What Is the Customs Inspection Process

What is the purpose of customs inspections?

Customs inspections serve as a critical safeguard for countries, protecting their borders, economies, and citizens from potential threats and illegal activities. These inspections are conducted by customs authorities to ensure that imported and exported goods comply with national laws, regulations, and international trade agreements.

The primary purposes of customs inspections include:

Revenue collection

Customs inspections allow governments to collect duties, taxes, and fees on imported goods. This revenue generation is a significant aspect of a country’s fiscal policy and economic management. Customs officers verify that importers have accurately declared the value, quantity, and classification of goods to ensure proper duty assessment.

Security and safety

Customs inspections play a crucial role in national security by preventing the entry of prohibited or restricted items. These may include weapons, explosives, drugs, or other contraband that could pose threats to public safety. Inspectors use various techniques and technologies to detect and intercept such dangerous goods.

Trade compliance

Customs authorities enforce trade laws and regulations to maintain fair competition and protect domestic industries. Inspections help identify goods that may violate intellectual property rights, circumvent quotas, or fail to meet safety or quality standards. This ensures a level playing field for businesses and protects consumers from substandard or counterfeit products.

Health and environmental protection

Customs inspections help prevent the introduction of pests, diseases, or harmful substances that could threaten public health or the environment. Agricultural products, food items, and chemicals are often subject to rigorous inspections to ensure they meet sanitary and phytosanitary standards.

Trade facilitation

While inspections may seem like a barrier to trade, they actually facilitate legitimate commerce by ensuring that all parties adhere to the same rules. This creates a predictable and transparent trading environment, reducing unfair competition and promoting economic growth.

Data collection and analysis

Customs inspections generate valuable data on trade flows, patterns, and trends. This information helps governments make informed policy decisions, negotiate trade agreements, and identify areas for improvement in trade facilitation.

Combating financial crimes

Customs inspections play a role in detecting and preventing financial crimes such as money laundering, tax evasion, and terrorist financing. By scrutinizing the movement of goods and associated financial transactions, customs authorities can identify suspicious activities and collaborate with other law enforcement agencies.

The following table illustrates the multifaceted nature of customs inspections and their impact on various stakeholders:

| Stakeholder | Benefits of Customs Inspections |

|---|---|

| Government | Revenue collection, national security, policy enforcement |

| Businesses | Fair competition, protection from counterfeit goods |

| Consumers | Product safety, quality assurance |

| Environment | Protection from invasive species and harmful substances |

| Society | Public health and safety, economic stability |

For importers and exporters, understanding the purpose of customs inspections is crucial for successful international trade. By recognizing the importance of these inspections, businesses can better prepare for the process, ensure compliance with regulations, and contribute to the smooth flow of legitimate trade across borders.

How do importers prepare for customs inspections?

Preparing for customs inspections is a critical step for importers to ensure smooth clearance of their goods and avoid costly delays or penalties. Proper preparation involves a combination of documentation, communication, and proactive measures. Here’s how importers can effectively prepare for customs inspections:

Accurate documentation

Importers must maintain meticulous records and prepare all necessary documents for customs clearance. This includes:

- Commercial invoice

- Packing list

- Bill of lading or airway bill

- Certificate of origin

- Import licenses (if required)

- Product-specific certificates (e.g., phytosanitary certificates for agricultural products)

Ensure all documents are complete, accurate, and consistent with each other. Any discrepancies can raise red flags and trigger more thorough inspections.

Proper classification of goods

Correctly classify imported goods using the Harmonized System (HS) codes. Misclassification can lead to incorrect duty assessments and potential penalties. When in doubt, seek guidance from customs brokers or request an official ruling from customs authorities.

Valuation compliance

Declare the correct value of imported goods. Undervaluation to reduce duties is a common violation that customs authorities actively look for. Be prepared to provide supporting documentation for declared values, such as purchase orders, contracts, or price lists.

Compliance with trade agreements

If claiming preferential treatment under a free trade agreement, ensure that goods meet the required rules of origin. Maintain proper documentation to substantiate origin claims, such as manufacturer’s affidavits or regional value content calculations.

Pre-arrival processing

Take advantage of pre-arrival processing options offered by many customs authorities. Submit required information and documentation before the goods arrive to expedite clearance and reduce the likelihood of inspections.

Risk assessment and mitigation

Conduct internal risk assessments to identify potential compliance issues. Address any vulnerabilities before they become problems during customs inspections. This may involve:

- Reviewing supplier agreements and practices

- Auditing internal processes for trade compliance

- Implementing quality control measures to ensure product consistency

Communication with suppliers

Maintain clear communication with suppliers to ensure they understand and comply with customs requirements. Provide them with specific instructions for packaging, labeling, and documentation to facilitate smooth inspections.

Customs broker engagement

Consider engaging a licensed customs broker to handle customs clearance. Brokers have expertise in customs regulations and procedures, which can help navigate complex inspection processes and resolve issues quickly.

Technology integration

Implement trade compliance software to manage import data, track shipments, and ensure consistency across all customs-related activities. This can help identify potential issues before they become problems during inspections.

Staff training

Provide regular training to staff involved in import operations. Ensure they understand customs regulations, documentation requirements, and the importance of compliance. Well-trained staff can help prevent errors that may trigger inspections.

Participation in trusted trader programs

Consider participating in trusted trader programs such as the Customs-Trade Partnership Against Terrorism (C-TPAT) in the United States or Authorized Economic Operator (AEO) programs in other countries. These programs can lead to fewer inspections and expedited clearance for compliant importers.

Proactive communication with customs

Establish open lines of communication with customs authorities. If you anticipate any issues or have questions about a particular shipment, reach out to customs officials proactively. This demonstrates good faith and can help resolve potential problems before they escalate.

Contingency planning

Develop contingency plans for potential inspection scenarios. This may include:

- Identifying secure storage facilities for goods awaiting clearance

- Establishing procedures for responding to customs queries or requests for additional information

- Preparing for potential delays in the supply chain due to extended inspections

By following these preparation strategies, importers can significantly reduce the risk of complications during customs inspections. Proactive preparation not only facilitates smoother clearance but also demonstrates a commitment to compliance that can foster positive relationships with customs authorities over time.

What are the key steps in the customs inspection process?

The customs inspection process involves a series of systematic steps designed to verify the compliance of imported goods with applicable laws and regulations. Understanding these steps helps importers navigate the process more effectively and anticipate potential challenges. Here are the key steps in the customs inspection process:

1. Arrival notification

When goods arrive at a port of entry, the carrier (shipping line or airline) notifies customs authorities. This triggers the initiation of the customs clearance process.

2. Document submission

The importer or their customs broker submits the required documentation to customs. This typically includes:

- Import declaration

- Commercial invoice

- Packing list

- Bill of lading or airway bill

- Certificates of origin

- Any other relevant permits or licenses

3. Initial screening

Customs officials conduct an initial review of the submitted documents. They check for completeness, accuracy, and any red flags that might warrant further inspection.

4. Risk assessment

Customs authorities use sophisticated risk management systems to assess the level of risk associated with each shipment. Factors considered may include:

- Importer’s compliance history

- Country of origin

- Type of goods

- Value of the shipment

- Intelligence information

Based on this assessment, shipments are typically categorized into different risk levels, which determine the extent of inspection required.

5. Selection for inspection

Depending on the risk assessment outcome, customs officials decide whether a shipment requires physical inspection. Shipments may be selected for:

- Document review only

- Non-intrusive inspection (e.g., X-ray scanning)

- Physical examination

6. Physical inspection (if selected)

If a shipment is selected for physical inspection, customs officers will:

- Locate the specific shipment in the customs-controlled area

- Open containers or packages

- Verify the contents against the declaration

- Check for prohibited or restricted items

- Assess the quantity and quality of goods

- Verify compliance with labeling and marking requirements

7. Sampling and testing

In some cases, customs may take samples of goods for laboratory testing. This is common for food products, chemicals, or other items that may pose health or safety risks.

8. Valuation and classification verification

Customs officers verify that the declared value and classification of goods are accurate. This may involve:

- Reviewing supporting documentation

- Comparing declared values with reference databases

- Consulting product experts for complex classification issues

9. Duty and tax assessment

Based on the inspection findings, customs calculates the applicable duties and taxes. This includes:

- Import duties

- Value-added tax (VAT) or goods and services tax (GST)

- Excise taxes (for certain products)

- Any additional fees or charges

10. Resolution of discrepancies

If any discrepancies or violations are found during the inspection, customs will notify the importer. The importer may need to:

- Provide additional documentation or explanations

- Pay additional duties or penalties

- Arrange for the re-export or destruction of non-compliant goods

11. Release decision

After all issues are resolved and duties are paid, customs makes a final decision on whether to release the goods. This decision is communicated to the importer or their broker.

12. Post-clearance audit

Even after goods are released, customs may conduct post-clearance audits to verify compliance. These audits can occur months or even years after importation and may involve a thorough review of the importer’s records and practices.

The following table summarizes the key steps and their significance in the customs inspection process:

| Step | Description | Significance |

|---|---|---|

| Arrival notification | Carrier informs customs of goods arrival | Initiates the clearance process |

| Document submission | Importer provides required paperwork | Establishes basis for inspection |

| Initial screening | Review of submitted documents | Identifies potential issues early |

| Risk assessment | Evaluation of shipment risk factors | Determines level of inspection needed |

| Selection for inspection | Decision on inspection type | Balances facilitation and enforcement |

| Physical inspection | Examination of goods (if selected) | Verifies compliance with declarations |

| Sampling and testing | Analysis of product samples | Ensures safety and regulatory compliance |

| Valuation and classification | Verification of declared information | Ensures correct duty assessment |

| Duty and tax assessment | Calculation of applicable charges | Determines financial obligations |

| Resolution of discrepancies | Addressing any found issues | Ensures full compliance before release |

| Release decision | Final determination on goods clearance | Allows goods to enter commerce |

| Post-clearance audit | Subsequent review of import transactions | Promotes ongoing compliance |

Understanding these steps allows importers to better prepare for the inspection process, anticipate potential challenges, and work proactively to ensure compliance at every stage. This knowledge can lead to smoother customs clearance, reduced delays, and improved overall efficiency in international trade operations.

Which areas do customs inspectors focus on during examinations?

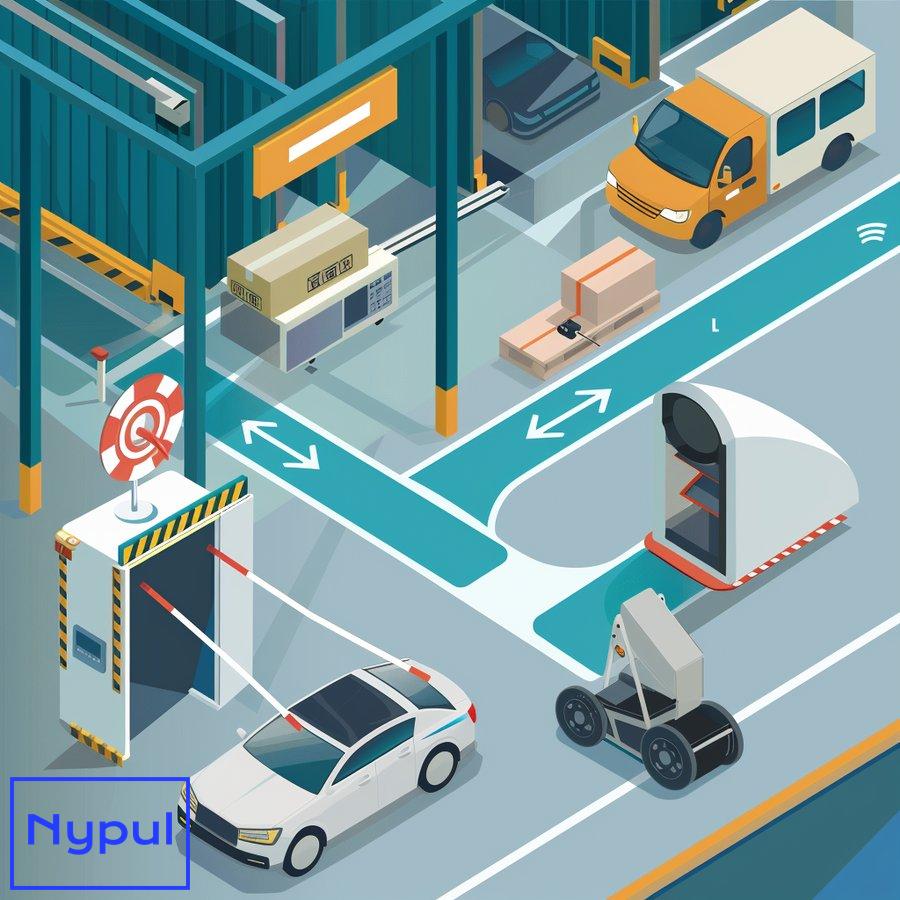

![]()

Customs inspectors are trained to scrutinize various aspects of imported goods to ensure compliance with laws and regulations. Their focus areas during examinations are designed to address key concerns related to revenue collection, safety, security, and trade compliance. Understanding these focus areas can help importers better prepare for inspections and minimize the risk of compliance issues. Here are the primary areas that customs inspectors concentrate on during examinations:

Quantity and description of goods

Inspectors verify that the actual quantity and description of goods match the information provided in the customs declaration and accompanying documents. This includes:

- Counting units or packages

- Weighing goods when applicable

- Verifying product descriptions and specifications

Discrepancies in quantity or description can lead to suspicions of undervaluation or misclassification, triggering more thorough inspections.

Classification accuracy

Proper classification of goods under the Harmonized System (HS) is crucial for determining applicable duties and regulations. Inspectors check whether:

- The declared HS code matches the actual goods

- The classification is consistent with customs rulings and regulations

- Any classification-based restrictions or requirements are met

Misclassification, whether intentional or accidental, can result in incorrect duty assessments and potential penalties.

Valuation compliance

Customs inspectors pay close attention to the declared value of goods, as this directly impacts duty calculations. They look for:

- Consistency between declared value and market prices

- Supporting documentation for declared values (e.g., invoices, contracts)

- Signs of undervaluation or transfer pricing issues

Undervaluation is a common form of customs fraud, and inspectors are trained to detect various schemes used to artificially lower declared values.

Country of origin

The origin of goods affects duty rates, preferential treatment under trade agreements, and compliance with import restrictions. Inspectors verify:

- Accuracy of declared origin

- Compliance with rules of origin under applicable trade agreements

- Presence and authenticity of certificates of origin

Falsely claiming preferential origin to benefit from lower duty rates is a serious violation that inspectors actively seek to prevent.

Prohibited and restricted goods

Customs inspectors are vigilant in identifying goods that are either prohibited or subject to special import restrictions. This includes:

- Counterfeit products infringing on intellectual property rights

- Narcotics and controlled substances

- Weapons and explosives

- Endangered species and products derived from them

- Cultural artifacts subject to export restrictions

Detection of such goods often involves specialized equipment and techniques, such as X-ray scanning or the use of trained detection dogs.

Safety and standards compliance

Inspectors check whether imported goods meet safety standards and regulatory requirements. This is particularly important for:

- Food products (checking for proper storage, expiration dates, and labeling)

- Pharmaceuticals and medical devices

- Toys and children’s products

- Electronic devices

- Automotive parts and vehicles

Non-compliance with safety standards can lead to the detention or destruction of goods.

Packaging and labeling

Proper packaging and labeling are essential for many products. Inspectors look for:

- Compliance with packaging regulations (e.g., for hazardous materials)

- Accurate and complete labeling, including country of origin markings

- Presence of required warning labels or instructions

Inadequate or misleading packaging and labeling can result in goods being held for correction or re-export.

Documentation accuracy and completeness

While document review typically occurs before physical inspection, inspectors also verify that the physical goods match the documentation provided. They check for:

- Consistency between physical goods and descriptions in invoices and packing lists

- Presence of required permits, licenses, or certificates

- Authenticity of documents and signatures

Discrepancies between documents and physical goods can raise suspicions of fraud or negligence.

Smuggling and concealment

Customs inspectors are trained to detect attempts to smuggle goods or conceal items within legitimate shipments. They look for:

- Hidden compartments or false bottoms in containers

- Goods concealed within other products

- Inconsistencies in weight or density that might indicate hidden items

Advanced imaging technologies and physical inspection techniques are employed to uncover such attempts.

Compliance with specific trade measures

Inspectors ensure compliance with various trade measures, such as:

- Antidumping and countervailing duties

- Quotas and tariff-rate quotas

- Embargoes and sanctions against specific countries

Violations of these measures can result in significant penalties and legal consequences.

The following table summarizes the key focus areas and their implications for importers:

| Focus Area | Key Aspects | Implications for Importers |

|---|---|---|

| Quantity and description | Accuracy of declared information | Ensure precise counting and description |

| Classification | Correct HS code assignment | Verify classification with experts if unsure |

| Valuation | Accuracy of declared value | Maintain clear records of transaction values |

| Country of origin | Compliance with origin rules | Obtain proper certificates of origin |

| Prohibited/restricted goods | Adherence to import regulations | Stay informed about import prohibitions |

| Safety and standards | Compliance with regulatory requirements | Ensure products meet applicable standards |

| Packaging and labeling | Adherence to packaging regulations | Follow all labeling requirements |

| Documentation | Consistency and completeness | Maintain accurate and complete records |

| Smuggling prevention | Detection of concealed items | Ensure transparency in all shipments |

| Trade measures compliance | Adherence to specific trade rules | Stay informed about applicable measures |

By understanding these focus areas, importers can take proactive steps to ensure compliance, prepare thoroughly for inspections, and minimize the riskof complications during customs inspections. This knowledge can lead to smoother customs clearance, reduced delays, and improved overall efficiency in international trade operations.

How do customs holds impact shipments and what can be done about them?

Customs holds can significantly impact the flow of goods in international trade, causing delays that can affect supply chains, inventory management, and financial performance. A customs hold occurs when customs authorities temporarily detain a shipment for further inspection or investigation. Understanding the reasons for customs holds and how to navigate them is crucial for importers.

Reasons for customs holds

Customs holds may arise from various factors, including:

-

Documentation issues: Incomplete or inaccurate paperwork can prompt customs to place a hold on a shipment until the necessary documents are provided or corrected.

-

Valuation discrepancies: If customs suspects that the declared value of goods is inaccurate or inconsistent with market prices, they may hold the shipment for further review.

-

Risk assessment flags: Shipments flagged as high-risk based on intelligence or historical compliance issues may be subject to holds for additional scrutiny.

-

Prohibited or restricted items: If there are concerns that a shipment contains prohibited goods, customs will hold it while they investigate.

-

Random selection: Some shipments are randomly selected for inspection as part of customs’ risk management strategy.

Impact of customs holds

The consequences of customs holds can be significant for businesses:

-

Delays in delivery: Holds can lead to extended transit times, disrupting supply chains and causing delays in getting products to market.

-

Increased costs: Delays often result in additional costs, such as storage fees at ports or warehouses, demurrage charges from shipping lines, and potential penalties for late delivery.

-

Customer dissatisfaction: Delays in shipments can lead to customer dissatisfaction and loss of business if clients do not receive their orders on time.

-

Cash flow issues: Extended holds can tie up inventory and impact cash flow, particularly if businesses rely on timely sales to maintain operations.

What can be done about customs holds?

To mitigate the impact of customs holds, importers can take several proactive steps:

-

Ensure accurate documentation: Double-check all paperwork before submission to avoid errors that could trigger a hold. Engage experienced customs brokers if needed.

-

Maintain open communication with customs: Establish a good relationship with customs officials. If a shipment is placed on hold, promptly communicate with them to understand the reasons and provide any requested information.

-

Monitor shipments closely: Use tracking systems to monitor the status of shipments in real-time. Being proactive allows importers to respond quickly if a hold occurs.

-

Implement compliance training: Regularly train staff on compliance requirements and best practices for documentation and classification. A well-informed team is less likely to make errors that lead to holds.

-

Participate in trusted trader programs: Engaging in programs like C-TPAT or AEO can enhance an importer’s reputation with customs authorities, potentially reducing the likelihood of holds.

-

Prepare for potential inspections: Be ready for inspections by ensuring that all goods are compliant with regulations. Conduct internal audits and risk assessments regularly.

By understanding the implications of customs holds and implementing strategies to minimize their occurrence, importers can maintain smoother operations and protect their bottom line in international trade.

What happens after a customs inspection is completed?

Once a customs inspection is completed, several outcomes may occur depending on the findings of the inspection. The resolution process is critical for importers as it determines whether goods are released or if further actions are required. Here’s what typically happens after a customs inspection:

Release of goods

If the inspection concludes that all documentation is accurate, goods are compliant with regulations, and no prohibited items are found, customs will authorize the release of the shipment. The importer will receive notification confirming that the goods can proceed into commerce. This allows businesses to continue their operations without significant disruptions.

Assessment of duties and taxes

Following clearance, customs will assess any applicable duties and taxes based on the declared value and classification of goods. Importers must ensure that these payments are made promptly to avoid additional penalties or interest charges.

Notification of discrepancies

If discrepancies are identified during the inspection—such as incorrect valuation, misclassification, or documentation issues—customs will notify the importer. The notification may include:

- Details of the discrepancies found

- Required corrective actions

- Potential penalties or additional duties owed

Importers must address these discrepancies swiftly to facilitate the release of their goods.

Further investigation

In cases where serious violations are suspected—such as smuggling attempts or significant regulatory breaches—customs may initiate further investigations. This could involve:

- Additional inspections

- Interviews with involved parties

- Coordination with law enforcement agencies

Such investigations can lead to severe consequences, including fines, seizure of goods, or legal action against importers.

Post-clearance audits

Even after goods have been released, customs authorities may conduct post-clearance audits at a later date. These audits serve as a means to verify compliance with regulations over time and may involve:

- Review of import records

- Examination of internal processes

- Evaluation of compliance history

Importers should maintain accurate records and be prepared for potential audits by ensuring ongoing compliance with all relevant regulations.

The following table summarizes possible outcomes after a customs inspection:

| Outcome | Description | Action Required |

|---|---|---|

| Release of goods | Goods cleared for entry into commerce | Proceed with distribution |

| Duties assessment | Customs calculates duties/taxes owed | Ensure timely payment |

| Notification of discrepancies | Customs identifies issues found during inspection | Address discrepancies promptly |

| Further investigation | Serious violations lead to deeper scrutiny | Cooperate with authorities |

| Post-clearance audit | Customs conducts audits after release | Maintain accurate records |

Understanding these outcomes allows importers to navigate post-inspection processes effectively. Proactive management ensures compliance and minimizes disruptions resulting from inspections.

How can importers ensure compliance with customs regulations?

Ensuring compliance with customs regulations is essential for importers seeking smooth operations in international trade. Non-compliance can lead to costly penalties, delays in shipments, and damage to business reputations. Here are strategies that importers can implement to ensure compliance:

Stay informed about regulations

Importers must keep abreast of current laws and regulations governing international trade. This includes understanding:

- Tariff classifications

- Duty rates

- Import restrictions

- Trade agreements

Regularly consult official government websites or industry publications for updates on changes in regulations affecting imports.

Engage experienced professionals

Working with licensed customs brokers or trade consultants can provide invaluable expertise in navigating complex regulations. These professionals help ensure that all documentation is accurate and compliant with current laws.

Implement robust recordkeeping practices

Maintain comprehensive records related to all imports. Essential documents include:

- Invoices

- Bills of lading

- Certificates of origin

- Import permits

Accurate recordkeeping facilitates compliance verification during inspections or audits.

Conduct internal audits

Regularly perform internal audits of import processes to identify potential compliance gaps. This proactive approach helps address issues before they escalate into violations during inspections.

Train staff regularly

Provide ongoing training for employees involved in import operations. Training should cover topics such as:

- Customs regulations

- Documentation requirements

- Classification procedures

Well-informed staff members are less likely to make mistakes that could lead to non-compliance.

Utilize technology solutions

Investing in trade compliance software can streamline processes related to documentation management, classification accuracy, and duty calculations. Such tools help ensure consistency across all import activities while reducing human error.

Participate in trusted trader programs

Engaging in programs like C-TPAT or AEO demonstrates commitment to compliance and security practices. Participation often leads to fewer inspections and expedited processing by customs authorities.

Develop strong supplier relationships

Work closely with suppliers to ensure they understand compliance requirements related to packaging, labeling, and documentation. Clear communication helps prevent errors that could result in non-compliance during inspections.

Create contingency plans

Prepare contingency plans for potential compliance issues that may arise during inspections. Having procedures in place allows businesses to respond swiftly if problems occur, minimizing disruptions caused by delays or holds.

By implementing these strategies, importers can foster a culture of compliance within their organizations. This not only reduces risks associated with non-compliance but also enhances relationships with customs authorities over time.

What role does technology play in modern customs inspections?

Technology has transformed the landscape of customs inspections by enhancing efficiency, accuracy, and security throughout the process. Customs authorities worldwide increasingly rely on advanced technologies to streamline operations while ensuring compliance with regulations. Here’s how technology plays a pivotal role in modern customs inspections:

Automated risk assessment systems

Customs agencies utilize sophisticated algorithms and data analytics tools to assess risks associated with incoming shipments automatically. These systems analyze various factors—such as historical data on importers’ compliance records—to determine which shipments require closer scrutiny versus those eligible for expedited processing.

Non-intrusive inspection technologies

Non-intrusive inspection (NII) technologies allow inspectors to examine cargo without physically opening containers or packages. Common NII methods include:

- X-ray scanning

- Gamma-ray imaging

- Ultrasonic testing

These technologies enable rapid assessments while minimizing disruption to cargo flow at ports and airports.

Electronic data interchange (EDI) systems

EDI systems facilitate seamless communication between importers, carriers, brokers, and customs authorities by enabling electronic submission of required documentation. This streamlines processes such as:

- Pre-arrival notifications

- Import declarations

- Payment processing

The use of EDI reduces paperwork errors while expediting clearance times significantly.

Blockchain technology

Blockchain technology offers enhanced transparency throughout supply chains by providing secure records that track product origins and movements from manufacturers through distributors down to retailers. Implementing blockchain solutions helps verify authenticity while preventing fraud—critical components for ensuring compliance during inspections.

Artificial intelligence (AI) applications

AI applications assist customs authorities in analyzing vast amounts of data quickly—identifying patterns indicative of potential fraud or smuggling activities more efficiently than traditional methods allow. AI-driven tools enhance decision-making capabilities by providing insights based on historical trends combined with real-time data analysis.

Drones for surveillance

Some countries have begun using drones equipped with cameras equipped specifically designed surveillance capabilities at ports/airports—allowing officials greater visibility over cargo movements while enhancing security measures against smuggling attempts or other illicit activities occurring within designated areas surrounding facilities themselves.

The following table summarizes key technological advancements impacting modern customs inspections:

| Technology | Description | Benefits |

|---|---|---|

| Automated risk assessment | Data analytics tools assess shipment risks | Faster identification of high-risk shipments |

| Non-intrusive inspection (NII) | Technologies like X-ray scanning examine cargo without opening it | Minimizes disruption while enhancing security |

| Electronic data interchange (EDI) | Electronic submission system streamlines communication between stakeholders | Reduces paperwork errors; expedites clearance |

| Blockchain technology | Secure records track product origins/movements throughout supply chains | Enhances transparency; prevents fraud |

| Artificial intelligence (AI) applications | Tools analyze large datasets quickly; identify suspicious patterns | Improves decision-making; increases efficiency |

| Drones for surveillance | Drones monitor cargo movements at ports/airports | Enhances security; improves oversight |

By leveraging these technologies effectively within their operations—both at governmental levels as well as within individual businesses—stakeholders involved in international trade stand poised not only towards achieving greater efficiencies but also ensuring higher levels overall regulatory compliance throughout global supply chains today!

How do customs inspection procedures vary internationally?

Customs inspection procedures differ significantly across countries due primarily due differing regulatory frameworks governing trade practices globally—reflecting local priorities regarding security measures alongside economic considerations unique each jurisdiction itself! Understanding these variations is essential for importers operating internationally since they impact how businesses prepare their shipments accordingly based upon specific requirements encountered within foreign markets they seek enter into!

Regional Variations

- North America (United States & Canada)

- The U.S. Customs and Border Protection (CBP) employs rigorous risk assessment protocols using advanced technologies.

- Canada Border Services Agency (CBSA) emphasizes cooperation through trusted trader programs like Partners in Protection (PIP).

-

Both countries share information through initiatives like NEXUS which facilitates expedited border crossings for pre-approved travelers/shippers alike!

-

European Union (EU)

- EU member states follow common guidelines established under EU Customs Code; however individual countries retain discretion over implementation specifics.

- The Union Customs Code (UCC) aims at harmonizing procedures across member states while allowing flexibility based upon national contexts.

-

Customs authorities utilize shared databases enabling real-time access information related imports/exports across borders among member nations!

-

Asia-Pacific Region (China & Japan)

- China has implemented strict controls focusing heavily upon safety standards regarding food products/electronics.

- Japan emphasizes meticulous documentation requirements along with thorough inspections aimed primarily towards preventing counterfeit goods from entering its markets.

- Both nations utilize sophisticated tracking systems allowing seamless coordination between various stakeholders involved throughout supply chains operating within their jurisdictions!

Key Differences

- Inspection Frequency & Intensity

- Some countries conduct random checks while others employ systematic approaches targeting specific high-risk categories based upon historical data analysis.

-

Emerging economies may have less stringent enforcement compared developed nations leading varying levels scrutiny faced by shippers operating across different regions globally!

-

Documentation Requirements

- Documentation expectations vary widely between jurisdictions; some nations require extensive certifications while others adopt streamlined processes aimed facilitating trade!

-

Importers must familiarize themselves thoroughly regarding local rules governing required paperwork prior shipping products internationally!

-

Technology Utilization Levels

- Countries vary significantly regarding adoption rates advanced technologies utilized within their respective custom processes!

-

Nations investing heavily into automated systems tend experience faster clearance times compared those relying primarily upon manual reviews alone!

-

Trade Agreements Impacting Procedures

- Bilateral/multilateral trade agreements influence how countries approach inspections; preferential treatment under agreements often leads reduced scrutiny levels certain imports!

-

Importers should remain aware existing agreements affecting markets they operate within order optimize clearance experiences accordingly!

-

Cultural Attitudes Towards Compliance & Enforcement Practices

- Cultural norms shape attitudes towards regulatory enforcement; some societies prioritize strict adherence rules whereas others exhibit more leniency towards minor infractions!

- Understanding local cultural contexts aids businesses effectively navigate complexities faced when entering foreign markets!

The following table summarizes key differences between regions concerning customs inspection procedures:

| Region/Country | Inspection Frequency & Intensity | Documentation Requirements | Technology Utilization Levels |

|---|---|---|---|

| North America | Rigorous risk assessments; frequent checks | Comprehensive documentation required | High adoption rates |

| European Union | Random checks; systematic targeting | Harmonized but varies by country | Shared databases among member states |

| Asia-Pacific | Strict controls focusing on safety | Meticulous documentation expectations | Varies widely; some advanced systems |

By understanding these international variations—alongside recognizing similarities shared among different jurisdictions—importers can better prepare themselves navigate complexities associated global trade successfully!