What Is Custom Clearance in Logistics

What is custom clearance and why is it important in logistics?

Custom clearance is a critical process in international trade and logistics that involves obtaining official permission from customs authorities to import or export goods across national borders. This procedure ensures that all imported and exported items comply with the regulations and laws of the countries involved in the transaction.

The importance of custom clearance in logistics cannot be overstated. It serves as a crucial checkpoint for governments to regulate the flow of goods, protect national security, and collect appropriate taxes and duties. For businesses engaged in international trade, understanding and navigating the custom clearance process is essential for several reasons:

Legal Compliance: Custom clearance ensures that all goods entering or leaving a country adhere to local laws and regulations. This includes verifying that the items are not prohibited or restricted, and that they meet safety and quality standards.

Revenue Collection: Governments use custom clearance as a mechanism to collect import duties, taxes, and other fees on incoming goods. This revenue contributes significantly to national budgets and helps fund various public services and infrastructure projects.

Trade Facilitation: While custom clearance may seem like a bureaucratic hurdle, it actually plays a vital role in facilitating legitimate trade. By standardizing procedures and documentation requirements, it helps streamline the movement of goods across borders.

Security Measures: Custom clearance procedures help prevent the entry of illegal or dangerous goods into a country. This includes screening for contraband, weapons, drugs, and other items that could pose a threat to national security or public safety.

Economic Protection: Through custom clearance, governments can implement trade policies designed to protect domestic industries. This may involve imposing higher duties on certain imported goods to make them less competitive compared to locally produced alternatives.

Statistical Data Collection: The custom clearance process generates valuable data on international trade flows. This information is used by governments and businesses to analyze economic trends, make policy decisions, and identify market opportunities.

Supply Chain Efficiency: For logistics professionals, efficient custom clearance is crucial for maintaining smooth supply chain operations. Delays in clearance can lead to increased costs, missed deadlines, and disruptions in production schedules.

Consumer Protection: Custom clearance helps ensure that imported goods meet local safety and quality standards, protecting consumers from potentially harmful or substandard products.

Understanding the intricacies of custom clearance is essential for anyone involved in international logistics. It requires knowledge of complex regulations, documentation requirements, and procedures that can vary significantly from one country to another. Failure to comply with custom clearance requirements can result in severe consequences, including fines, delays, and even legal action.

For businesses, the ability to navigate custom clearance efficiently can provide a competitive advantage. It can lead to faster delivery times, reduced costs, and improved customer satisfaction. On the other hand, mishandling custom clearance can result in costly delays, damaged goods, and reputational harm.

As global trade continues to grow and evolve, the importance of custom clearance in logistics is likely to increase. Emerging technologies, changing regulations, and geopolitical factors all contribute to the dynamic nature of this field. Staying informed about custom clearance procedures and best practices is crucial for logistics professionals, importers, exporters, and anyone involved in international trade.

In the following sections, we will delve deeper into the various aspects of custom clearance, including the step-by-step process, required documentation, calculation of duties and taxes, common challenges, and how procedures differ across transport modes and countries. This comprehensive guide aims to provide a thorough understanding of custom clearance and its critical role in the global logistics landscape.

How does the custom clearance process work?

The custom clearance process is a systematic procedure that involves several steps and multiple stakeholders. While the exact process may vary slightly depending on the country and the type of goods being imported or exported, the general framework remains consistent. Understanding this process is crucial for anyone involved in international trade and logistics.

Pre-Arrival Procedures

The custom clearance process often begins before the goods even arrive at the port of entry. Many countries have implemented pre-arrival processing systems to expedite clearance:

Electronic Pre-Filing: Importers or their agents submit electronic declarations and supporting documents to customs authorities in advance. This allows for preliminary risk assessment and processing.

Advance Ruling Requests: In some cases, importers may request advance rulings on tariff classification, valuation, or origin of goods to ensure compliance and avoid delays.

Arrival and Presentation

When goods arrive at the port of entry, several steps are taken:

Cargo Manifest Submission: The carrier submits a cargo manifest to customs, detailing all goods on board.

Goods Presentation: The goods are presented to customs officials, either physically or through documentation, depending on the clearance channel assigned.

Declaration and Documentation

The formal declaration process is a critical step in custom clearance:

Customs Declaration: The importer or their agent submits a detailed customs declaration, typically using standardized forms such as the Single Administrative Document (SAD) in the EU.

Supporting Documents: Along with the declaration, various supporting documents are submitted, including commercial invoice, packing list, bill of lading or airway bill, and certificates of origin.

Assessment and Verification

Customs authorities assess the declaration and may conduct various checks:

Document Review: Officials examine the submitted documents for completeness and accuracy.

Physical Inspection: Depending on risk assessment, goods may undergo physical inspection. This can range from non-intrusive scanning to a full physical examination.

Valuation and Classification: Customs officials verify the declared value of goods and ensure correct tariff classification.

Duty and Tax Calculation

Based on the assessment, customs calculates applicable duties and taxes:

Tariff Application: The appropriate tariff rate is applied based on the goods’ classification.

Tax Calculation: Various taxes, such as VAT or excise duties, are calculated.

Payment Processing: The importer or their agent pays the calculated duties and taxes.

Release and Post-Clearance

Once all requirements are met, the goods are released:

Release Order: Customs issues a release order, allowing the goods to be removed from customs control.

Post-Clearance Audit: In some cases, customs may conduct post-clearance audits to verify compliance.

To illustrate the typical flow of the custom clearance process, here’s a simplified table outlining the key steps and responsible parties:

| Step | Description | Responsible Party |

|---|---|---|

| 1. Pre-Arrival Filing | Submit electronic declaration and documents | Importer/Agent |

| 2. Arrival Notification | Notify customs of cargo arrival | Carrier |

| 3. Customs Declaration | File formal customs declaration | Importer/Agent |

| 4. Document Submission | Provide supporting documents | Importer/Agent |

| 5. Risk Assessment | Assess risk and determine inspection level | Customs Authority |

| 6. Inspection (if required) | Conduct physical or document inspection | Customs Authority |

| 7. Duty/Tax Calculation | Calculate and communicate payable amounts | Customs Authority |

| 8. Payment | Pay duties and taxes | Importer/Agent |

| 9. Release Order | Issue release order for goods | Customs Authority |

| 10. Goods Collection | Collect goods from customs control | Importer/Agent |

Factors Influencing the Process

Several factors can affect the custom clearance process:

Type of Goods: Certain goods, such as perishables, hazardous materials, or high-value items, may require special handling or additional documentation.

Country of Origin: The origin of goods can impact tariff rates and documentation requirements.

Trade Agreements: Preferential trade agreements between countries can affect duty rates and clearance procedures.

Customs Regimes: Different customs regimes (e.g., temporary import, transit, warehousing) have specific clearance procedures.

Risk Profile: The risk profile of the importer or the goods can influence the level of scrutiny applied during clearance.

Authorized Economic Operator (AEO) Status: Companies with AEO status often benefit from simplified customs procedures and faster clearance.

Challenges in the Custom Clearance Process

While the process outlined above represents an ideal scenario, various challenges can arise:

Documentation Errors: Incorrect or incomplete documentation can lead to delays and penalties.

Valuation Disputes: Disagreements over the declared value of goods can result in extended negotiations with customs authorities.

Classification Issues: Incorrect tariff classification can lead to duty overpayment or underpayment, potentially resulting in fines.

Regulatory Changes: Frequent changes in customs regulations can make compliance challenging for importers and exporters.

System Failures: Technical issues with customs’ electronic systems can cause significant delays in processing.

Capacity Constraints: High volumes of trade during peak seasons can overwhelm customs resources, leading to backlogs.

Improving the Custom Clearance Process

Efforts are continually being made to streamline and improve custom clearance processes globally:

Single Window Systems: Many countries are implementing single window systems that allow traders to submit all required documents through a single entry point.

Risk Management Systems: Advanced risk assessment tools help customs authorities focus resources on high-risk shipments while expediting low-risk ones.

Harmonization Efforts: International organizations like the World Customs Organization (WCO) work towards harmonizing customs procedures across countries.

Technology Integration: The use of blockchain, artificial intelligence, and Internet of Things (IoT) technologies is being explored to enhance transparency and efficiency in customs processes.

Understanding the intricacies of the custom clearance process is crucial for businesses engaged in international trade. It allows for better planning, cost estimation, and risk management. For logistics professionals, this knowledge is essential in designing efficient supply chains and ensuring smooth movement of goods across borders.

As the global trade landscape continues to evolve, staying informed about changes in custom clearance procedures and leveraging available tools and technologies can provide a significant competitive advantage. In the next sections, we will explore the specific documents required for custom clearance and delve into the complexities of calculating customs duties and taxes.

What documents are required for custom clearance?

Proper documentation is the cornerstone of a smooth custom clearance process. The required documents serve multiple purposes: they provide information about the goods being imported or exported, establish their origin and value, and demonstrate compliance with various regulations. While specific requirements can vary depending on the country, type of goods, and trade agreements, there is a core set of documents that are typically required for custom clearance.

Essential Documents for Custom Clearance

Commercial Invoice: This is one of the most critical documents in the custom clearance process. The commercial invoice is issued by the seller to the buyer and includes:

- Detailed description of the goods

- Quantity of each item

- Unit price and total value

- Terms of sale (Incoterms)

- Seller and buyer information

Packing List: This document provides a detailed inventory of the shipment contents. It includes:

- Number of packages

- Contents of each package

- Dimensions and weight of each package

- Total shipment weight and volume

Bill of Lading (for sea freight) or Airway Bill (for air freight): This serves as a contract between the shipper and the carrier. It includes:

- Shipper and consignee details

- Description of goods

- Number of packages

- Vessel or flight details

Certificate of Origin: This document certifies the country where the goods were manufactured or produced. It’s particularly important for:

- Determining eligibility for preferential tariff rates under trade agreements

- Complying with import restrictions or embargoes

Customs Declaration Form: This is the official document submitted to customs authorities declaring the nature, quantity, and value of goods being imported or exported. Common forms include:

- U.S. Customs Form 7501 (Entry Summary)

- EU Single Administrative Document (SAD)

Import License (if applicable): Some goods require specific import licenses or permits. These may include:

- Restricted goods (e.g., firearms, certain chemicals)

- Quota-controlled items

- Goods subject to special regulations (e.g., pharmaceuticals, food products)

Additional Documents

Depending on the nature of the goods and specific regulations, additional documents may be required:

Phytosanitary Certificate: Required for plants and plant products to certify they are free from pests and diseases.

Veterinary Health Certificate: Needed for animals and animal products to ensure they meet health standards.

Dangerous Goods Declaration: Mandatory for hazardous materials, detailing their classification and handling requirements.

Insurance Certificate: Proves that the shipment is insured, which may be required by customs or the importer.

Product-Specific Certificates: These may include certificates of conformity, quality certificates, or test reports.

Letter of Credit: In some cases, customs may require proof of payment, often in the form of a letter of credit.

To provide a clearer overview of document requirements, here’s a table summarizing the key documents and their purposes:

| Document | Purpose | Required For |

|---|---|---|

| Commercial Invoice | Declares value and details of goods | All shipments |

| Packing List | Provides inventory of shipment contents | All shipments |

| Bill of Lading/Airway Bill | Contract of carriage | All shipments |

| Certificate of Origin | Certifies country of manufacture | Most shipments, crucial for preferential tariffs |

| Customs Declaration Form | Official declaration to customs | All shipments |

| Import License | Permits import of restricted goods | Specific goods |

| Phytosanitary Certificate | Certifies plant health | Plants and plant products |

| Veterinary Health Certificate | Certifies animal health | Animals and animal products |

| Dangerous Goods Declaration | Details hazardous materials | Shipments containing dangerous goods |

| Insurance Certificate | Proves insurance coverage | As required by customs or importer |

| Product-Specific Certificates | Certifies compliance with standards | Specific products (e.g., electronics, food) |

Electronic Documentation

Many countries are moving towards electronic documentation systems to streamline the custom clearance process:

Electronic Data Interchange (EDI): Allows for the electronic submission of customs declarations and supporting documents.

Single Window Systems: Enables traders to submit all required documents through a single electronic gateway.

Digital Signatures: Increasingly accepted for authenticating electronic documents.

Challenges in Documentation

Several challenges can arise in the documentation process:

Inconsistencies: Discrepancies between different documents (e.g., quantities or descriptions) can lead to delays and investigations.

Incomplete Information: Missing or incomplete data on any required document can halt the clearance process.

Language Barriers: Documents may need to be translated into the official language of the importing country.

Regulatory Changes: Frequent changes in documentation requirements can catch importers off guard.

Document Authenticity: Customs authorities are increasingly vigilant about detecting fraudulent or altered documents.

Best Practices for Documentation

To ensure smooth custom clearance, consider the following best practices:

Accuracy and Consistency: Ensure all information is accurate and consistent across all documents.

Completeness: Provide all required information, leaving no fields blank unless explicitly not applicable.

Timeliness: Submit documents well in advance of the shipment’s arrival to allow for pre-clearance processing.

Digital Copies: Keep digital copies of all documents for easy reference and resubmission if needed.

Expert Assistance: Consider working with a customs broker or freight forwarder who is familiar with specific country requirements.

Regular Updates: Stay informed about changes in documentation requirements for your specific products and markets.

Standardization: Use internationally recognized forms and formats where possible to facilitate processing.

Advance Rulings: For complex or high-value shipments, consider requesting advance rulings on classification or valuation to avoid disputes.

The importance of proper documentation in custom clearance cannot be overstated. It not only facilitates the smooth movement of goods across borders but also helps businesses avoid costly delays, fines, and legal issues. As global trade continues to grow in complexity, staying informed about documentation requirements and leveraging technology for efficient document management will be crucial for success in international logistics.

In the next section, we will explore how customs duties and taxes are calculated, a process that relies heavily on the information provided in these essential documents.

How are customs duties and taxes calculated?

The calculation of customs duties and taxes is a crucial aspect of the custom clearance process. It determines the amount importers must pay to bring goods into a country. Understanding this calculation is essential for businesses to accurately forecast costs, price their products competitively, and ensure compliance with customs regulations.

Components of Customs Duties and Taxes

The total amount payable during custom clearance typically includes several components:

Customs Duty: A tax imposed on imported goods based on their classification and value.

Value Added Tax (VAT) or Sales Tax: An additional tax based on the value of the goods, including the duty.

Excise Duty: A tax on specific goods, often luxury items, alcohol, or tobacco.

Other Fees: May include processing fees, harbor maintenance fees, or merchandise processing fees.

Factors Influencing Duty and Tax Calculation

Several factors play a role in determining the applicable duties and taxes:

Tariff Classification: The Harmonized System (HS) code assigned to the goods.

Customs Value: The value of the goods as determined by customs authorities.

Country of Origin: Where the goods were manufactured or substantially transformed.

Trade Agreements: Preferential rates may apply under certain trade agreements.

Customs Valuation Methods

Customs authorities use## How are customs duties and taxes calculated?

The calculation of customs duties and taxes is a crucial aspect of the custom clearance process. It determines the amount importers must pay to bring goods into a country. Understanding this calculation is essential for businesses to accurately forecast costs, price their products competitively, and ensure compliance with customs regulations.

Components of Customs Duties and Taxes

The total amount payable during custom clearance typically includes several components:

Customs Duty: A tax imposed on imported goods based on their classification and value.

Value Added Tax (VAT) or Sales Tax: An additional tax based on the value of the goods, including the duty.

Excise Duty: A tax on specific goods, often luxury items, alcohol, or tobacco.

Other Fees: May include processing fees, harbor maintenance fees, or merchandise processing fees.

Factors Influencing Duty and Tax Calculation

Several factors play a role in determining the applicable duties and taxes:

Tariff Classification: The Harmonized System (HS) code assigned to the goods.

Customs Value: The value of the goods as determined by customs authorities.

Country of Origin: Where the goods were manufactured or substantially transformed.

Trade Agreements: Preferential rates may apply under certain trade agreements.

Customs Valuation Methods

Customs authorities use several methods to determine the customs value of imported goods:

Transaction Value: The price actually paid or payable for the goods, subject to certain adjustments.

Identical Goods Value: Based on the transaction value of identical goods sold for export to the same country.

Similar Goods Value: Based on the transaction value of similar goods sold for export to the same country.

Deductive Value: Derived from the selling price in the country of importation, less various deductions.

Computed Value: Based on the cost of production, plus an amount for profit and general expenses.

Fall-back Method: If none of the above methods are applicable, authorities may use reasonable means to determine the customs value.

Duty and Tax Calculation Example

To illustrate the calculation process, let’s consider an example:

A shipment of 1,000 widgets is imported into Country X. The relevant details are:

- Transaction value: $10,000

- Freight and insurance cost: $1,000

- Customs duty rate: 10%

- VAT rate: 15%

The customs value is determined as follows:

– Customs value = Transaction value + Freight and insurance cost

= $10,000 + $1,000 = $11,000

The duty is calculated:

– Duty = Customs value × Duty rate

= $11,000 × 0.10 = $1,100

The VAT is calculated:

– VAT = (Customs value + Duty) × VAT rate

= ($11,000 + $1,100) × 0.15 = $1,830

The total amount payable is the sum of duty and VAT:

– Total = Duty + VAT

= $1,100 + $1,830 = $2,930

Duty Deferral and Exemption Programs

To reduce the immediate cost burden, some countries offer duty deferral or exemption programs:

Bonded Warehouses: Goods can be stored in customs-approved warehouses without paying duties until they are withdrawn for domestic consumption or export.

Free Trade Zones: Designated areas where goods can be landed, handled, manufactured, or reconfigured and re-exported without the intervention of customs authorities.

Temporary Admission: Allows for the duty-free importation of goods intended for re-export within a specified time frame, such as goods for trade fairs or professional equipment.

Duty Drawback: Provides a refund of previously paid duties when imported goods are subsequently exported in the same condition or after undergoing manufacturing.

Challenges in Duty and Tax Calculation

Several challenges can arise in the calculation of customs duties and taxes:

Tariff Classification Disputes: Disagreements between importers and customs authorities over the appropriate HS code can lead to lengthy disputes and potential penalties.

Valuation Discrepancies: Importers and customs may have differing views on the proper customs value, especially for related-party transactions or royalty payments.

Preferential Eligibility: Proving origin criteria for preferential tariff treatment under trade agreements can be complex and requires careful documentation.

Frequent Regulatory Changes: Keeping up with changes in duty rates, trade agreements, and customs regulations requires constant vigilance.

Penalties and Interest: Underpayment of duties can result in penalties, interest charges, and even criminal prosecution in some cases.

Best Practices for Duty and Tax Management

To effectively manage customs duties and taxes, consider the following best practices:

Accurate Tariff Classification: Ensure goods are properly classified using the latest HS codes to avoid disputes and overpayment of duties.

Customs Valuation Strategies: Develop a defensible customs valuation methodology, especially for related-party transactions and royalty payments.

Preferential Trade Agreement Utilization: Take advantage of preferential tariff rates by maintaining proper documentation and understanding origin criteria.

Duty Deferral Program Participation: Utilize duty deferral and exemption programs to improve cash flow and reduce costs.

Customs Audit Preparedness: Maintain detailed records and be ready for potential customs audits to demonstrate compliance.

Collaboration with Customs Authorities: Foster a cooperative relationship with customs authorities through regular communication and transparency.

Leveraging Customs Brokers: Work with experienced customs brokers who can provide guidance on regulations, classifications, and duty optimization strategies.

Continuous Improvement: Regularly review and optimize customs duty and tax management processes to adapt to changing business needs and regulatory environments.

Effective management of customs duties and taxes is crucial for businesses engaged in international trade. By understanding the calculation process, leveraging available programs and strategies, and maintaining compliance, companies can minimize costs, improve cash flow, and gain a competitive edge in the global marketplace.

In the next section, we will explore some of the common challenges faced in the custom clearance process and discuss strategies for overcoming them.

What are the common challenges in custom clearance?

Despite advancements in technology and efforts to streamline procedures, the custom clearance process continues to present various challenges for importers, exporters, and logistics providers. Understanding these challenges and developing strategies to mitigate them is essential for ensuring smooth international trade operations.

Documentation Errors

Inaccurate, incomplete, or inconsistent documentation is one of the most common causes of delays and penalties in custom clearance. Errors in product descriptions, quantities, values, or country of origin can lead to lengthy investigations and potential fines. To avoid these issues:

- Ensure all documents are accurate, complete, and consistent with each other.

- Provide detailed and precise product descriptions, including HS codes where applicable.

- Maintain proper documentation for proof of origin, especially when claiming preferential tariff treatment.

- Work with experienced customs brokers or freight forwarders who can help navigate documentation requirements.

Tariff Classification Disputes

Determining the correct tariff classification for goods can be challenging, especially for complex or novel products. Disagreements between importers and customs authorities over the appropriate HS code can lead to duty overpayment, underpayment, or even penalties. To minimize classification disputes:

- Maintain a comprehensive database of HS codes for all products.

- Consult with customs experts or industry associations to ensure proper classification.

- Request advance rulings from customs authorities for complex or high-value shipments.

- Be prepared to provide technical specifications, samples, or expert opinions to support the chosen classification.

Customs Valuation Issues

Customs valuation, which determines the value on which duties are assessed, is another area prone to disputes. Importers and customs authorities may have differing views on the proper customs value, especially for related-party transactions, royalty payments, or goods with intangible components. To address customs valuation challenges:

- Develop a defensible customs valuation methodology that aligns with relevant laws and regulations.

- Maintain detailed records and documentation to support the declared values.

- Consult with customs experts or legal professionals to ensure compliance with valuation rules.

- Be prepared to negotiate with customs authorities and provide additional information or evidence if needed.

Regulatory Changes and Compliance

Keeping up with frequent changes in customs regulations, trade agreements, and security requirements can be a significant challenge for businesses engaged in international trade. Failure to comply with these evolving rules can lead to delays, penalties, and even legal issues. To stay on top of regulatory changes:

- Subscribe to updates from customs authorities, trade associations, and legal professionals.

- Regularly review and update internal procedures and documentation to reflect regulatory changes.

- Provide ongoing training to employees involved in the custom clearance process.

- Consider working with a customs compliance specialist or legal counsel to ensure adherence to regulations.

Capacity Constraints and Delays

High volumes of trade during peak seasons or unexpected events can overwhelm customs resources, leading to backlogs and delays in the clearance process. These delays can have a ripple effect throughout the supply chain, causing missed deadlines, increased costs, and customer dissatisfaction. To mitigate the impact of capacity constraints:

- Plan ahead and submit documentation well in advance of shipment arrival.

- Utilize expedited clearance programs or trusted trader schemes where available.

- Maintain open communication with customs authorities, freight forwarders, and other supply chain partners to stay informed of potential delays.

- Develop contingency plans and alternative sourcing options to minimize the impact of clearance delays on business operations.

Security Requirements and Inspections

Customs authorities are increasingly focused on security measures to prevent the entry of illegal or dangerous goods. This includes conducting physical inspections, scanning shipments, and requesting additional information or documentation. While these measures are necessary for maintaining national security, they can also lead to delays and increased costs for importers. To navigate security requirements:

- Ensure compliance with all applicable security regulations, including advance cargo information requirements.

- Maintain detailed records and documentation to demonstrate the legitimacy of goods and transactions.

- Consider participating in trusted trader programs or supply chain security initiatives to qualify for expedited clearance.

- Work closely with customs authorities and security experts to address any concerns or issues that arise during the clearance process.

Penalties and Fines

Failure to comply with customs regulations can result in penalties, fines, and even criminal prosecution in some cases. These penalties can be severe, often amounting to multiple times the value of the goods or duties owed. To avoid penalties and fines:

- Ensure strict compliance with all customs laws and regulations.

- Maintain detailed records and documentation to demonstrate good faith efforts to comply.

- Promptly address any notices or inquiries from customs authorities and provide requested information.

- Consider seeking legal counsel or consulting with customs experts if facing potential penalties or fines.

Strategies for Overcoming Custom Clearance Challenges

While the challenges outlined above can be daunting, there are several strategies businesses can employ to overcome them and ensure smooth custom clearance:

Collaboration and Communication: Foster strong relationships with customs authorities, freight forwarders, and other supply chain partners through regular communication and transparency.

Leveraging Technology: Utilize available technologies, such as electronic data interchange (EDI), single window systems, and blockchain, to streamline documentation and clearance processes.

Continuous Improvement: Regularly review and optimize custom clearance procedures, incorporating lessons learned and best practices to enhance efficiency and compliance.

Proactive Planning: Plan ahead, submit documentation early, and maintain contingency plans to minimize the impact of delays and unexpected events.

Seeking Expert Assistance: Work with experienced customs brokers, freight forwarders, and legal professionals who can provide guidance on regulations, procedures, and strategies for overcoming challenges.

By understanding the common challenges in custom clearance and employing effective strategies to address them, businesses can minimize delays, reduce costs, and maintain a competitive edge in the global marketplace.

In the next section, we will explore how custom clearance procedures differ across various transport modes and discuss the unique considerations for each.

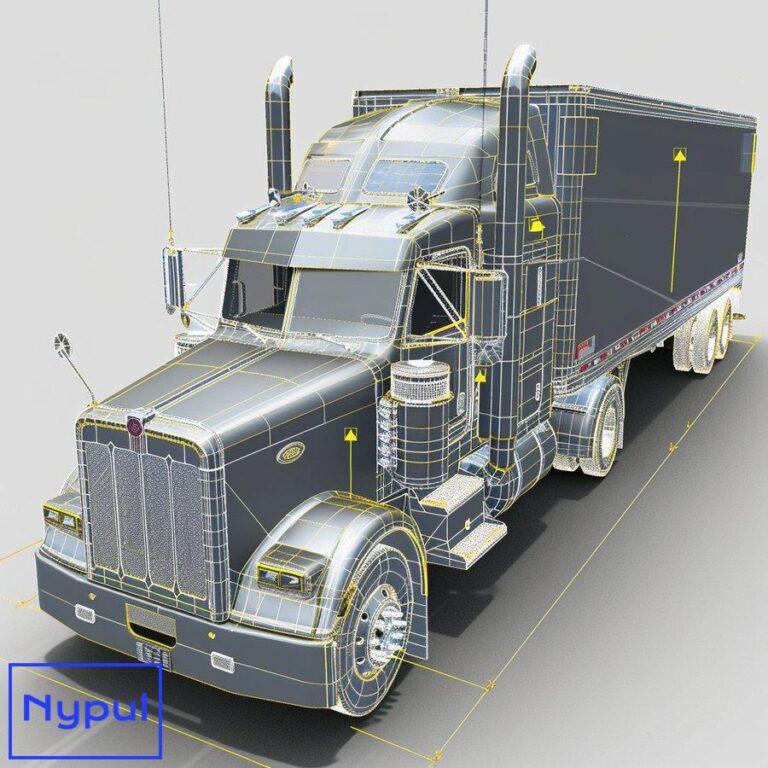

How does custom clearance differ across transport modes?

Custom clearance procedures can vary significantly depending on the mode of transportation used to import or export goods. Each transport mode presents its own set of challenges, documentation requirements, and best practices. Understanding these differences is crucial for logistics professionals and businesses engaged in international trade.

Air Freight Custom Clearance

Air freight is known for its speed and reliability, but it also requires special attention to custom clearance procedures:

Expedited Clearance: Air cargo is often prioritized for faster clearance, but this also means customs authorities may conduct more intensive inspections.

Advance Information Requirements: Airlines must provide detailed cargo information to customs authorities well before the aircraft’s arrival.

Perishable Goods: Goods such as fresh produce, flowers, and pharmaceuticals may require special handling and expedited clearance to maintain quality and freshness.

Documentation: In addition to standard documents, air freight may require specific documents like airway bills, dangerous goods declarations, and certificates for perishable items.

Sea Freight Custom Clearance

Sea freight is the most common mode for bulk and heavy cargo, but it also has its own unique custom clearance considerations:

Longer Transit Times: The extended transit times associated with sea freight allow for more thorough customs inspections and document review.

Containerization: The use of containers can simplify handling and security, but it also requires additional documentation and procedures.

Bulk Cargo: Bulk commodities like grains, minerals, and chemicals may require specialized handling and documentation.

Vessel Manifests: Detailed vessel manifests must be submitted to customs authorities before the ship’s arrival.

Rail and Road Transport Custom Clearance

Rail and road transport are often used for cross-border trade within regions or between neighboring countries. These modes present unique custom clearance challenges:

Border Crossing Procedures: Goods must clear customs at each border crossing, which can lead to delays and additional documentation requirements.

Cabotage Restrictions: Some countries restrict the movement of goods by foreign-registered vehicles within their borders, requiring transshipment or additional permits.

Customs Seals: Customs seals are often used to secure goods in transit, ensuring they arrive at their destination without tampering.

Advance Information: Truck and rail carriers must provide customs authorities with advance information on cargo and routing.

Multimodal Transport Custom Clearance

Multimodal transport, which involves the use of two or more modes of transportation, requires careful coordination of custom clearance procedures:

Harmonized Documentation: Ensuring consistent documentation across all modes is crucial to avoid delays and discrepancies.

Liability Allocation: Determining liability for customs compliance and penalties can be complex in multimodal transport.

Bonded Transport: Goods may be transported under customs bond from one customs office to another, allowing for deferred payment of duties.

Customs Brokers: Working with experienced customs brokers who can coordinate clearance across multiple modes and jurisdictions is highly recommended.

Best Practices for Custom Clearance Across Transport Modes

Regardless of the transport mode, several best practices can help ensure smooth custom clearance:

Advance Planning: Start the custom clearance process well before the scheduled arrival of goods, allowing time for document submission and potential delays.

Consistent Documentation: Ensure all documentation, including product descriptions, quantities, and values, is accurate and consistent across all modes and jurisdictions.

Communication: Maintain open communication with customs authorities, carriers, and other supply chain partners to stay informed of any issues or changes that may affect the clearance process.

Leveraging Technology: Utilize available technologies, such as electronic data interchange (EDI) and single window systems, to streamline documentation and clearance procedures.

Compliance: Strictly adhere to all customs regulations, security requirements, and documentation standards to avoid delays, penalties, and fines.

Seeking Expert Assistance: Work with experienced customs brokers, freight forwarders, and logistics providers who have a deep understanding of custom clearance procedures for each transport mode and jurisdiction.

By understanding the unique custom clearance considerations for each transport mode and employing best practices, businesses can ensure efficient and compliant movement of goods across borders, regardless of the mode of transportation used.

In the next section, we will explore how custom clearance procedures vary globally and discuss the importance of understanding local regulations and practices.

How do custom clearance procedures vary globally?

Custom clearance procedures can vary significantly from country to country, reflecting differences in regulations, trade policies, and administrative practices. Understanding these global variations is crucial for businesses engaged in international trade, as it allows them to navigate customs requirements effectively and minimize delays and costs.

Regulatory Differences

![]()

Countries have different laws and regulations governing the import and export of goods. These differences can manifest in various ways:

Tariff Rates: Customs duty rates can vary widely depending on the country, the type of goods, and trade agreements in place.

Documentation Requirements: The specific documents required for custom clearance, such as certificates of origin or import licenses, may differ across countries.

Valuation Methods: Customs authorities may use different valuation methods to determine the dutiable value of imported goods.

Prohibited and Restricted Goods: Each country maintains its own list of goods that are prohibited or restricted from import or export.

Trade Agreements and Preferential Treatment: The availability and eligibility criteria for preferential tariff treatment under trade agreements can vary significantly between countries.

Administrative Practices

In addition to regulatory differences, countries also have unique administrative practices and procedures for custom clearance:

CustomsAdministrative Practices**

In addition to regulatory differences, countries also have unique administrative practices and procedures for custom clearance:

Customs Authority Structure: The organization and structure of customs authorities can vary, affecting how customs clearance is processed. Some countries may have centralized customs agencies, while others may operate through regional or local offices.

Processing Times: The speed at which customs clearance is processed can differ significantly. Some countries may prioritize efficiency and have streamlined processes, while others may experience delays due to bureaucratic hurdles or resource constraints.

Inspection Protocols: The frequency and intensity of inspections can vary. Some countries may conduct thorough inspections on a high percentage of shipments, while others may rely more heavily on risk assessment and target only high-risk shipments for inspection.

Technology Utilization: The extent to which customs authorities utilize technology for processing and clearance can differ. Countries with advanced electronic systems may offer faster processing times, while those relying on paper-based systems may experience delays.

Customs Brokers and Agents

The role of customs brokers and agents can also vary globally:

Licensing Requirements: Different countries have specific licensing requirements for customs brokers. In some regions, brokers must pass exams or meet certain qualifications, while in others, the requirements may be less stringent.

Scope of Services: The range of services offered by customs brokers can differ. Some may provide comprehensive services, including documentation preparation, compliance consulting, and logistics management, while others may focus solely on clearance.

Cost Structures: The fees charged by customs brokers can vary based on the complexity of the services provided and the local market conditions.

Cultural Considerations

Cultural factors can also influence custom clearance procedures:

Communication Styles: Different cultures have varying communication styles that can affect negotiations and interactions with customs officials. Understanding local customs and etiquette can facilitate smoother interactions.

Business Practices: Local business practices, such as the importance of personal relationships or informal agreements, can impact how customs processes are navigated.

What impact does custom clearance have on business operations?

The custom clearance process has a profound impact on business operations, particularly for companies engaged in international trade. Understanding this impact is essential for organizations looking to optimize their supply chains and enhance their competitiveness in the global marketplace.

Operational Efficiency

The efficiency of custom clearance directly affects the overall operational efficiency of a business:

-

Lead Times: Delays in custom clearance can extend lead times for receiving goods, impacting production schedules and delivery timelines.

-

Inventory Management: Unpredictable clearance times can complicate inventory management, leading to stockouts or excess inventory situations.

-

Supply Chain Disruptions: Inefficient custom clearance processes can disrupt supply chains, resulting in missed deadlines and increased costs.

-

Resource Allocation: Businesses may need to allocate additional resources to manage delays or compliance issues related to custom clearance.

Cost Implications

Custom clearance has significant cost implications for businesses:

-

Duties and Taxes: The amount paid in customs duties and taxes directly affects the overall cost of goods sold (COGS) and profitability.

-

Penalties and Fines: Non-compliance with customs regulations can result in costly penalties and fines that impact financial performance.

-

Storage Fees: Delays in clearance may lead to increased storage fees at ports or warehouses due to extended holding periods.

-

Insurance Costs: Higher risks associated with delayed shipments can lead to increased insurance premiums.

-

Operational Costs: Additional costs may arise from hiring customs brokers or consultants to navigate complex regulations or resolve disputes.

Market Competitiveness

The ability to navigate custom clearance efficiently can enhance a company’s competitiveness:

-

Faster Delivery Times: Efficient custom clearance allows businesses to deliver products more quickly to customers, improving customer satisfaction and loyalty.

-

Cost Leadership: Companies that manage custom clearance effectively can reduce costs associated with delays and penalties, allowing them to offer competitive pricing.

-

Market Expansion Opportunities: Understanding global custom clearance procedures enables businesses to explore new markets and expand their international presence without significant barriers.

-

Reputation Management: A strong track record of compliance with customs regulations enhances a company’s reputation among customers, suppliers, and regulatory authorities.

Conclusion

Custom clearance is a complex but essential aspect of international logistics that significantly impacts business operations. By understanding the intricacies of the custom clearance process—including its importance, procedures, documentation requirements, duty calculations, challenges across transport modes, global variations, and its overall impact—businesses can better navigate the complexities of international trade.

Efficient management of custom clearance not only ensures compliance with regulations but also enhances operational efficiency, reduces costs, and improves market competitiveness. As global trade continues to evolve with technological advancements and changing regulations, staying informed about best practices in custom clearance will be crucial for businesses aiming to thrive in the international marketplace.