What Is a Customs Bonded Warehouse

A customs bonded warehouse is a secure facility authorized by customs authorities to store imported goods without immediate payment of duties and taxes. These specialized warehouses serve as crucial intermediaries in international trade, allowing importers to defer customs duties, taxes, and other charges until the goods are released for domestic consumption or re-exported.

Customs bonded warehouses operate under strict government supervision and regulations. They provide a controlled environment where imported merchandise can be stored, manipulated, or undergo specific operations while remaining under customs control. This arrangement offers significant financial and operational advantages to importers, exporters, and businesses involved in global trade.

The concept of customs bonded warehouses dates back centuries, evolving alongside international commerce. In modern times, these facilities play an integral role in facilitating trade, managing inventory, and optimizing cash flow for businesses engaged in cross-border transactions.

Key features of customs bonded warehouses include:

Duty deferment: Importers can postpone payment of customs duties and taxes until goods are withdrawn from the warehouse for domestic consumption.

Extended storage: Goods can typically be stored for extended periods, often up to several years, depending on local regulations.

Customs control: The warehouse operates under the supervision of customs authorities, ensuring compliance with import regulations and security requirements.

Permitted activities: Depending on the type of bonded warehouse, various operations may be allowed, such as repackaging, sorting, or minor processing of goods.

Re-exportation option: Goods stored in bonded warehouses can be re-exported without incurring import duties, providing flexibility for international trade operations.

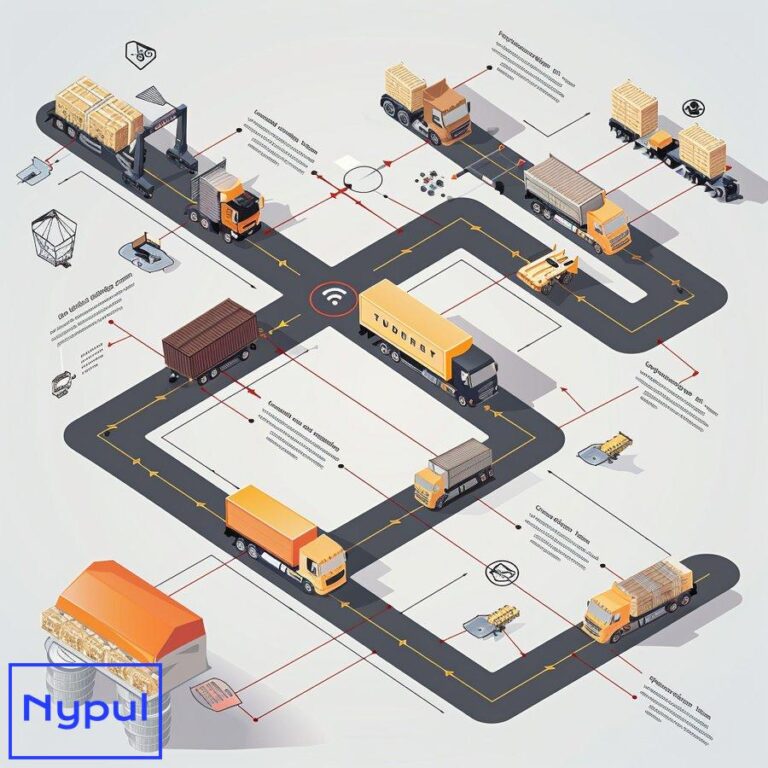

Customs bonded warehouses serve various purposes in the global supply chain. They act as distribution centers, consolidation points, and strategic inventory management hubs. These facilities enable businesses to optimize their logistics operations, reduce costs, and respond more effectively to market demands.

For importers, customs bonded warehouses offer the advantage of deferring duty payments, which can significantly improve cash flow. This arrangement allows companies to bring in larger quantities of goods without immediately tying up capital in customs duties and taxes.

Exporters also benefit from customs bonded warehouses, particularly when engaging in re-export activities. These facilities enable them to store goods temporarily without paying import duties, facilitating smoother international transactions and reducing overall logistics costs.

The legal framework governing customs bonded warehouses varies by country but generally falls under the purview of national customs authorities. In the United States, for example, these facilities are regulated by U.S. Customs and Border Protection (CBP) under the provisions of the Tariff Act of 1930 and subsequent amendments.

Understanding the nature and function of customs bonded warehouses is essential for businesses involved in international trade. These facilities offer a range of strategic advantages, from financial benefits to operational flexibility, making them valuable assets in the global supply chain ecosystem.

How do customs bonded warehouses operate?

Customs bonded warehouses operate under a complex system of regulations, procedures, and oversight designed to facilitate international trade while ensuring compliance with customs laws. The operation of these facilities involves multiple stakeholders, including warehouse operators, importers, exporters, customs authorities, and logistics providers.

Admission of Goods

The process begins when imported goods arrive at a port of entry. Instead of clearing customs immediately, the importer or their agent can request to transfer the goods to a customs bonded warehouse. This transfer is documented using specific customs forms, such as the CBP Form 7501 in the United States.

Upon arrival at the bonded warehouse, goods undergo an inspection process to verify quantity, condition, and compliance with import regulations. The warehouse operator must maintain detailed records of all goods received, including their description, quantity, and status.

Storage and Inventory Management

Once admitted, goods are stored in the bonded area, which is physically separated from any non-bonded sections of the warehouse. The warehouse operator is responsible for maintaining a secure environment and implementing inventory management systems that track the location and status of all bonded goods.

Inventory management in customs bonded warehouses typically involves:

Real-time tracking: Advanced warehouse management systems (WMS) are used to monitor the movement and status of goods in real-time.

Regular audits: Periodic physical inventories are conducted to reconcile actual stock with recorded inventory.

Reporting: Regular reports are submitted to customs authorities detailing the status of bonded goods.

Permitted Activities

Depending on the type of bonded warehouse and local regulations, various activities may be permitted within the facility:

Storage: The primary function of most bonded warehouses is to store goods for extended periods.

Manipulation: This can include repackaging, sorting, grading, or cleaning of goods.

Manufacturing: Some types of bonded warehouses allow for the manufacturing or assembly of products using imported components.

Sampling: Importers may be permitted to take samples of goods for quality control or marketing purposes.

All activities must be conducted under customs supervision and in compliance with relevant regulations.

Withdrawal of Goods

When goods are ready to be removed from the bonded warehouse, there are several options:

Entry for consumption: The importer pays the applicable duties and taxes, and the goods are released for domestic use.

Re-exportation: Goods can be exported directly from the bonded warehouse without paying import duties.

Transfer: Goods may be transferred to another bonded facility or a foreign trade zone.

Each withdrawal must be properly documented and approved by customs authorities.

Customs Oversight

Customs authorities maintain strict oversight of bonded warehouse operations:

Regular inspections: Customs officials conduct periodic inspections to ensure compliance with regulations.

Documentation review: All warehouse records and transaction documents are subject to review by customs authorities.

Security measures: Warehouses must implement and maintain security measures approved by customs authorities.

Bonding requirements: Warehouse operators must maintain a customs bond to guarantee payment of potential duties and penalties.

Technology Integration

Modern customs bonded warehouses leverage technology to enhance efficiency and compliance:

Electronic data interchange (EDI): This facilitates seamless communication between the warehouse, customs authorities, and other stakeholders.

Automated systems: Many countries have implemented automated customs systems that integrate with warehouse management software.

RFID and barcode technology: These are used for accurate tracking and inventory management.

Operational Challenges

Operating a customs bonded warehouse comes with several challenges:

Regulatory compliance: Staying up-to-date with changing customs regulations and ensuring continuous compliance.

Inventory accuracy: Maintaining precise inventory records to avoid discrepancies and potential penalties.

Security management: Implementing and maintaining robust security measures to prevent theft or unauthorized access.

Operational efficiency: Balancing customs requirements with the need for efficient warehouse operations.

Financial considerations: Managing the costs associated with bonding, compliance, and specialized staffing.

The operation of customs bonded warehouses requires a delicate balance between regulatory compliance and operational efficiency. Successful warehouse operators must navigate complex customs regulations while providing value-added services to their clients. By leveraging technology, implementing robust processes, and maintaining strong relationships with customs authorities, these facilities play a crucial role in facilitating global trade and optimizing supply chain operations.

What are the different types of customs bonded warehouses?

Customs bonded warehouses are classified into several types, each designed to serve specific purposes and accommodate different operational needs. The classification system varies by country, but generally, these warehouses are categorized based on the types of goods they can store, the activities permitted within them, and their ownership structure.

In the United States, U.S. Customs and Border Protection (CBP) recognizes eleven types of bonded warehouses, each designated by a letter from A to K. Other countries may have similar or different classification systems. Here’s an overview of the main types of customs bonded warehouses:

General Purpose Warehouses (Type A)

These are the most common type of bonded warehouses. They are privately owned and operated facilities that can store a wide variety of imported goods.

Key features:

– Can store any type of merchandise that is not prohibited by law

– Goods can be stored for up to 5 years

– Ideal for importers who need flexibility in storage options

Specific Purpose Warehouses

These warehouses are designed for particular types of goods or specific operations:

Cigar Manufacturing Warehouses (Type B)

– Used for the storage and manufacture of cigars from imported tobacco

Smelting and Refining Warehouses (Type C)

– For the smelting and refining of metal-bearing materials

Bulk Storage Warehouses (Type D)

– Used for storing bulk liquids, such as petroleum products

Bonded Storage Tanks (Type E)

– Similar to Type D, but specifically for storing bulk liquids in tanks

Manufacturing Warehouses (Type F)

These warehouses allow for the manufacture of articles using imported materials and/or domestic materials.

Key features:

– Goods can be manipulated, manufactured, or exhibited

– Finished products can be exported without paying duties on the imported materials

– Useful for companies that import components for assembly or processing

Duty-Free Stores (Type G)

These are retail stores located in international airports or other ports of entry.

Key features:

– Sell duty-free merchandise to outbound international travelers

– Goods are sold for export and must be taken out of the country

Bonded Container Stations (Type H)

These facilities are used for the storage and handling of cargo containers.

Key features:

– Allow for the unpacking and repacking of containerized cargo

– Facilitate the distribution of imported goods

General Order Warehouses (Type I)

These warehouses are used to store unclaimed or abandoned merchandise.

Key features:

– Operated by the government or by private entities under contract

– Goods are typically auctioned off if not claimed within a specified period

Duty-Free Sales Warehouses (Type J)

Similar to Type G, but these are duty-free stores that can be located away from the port of entry.

Key features:

– Can sell duty-free goods to international travelers at various locations

– Must have stringent inventory control measures

Private Bonded Warehouses (Type K)

These are warehouses used exclusively by the owner-operator for their own goods.

Key features:

– Cannot be used to store goods belonging to other importers

– Offer maximum control and privacy for the owner’s inventory

The following table summarizes the key characteristics of the main types of customs bonded warehouses:

| Type | Description | Key Features | Typical Users |

|---|---|---|---|

| A | General Purpose | Wide variety of goods, up to 5 years storage | General importers |

| B | Cigar Manufacturing | Tobacco storage and cigar production | Cigar manufacturers |

| C | Smelting and Refining | Metal-bearing materials | Metal refineries |

| D | Bulk Storage | Bulk liquids storage | Oil and chemical companies |

| F | Manufacturing | Production using imported materials | Manufacturers, assemblers |

| G | Duty-Free Stores | Retail at ports of entry | Airport retailers |

| H | Container Stations | Container handling and unpacking | Logistics companies |

| K | Private Warehouses | Exclusive use by owner | Large importers |

Each type of customs bonded warehouse serves a specific niche in the international trade ecosystem. The choice of warehouse type depends on various factors, including:

Nature of goods: Different types of goods may require specific storage conditions or handling procedures.

Intended operations: The activities planned for the goods (storage, manufacturing, retail sale) determine the appropriate warehouse type.

Business model: The importer’s business strategy and operational needs influence the choice of warehouse.

Regulatory compliance: Certain goods may be restricted to specific types of bonded warehouses due to regulatory requirements.

Volume of trade: The scale of import operations may dictate whether a private warehouse is economically viable.

Understanding the different types of customs bonded warehouses is crucial for importers, exporters, and logistics providers. It allows businesses to choose the most appropriate facility for their specific needs, optimizing their supply chain operations and potentially reducing costs associated with customs duties and taxes.

The diversity of bonded warehouse types reflects the complexity and variety of international trade operations. By offering specialized facilities for different purposes, the customs bonded warehouse system provides a flexible framework that can accommodate a wide range of business needs while maintaining regulatory oversight and control.

What are the legal requirements for customs bonded warehouses?

Customs bonded warehouses operate under a complex framework of laws, regulations, and administrative procedures designed to ensure compliance with customs requirements while facilitating international trade. The legal requirements for these facilities are stringent and multifaceted, reflecting their critical role in the global supply chain and the need for strict oversight of imported goods.

While specific requirements may vary by country, there are several common legal and regulatory aspects that apply to most customs bonded warehouses:

Licensing and Approval

Obtaining and maintaining the necessary licenses is a fundamental legal requirement for operating a customs bonded warehouse.

Application process: Prospective operators must submit detailed applications to the relevant customs authority, such as U.S. Customs and Border Protection (CBP) in the United States.

Background checks: Operators and key personnel may be subject to background investigations to ensure integrity and compliance capability.

Facility inspection: Customs authorities typically conduct thorough inspections of the proposed warehouse facility to ensure it meets security and operational standards.

Bonding Requirements

Customs bonds are a critical legal requirement for bonded warehouse operators.

Types of bonds: Operators must obtain and maintain customs bonds, which may include activity-specific bonds and custodial bonds.

Bond amounts: The required bond amount is typically based on the type of warehouse, the value of goods stored, and potential duties and taxes.

Continuous compliance: Bonds must be kept current and may need to be increased if the volume or value of stored goods increases significantly.

Security Measures

Implementing and maintaining robust security measures is a legal obligation for bonded warehouse operators.

Physical security: This includes secure perimeters, controlled access points, surveillance systems, and alarm systems.

Personnel security: Background checks for employees, security training, and access control procedures are typically required.

IT security: Measures to protect electronic records and prevent unauthorized access to customs-related data systems.

Inventory Control and Recordkeeping

Accurate and comprehensive recordkeeping is a critical legal requirement for customs bonded warehouses.

Inventory systems: Operators must maintain detailed, real-time inventory records of all bonded goods.

Transaction records: All movements of goods into, within, and out of the warehouse must be meticulously documented.

Record retention: Records typically must be retained for a specified period, often several years after the closure of a transaction.

Regular reporting: Periodic reports on warehouse activities and inventory status must be submitted to customs authorities.

Customs Supervision and Access

Bonded warehouses must comply with requirements for customs supervision and access.

Right of entry: Customs officials must be granted immediate access to the warehouse and all records upon request.

Designated areas: Many jurisdictions require a designated customs office or area within the warehouse facility.

Supervision of operations: Certain activities, such as the destruction of goods or taking of samples, may require direct customs supervision.

Compliance with Customs Regulations

Adherence to customs laws and regulations is a fundamental legal requirement.

Permitted activities: Operators must ensure that only authorized activities are conducted within the warehouse.

Time limits: Compliance with storage time limits and other temporal restrictions on bonded goods.

Prohibited goods: Strict adherence to regulations regarding prohibited or restricted merchandise.

Duty and Tax Liability

Warehouse operators have legal responsibilities related to the payment of duties and taxes.

Liability for duties: Operators may be held liable for duties and taxes on missing or improperly handled goods.

Accurate declarations: Ensuring the accuracy of customs declarations for goods entering or leaving the warehouse.

Timely payments: Facilitating the timely payment of duties and taxes when goods are withdrawn for consumption.

Operational Procedures

Bonded warehouses must establish and follow specific operational procedures to maintain legal compliance.

Standard Operating Procedures (SOPs): Detailed SOPs must be developed, documented, and followed for all warehouse operations.

Staff training: Employees must be trained in customs regulations and compliance procedures.

Internal audits: Regular internal audits to ensure compliance with legal requirements and identify areas for improvement.

Environmental and Safety Regulations

In addition to customs-specific requirements, bonded warehouses must comply with general environmental and safety regulations.

Hazardous materials handling: Special procedures and permits for storing hazardous materials.

Occupational safety: Compliance with workplace safety regulations and standards.

Environmental protection: Adherence to environmental regulations related to storage and handling of goods.

The following table summarizes key legal requirements for customs bonded warehouses:

| Requirement Category | Key Components | Regulatory Body (US Example) |

|---|---|---|

| Licensing | Application, Background Checks, Facility Inspection | U.S. Customs and Border Protection |

| Bonding | Activity-specific Bonds, Custodial Bonds | U.S. Customs and Border Protection |

| Security | Physical Security, Personnel Security, IT Security | U.S. Customs and Border Protection, Department of Homeland Security |

| Recordkeeping | Inventory Systems, Transaction Records, Record Retention | U.S. Customs and Border Protection |

| Customs Supervision | Right of Entry, Designated Areas, Supervision of Operations | U.S. Customs and Border Protection |

| Compliance | Permitted Activities, Time Limits,## What are the challenges of operating a customs bonded warehouse? |

Operating a customs bonded warehouse comes with several challenges that require careful management and compliance:

Regulatory compliance: Staying up-to-date with changing customs regulations and ensuring continuous compliance is critical. Failure to comply can result in penalties, fines, or even the revocation of the warehouse’s bonded status.

Inventory accuracy: Maintaining precise inventory records to avoid discrepancies and potential penalties is essential. Warehouse operators must implement robust inventory management systems and conduct regular audits to ensure accuracy.

Security management: Implementing and maintaining robust security measures to prevent theft or unauthorized access is a significant challenge. Warehouse operators must invest in physical security infrastructure, personnel training, and access control systems to mitigate risks.

Operational efficiency: Balancing customs requirements with the need for efficient warehouse operations is a constant challenge. Operators must streamline processes, optimize workflows, and leverage technology to maintain productivity while ensuring compliance.

Financial considerations: Managing the costs associated with bonding, compliance, and specialized staffing can be a significant challenge. Warehouse operators must carefully budget for these expenses and find ways to optimize costs without compromising compliance or service quality.

Adapting to changing trade patterns: As global trade patterns evolve, warehouse operators must adapt their operations to accommodate new types of goods, changing customer requirements, and shifting trade routes. Failure to adapt can lead to lost business opportunities and reduced competitiveness.

Maintaining strong relationships with customs authorities: Building and maintaining positive relationships with customs authorities is crucial for the smooth operation of a bonded warehouse. Warehouse operators must proactively communicate with customs officials, address concerns promptly, and demonstrate a commitment to compliance.

Ensuring staff competence: Hiring and retaining staff with the necessary skills and knowledge to operate a bonded warehouse is a challenge. Warehouse operators must provide comprehensive training, ongoing education, and clear guidance to ensure that employees understand and adhere to customs regulations and operational procedures.

Overcoming these challenges requires a combination of strong leadership, robust processes, effective communication, and a commitment to continuous improvement. By proactively addressing these challenges, customs bonded warehouse operators can maintain compliance, enhance operational efficiency, and contribute to the success of their clients’ international trade operations.

How can a business establish a customs bonded warehouse?

Establishing a customs bonded warehouse is a complex process that requires careful planning, significant investment, and close collaboration with customs authorities. The specific steps may vary depending on the country and local regulations, but generally, the process involves the following key stages:

1. Feasibility Assessment

Before embarking on the establishment process, businesses must conduct a thorough feasibility assessment to determine the viability and potential benefits of operating a customs bonded warehouse. This assessment should consider factors such as:

- Market demand: Analyzing the potential demand for bonded warehouse services in the target market and identifying specific customer needs.

- Competitive landscape: Assessing the existing competition and identifying opportunities for differentiation.

- Financial viability: Projecting the expected costs, revenues, and profitability of operating a bonded warehouse.

- Regulatory environment: Reviewing the relevant customs laws, regulations, and requirements in the target market.

2. Site Selection and Facility Design

Choosing the right location and designing the warehouse facility are critical steps in the establishment process. Businesses must consider factors such as:

- Proximity to ports of entry and major transportation hubs: To minimize transit times and costs for imported goods.

- Available space and infrastructure: Ensuring that the site can accommodate the required warehouse size and layout.

- Security features: Incorporating necessary security measures, such as perimeter fencing, access control systems, and surveillance equipment.

- Compliance with customs and building regulations: Designing the facility to meet all relevant regulatory requirements.

3. Application and Licensing Process

Businesses must submit a detailed application to the relevant customs authority to obtain a license to operate a customs bonded warehouse. The application process typically involves:

- Submitting required documentation: Such as business plans, financial statements, and facility plans.

- Providing information on key personnel: Including background checks and security clearances.

- Undergoing facility inspections: To ensure compliance with security and operational requirements.

- Obtaining necessary permits and licenses: Such as business licenses, environmental permits, and occupational safety approvals.

4. Bonding and Financial Requirements

Securing the necessary customs bonds is a critical step in the establishment process. Businesses must:

- Obtain appropriate bonds: Such as activity-specific bonds and custodial bonds.

- Ensure that bond amounts are sufficient: Based on the type of warehouse, value of goods, and potential duties and taxes.

- Maintain continuous compliance: By keeping bonds current and increasing them if the volume or value of stored goods increases significantly.

5. Operational Planning and Implementation

Once the licensing and bonding requirements are met, businesses must develop and implement detailed operational plans for the customs bonded warehouse. This includes:

- Establishing Standard Operating Procedures (SOPs): For all warehouse activities, from receiving goods to inventory management and withdrawal.

- Implementing inventory control systems: To maintain accurate, real-time records of all bonded goods.

- Training staff: On customs regulations, compliance procedures, and operational best practices.

- Developing reporting and communication protocols: With customs authorities and other stakeholders.

6. Ongoing Compliance and Improvement

Operating a customs bonded warehouse requires continuous compliance monitoring and improvement efforts. Businesses must:

- Conduct regular internal audits: To ensure adherence to regulations and identify areas for improvement.

- Stay informed: About changes in customs laws and regulations that may impact operations.

- Continuously optimize: Processes and workflows to enhance efficiency and maintain compliance.

- Foster strong relationships: With customs authorities and other stakeholders to facilitate smooth operations.

Establishing a customs bonded warehouse is a complex and resource-intensive undertaking. However, for businesses engaged in international trade, it can offer significant strategic advantages, such as improved cash flow, enhanced supply chain flexibility, and reduced logistics costs. By carefully navigating the establishment process and maintaining a strong commitment to compliance and operational excellence, businesses can successfully leverage the benefits of customs bonded warehousing to support their global trade activities.