive approach allows them to address concerns early on.

Benefits for Freight Forwarders

Freight forwarders act as intermediaries between shippers and carriers, coordinating logistics services for international shipments. The functionalities of ACE provide valuable support for freight forwarders as they manage complex supply chains.

Key Benefits for Freight Forwarders:

Streamlined Documentation Processes: Freight forwarders can utilize ACE’s electronic submission capabilities to file necessary documentation on behalf of their clients efficiently. This streamlining reduces delays associated with paperwork processing.

Centralized Information Access: With all trade-related information housed within ACE, freight forwarders can easily access shipment details, duty calculations, and compliance status from a single platform. This centralization simplifies operations significantly.

Improved Compliance Management: By leveraging the automated checks within ACE, freight forwarders can ensure that all necessary information is submitted accurately and in compliance with CBP regulations. This reduces the risk of penalties or delays due to non-compliance issues.

Enhanced Visibility Across Supply Chains: Freight forwarders benefit from real-time tracking capabilities provided by ACE. They can monitor shipments at every stage of transit, allowing them to provide accurate updates to clients regarding delivery timelines.

To summarize some key benefits for both carriers and freight forwarders in a table format:

| Stakeholder | Key Benefits |

|---|---|

| Carriers | – Faster cargo processing |

| – Real-time status updates | |

| – Reduced paperwork | |

| – Improved communication with CBP | |

| – Enhanced risk management | |

| **Freight Forwarders | – Streamlined documentation processes |

| – Centralized information access | |

| – Improved compliance management | |

| – Enhanced visibility across supply chains |

By utilizing the capabilities offered by ACE, both carriers and freight forwarders can enhance their operational efficiency while ensuring compliance with customs regulations. The system’s focus on automation, data integration, and real-time communication allows these stakeholders to navigate complex logistics challenges more effectively while maintaining high service levels for their clients.

What advantages does ACE offer to importers and exporters?

ACE provides significant advantages to both importers and exporters by enhancing efficiency, improving compliance management, and facilitating smoother trade operations. Understanding these benefits is crucial for businesses engaged in international trade as they navigate complex regulatory environments while striving for operational excellence.

Advantages for Importers

Importers face various challenges when bringing goods into the United States. The capabilities offered by ACE help mitigate these challenges while providing numerous operational benefits.

Key Advantages for Importers:

-

Streamlined Entry Processes: With electronic filing capabilities through ACE, importers can submit required documentation quickly and efficiently. This streamlining reduces processing times associated with traditional paper-based systems.

-

Automated Duty Calculations: ACE automates the calculation of duties, taxes, and fees based on submitted data. This automation minimizes errors in calculations while expediting payment processes.

-

Enhanced Compliance Monitoring: Importers benefit from built-in compliance checks within ACE that ensure all required information is submitted accurately. Automated alerts notify importers of any pending submissions or potential compliance issues.

-

Access to Real-Time Data: Importers have access to real-time shipment status updates through ACE’s reporting features. This visibility enables better decision-making regarding inventory management and supply chain planning.

-

Post-Entry Correction Capabilities: If errors are discovered after submission of an entry summary or other filings, importers can easily make corrections electronically through ACE without lengthy delays.

Advantages for Exporters

Exporting goods involves navigating various regulatory requirements both domestically and internationally. The functionalities provided by ACE support exporters in meeting these challenges effectively.

Key Advantages for Exporters:

-

Simplified Export Reporting: Exporters can file Electronic Export Information (EEI) electronically through ACE’s Export component. This simplification reduces administrative burdens associated with export documentation.

-

Integration with Partner Government Agencies (PGAs): Through its integration capabilities, ACE facilitates coordination between CBP and other government agencies involved in export regulation (e.g., Department of Commerce). This collaboration ensures smoother processing of export shipments.

-

Enhanced Risk Management: Automated risk assessments conducted by ACE help exporters identify potential issues before shipments depart from U.S. ports. Proactive measures can be taken based on these assessments.

-

Improved Visibility Across Supply Chains: Exporters benefit from real-time tracking capabilities provided by ACE that allow them to monitor shipments at every stage of transit—this visibility enhances customer service by providing accurate delivery timelines.

To summarize some key advantages offered by ACE to both importers and exporters in a table format:

| Stakeholder | Key Advantages |

|---|---|

| Importers | – Streamlined entry processes |

| – Automated duty calculations | |

| – Enhanced compliance monitoring | |

| – Access to real-time data | |

| – Post-entry correction capabilities | |

| Exporters | – Simplified export reporting |

| – Integration with Partner Government Agencies | |

| – Enhanced risk management | |

| – Improved visibility across supply chains |

By leveraging the functionalities offered by ACE, both importers and exporters can enhance their operational efficiency while ensuring compliance with customs regulations. The system’s focus on automation, data integration, real-time communication fosters smoother trade operations that ultimately benefit businesses engaged in international commerce.

How can customs brokers leverage ACE for improved operations?

Customs brokers play an essential role in facilitating international trade by acting as intermediaries between importers/exporters and government authorities like U.S. Customs and Border Protection (CBP). Leveraging the Automated Commercial Environment (ACE) system enables customs brokers to enhance their operations significantly while ensuring compliance with trade regulations.

Key Ways Customs Brokers Can Leverage ACE

Streamlined Documentation Processes

Customs brokers can utilize the electronic filing capabilities within ACE to submit required documentation efficiently on behalf of their clients—this includes manifests, entry summaries, invoices, etc.—reducing delays associated with traditional paper-based systems.

Real-Time Access to Shipment Status

With access to real-time shipment status updates provided by ACE’s reporting features, customs brokers can monitor cargo movements throughout transit more effectively—this visibility allows them to provide timely updates to clients regarding delivery timelines or potential issues that may arise during clearance procedures.

Enhanced Compliance Management

ACE includes built-in compliance checks designed specifically for trade participants—customs brokers can leverage these tools when preparing entries or submitting documents—to ensure all required information is accurate before submission—this proactive approach minimizes risks associated with penalties or audits due to non-compliance issues later down the line.

Automated Risk Assessment

The automated risk assessments conducted by ACE allow customs brokers greater insight into potential issues related to specific shipments before they arrive at port—by identifying high-risk shipments early on; brokers can take proactive measures such as gathering additional documentation or preparing clients accordingly.

Efficient Communication with CBP

ACE facilitates improved communication between customs brokers and CBP—automated notifications alert brokers about holds or inspections placed on specific shipments—this timely communication enables faster resolution of any issues that may arise during clearance procedures.

Simplified Post-Entry Correction Processes

If errors are discovered after submission (e.g., incorrect classification), customs brokers benefit from streamlined post-entry correction capabilities offered by Ace—they can easily submit corrections electronically without lengthy delays—this flexibility ensures ongoing compliance even after initial filings have been made.

To summarize how customs brokers leverage various aspects offered by Ace into improved operations:

| Benefit | Description |

|---|---|

| Streamlined Documentation | Efficient electronic filing reduces paperwork delays |

| Real-Time Shipment Status | Enhanced visibility enables timely client updates |

| Enhanced Compliance Management | Built-in checks minimize risks associated with errors |

| Automated Risk Assessment | Early identification allows proactive measures |

| Efficient Communication | Timely alerts facilitate faster issue resolution |

| Simplified Post-Entry Corrections | Easy electronic submissions maintain ongoing compliance |

By effectively utilizing these features within Ace; customs brokers not only improve their operational efficiency but also enhance service levels provided towards clients navigating complex regulatory environments associated with international trade.

What steps are involved in implementing ACE for transportation operations?

Implementing Automated Commercial Environment (ACE) into transportation operations requires careful planning; coordination among various stakeholders involved within supply chains; understanding regulatory requirements; training personnel; among other considerations necessary towards successful adoption—here’s an overview outlining key steps involved during this implementation process:

Step 1: Assess Current Operations

Before implementing Ace; organizations should conduct thorough assessments regarding current operational workflows concerning trade transactions—identifying areas where improvements could be made via automation would help establish clear objectives guiding future implementation efforts.

Step 2: Engage Stakeholders

Collaboration among stakeholders—including internal teams (e.g., logistics; finance) along external partners (e.g., customs brokers; freight forwarders)—is crucial throughout this process—engaging relevant parties ensures everyone understands new procedures being introduced via Ace while fostering buy-in towards successful adoption.

Step 3: Develop an Implementation Plan

An effective implementation plan should outline specific goals; timelines; resource allocations; training requirements; etc.—this plan serves as a roadmap guiding organizations through each phase during rollout ensuring alignment among stakeholders involved.

Step 4: Train Personnel

Training employees who will interact directly with Ace is essential towards maximizing its potential benefits—training sessions should cover topics ranging from basic navigation within system interfaces towards understanding regulatory requirements relevant towards specific roles performed.

Step 5: Integrate Existing Systems

Organizations may need integrations between existing systems (e.g., ERP software) alongside Ace—ensuring seamless data exchange across platforms enhances overall efficiency while minimizing manual input errors associated during transitions between systems.

Step 6: Conduct Testing & Validation

Before fully deploying Ace across transportation operations; conducting rigorous testing alongside validation exercises ensures all functionalities operate correctly—this step helps identify any potential issues prior towards launch minimizing disruptions once implemented.

Step 7: Monitor & Optimize Performance

After implementation; continuous monitoring alongside performance optimization efforts should occur regularly—assessing how well Ace meets established objectives helps organizations identify areas requiring further adjustments enhancing overall effectiveness over time.

To summarize key steps involved implementing Ace into transportation operations:

- Assess Current Operations

- Engage Stakeholders

- Develop an Implementation Plan

- Train Personnel

- Integrate Existing Systems

- Conduct Testing & Validation

- Monitor & Optimize Performance

Implementing Ace represents significant opportunities towards improving efficiency; reducing costs associated within transportation operations—all while enhancing overall service levels provided towards customers navigating complex regulatory environments surrounding international trade transactions!