What Is an Intensive Exam by Customs

An intensive exam by customs, also known as an intensive customs examination or intensive inspection, is a thorough and detailed inspection of imported goods conducted by customs authorities. This process involves a comprehensive review of the shipment’s contents, documentation, and compliance with import regulations. Intensive exams are a critical component of customs enforcement strategies, designed to ensure national security, prevent smuggling, and enforce trade laws.

What is an intensive customs exam?

An intensive customs exam is a rigorous inspection procedure carried out by customs officials on selected shipments entering a country. This examination goes beyond routine checks and involves a meticulous scrutiny of the cargo’s contents, accompanying documentation, and adherence to import regulations. The primary purpose of these exams is to verify the accuracy of declarations, detect prohibited or restricted items, and ensure compliance with customs laws and regulations.

Key aspects of intensive customs exams:

Thorough physical inspection: Customs officers physically examine the contents of the shipment, often unpacking and inspecting individual items. This may involve opening containers, crates, or packages to verify the nature, quantity, and quality of the goods.

Document verification: All relevant documentation, including commercial invoices, packing lists, certificates of origin, and import licenses, undergoes careful scrutiny to ensure accuracy and completeness.

Compliance checks: Officers assess whether the shipment complies with various regulations, including those related to safety, health, environmental protection, and intellectual property rights.

Sample collection: In some cases, samples of the goods may be collected for laboratory analysis to confirm their composition or detect any prohibited substances.

Use of technology: Advanced scanning equipment, such as X-ray machines or radiation detectors, may be employed to identify hidden compartments or detect potentially dangerous materials.

Duration and intensity: These examinations are typically more time-consuming and resource-intensive than standard customs checks, often taking several hours or even days to complete.

Targeted selection: Intensive exams are usually conducted on shipments flagged for various reasons, such as risk profiling, random selection, or specific intelligence information.

Intensive customs exams play a crucial role in maintaining border security and ensuring the integrity of international trade. They serve as a deterrent against illegal activities and help customs authorities identify and address potential threats or violations. While these examinations can be disruptive to the supply chain, they are essential for protecting national interests and maintaining the integrity of global commerce.

How does the intensive exam process work?

The intensive exam process is a structured and methodical procedure designed to thoroughly inspect selected shipments. Understanding this process is crucial for importers and logistics professionals to navigate the complexities of customs clearance effectively. The following steps outline the typical workflow of an intensive customs examination:

Selection for examination:

The process begins with the selection of shipments for intensive examination. This selection is based on various factors, including:

- Risk assessment algorithms

- Intelligence information

- Random selection

- Historical compliance records

- Nature of the goods

- Country of origin

Once a shipment is flagged for intensive examination, it is diverted from the standard clearance process.

Notification and scheduling:

The importer or their customs broker is notified of the selection for intensive examination. Customs authorities provide information on:

- The location of the examination

- Estimated timeframe

- Required documentation

- Any specific instructions

Scheduling is coordinated to ensure the availability of necessary personnel and equipment.

Preparation for examination:

Prior to the actual inspection, several preparatory steps are taken:

- The shipment is moved to a designated examination area

- Necessary equipment and personnel are assembled

- Required documentation is gathered and reviewed

- Any special handling requirements are addressed

Physical inspection:

The core of the intensive exam involves a thorough physical inspection of the shipment:

- Containers or packaging are opened

- Contents are carefully unpacked and examined

- Items are counted and compared against the manifest

- Samples may be collected for further analysis

- Non-intrusive inspection technologies may be used

Document verification:

Simultaneously with the physical inspection, a comprehensive review of all accompanying documentation is conducted:

- Commercial invoices

- Packing lists

- Certificates of origin

- Import licenses

- Safety certifications

- Any other relevant paperwork

Compliance assessment:

Customs officers assess the shipment’s compliance with various regulations:

- Import/export laws

- Safety standards

- Labeling requirements

- Intellectual property rights

- Environmental regulations

Sample analysis (if applicable):

If samples were collected during the inspection, they undergo laboratory analysis:

- Chemical composition tests

- Material identification

- Detection of prohibited substances

Findings and report:

Upon completion of the examination, customs officers compile a detailed report:

- Summary of findings

- Any discrepancies or violations noted

- Recommendations for further action (if necessary)

Resolution and release:

Based on the examination results, one of the following outcomes occurs:

- Clearance and release of the shipment

- Request for additional information or documentation

- Imposition of penalties or fines

- Seizure of goods (in cases of serious violations)

Post-examination procedures:

After the intensive exam, several follow-up actions may be necessary:

- Repacking and resealing of the shipment

- Updating customs records

- Providing examination results to the importer

- Initiating any required enforcement actions

The intensive exam process is designed to be thorough and comprehensive, ensuring that all aspects of the shipment are scrutinized for compliance and security. While it can be time-consuming and potentially disruptive to supply chains, understanding each step of the process can help importers and logistics professionals better prepare for and manage these examinations.

Which types of cargo are most likely to undergo intensive exams?

Customs authorities employ risk-based targeting systems to determine which shipments require intensive examinations. While any cargo can potentially be selected for an intensive exam, certain types of shipments are more likely to be flagged due to various risk factors. Understanding these high-risk categories can help importers and logistics professionals better prepare for potential examinations.

High-value goods:

Luxury items, precious metals, and expensive electronics are often subject to intensive exams due to:

- Higher risk of undervaluation for duty evasion

- Potential for counterfeiting

- Attractiveness to theft and smuggling operations

Regulated or restricted items:

Products subject to special regulations or import restrictions face increased scrutiny:

- Pharmaceuticals and medical devices

- Chemicals and hazardous materials

- Firearms and weapons

- Dual-use technologies with potential military applications

Agricultural and food products:

These items often undergo intensive exams due to:

- Biosecurity concerns

- Compliance with phytosanitary regulations

- Risk of introducing pests or diseases

Textiles and apparel:

The textile industry is frequently targeted for examinations because of:

- Complex quota systems and trade agreements

- High incidence of origin fraud and mislabeling

- Potential for intellectual property rights violations

Electronics and technology products:

Advanced technology items are often selected for intensive exams due to:

- Concerns over intellectual property rights infringement

- Potential for hidden or undeclared components

- Export control regulations for sensitive technologies

Goods from high-risk countries:

Shipments originating from or transiting through countries associated with higher risks may face increased scrutiny:

- Nations with known issues of counterfeiting or product safety

- Countries subject to trade sanctions or embargoes

- Regions associated with drug trafficking or terrorism financing

New importers or infrequent shippers:

Entities with limited import history or those engaging in irregular shipments may be subject to more frequent examinations:

- Lack of established compliance track record

- Higher potential for inadvertent errors or deliberate violations

Shipments with discrepancies:

Cargo with inconsistencies in documentation or declaration is more likely to be examined:

- Mismatches between manifest and actual contents

- Incomplete or suspicious documentation

- Unusual routing or transshipment patterns

Goods subject to anti-dumping or countervailing duties:

Products affected by trade remedies often face increased examination rates:

- Verification of correct classification and valuation

- Detection of attempts to circumvent duties

Used or second-hand goods:

These items may be targeted due to:

- Difficulty in accurately determining value

- Potential for concealing contraband

- Compliance with safety and environmental standards

To illustrate the relative likelihood of intensive exams for different cargo types, consider the following table:

| Cargo Type | Relative Likelihood of Intensive Exam | Key Risk Factors |

|---|---|---|

| High-value luxury goods | Very High | Undervaluation, counterfeiting |

| Pharmaceuticals | High | Regulatory compliance, safety |

| Fresh produce | Moderate to High | Biosecurity, perishability |

| Textiles | High | Origin fraud, quota violations |

| Consumer electronics | Moderate to High | IPR infringement, hidden components |

| Industrial machinery | Moderate | Dual-use concerns, valuation |

| Bulk commodities | Low to Moderate | Product safety, origin verification |

| Standard consumer goods | Low | Random selection, occasional checks |

This table provides a general overview, but it’s important to note that actual examination rates can vary significantly based on specific circumstances, local regulations, and current enforcement priorities.

Understanding which types of cargo are more likely to undergo intensive exams allows importers and logistics professionals to:

- Implement robust compliance programs

- Prepare comprehensive and accurate documentation

- Anticipate potential delays and plan accordingly

- Consider alternative sourcing or shipping strategies when appropriate

By recognizing the risk factors associated with different types of cargo, businesses can take proactive steps to minimize disruptions and ensure smoother customs clearance processes.

What are the financial implications of intensive customs exams?

![]()

Intensive customs exams can have significant financial implications for importers, exporters, and other stakeholders in the supply chain. These examinations, while necessary for regulatory compliance and security, often result in both direct costs and indirect financial impacts. Understanding these implications is crucial for businesses to effectively manage their international trade operations and budget accordingly.

Direct costs:

Examination fees: Customs authorities may charge fees for conducting intensive exams. These fees can vary depending on:

- The type and complexity of the examination

- The duration of the inspection

- The use of specialized equipment or facilities

Storage and demurrage charges: As intensive exams can delay the release of goods, importers may incur additional storage fees at ports or bonded warehouses. These charges typically increase the longer the goods remain in custody.

Handling and labor costs: The physical manipulation of cargo during an exam often requires additional labor and equipment, which may be billed to the importer.

Transportation expenses: Rerouting shipments to examination facilities or moving goods for inspection can result in extra transportation costs.

Sample analysis fees: If samples are taken for laboratory testing, the importer may be responsible for the associated costs.

Indirect financial impacts:

Inventory carrying costs: Delays caused by intensive exams can lead to increased inventory carrying costs, tying up working capital for longer periods.

Production disruptions: For just-in-time manufacturing operations, exam-related delays can lead to production slowdowns or stoppages, resulting in lost productivity and potential contractual penalties.

Market opportunity losses: Delayed shipments may cause importers to miss critical market windows, especially for seasonal or time-sensitive goods.

Customer dissatisfaction: Late deliveries due to extended customs examinations can lead to customer complaints, canceled orders, or damage to business relationships.

Compliance and administrative costs: Preparing for and responding to intensive exams often requires additional staff time and resources, increasing administrative overhead.

Potential fines and penalties: If discrepancies or violations are discovered during an intensive exam, importers may face fines, penalties, or increased duty assessments.

Long-term financial considerations:

Insurance premiums: Frequent intensive exams may be perceived as increased risk, potentially leading to higher cargo insurance premiums.

Supply chain restructuring: Recurring examination-related delays might necessitate changes in supply chain strategies, such as increasing safety stock or diversifying suppliers, which can impact overall operational costs.

Compliance investment: To reduce the likelihood of intensive exams, companies may need to invest in robust compliance programs, trade management software, or professional services.

To illustrate the potential financial impact of intensive customs exams, consider the following example scenario:

| Cost Category | Without Intensive Exam | With Intensive Exam | Difference |

|---|---|---|---|

| Customs clearance fees | $500 | $1,500 | +$1,000 |

| Storage charges (3 days) | $0 | $900 | +$900 |

| Handling and labor | $200 | $800 | +$600 |

| Transportation | $1,000 | $1,500 | +$500 |

| Production delay costs | $0 | $5,000 | +$5,000 |

| Administrative overhead | $300 | $1,000 | +$700 |

| Total Impact | $2,000 | $10,700 | +$8,700 |

This example demonstrates how a single intensive exam can significantly increase the total cost associated with importing a shipment. The actual figures will vary based on factors such as the nature of the goods, the duration of the exam, and the specific circumstances of the import.

Strategies for mitigating financial impacts:

Robust compliance programs: Investing in comprehensive compliance measures can reduce the likelihood of intensive exams and associated costs over time.

Accurate documentation: Ensuring all import documentation is complete, accurate, and consistent can help expedite the examination process and reduce the risk of fines or penalties.

Advance planning: Building additional lead time into supply chains to account for potential examinations can help mitigate the impact of delays.

Trusted trader programs: Participating in customs trusted trader programs, such as C-TPAT in the United States, can lead to reduced examination rates and expedited processing.

Insurance coverage: Consider obtaining insurance that covers examination-related delays and associated costs.

Data analytics: Utilizing trade data analytics can help identify patterns and risk factors, allowing for proactive measures to reduce the likelihood of intensive exams.

Understanding and anticipating the financial implications of intensive customs exams is essential for businesses engaged in international trade. By recognizing both the direct and indirect costs associated with these examinations, companies can develop strategies to minimize their financial impact and maintain efficient, cost-effective supply chains.

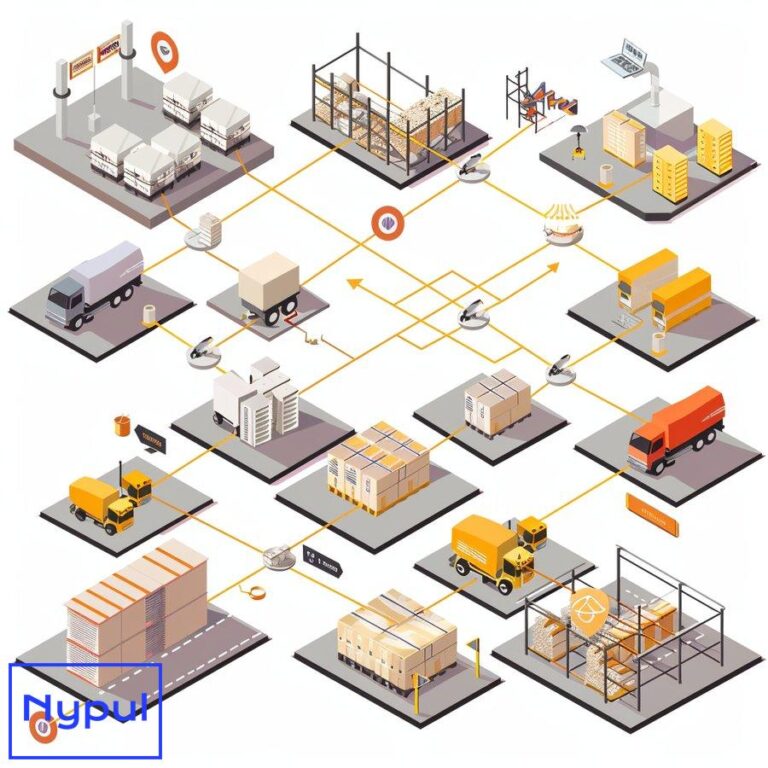

How do intensive exams impact supply chain operations?

Intensive customs exams can have far-reaching effects on supply chain operations, often causing disruptions that ripple through various stages of the logistics process. Understanding these impacts is crucial for supply chain managers to develop effective strategies for mitigating risks and maintaining operational efficiency.

Delivery delays:

The most immediate and obvious impact of intensive exams is the delay in cargo delivery. These delays can range from a few days to several weeks, depending on the complexity of the examination and the efficiency of the customs process. Consequences of these delays include:

- Missed delivery deadlines

- Disrupted production schedules

- Increased inventory holding costs

- Potential stockouts at retail locations

Inventory management challenges:

Intensive exams introduce uncertainty into inventory planning and management:

- Safety stock requirements may increase to buffer against potential delays

- Just-in-time (JIT) inventory systems can be severely disrupted

- Seasonal or perishable goods may lose value or become unsellable

Transportation and logistics complications:

The examination process often necessitates changes to planned transportation routes and schedules:

- Rerouting of shipments to examination facilities

- Coordination of additional transportation for inspected goods

- Potential need for expedited shipping to make up for lost time

- Disruption of carefully planned multi-modal transportation schedules

Warehouse and distribution center impacts:

Intensive exams can create bottlenecks and inefficiencies in warehouse operations:

- Unexpected storage requirements for delayed shipments

- Disruption of planned receiving and processing schedules

- Potential need for rush processing once goods are released

- Increased labor costs for handling examined shipments

Customer relationship management:

Delays and uncertainties caused by intensive exams can strain relationships with customers:

- Communication challenges regarding delivery timelines

- Potential loss of customer trust and loyalty

- Increased customer service workload to manage expectations and issues

Compliance and documentation workload:

Intensive exams often require additional compliance efforts and documentation:

- Increased workload for customs brokers and compliance teams

- Need for rapid response to customs inquiries and document requests

- Potential for follow-up audits or reviews based on examination findings

Financial flow disruptions:

The timing of intensive exams can impact cash flow and financial operations:

- Delayed revenue recognition for goods held in customs

- Potential for additional financing costs to cover extended inventory holding periods

- Complications in invoice processing and payment schedules

Supply chain visibility challenges:

Intensive exams can create blind spots in supply chain visibility systems:

- Difficulty in accurately tracking shipment status and location

- Challenges in providing real-time updates to stakeholders

- Potential for data discrepancies between customs and company systems

Risk management considerations:

The possibility of intensive exams introduces additional risk factors into supply chain planning:

- Need for contingency planning to address potential delays

- Increased focus on supplier and carrier selection to minimize examination risks

- Consideration of alternative sourcing or routing strategies

Long-term strategic impacts:

Recurring intensive exams may lead to broader strategic changes in supply chain operations:

- Reevaluation of global sourcing strategies

- Investment in trade compliance technologies and expertise

- Consideration of nearshoring or reshoring options toLong-term strategic impacts:

Recurring intensive exams may lead to broader strategic changes in supply chain operations:

-

Reevaluation of global sourcing strategies: Companies may reassess their sourcing decisions to minimize risks associated with customs examinations. This could involve shifting suppliers to countries with lower examination rates or more favorable trade agreements.

-

Investment in trade compliance technologies and expertise: To mitigate the frequency and impact of intensive exams, businesses may invest in advanced compliance software, training programs for staff, and hiring dedicated compliance professionals.

-

Consideration of nearshoring or reshoring options: Companies might explore relocating production closer to their primary markets to reduce transit times and the likelihood of customs delays. This can enhance supply chain agility and responsiveness.

-

Collaboration with logistics partners: Strengthening relationships with logistics providers can improve communication and efficiency during customs processes. Collaborating closely with customs brokers can also help streamline documentation and compliance efforts.

Understanding the multifaceted impacts of intensive customs exams on supply chain operations is essential for businesses engaged in international trade. By anticipating potential disruptions and implementing proactive strategies, companies can maintain operational efficiency and minimize the negative effects on their supply chains.

What documentation is required for an intensive customs exam?

Documentation plays a critical role in the intensive customs exam process. Properly prepared and accurate documentation can facilitate a smoother examination and expedite the release of goods. Importers must be aware of the specific documents required by customs authorities to ensure compliance and avoid unnecessary delays.

Essential documentation for an intensive customs exam includes:

1. Commercial Invoice:

The commercial invoice is a fundamental document that provides details about the transaction between the buyer and seller. It typically includes:

- Description of goods

- Quantity and unit price

- Total value of the shipment

- Terms of sale (Incoterms)

- Seller and buyer information

2. Packing List:

The packing list complements the commercial invoice by detailing how the goods are packed. It should include:

- Itemized list of all contents

- Dimensions and weight of each package

- Packaging type (e.g., boxes, pallets)

- Any special handling instructions

3. Bill of Lading (BOL):

The bill of lading serves as a receipt for goods shipped and outlines the terms of transportation. It includes:

- Carrier information

- Shipment details (origin, destination)

- Description of goods

- Signatures from the shipper and carrier

4. Certificates of Origin:

Certificates of origin verify the country where the goods were manufactured or produced. This document is crucial for determining eligibility for preferential tariffs under trade agreements.

5. Import Licenses:

Certain goods may require specific import licenses or permits issued by government agencies. Importers must ensure they possess all necessary licenses relevant to their products.

6. Safety Data Sheets (SDS):

For hazardous materials, safety data sheets provide information on handling, storage, and emergency measures. These documents are essential for compliance with safety regulations.

7. Customs Declaration Forms:

Importers must complete customs declaration forms that provide detailed information about the shipment, including:

- Tariff classification

- Value declaration

- Country of origin

- Any applicable exemptions or special provisions

8. Additional Supporting Documents:

Depending on the nature of the cargo, additional documents may be required, such as:

- Export licenses from the country of origin

- Inspection certificates (e.g., phytosanitary certificates for agricultural goods)

- Insurance certificates

To illustrate the importance of proper documentation, consider the following table summarizing key documents required for an intensive customs exam:

| Document Type | Purpose | Key Information Included |

|---|---|---|

| Commercial Invoice | Transaction details | Description, quantity, value |

| Packing List | Shipment contents | Itemized list, dimensions, weight |

| Bill of Lading | Transportation receipt | Carrier info, shipment details |

| Certificate of Origin | Country verification | Manufacturing location |

| Import License | Regulatory compliance | Authorization to import |

| Safety Data Sheet | Hazardous materials info | Handling and safety measures |

| Customs Declaration Form | Customs processing | Tariff classification, value |

| Additional Supporting Documents | Compliance verification | Varies by product type |

Ensuring that all required documentation is accurate, complete, and readily available is crucial for expediting the intensive exam process. Importers should work closely with their customs brokers to prepare these documents in advance and address any potential discrepancies before shipments arrive at customs.

How can importers prepare for an intensive customs exam?

Preparation is key to navigating an intensive customs exam successfully. Importers can take several proactive steps to minimize disruptions during this process and ensure compliance with customs regulations.

1. Understand Customs Regulations:

Importers should familiarize themselves with relevant customs regulations governing their specific products. This includes understanding:

- Tariff classifications

- Import restrictions or prohibitions

- Documentation requirements

Staying informed about changes in regulations can help prevent non-compliance issues that may trigger an intensive exam.

2. Maintain Accurate Records:

Keeping detailed records related to imports is essential for demonstrating compliance during an intensive exam:

- Maintain organized files for all documentation associated with shipments.

- Regularly update records to reflect any changes in product specifications or regulations.

Accurate recordkeeping can streamline communication with customs authorities during examinations.

3. Conduct Internal Audits:

Regular internal audits can help identify potential compliance gaps before shipments are flagged for intensive exams:

- Review past import transactions for accuracy.

- Assess adherence to regulatory requirements.

Addressing any discrepancies proactively can reduce the likelihood of future examinations.

4. Collaborate with Customs Brokers:

Engaging experienced customs brokers can provide valuable insights into navigating the intensive exam process:

- Work closely with brokers to ensure all documentation is complete.

- Seek guidance on best practices for compliance.

Brokers can also assist in communicating with customs authorities during examinations.

5. Implement Robust Compliance Programs:

Developing comprehensive compliance programs within organizations can help mitigate risks associated with intensive exams:

- Train staff on import regulations and best practices.

- Establish clear procedures for handling documentation and communication with customs.

A strong compliance culture can significantly reduce examination rates over time.

6. Prepare Cargo Thoroughly:

Ensuring that cargo is properly packed and labeled can facilitate a smoother examination process:

- Use appropriate packaging materials that comply with safety standards.

- Clearly label all items according to regulatory requirements.

Proper preparation minimizes delays during physical inspections.

7. Anticipate Potential Issues:

Anticipating potential issues that could arise during an intensive exam allows importers to be better prepared:

- Identify common reasons shipments are flagged for examination.

By understanding these issues, importers can take proactive measures to address them before they escalate.

8. Establish Contingency Plans:

Having contingency plans in place can help mitigate disruptions caused by intensive exams:

- Develop alternative sourcing strategies in case delays occur.

Planning ahead ensures that businesses remain agile in response to unexpected challenges.

To summarize preparation strategies for an intensive customs exam, consider this table outlining key actions:

| Preparation Action | Description |

|---|---|

| Understand Regulations | Familiarize yourself with relevant customs laws |

| Maintain Accurate Records | Keep organized files for all shipment documentation |

| Conduct Internal Audits | Regularly review past transactions for compliance |

| Collaborate with Brokers | Engage experienced brokers for guidance |

| Implement Compliance Programs | Develop training programs on import regulations |

| Prepare Cargo Thoroughly | Ensure proper packing and labeling of goods |

| Anticipate Potential Issues | Identify common reasons for examination flags |

| Establish Contingency Plans | Develop strategies to address potential delays |

By taking these proactive steps, importers can better prepare themselves for potential intensive exams while minimizing disruptions to their supply chains.

What are the legal rights of importers during an intensive exam?

Understanding legal rights during an intensive customs exam is crucial for importers as it helps them navigate this potentially stressful process while ensuring their interests are protected. Customs authorities operate under specific legal frameworks that grant certain rights to importers during examinations.

1. Right to Notification:

Importers have the right to be notified when their shipment has been selected for an intensive exam:

- Customs authorities must inform importers or their representatives about the examination process.

This notification typically includes details about where and when the examination will take place.

2. Right to Representation:

Importers have the right to be represented by a licensed customs broker or other authorized representative during the examination process:

- Importers may choose to have someone present at the examination site who understands customs procedures.

This representation ensures that importers’ interests are advocated throughout the process.

3. Right to Review Documentation:

Importers have the right to review all documentation related to their shipment during an intensive exam:

- Customs officers should provide access to relevant records upon request.

This allows importers to understand any discrepancies or issues identified during the examination.

4. Right to Appeal Decisions:

If any adverse decisions are made as a result of an intensive exam (e.g., fines or penalties), importers have legal rights to appeal those decisions:

- Customs authorities typically have established procedures for filing appeals against unfavorable outcomes.

Understanding these procedures is vital for protecting one’s rights as an importer.

5. Right to Fair Treatment:

Importers have a right to fair treatment throughout the entire examination process:

- Customs officials must conduct examinations professionally and without bias.

If any concerns arise regarding treatment or conduct during an examination, importers should document these instances.

6. Right to Confidentiality:

Importers have a right to confidentiality concerning sensitive business information disclosed during an intensive exam:

- Customs authorities must handle proprietary information responsibly.

This protection helps safeguard business interests while complying with regulatory requirements.

To summarize these legal rights, consider this table outlining key entitlements during an intensive customs exam:

| Legal Right | Description |

|---|---|

| Right to Notification | Importers must be informed about selection for examination |

| Right to Representation | Importers can have a licensed broker present during inspections |

| Right to Review Documentation | Access to relevant records must be provided upon request |

| Right to Appeal Decisions | Adverse decisions may be appealed through established procedures |

| Right to Fair Treatment | Examinations must be conducted professionally without bias |

| Right to Confidentiality | Sensitive business information should be handled responsibly |

By understanding these legal rights, importers can navigate intense examinations more effectively while ensuring that their interests are protected throughout this challenging process.

How can companies reduce the frequency of intensive exams?

Reducing the frequency of intensive customs exams requires a strategic approach focused on enhancing compliance practices, improving documentation accuracy, and fostering strong relationships with customs authorities. Companies engaged in international trade can implement several best practices aimed at minimizing their risk profiles concerning customs examinations.

1. Enhance Compliance Training:

Investing in comprehensive training programs ensures that employees involved in international trade understand regulatory requirements thoroughly:

- Provide regular training sessions on current customs laws and best practices.

Well-informed staff are less likely to make errors that could trigger inspections.

2. Implement Robust Internal Controls:

Establishing internal controls helps ensure adherence to compliance standards throughout all stages of international shipping:

- Develop clear processes for verifying product classifications, valuations, and documentation accuracy.

Strong internal controls reduce errors that could lead to increased scrutiny from customs authorities.

3. Utilize Technology Solutions:

Leveraging technology solutions such as trade management software can streamline compliance processes:

- Automate documentation generation based on established templates.

Technology reduces human error while ensuring consistency across shipments.

4. Foster Strong Relationships with Customs Authorities:

Building positive relationships with local customs officials fosters trust and cooperation:

- Engage proactively through regular communication regarding regulatory updates or changes.

A collaborative approach may lead authorities to view your company as lower risk based on established rapport over time.

5. Participate in Trusted Trader Programs:

Joining trusted trader programs (e.g., CTPAT) demonstrates commitment towards security measures within supply chains:

- These programs often result in reduced inspection rates due diligence checks due diligence checks conducted by participating companies themselves rather than relying solely upon random selection processes imposed by regulators

Participation signals reliability which may lead authorities towards favoring less frequent examinations overall

6. Conduct Regular Compliance Audits:

Performing internal audits regularly helps identify areas needing improvement within existing processes related specifically towards imports/exports

Corrective actions taken beforehand mitigate chances triggering future inspections

Auditing also showcases commitment towards maintaining high standards when dealing directly with regulators

To summarize strategies aimed at reducing frequency associated specifically towards intense custom exams consider this table outlining key actions taken by companies engaged internationally :

| Strategy | Description |

|---|---|

| Enhance Compliance Training | Regular training sessions on current laws/best practices |

| Implement Robust Internal Controls | Establish clear processes verifying classifications/valuations/documentation accuracy |

| Utilize Technology Solutions | Automate documentation generation based established templates |

| Foster Strong Relationships | Engage proactively through regular communication regarding updates/changes |

| Participate Trusted Trader Programs | Demonstrate commitment security measures within supply chains |

| Conduct Regular Compliance Audits | Identify areas needing improvement/corrective actions beforehand |

By implementing these strategies effectively companies not only reduce frequency associated intense custom exams but also strengthen overall operations ensuring smoother transactions across borders ultimately benefiting bottom lines significantly over time .